Amazon – Whole Foods tie up opens up opportunity for Costco calls

No, you’re not going crazy — this week we’re sending you Tematica Pro before you receive the weekly issue of Tematica Investing.

We are coming to you a day earlier than usual today for a few reasons. First, later this morning you’ll be receiving this week’s issue of Tematica Investing, which will include our recommendation for re-entering shares of Costco Wholesale (COST). The issue has been posted to the website already if you care to read it now, just click here, but given that move, we are also adding a call option play this morning tied to COST shares. More on that below.

Also included in this morning’s Tematica Investing are some positive comments on Dycom Industries (DY), and those are also positive for our Dycom calls. We also mentioned the likely fallout from the drop in oil prices and what it means directionally for earnings expectations for the S&P 500; here at Pro that means keeping our inverse ETF position in play.

In a nutshell, we thought it best to tie it all together for Pro subscribers, and the fact that we’re tied up with some hush-hush new project tomorrow made it all seem like a smart move. With that out of the way, here we go…

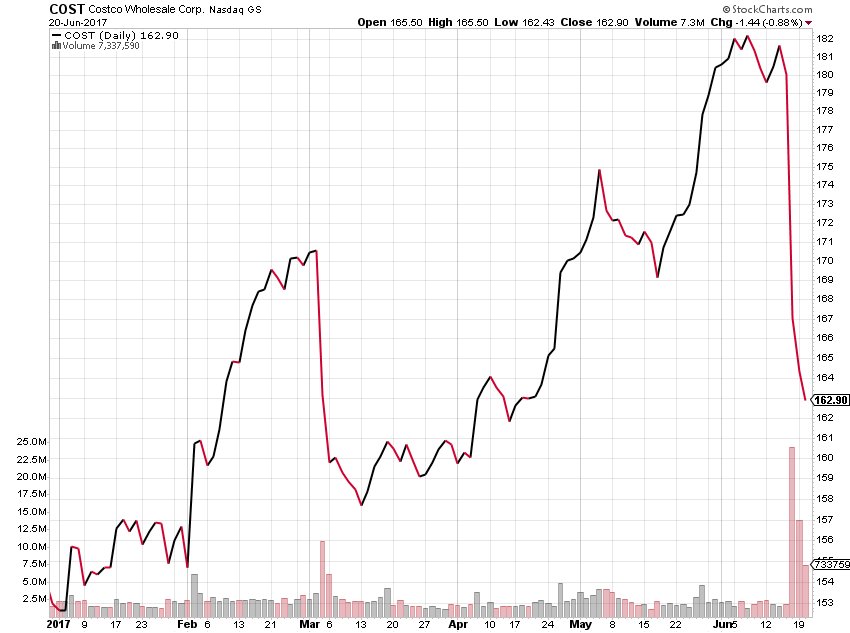

First Costco Shares, and Now Costco Calls

As we quickly shared above, in today’s issue of Tematica Investing we used the post Amazon (AMZN) — Whole Foods (WFM) tie-up news to once again add shares of Costco Wholesale (COST) to the Tematica Select List. Unlike the herd, we do not see Costco getting hard hit from this combination given how and where it derives a significant piece of its operating income – membership fees. With plans to further grow its warehouse locations, more data that points to limited wage growth and the now oversold status of COST shares, we saw a more than favorable risk-to-reward trade-off at current levels.

That same combination also offers a compelling opportunity to step into COST calls, and we’re adding the Costco Wholesale (COST) October 2017 173 calls (COST171020C00173000) that closed last night at 3.10. The timing takes us through the summer and captures the Back to School shopping season, which is slated to account for 17 percent of overall 2017 retails sales per eMarketer. It also allows us to benefit from Costco’s position as the #1 seller of beef in the U.S., as we light up our grills this summer and take advantage of the still favorable beef prices compared to last year.

As with most new call option positions, we’re going to be patient with this one, due in part to the longer than usual strike date. As such, we are not beginning this position with a stop loss recommendation, but should we scale into it, we will simultaneously set at stop loss.

- We are issuing a Buy rating on Costco Wholesale (COST) October 2017 173 calls (COST171020C00173000) that closed last night at 3.10.

- We would acquire these calls up to $3.70, but at this time we are holding off with a stop loss recommendation.

Instead of Putting Pressure on Costco, We See Amazon Squeezing Even Harder on Commercial Real Estate

Candidly, we do see the same destruction that Amazon is having on traditional retail spilling over into grocery with key targets being Kroger (KR) and Sprouts Farmers Market (SFM), which is already closing locations. Moreover given the near razor thin margins at Kroger Sprouts, it’s hard to fathom how it will invest to compete alongside Amazon-Whole Foods. This is, however, good news for us, as we see our short position in Simon Property Group (SPG) shares continue to play out.

We’re going to roll up our sleeves and dig into KR and SFM to see if they merit a short position. For now, we’ll continue to stick with our short positions in both General Motors (GM) and Simon Property Group.

- We continue to have a $150 price target on our remaining Simon Property Group (SPG) shares and the buy stop order is still set at $163.

- We are holding steady with our short position in General Motors (GM) shares and our price target remains $30. Our buy-stop level remains at $40.

Bullish Comments Have Us Sticking with Dycom Calls

Inside today’s issue of Tematica Investing, we shared our recent findings on Dycom (DY) as it and other specialty contractors have been making the conference rounds with upbeat presentations. We’ve seen this reflected in our Dycom Industries (DY) September 2017 $90 calls (DY170915C00090000)that closed last night at 7.90, up 49 percent from the buy-in recommendation issued on June 1.

As the DY calls move higher yet, we’ll look to lock in some gains with a protective stop loss order, but for now we’re going to sit back and enjoy watching Dycom’s customers expand the reach of their networks. It won’t be fun on the highways and byways, but we’ll take comfort knowing the Select List is positioned to benefit.

- We rate Dycom Industries (DY) September 2017 $90 calls (DY170915C00090000) a Hold at current levels. We see these calls as back in the Buy zone below $6.25.

- As the calls trend higher, we’ll look to establish a protective stop loss to lock in position gains.

Quick Housekeeping Comments on MGM and AXTI Calls

Our MGM Resorts International (MGM) July 2017 $33 calls (MGM170721C00033000) closed last night at 1.03, up 13 percent from our 0.91 entry point. Last week, New Jersey Gaming reported Atlantic City gaming wins rose 2.5% year over year in May. The next major catalyst for the underlying shares and the calls won’t come until we receive the end of the month gaming and revenue report from the Nevada Gaming Control Board. That will be followed by a similar report from the Macau Gaming, Inspection and Coordination Bureau. With indications pointing to a rebound in gaming activity in Macau as well as favorable summer traffic in Las Vegas, we remain bullish on both MGM shares and the July 2017 calls.

- We continue to rate the MGM Resorts International (MGM) July 2017 $33 calls (MGM170721C00033000) a Buy at current levels.

- We would be buyers of these MGM calls up to $1.50; because this is a new position we are holding off implementing a stop loss for this position at this time.

Last night our AXT Inc. (AXTI) November 17, 2017 calls (AXTI171117C00007500) closed at 0.60, up from our 0.55 entry point last week. We’d refer back to our Dycom comments both here in Pro and in today’s Tematica Investing regarding mobile network operators expanding 4G LTE capacity and beta-ing 5G services in both smartphones and other connected devices. This

requires additional layers of RF semiconductors, which is a positive for AXT’s substrate business.

As we head into 2Q 2017 earnings, the next known catalyst will be earnings from Qorvo (QRVO) and Skyworks Solutions (SWKS), two key players in the RF semiconductor market and AXT customers. With both reportedly designed into the iPhone as well as key models from Samsung as well as Chinese smartphone vendors, their earnings and outlooks will set the tone for AXT’s quarterly results and outlook. Given the proliferation of connected devices as part of our Connected Society investing theme, we suspect all three will offer a vibrant outlook for the second half of 2017.

- We continue to have a Buy on AXT Inc. (AXTI) November 17, 2017 calls (AXTI171117C00007500).

- We would add the calls up to 1.00, and given the thin volume that is likely to make the calls volatile from time to time, we are not employing a stop loss at this time.