TRADE ALERT: Freight pain leads to this Economic Acceleration/Deceleration addition

KEY POINTS FROM THIS ALERT:

- We are issuing a Buy on truck company Paccar (PCAR) with an $85 price target as part of our Economic Acceleration/Deceleration investment theme.

With the market’s volatility over the last several days, a number of stocks are revisiting levels that are 5%, 10%, 15% lower than they stood at end of January. And while investors have been thunderstruck by the market gyrations, the day to day data from the December quarter earnings season as well as recent economic data, has continued to confirm certain opportunities. One of the recurring drum beats this earnings season has been companies ranging from Tyson Foods (TSN, Hershey (HSY), Packaging Corp. of America (PKG), Sysco (SYY) and J.M. Smucker (SJM) to Tractor Supply (TSCO) and Prestige Brands (PBH) talking about rising freight costs and the impact on earnings.

One of the culprits is the national shortage in available trucks, which has sent shipping costs soaring, with retailers and manufacturers in some cases paying over 30% above typical rates to book last-minute transportation for cargo. This, of course, goes hand in hand with the accelerating shift toward digital commerce that we talk about, a shift that led Amazon to correctly assess back in 2013 that as more shoppers bought products online, “parcel volume was growing too rapidly for existing carriers to handle.” As that shift to digital commerce has happened, we’ve seen that forward-looking view come to play out, and odds are it’s only going to get worse. According to Statista, e-commerce sales accounted for 9.1% of total U.S. retail sales in 3Q 2017, but we see that only growing further. In South Korea, e-commerce represented 18% of all retail sales in 2016 with forecasts calling for that percentage to reach 31% by 2021. We may not reach such a level for years to come, but each percentage point that e-commerce gains, means more product that needs to be shipped from a warehouse to the buyer.

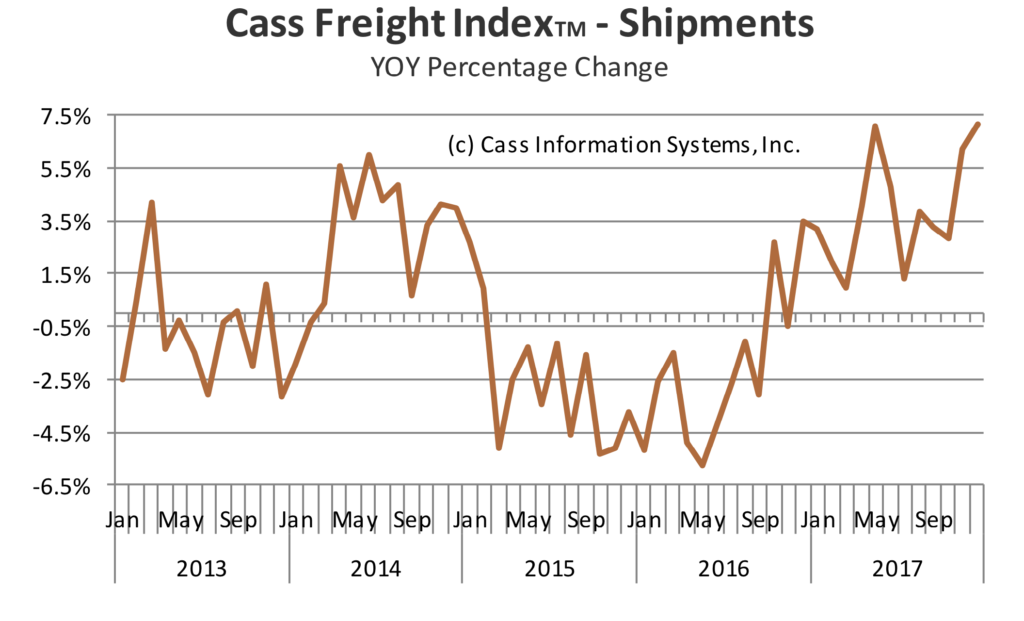

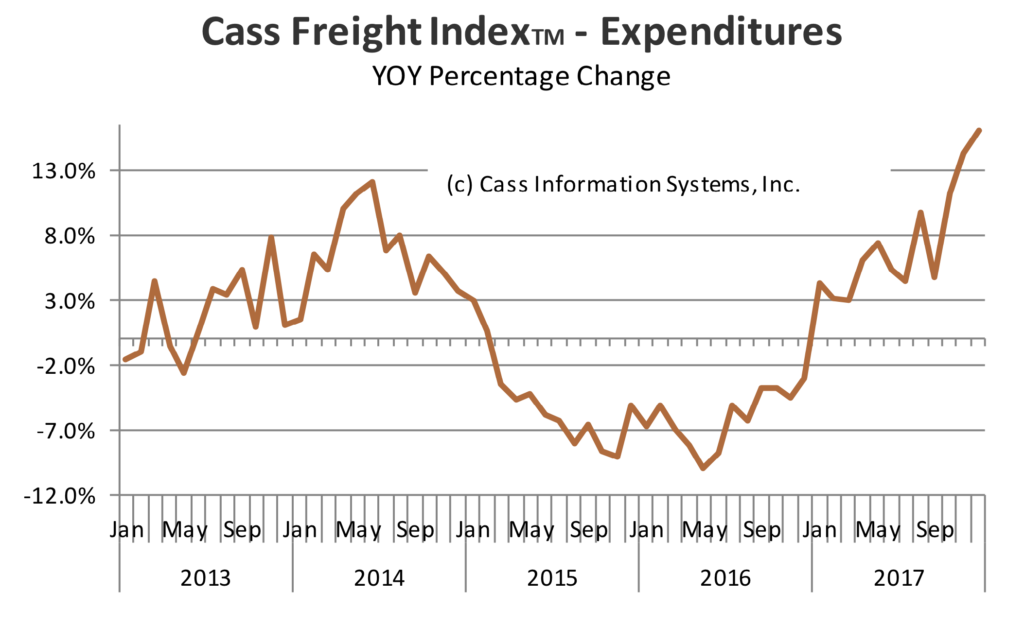

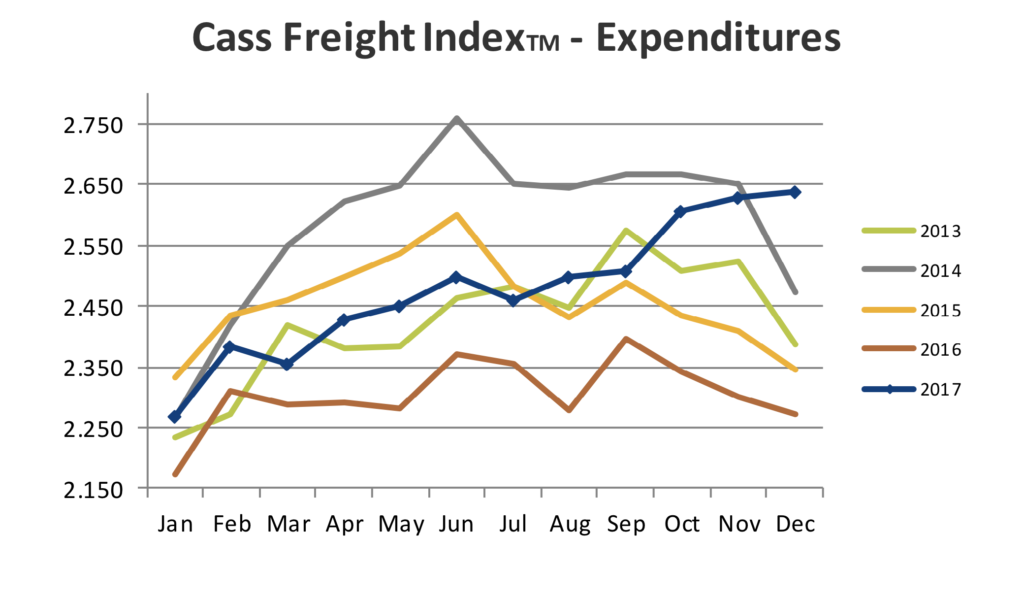

Historically, the trucking industry has been associated with the economic cycle. When the economy is growing, more goods (parts, subassemblies, products) need to be shipped to customers at factories, distribution sites, warehouses and so on. According to the American Trucking Association, the trucking industry accounts for 70.6% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. This has made freight traffic a good barometer of the economy, and the December year over year increase of 7.2% in the Cass Shipments Index capped off a year in which the ATA’s truck tonnage index rose 3.7%, the strongest annual gain since 2013.

As truck tonnage climbed in late 2016 and 2017, industry capacity has been tightening after tepid tonnage in most of 2015 and the first half of 2016 leading to the robust jump in freight costs we described above. This data point from DAT Solutions puts in all into perspective – “there were about 10 loads waiting to be moved for every available truck in the week ending Jan. 20, compared with three in the same week last year…”

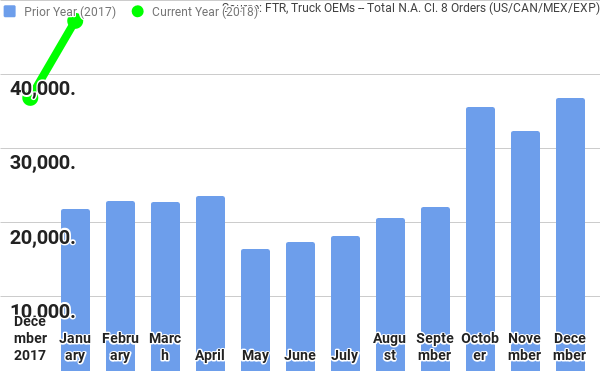

As freight costs climbed in the back half of 2017, so too did heavy truck orders, which have continued to climb into 2018. According to ACT Research, December 2017, which saw a 76% increase in truck order volume was the best month for orders since December 2014. In full, due to the year-end surge, 2017 saw truck orders hit 290,000 units, up 60% year over year. That strength continued into January with monthly truck orders hitting some 47,000 units, the highest level since 2006.

This data is not surprising, given that for the first three weeks of January, national average spot truckload rates were higher than during the peak season in 2017, according to DAT. January was also the fourth consecutive month in which truck orders were above the 30,000 mark. Initial heavy truck forecasts put orders near 300,000 for 2018, however tight industry capacity combined with companies that are benefitting from tax reform and looking to replace older, less fuel-efficient trucks, we could see that some lift to that forecast in the coming months.

But that’s heavy truck orders, and while four months above 30,000 paves the way for a pick-up in business, the real question to focus on is heavy truck retail sales. Heavy truck, otherwise known in the industry as class 8 trucks, industry retail sales were 218,000 units in 2017, compared to 216,000 vehicles sold in 2016, with forecasts calling for 235,000-265,000 trucks to be sold in the U.S. and Canada during 2018.

Looking outside the U.S. and Canada, the data shows an improving European economy and that should give way to a favorable truck market there as well. European truck industry sales above 16-tonnes were a robust 306,000 trucks in 2017, and It is estimated that European truck industry sales in that category will be in the range of 290,000 to 320,000 trucks in 2018.

Paccar – more than a leading heavy truck company

And that brings us to Paccar (PCAR), whose shares have fallen some 15% as the domestic stock market moved sharply lower over the last two weeks. The company is an assembler of heavy-duty trucks, with an estimated market share near 31% in the U.S. and Canada, as well as medium duty trucks (think the kind you see being driven locally by United Parcel Services (UPS) and FedEx (FDX)). That business drove 53% of its truck deliveries in 2017, with the balance coming from Europe (36%) and other markets (11%). As truck retail sales improve in the U.S., Canada and Europe, even absent additional share gains, Paccar’s truck business in terms of revenues and profits should see a nice lift.

The improving truck market also bodes well for Paccar’s high margin truck financing business – while it generated just 6.5% of total revenue in 2017 with operating margins that are more than double the truck business, it accounted for 12% of overall operating profits.

The third leg to the Paccar stool is its Parts business (20% of 2017 revenue, 28% of 2017 operating profit), which stands to benefit from the time lag between truck orders and sales in a capacity constrained industry, where up-time for existing equipment will be crucial.

Given the industry dynamics and Paccar’s position, we are seeing revenue and earnings expectations move higher in recent weeks, with the current consensus calling for EPS of $5.34 this year up from $4.26 in 2017 on a 13% revenue increase to $20.6 billion. With the company only recently sharing its 2018 tax rate will be 23%-25% vs. 31% in 2017, we could see the 2018 consensus move higher in the coming weeks.

As mentioned above, Paccar’s share price has fallen some 15% in the last two weeks, which in our view makes the shares rather compelling given our $85 price target. That target equates to just under 16x 2018 EPS. Over the prior seven years, PCAR shares have bottomed at an average P/E of 12.2x, which derives a downside target of $67.65 based on current 2018 EPS expectations. On the upside, the average peak multiple over those same years of just over 17x hints at a potential price target near $95. Looking at a dividend yield valuation, we see upside vs. downside of $82 vs. $60.

As we add the shares, we’ll split the difference with an $85 price target, and we’ll look to aggressively scale into the shares should the market come under further pressure and drag PCAR shares closer to $60. In terms of sign posts to watch for the shares in the coming days and weeks, monthly heavy truck data as well as tonnage stats and manufacturing industrial production data is what we’ll be watching. As the current earnings season winds on, we’ll be focusing on the results and outlook from Rush Enterprises (RUSHA), which owns the largest network of commercial dealerships in the U.S., with more than 100 dealerships in 21 states.

The bottom line for this alert today:

- On Monday morning we are adding Paccar (PCAR) shares to the Tematica Investing Select List.

- Our price target for PCAR shares is $85, nearly 26% above where the shares closed on Friday February 9.

- At this time we are not setting a protective stop loss, but instead will look to scale further into the shares should further pressure drag them closer to $60 per share.