Thematic tailwinds continue to be a guiding light in the market storm

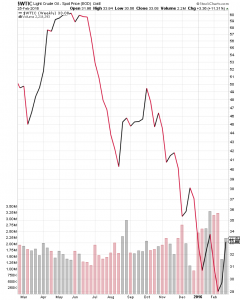

It’s been another up and down week for the stock market, once again shaped by the moves in oil prices. These movements can cause short-term disruptions in stock prices as evidenced by the gyrations of the last few weeks, but our thematic tailwinds continue to be a guiding light in the market storm.

Over the last few weeks we’ve recommended investors continue to sit on the sidelines preferring to keep our powder dry amid the market turbulence as we wait for more favorable risk to reward profiles in stock prices. On the dividend side of our holdings — which continues to outperform— as of the market’s close last night, our position in Philip Morris International ([stock_quote symbol=”PM”]) is up more than 15% from my initial recommendation and both AT&T ([stock_quote symbol=”T”]) and PayPal ([stock_quote symbol=”PYPL”]) shares are up more than 10% including dividends.

While the stock market has rebounded, there are still reasons to remain cautious. . .

The recent rally in the stock market has been due in part to organizations like the OECD and others that are calling for more monetary stimulus. Let’s remember, we have yet to feel the full impact of the oil price drop, but the evidence is mounting:

- Comments from the CEO of Devon Energy ([stock_quote symbol=”DVN”]) imply most US shale producers need $55-$60 oil to work

- We’re beginning to hear about more oil related layoffs as Halliburton cut another 5,000 jobs following up on cuts of 4,000 jobs in the December quarter.

- Wells Fargo ([stock_quote symbol=”WFC”]) has set aside $1.2 billion for potential oil and gas sector loan losses as different forecasts suggest up to 35% of public oil companies could face bankruptcy.

- A report from Deloitte found 175 such companies are facing “a combination of high leverage and low debt service coverage ratios.” Odds are more financial institutions that just Wells Fargo will be hit should Deloitte be correct.

Meanwhile, the economy in China is expected to have contracted even further in February

February would mark the seventh consecutive monthly decline in China’s manufacturing sector. Per a poll conducted by Reuters based on 23 economists, China’s official manufacturing Purchasing Managers’ Index (PMI) is expected to dip to 49.3 in February from 49.4 a month earlier. We’re already seen the ripple effect into the Eurozone, and that along with oil related loan losses helps explain why European Central Bank chief Mario Draghi is ready to do “whatever it takes” come March.

Taken all together, these data points lead us to conclude that there is likely another shoe to drop, and that shoe will not only weigh on the market, but it will probably lead to job destruction along the way. Keep in mind, the jobs created in the oil and energy sector have been some of the better paying ones created over the last few years, compared to the those in the retail, hospitality and other sectors that have led recent job growth

All of this is likely to keep the Fed’s hand off the interest rate button in next few weeks.

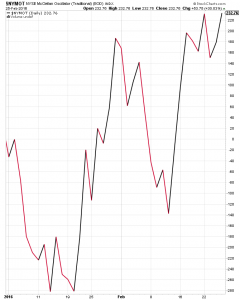

Finally, we also have to acknowledge that short covering has helped propel the market higher over the last few days even though the fundamentals (economic growth, earnings expectations) have not changed much in the last few days. That short covering has led the NYSE McClellan Oscillator (an indicator or market breadth based on the number of advancing and declining issues on the NYSE) to rebound sharply over the last few days, past levels from which we’ve seen pullbacks in the market.

So this short selling activity is yet another reason to remain cautious near-term in my view, which means we are maintaining our “Hold” rating on ProShares Short S&P 500 ETF ([stock_quote symbol=”SH”]) shares.

Trimming back our PM, T and PYPL positions, and checking some stop losses

Rather than dawdle, we recommend using the recent strength in the market to trim back positions in Philip Morris International ([stock_quote symbol=”PM”]), AT&T ([stock_quote symbol=”T”]) and PayPal ([stock_quote symbol=”PYPL”]) by selling half of each. This move will lock in double-digit gains, while leaving some skin in the game should the market climb higher in the near-term. We are also recommending at this time that investors set a stop loss for PM shares at $87 and raising the stop loss on PYPL shares to $33 from $31.

Over the last few weeks a number of thematically well positioned companies have had their share prices retreat to more attractive levels. Examples include Netflix ([stock_quote symbol=”NFLX”]), Amazon ([stock_quote symbol=”AMZN”]), and Skyworks Solutions ([stock_quote symbol=”SWKS”]) to name a few. Should another pullback in the market come to pass as I expect, we’ll be watching these and other thematic contenders closely.

What’s playing at the box office?

Year to date the movie box office is up 1.6% year over year due to strong performances from “Deadpool”, “The Revenant”, “Kung Fu Panda 3”, and of course “Star Wars: The Force Awakens”. In just under a month “Batman v Superman: Dawn of Justice” will drop and soon after that “Captain America: Civil War” will hit in early May. Other tent pole films from Disney and other film companies have 2016 looking like a better year for bodies in seats, and we all know that drives sales of those high margin snacks and beverages.

This points to additional upside for Regal Entertainment ([stock_quote symbol=”RGC”]) shares, which closed last night up more than 6% including dividends since our initial “Buy” rating in mid-January recommendation. The next sign post for the shares will be on March 8th when the management team gives it presentation at the Raymond James Institutional Investors Conference in Orlando, FL. For investors who have already made a move on RGC shares, we recommend you continue to hold them; for those that haven’t jumped in yet you could still do so lest they pass $20, at which point we do not recommend committing fresh capital. Our RGC price target remains $24.

Coming up, earnings from Physicians Realty Trust

On Monday, our Aging of the Population play, Physician Realty Trust ([stock_quote symbol=”DOC”]), reports its quarterly earnings. Consensus expectations for the quarter are sitting at earnings per share of $0.26 on revenue of $39.2, up 18% and more than 100% year over year, respectively. Remember, Physicians Realty has been upsizing and using its balance sheet to grow its leased property footprint to doctors, hospitals and other healthcare delivery systems. In late January the company completed a secondary offering that garnered it net proceeds of more than $320 million, and the company should shed more light on its plans to put that capital to work and grow its footprint in 2016.