2018 poised to be a much more interesting year than many are expecting

Stocks continue to be on a tear while the dollar just experienced its fifth straight week of declines against a broad range of currencies, hitting a 3-year low against the euro. Make America Great Again (better known as MAGA) isn’t doing much for the greenback! The bulls are fully in charge when it comes to stock indices, making new high after new high with most every country ETF, outside of Mexico, in overbought territory in a rally that looks to us to be blissfully ignoring what it doesn’t like and seeing only what it does. Begs the question how long can this last?

The bulls cheered the news that Walmart (WMT) is going to raise wages, provide bonuses and expand maternity and family benefits while utterly ignoring the fact that it rather abruptly announced it will be closing 63 Sam’s Club stores. That news, by the way, bumped shares of Cash-Strapped Consumer investment theme company Costco Wholesale (COST) up over 3% this week. December’s Bank of America Merrill Lynch survey of global portfolio managers found that 45% of respondents believe the equity market is overvalued, the highest level in the 20-plus year history of the poll. Yet, a net 48% are more exposed than normal to the stock market as FOMO (Fear Of Missing Out) and TINA (There Is No Alternative since most think bonds are also overpriced) conspire to keep stocks moving higher.

It isn’t just at Walmart where we are seeing a shift in employment data. Initial jobless claims rose 11,000 for the January 6th weekly report – the fourth consecutive weekly increase and a three-month high. This week’s JOLTS report revealed that job openings fell by 46,000 in November to sit at the lowest level in six months, after having declined in three of the past four months. New hires also fell 104,000 and are down in the three of the past four months. Both of these are consistent with late business cycle dynamics.

We are also looking at a 2.9% personal savings rate and a 4.1% unemployment rate. To put that in context only 15% of the time since WWII has the unemployment rate been this low and yet, Friday’s Earnings Report from the Bureau of Labor Statistics showed that there is little wage pressure. Real average hourly earnings for production and nonsupervisory employees, (about 80% of the population) increased 0.1% from December 2016 to December 2017. If we combine that with the 0.6% increase in the length of the average workweek, weekly take home over the prior 12 months grew a whopping 0.7%. Apparently, that isn’t all that concerning to most as Bloomberg Consumer Confidence data hit a new expansion high. Must be those growing credit card balances keeping folks happy. But much like the market melting higher…. We have to wonder how much longer that can last?

Longer dated bond yields were on the rise during the week, thanks to the revival of the inflation story with Jeffrey Gundlach and Bill Gross issuing the same dire warnings that the multi-decade bond bull run is over. Yet, on Thursday the Bureau of Labor Statistics Producer Price Index for all commodities actually fell 0.1% versus expectations for a 0.2% increase. No signs of inflation just yet, at least in this area. Core PPI (which excludes energy and food) was also weaker than expected, so it isn’t just about energy, and overall year-over-year growth rates have decelerated on a broad basis, meaning across many categories.

For all the talk of an economy that was accelerating in 2017, why then did we have the biggest deficit last year since 2012, coming in at $680 billion? In fact, nominal deficits have been growing faster than the economy (GDP) for the past several years – that’s not what you would expect to see outside of a recession. The prevailing economic theory in the western world is for the government to spend the country out of a recession, but in the good times to cut back. Lord Keynes is rolling over in his grave.

Some of the air has also been let out of the small business sentiment with the December National Federation of Independent Businesses (NFIB) index falling to 104.9 in December after having ripped to a 32-year high in November of 107.5. December’s slide was the steepest drop in the past five years as plans to build inventory dropped from 7% to -1% in just one month. That’s tied for the sharpest decline on record. Plans to boost employment also declined from 24% down to 20%, which is right about where it was last summer. It appears that Santa didn’t make those smaller business owners feel all that merry as the net share expecting the economy to improve dropped from 48% in November to 37%, which is the sharpest decline in 3 years – lots of coal found in stockings over the holidays it seems.

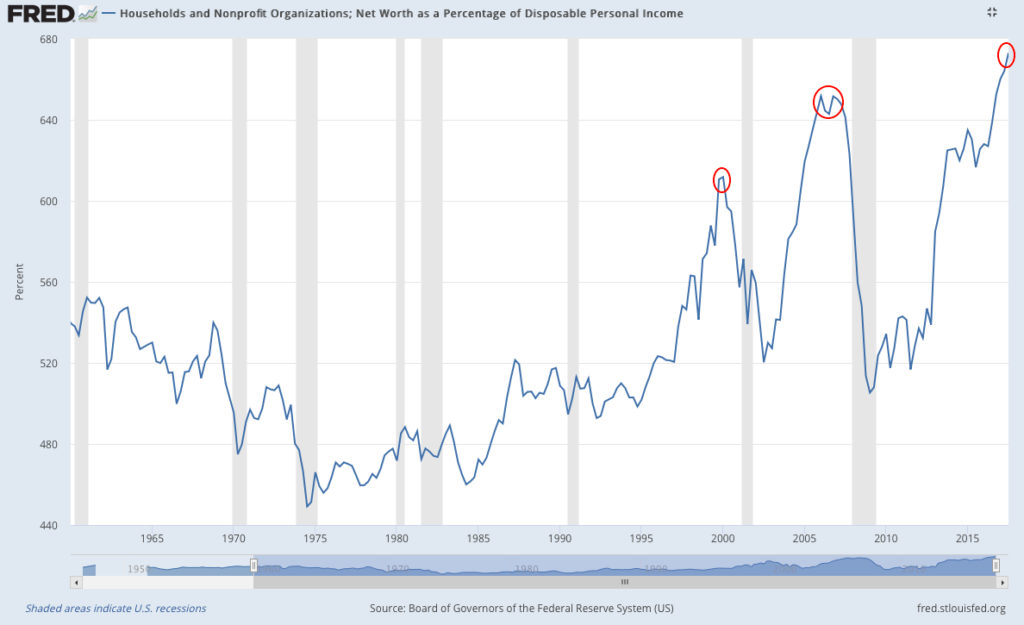

On the other hand, household net worth as a percent of disposable income has shot up to record territory as the chart below shows. The prior two peaks were the dotcom boom and the housing boom. Again…. How much longer… oh you know what I’m going to say.

We’d point out that household net worth as a percent of disposable income doesn’t tend to stay at new highs for very long though, as was pointed out in the San Francisco Fed’s January 8th publication of Valuation Ratios for Households and Businesses. The conclusion of this report had a rather interesting assessment, “we find that the current price-to-earnings ratio predicts approximately zero growth in real equity prices over the next 10 years.” Let’s add on that this year we are going to see roughly $1.8 trillion in reduced flow-of-fund support from the world’s major central banks this year.

We suspect 2018 is going to be a more interesting year than many are prepared to experience, and we didn’t even talk about tax reform related spending and investment assumptions. As Fozzie Bear would say, “Yowza.”