Clean Living: Healthier food, healthier people, healthier homes, offices and a healthier planet

They say too much information is a dangerous thing, but in the case of consumers, access to information is helping reshape how they are living their lives:

According to a recent survey from Label Insight, 39% of U.S. consumers say they would switch from the brands they currently buy to others that provide clearer, more accurate product information.

According to a recent survey from Label Insight, 39% of U.S. consumers say they would switch from the brands they currently buy to others that provide clearer, more accurate product information.- Per Nielsen, 73% of consumers surveyed said they feel positive about brands that share the “why behind the buy” information about their products.

- 68% say they’re willing to pay more for foods and beverages that don’t contain ingredients that they perceive to be

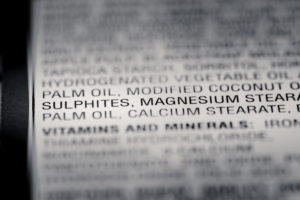

- In some cases, consumers are more interested in knowing what’s not included than what is included in the products they buy. 53% percent of consumers surveyed said the exclusion of undesirable ingredients is more important than the inclusion of beneficial ingredients. These include high fructose corn syrup, artificial sweeteners and colorings, sugar, sulfites, genetically modified organisms (GMOs), refined grains and carbohydrates, and dozens of other ingredients.

This shift in preference for healthy, natural products and the eschewing of artificial chemicals, sweeteners, sugar and other synthetics is one of the basic building blocks for TematicaResearch’s Clean Living investing theme. In 2017, the US organic food market was roughly $44 billion and is expected to reach $70.4 billion by 2025 according to Hexa Research. The trend towards more natural, “good for you” foods and other products isn’t just focused on organics, however:

- According to a 2016 Neilsen survey, 50% of people surveyed in North America reported they try to avoid foods with GMOs.

- In another study, this time by Consumer Reports in 2014, 72% of participants responded that when shopping it is important to avoid GMOs and 40% look for non-GMO labels and claims on packaging.

- On the gluten free front Statista reports that by 2020, the market is projected to be valued at 7.59 billion U.S. dollars.

We see this movement towards natural, organic, non-GMO and even gluten-free foods reflected in commentary from grocery chain Kroger that natural foods continue to generate strong double-digit growth compared to overall same-store sales growth in the low single-digits. This shift in consumer preferences is already having an impact on companies, with some responding to the tailwind, such as

- Amazon (AMZN) buying Whole Foods Market

- The Hershey Company (HSY) first acquiring Krave, a maker of jerky products, and then Amplify Snacks, the provider of Skinny Pop popcorn products and Oatmega grass fed whey protein bars and cookies;

- Annie’s Homegrown, the Berkeley, California-based maker of “natural” and organic pastas, meals and snacks was snatched up by General Mills (GIS) in 2014, one of several natural acquisitions by the food giant that includes Immaculate Baking, Cascadian Farms, and Muir Glen.

- Baked fruit and vegetable snack-maker Bare Foods Co. was scooped up by PepsiCo (PEP), which has also introduced organic and healthier versions of some of its biggest snack brands. PepsiCo has also introduced Bubly, a sparkling water brand.

- In 2016 Coca-Cola (KO) announced it had more than 200 reformulation initiatives underway to reduce added sugar across its carbonated soft drink portfolio.

- French dairy giant Danone has agreed to acquire plant-based dairy alternatives company WhiteWave Foods Co.

- International Flavors and Fragrances (IFF) acquired Israeli flavors and natural ingredients firm Frutarom for $7.1 billion to become the second largest supplier in the global natural flavors market.

- Cott Corp. (COT) sold its traditional beverage manufacturing business for $1.25 billion to Refresco Group NV and retained its water, coffee, tea and filtration service business — categories aligned with health and wellness trends.

Dining Out Trends Towards Clean as Well

While softening in recent years, in the United States we eat a good portion of our meals away from home — as much as 50% according to some reports. Of course, we all like to indulge ourselves when we go out for a night on the town, however, the Clean Living movement has also become pervasive across restaurant menus and chains in recent years. According to the Natural Restaurant Association, restaurant operators are taking notice, and in 2016 it was reported that more than eight in 10 of their guests paid more attention to the nutrition content of food when compared to two years prior. Given the growing pervasiveness of clean living and transparency, we suspect that percentage has likely inched higher since them

While softening in recent years, in the United States we eat a good portion of our meals away from home — as much as 50% according to some reports. Of course, we all like to indulge ourselves when we go out for a night on the town, however, the Clean Living movement has also become pervasive across restaurant menus and chains in recent years. According to the Natural Restaurant Association, restaurant operators are taking notice, and in 2016 it was reported that more than eight in 10 of their guests paid more attention to the nutrition content of food when compared to two years prior. Given the growing pervasiveness of clean living and transparency, we suspect that percentage has likely inched higher since them

Just a couple of years ago, Chipotle (CMG), before its rash of health and food safety issues, was held out as the poster child for Clean Living restaurants. With its “Food with Integrity” program that began in earnest in 2015 with its ban on GMO’s across its entire menu, the burrito chain also focused on locally grown vegetables, free-range pork and chicken and antibiotic-free meats among other things. Panera Bread Co. (PNRA) announced in 2014 its plan to remove preservatives, sweeteners, flavors and colors from artificial sources from its entire menu, a process that took nearly 3 years to complete.

Zoe’s Kitchen (ZOES) — the fast-casual chain of Mediterranean-inspired comfort food with made-from-scratch recipes using fresh ingredients — made the leap from private to public in 2014 and now boasts over 200 locations across 17 states. There is a rash of food chains that are currently privately-held that are also riding this trend which includes the probably the most widely known, Cava Grill. Others include True Food Kitchen, Sweetgreen, Freshii, and Chopt.

Clean Living Isn’t Just What We Put In Our Bodies

In addition to clean eating, another aspect of this theme includes natural skincare & make-up, and non-toxic baby products. According to a market study by Grand View Research, the global market for natural and organic personal care products is projected to grow to $25.1 billion by 2025, expanding at a CAGR of 9.5% over the 2017-2025 period. In recent years there has been a long list of acquisitions in this natural category:

In addition to clean eating, another aspect of this theme includes natural skincare & make-up, and non-toxic baby products. According to a market study by Grand View Research, the global market for natural and organic personal care products is projected to grow to $25.1 billion by 2025, expanding at a CAGR of 9.5% over the 2017-2025 period. In recent years there has been a long list of acquisitions in this natural category:

- Tom’s of Maine, known for its natural toothpastes, mouthwashes and deodorants was scooped up by Colgate-Palmolive (CL) in 2006 for $100 million.

- Organic balms and butters brand Burt’s Bees was acquired by Clorox (CLX) for $925 million in 2017.

- After building Bare Escentuals — producer of mineral and powder based makeup line bareMinerals — from the ground up, CEO Leslie Blodgett accepted a buyout in 2010 from Tokyo-based cosmetics company Shieseido for a reported $1.7 billion

- Similarly, Johnson & Johnson (JNJ) counts in its stable of brands Aveeno, L’Oreal owns The Body Shop, and Estee Lauder (EL) owns both Aveda and Origins, among other brands.

As with clean eating, where the movement went from fringe brands being acquired by large consumer packaged goods brands to those companies actually reformulating their mainstay brands to be more natural, organic and chemical-free, we’ve seen personal care brands respond to this movement as well:

- Companies such as Procter & Gamble (PG) and Estée Lauder have acquired or invested in clean brands, knowing their giant manufacturing processes can’t just take out a few parabens and call ita day. Other companies, such as Unilever (UL), have started completely from scratch, creating their own new skin-care and hair-care lines.

- Johnson & Johnson has announced it will disclose all ingredients in its baby care products, including fragrance ingredients, down to 0.01% of content.

- In 2017, L’Oréal Paris-owned Garnier introduced Skin Actives Naturals, a line of 96% (at least) naturally derived products, they also began listing ingredient sources on their labels, while cutting parabens, silicones, dyes, and sulfates.

- Unilever announced that it would be scooping up natural deodorant brand Schmidt’s. That closely followed the acquisition of cult-fave natural deodorant brand Native by Proctor & Gamble in late November.

In keeping with our Rise of the Middle Class investing theme, we are also seeing a growing number of health-conscious consumers in the emerging markets as well.

According to a report from RedSeer the current organic skin care market in India is pegged at $125 million, growing at 25% year-over-year to reach $315 million by 2022.

Clean Living Means a Clean Planet

The market for natural and organic cleaning supplies has been a niche market at best for many decades — when it came to cleaning, consumers felt a chemical onslaught was best. But in recent years, as health concerns began to arise with the chemicals in these products as part of an overall adoption of a healthier lifestyle, such products have moved into the mainstream and according to ReportLinker, the U.S specialty household cleaners market is expected to reach $7.96 billion by 2024.

The market for natural and organic cleaning supplies has been a niche market at best for many decades — when it came to cleaning, consumers felt a chemical onslaught was best. But in recent years, as health concerns began to arise with the chemicals in these products as part of an overall adoption of a healthier lifestyle, such products have moved into the mainstream and according to ReportLinker, the U.S specialty household cleaners market is expected to reach $7.96 billion by 2024.

When asked by Nielsen to pick the attributes they seek when purchasing all-purpose cleaners, 40% around the world say they want environmentally friendly benefits and nearly as many (36%) say they don’t want harsh chemicals. Seventh Generation Inc, based in Burlington, VT is probably one of the most well-known brands in the space, selling cleaning, paper and personal care products with a focus on sustainability and the conservation of natural resources. Starting as a mail-order only company in 1988, the company was acquired by Unilever in 2016 for $700 million – notice a trend here yet?

Other companies are also offering products for the home that have high recycling content and environmentally friendly processes, such as Trex Companies and its decking products. The average 500-square foot composite Trex deck contains 140,000 recycled plastic bags, which makes it one of the largest plastic bag recyclers in the U.S. as it saves 400 million pounds of plastic film and wood from landfills each year. As one might suspect Trex is not the only company capitalizing on recycling and clean. Other areas in which we are seeing these unfold include low chemical furniture, mattresses, paint, flooring and even footwear made entirely from post-consumer water bottles by Rothy’s.

Another aspect of this theme is clean technologies, which include products and technologies designed to be economically competitive by using less material and energy to reduce their environmental impact compared with incumbent technologies. Example of clean technologies include biofuels, wind and solar power, electric vehicles, solid-state lighting and other renewables that are replacing coal, petroleum and other fossil fuel based solutions. According to the International Agency, by 2030 there will be 125 million electric vehicles across the globe compared to the 3.1 million found in 2017. With these and other forms of clean energy, we’ll be careful to watch the political landscape as well as new technological developments associated with our Disruptive Innovators investing theme that could alter the playing field on cost, efficiency or both.

Companies Sustaining the Clean Living Focus

As its name suggests, the Tematica Research Clean Living investing theme focuses on companies that provide products, ingredients and other solutions and services that are in keeping with the clean lifestyle. This theme could be summed up succinctly with “Healthier food, healthier people, healthier homes, offices and a healthier planet.”

Examples of publicly traded companies riding the Clean Living investment theme tailwinds:

- Amazon (AMZN)

- Chipotle (CMG)

- Cott Corp. (COT)

- First Solar (FSLR)

- Freshpet (FRPT)

- Gaia (GAIA)

- Hain Celestial (HAIN)

- International Flavors (IFF)

- National Beverage Corp. (FIZZ)

- Natural Grocers (NGVC)

- Nautilus (NLS)

- Primo Water (PRMW)

- The Simply Good Foods Co. (SMPL)

- SodaStream International (SODA)

- Sprouts Farmers Market (SFM)

- Tesla (TSLA)

- Town Sports International Holdings (CLUB)

- Trex Company (TREX)

- United Natural Foods (UNFI)

- Zoes’ Kitchen (ZOES)