Another Move that should deliver on Back to School Shopping

In last week’s Tematica Pro we added two call option plays for the Back to School shopping season. These were our Consumer Discretionary Select Sector SPDR Fund (XLV) September 16, 2016 calls (XLY160916C00082000) and Under Armour (UA) January 20, 2016 $45 (UA170120C00040000) additions, both of which closed last night essentially unchanged from where we added them last week. As you may recall, clothing and accessories, as well as footwear are expected to be in high demand this Back to School season, and those positions offer us ample exposure.

With Back to School shopping getting into gear over the coming weeks, both of those call options remain Buys at current levels. Our protective stop losses remain intact as well.

Another Move that should deliver on Back to School Shopping

As we’ve shared over the last few months in Tematica Investing, particularly when discussing our Amazon (AMZN) shares, we’ve seen a pronounced pick up in the transition to online and mobile shopping. As you more than likely know, this means ordering through a Connected Society device, such as a tablets, smartphone or even a computer, with your parcels showing up a few days later. This, of course, has been a boon to United Parcel Service (UPS) shares especially as it’s become clear that Amazon is not going to replicate UPS’s vast delivery network, but rather incremental capacity to meet its growing logistical needs.

Another confirming data point was found in this year’s back-to-school sales forecast from retail consultant Customer Growth Partners (CGP). Per CGP, back-to-school sales this year are expected to climb 3.3 percent to $540 billion (the back-to-school shopping period is defined as July through September). Digging into the data, online sales (roughly 18 percent of overall back-to-school sales) are expected to grow far faster, 11 percent year over year, meaning this area once again will take consumer wallet share. Much like we do, CGP expects Amazon to be a strong beneficiary, with the company accounting for “at least a quarter of back-to-school’s projected $17 billion rise this year.”

This bodes extremely well for UPS shares over the coming weeks and as such we are adding the following to our list:

- UPS September 23, 2016 $112 calls (UPS160923C00112000) that closed last night at 0.54.

- We’d buy the calls up to 0.75

- On the downside to protect capital we’ll be setting a protective stop loss at 0.35.

On Friday, we’ll get the July Retail Sales Report, which could show some pull-forward in Back to School sales. We’ve noticed in recent outings to Costco Wholesale (COST) and Target (TGT) that the season items associated with Back to School spending were out in full force, and the schools in our area aren’t back in session until the week before Labor Day. Inside the report, we’ll be looking at the various line items, such as those found under Clothing & Clothing Accessories for our UA and XLY call options, while for our UPS calls the nonstore retailers will be the one to watch.

One interesting fact on all of these tax-free shopping holidays that have cropped up and coincided with Back to School shopping: Kansas, North Carolina, Nebraska, Rhode Island and Wisconsin are among the states that have decided against holding new tax holidays or reinstating them during the last few years. The reason according to the Institute on Taxation and Economic Policy, or ITEP, a nonpartisan think tank, is they will be saving money. ITEP estimates that state and local governments that retain the holidays will lose out on more than $300 million in revenue due to the holidays this year. Those losses in revenue come as states are also poised to see aggregate tax revenue growth below 4 percent this year, down from 5.5 percent in 2015, according to Moody’s Investors Service.

If you’re wondering if you are in one of those 17 states where you can shop tax free for Back to School, click here to find out.

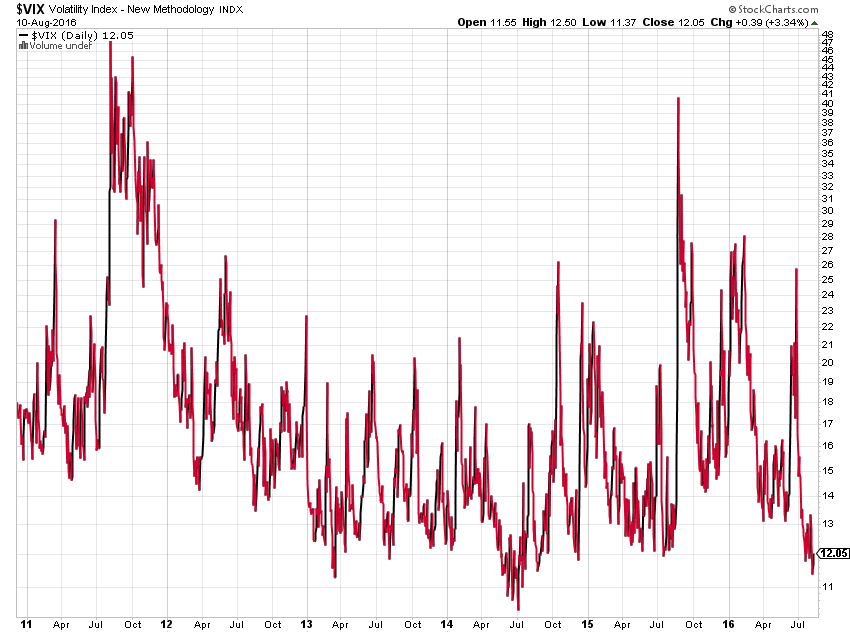

A few weeks ago, we cautioned that as the frequency of June quarter corporate earnings slowed, we would be entering a seasonally weak time for the market. It seems that once again, the financial media is catching up to our way of thinking — this headline “Traders bet on another late-August volatility spike” appeared on CNBC.com yesterday, with the gist of the story being that if the Volatility Index (better known as the “VIX”) was below 12 in August, “there was almost a sure bet that the VIX will be higher three months out by more than 6 percent with a fair possibility of an outsized move.”

While the VIX closed last night at 12.05, it’s spent some time below 12 thus far in August. With a few weeks left to go, we’ll continue to keep an eye on the VIX, but with the market at increasing stretched valuation levels on expectations now for a dip in 2016 S&P 500 earnings year over year, we’ll continue to keep the inverse ETFs that are SH, DOG and RWM shares on the Tematica Pro Select List.