Adding option-play to Cash-Strapped Consumer position, continue hold on market hedge positions

Over the last week, the market has continued to melt up despite the arrival of economic data and the earnings reports from Alcoa (AA) and CSX (CSX) which confirm the mismatch between fundamentals and valuations. We’ve covered much of the recent economic data, including the Atlanta Fed’s dismal GDPNow reading for the March quarter, and yesterday in this week’s Tematica Investing we filled in the picture with yet another disappointing Retail Sales report, this time for March. Also in yesterday’s issue we shared the latest global growth forecast cuts the OECD and the IMF.

From our perspective, all of this warrants continuing to hold all three of our market hedging positions:

- ProShares Short Dow30 ETF (DOG)

- ProShares Short S&P 500 (SH)

- ProShares Short Russell2000 (RWM)

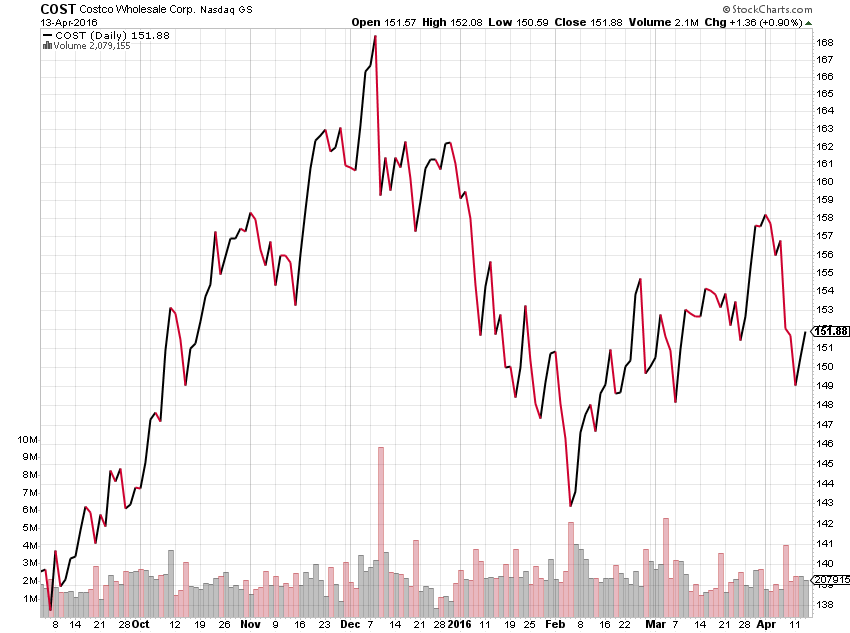

Adding Costco Wholesale (COST) calls to the Tematica Pro Select List

Last week we added shares of Costco Wholesale (COST) to the Tematica Pro Select List and as we learned yesterday our view that Costco continued to grab consumer wallet share, we added COST shares to the Tematica Select List as well. The shares have also come under pressure related to a “mini-tender” offer from TRC Capital. Costco is not the first company to have TRC attempt such a dubious below market offer that looks to capitalize on the perception of mini-tender offers. Much like Wal-Mart (WMT), Lowe’s (LOW), Kinder Morgan (KMI), Disney (DIS) and others, Costco recognized TRC as the mini-tender menace that launches an unsolicited “mini-tender” offering to buy a small percentage of a company’s stock BELOW the market price and then sells any shares tendered and pockets the difference. Looking out for its shareholders, Costco recommended they not participate in the mini-tender offer.

When we added COST shares to the Tematica Pro Select List last week, we shared we would continue to evaluate potential call option plays. In our view the combination of confirming strong retail sales market share gains over the last few months (again, see details in yesterday’s Tematica Investing) versus the pullback in the shares due to the low ball TRC mini-tender price of $149.50 affords us such an opportunity. We are adding the COST May 2016 160 calls (COST160520C00160000) at or near last night’s closing price of $0.42. We would look to add to the position on modest weakness and would consider adding to the position up to $0.50.

Read yesterday’s Tematica Investing for more details on why we think Costco Warehouse is well-positioned to grab more wallet-share as the Cash-Strapped Consumer thematic takes hold in today’s economic environment.

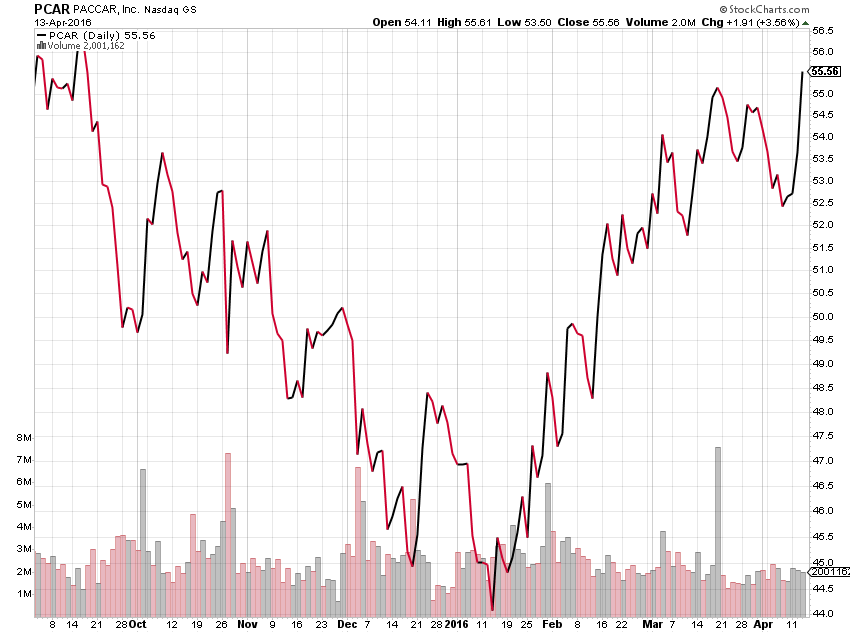

More Bad Truck News Affirms our Short on Paccar (PCAR) Shares

Over the last few days shares of heavy-duty truck company, Paccar (PCAR), have traded higher along with the market even though more data points to a weakening domestic heavy truck market. Recently FTR released preliminary data showing March 2016 North American Class 8 truck net orders fell for the third consecutive month to 15,800 units, the lowest level since September 2012. Digging into the data for March 2016, orders fell 12 percent month over month and down 37 percent year over year, making it the weakest March for heavy truck orders since 2010.

Then during March quarter earnings call this past Monday night, Klaus Kleinfeld, CEO metals company Alcoa (AA), had this to say on the heavy-duty truck market — “North America, we already had a pretty bleak outlook for this year. And originally said minus 19% to minus 23%, it looks even worse than what we saw before. Granted it comes off now a high base of last year. So, we are now at minus 23 percent to minus 27 percent. Production is down 19 percent. Weak freight growth is hitting demand. Weak order, down 42%. Inventory is climbing, up 15.6%, now stands at 66,800 units. The 10-year average is 47,400, so, gives you a feel for it. The order book is falling.”

No wonder investment firm Macquarie downgraded Paccar shares to a Neutral rating from Outperform earlier this week.

Surprisingly, on the back of the eroding economic outlook and corroborating drop in industry orders that is backed by falling rail traffic, the market melt up has pushed PCAR shares to their highest levels in 2016.

Recognizing the disconnect between PCAR shares and industry data, we will continue to hold the short position in PCAR shares. Our stop loss on the position remains set at $60.

Signs of a Better Than Seasonal Pick Up in Real Estate Start to Emerge

As we finally put the winter chill behind us, market share leading real estate company RE/MAX reported a solid pick up for the historically seasonally strong home buying season. Per RE/MAX, February sales rose 4.8 percent year over year and climbed 5.8 percent when compared with January, a pick up from the 5.2 percent average seen in each month of February since 2009. Over the last 12 months, Re/Max’s data shows the average year-over-year increase in home sales has been 5.8 percent.

In rolling up our sleeves on the housing market, we’ve noticed the inventory of homes for sale remain at historically low levels, and that has led to the sharp move higher in asking prices for homes being offered for sale. The inventory of homes for sale remains very tight in many markets across the country, with February seeing a level that is 13.3 percent lower than a year ago. Given the simple laws of supply and demand dynamics, median home sales price rose 5.9 percent year over year, marking the 49th consecutive month for such increases. Viewed another way, among the 53 metro areas surveyed in February, 45 reported higher prices than last year, with 12 rising by double-digit percentages.

With Re/Max’s report on conditions in March due in a few days, should the findings point to this recent acceleration having legs and confirms a stronger than expected seasonal pick up, we’ll look to add Re/Max or another residential real estate/realtor play (perhaps an ETF?) as well as corresponding options into the Tematica Pro Select list as part of our Tooling & Re-tooling investing theme. Stay tuned . . .

Recap of Action Items from this Week

- Adding the COST May 2016 160 calls (COST160520C00160000) at or near last night’s closing price of $0.42. Look to add to the position on modest weakness and would consider adding to the position up to $0.50.

- Continue hold ProShares Short Dow30 ETF (DOG), ProShares Short S&P 500 (SH), ProShares Short Russell2000 (RWM), and our short position in Paccar (PCAR).