Aspirational Products Drive Affordable Luxury Brands to Blow the Doors Off Mainstream Retail

Don’t let all the bad news from domestic brick & mortar retailers cloud your view of the overall retail landscape as it would mislead you into thinking that it was doom and gloom for all retail. Looking at the performance from Affordable Luxury retailers like Kering, LVMH, Burberry and Hermes, that’s certainly not the case.

The BI Europe Luxury Goods Top Peers index has jumped 8 percent this year, amid signs that appetite for expensive handbags, silk scarves and timepieces is rebounding. While the industry had grappled with ebbing demand in China and a slowdown in tourism in Europe after terrorist attacks, a rebounding China and the Chinese New Year are likely to stoke demand for our companies that fit our Affordable Luxury investing theme.

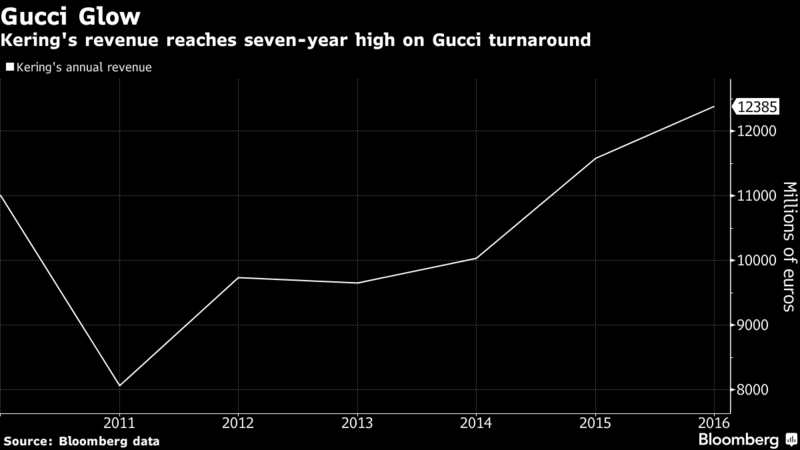

Gucci’s $2,000 Sylvie leather shoulder bags and $1,190 studded leather pumps are flying off the shelves, propelling parent company Kering SA to its fastest sales growth in four years and further lifting spirits in the hard-hit luxury-goods industry.

The Italian fashion brand’s revenue advanced 21 percent in the fourth quarter, almost twice as fast as analysts expected, Kering said Friday. Full-year sales at the business, Kering’s largest, exceeded 4 billion euros ($4.3 billion) for the first time as creative director Alessandro Michele reignited interest in the label.

Source: Gucci’s Record Sales Propel French Luxury House Kering – Bloomberg