Key points inside this issue:

- Earnings season notables from Amazon, Disney, Alphabet/Google and Nokia

- We are sitting out this week with a new option recommendation, waiting for the market to find its footing rather than get stopped out due to either an earnings season swing one way or the other.

Last Friday we received the better than expected initial March GDP quarter print of 3.2%, which was well ahead of the expected range of 2.3%-2.5% depending on the source. Digging into that report, we found that inventory build was a key factor in the upside surprise. In our weekly Roundup comments, we shared that such builds tend to be temporary factor for the economy, and we’ll be watching to see the speed at which that inventory build is utilized in what the data shows to be a slowing global economy. To gauge that speed of inventory digestion, it means examining some of the key economic data, and this being the start of the month, there is no shortage of that to be had.

Yesterday morning we received the IHS Markit Caixin China General Manufacturing PMI reading for April and at 50.2, it was down meaningfully from 50.8 in March. Technically still in expansion territory, but barely so. Inside the report, new export orders returned to contractionary territory, suggesting cooling overseas demand, and while “stocks of purchased items returned to contractionary territory, the measure for stocks of finished goods fell more markedly.

Granted this is somewhat better than the data from a few months ago that showed China’s manufacturing economy contracting full on, but the April data does not suggest a meaningful upturn is imminent.

Over the next few days, we’ll get the April IHS Markit PMI data for Japan, eurozone and the US, but yesterday’s National Association of Business Economics’ (NABE’s) April survey of economists showed 53% of respondents now see the economy growing by more than 2% this year. That’s down from 67% in January. When we factor in the initial GDP print of 3.2% for the March quarter, it suggests a more pronounced slowdown in the coming quarters than was thought at the start of 2019. That likely means business’s ability to chew through that March quarter inventory build will not be brisk and will serve as an economic headwind in the current quarter.

Like always, I’ll be watching the economic tea leaves in the coming days and weeks as we look to zero in on the true speed of the domestic and larger global economy. This includes keeping tabs on what appears to be the never-ending US-China trade conversation. Yesterday morning, it was reported that Treasury Secretary Steven Mnuchin suggested the U.S. and China are closing in on a trade deal. Our position remains the same as it has been for some time – hopeful, but we acknowledge the details of any agreement will be what matters most, not headlines touting victory.

Tematica Investing

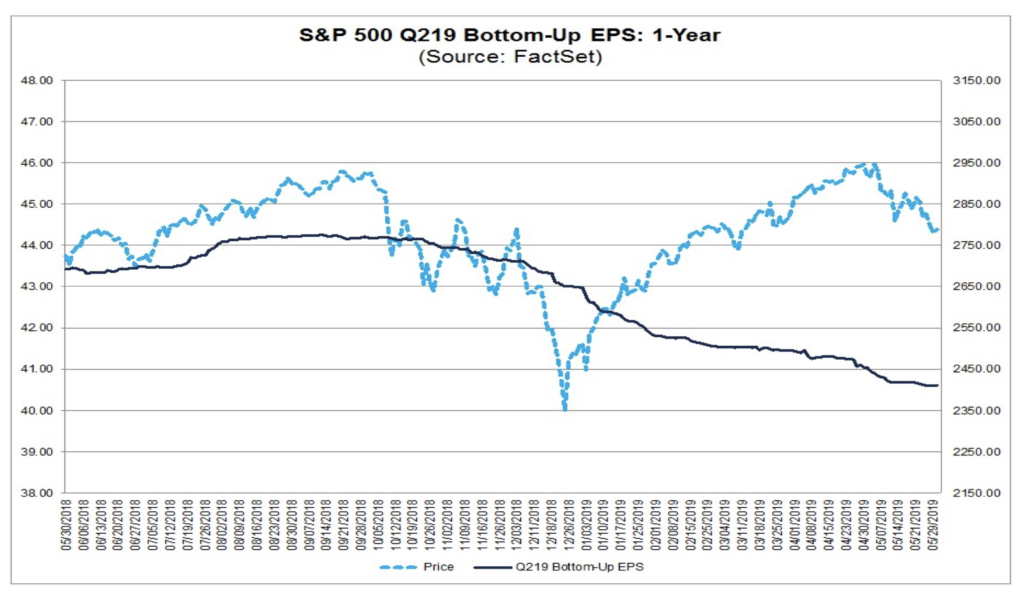

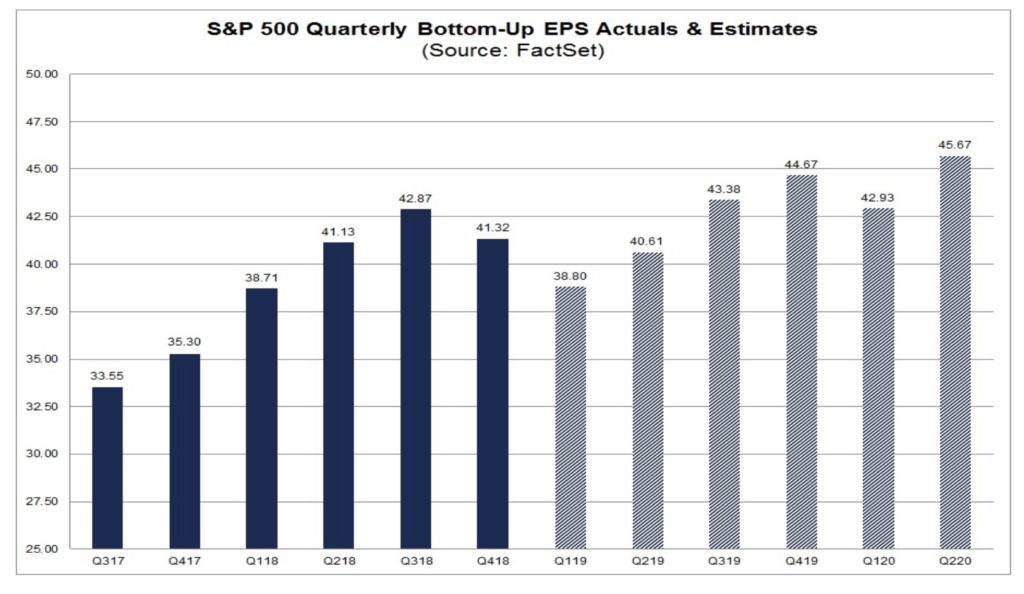

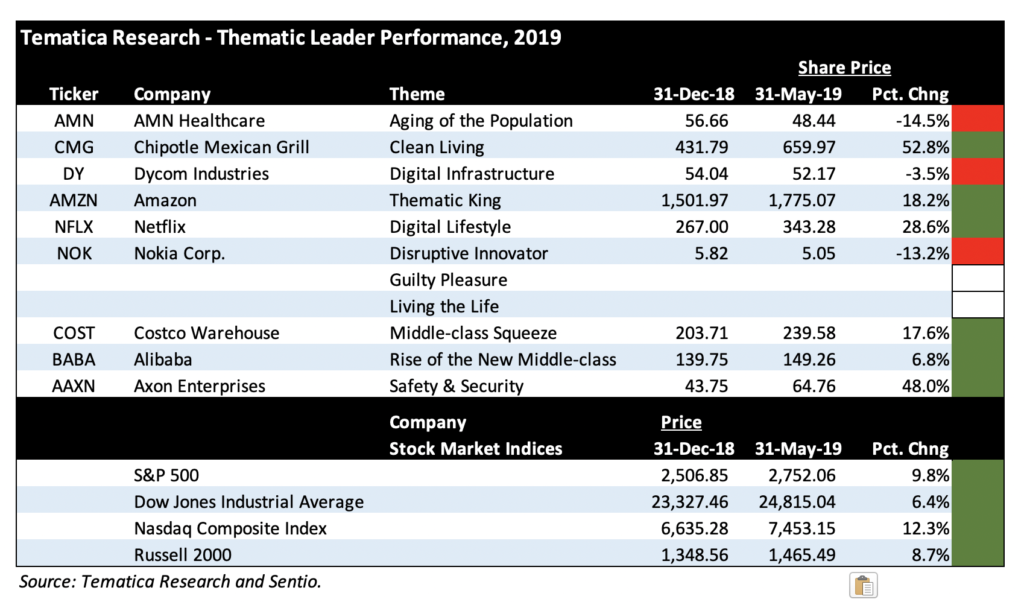

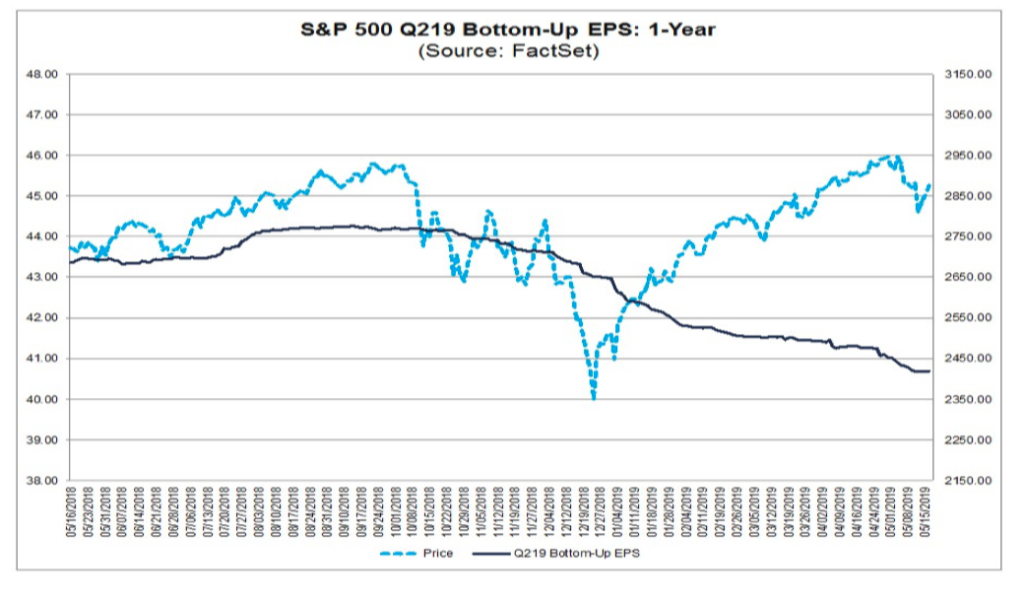

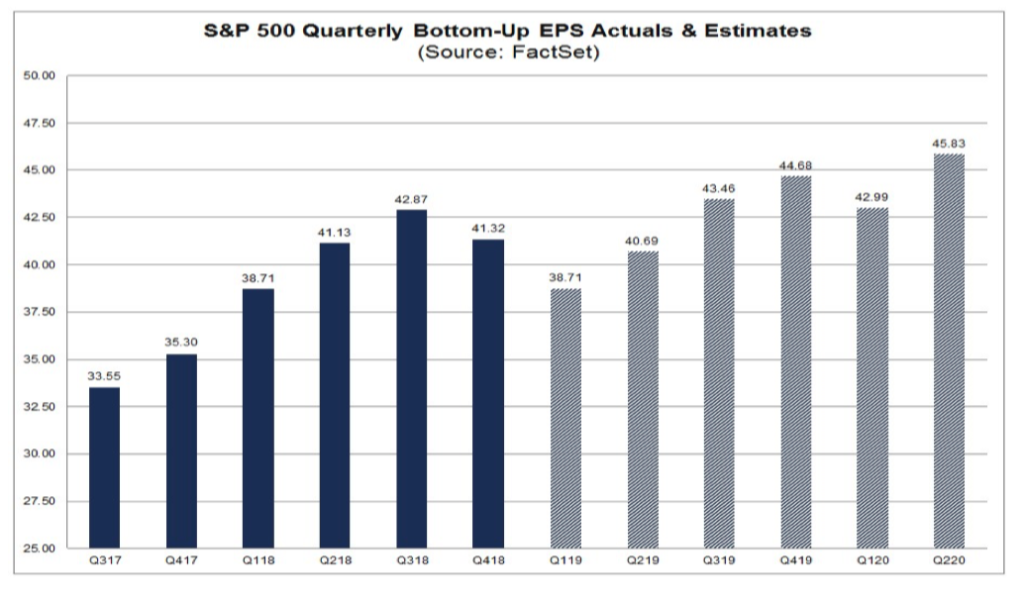

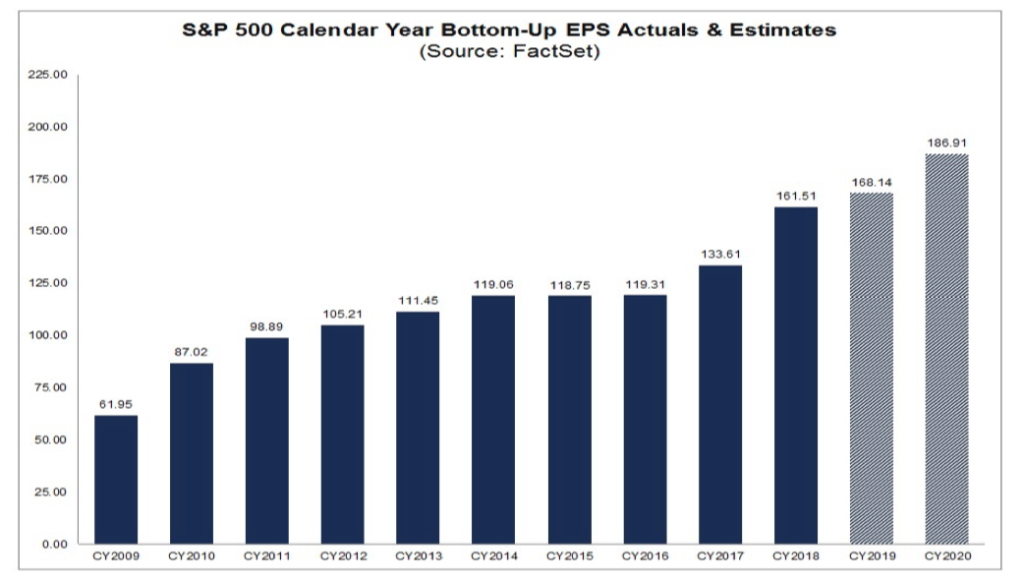

As we all know, we are smack dab in the middle of the March quarter earnings season, and there have been some high-profile beats, but also some high-profile misses complete with revised outlooks to the downside. Stepping back, the market is coming to grips with the data we’ve received over the last few months and its impact on company business models. In some cases, as we saw with results from Clean Living Thematic Leader Chipotle Mexican Grill, or those from Procter & Gamble Co. (PG) and The Hershey Co. (HSY), specific corporate strategies are paying off. Meanwhile, results from 3M (MMM), Tesla (TSLA), The Sherwin-Williams Co. (SHW), GATX (GATX), The Gorman-Rupp Co. (GRC), and others, remind us that pockets of the global economy have slowed considerably.

I expect this dichotomy to continue into next week as the March-quarter earnings season continues. As we and the market digest these reports, the coming of additional economic data, and any progress on trade talks, we’ll be able to triangulate on the next likely move for the market as we move further into the second trading month of the quarter.

Now let’s review some of the recent results for stocks on the Thematic Leaderboard and the Select List:

Amazon (AMZN) Thematic King

Shares of Amazon climbed following the company’s March-quarter results last week that simply crushed expectations. The likely follow through on those results was offset by Amazon once again providing in-line guidance which is likely to prove to be conservative. From an operations perspective, sales and profit growth were posted by the company’s two largest business segments — North America and AWS — while continued revenue growth at International and cost containment dramatically shrank that segment’s operating profit drag during the quarter. And while Amazon’s advertising business shrank quarter over quarter as the holiday shopping season subsided, year over year the company grew that business by 34%, putting to rest chatter concerning its level of growth.

Perhaps the most noteworthy item exiting the company’s earnings call was the announcement that free Prime two-day shipping would become free one-day shipping. In my view, this changes the table stakes for retail, and will no doubt lead to share gains for Amazon ahead of the upcoming Prime Day, but also as we move through the remainder of the year. Our price target on Amazon shares remains $2,250.

Walt Disney (DIS) Digital Lifestyle

Disney shares continued their march higher this week, adding to impressive gains in recent weeks that were sparked by the formal unveiling of its Disney+ streaming service. Fueling the move higher were several items, including the growing euphoria surrounding “Avengers: Endgame,” its latest tent pole franchise film that as expected pierced the $1 billion level at the box office in record time. Also last week, Comcast (CMCSA) shared it will sell its ownership stake in Hulu to Disney, which I expect will shore up its forthcoming Disney+ offering.

As I have shared previously, as Disney+ gains traction, I expect Wall Street will re-think how it values DIS shares. Disney will report its quarterly results on May 8 and no doubt remind investors of its vibrant film slate for the balance of 2019. With both of those factors in mind, I am boosting our price target on DIS shares to $140 from $125.

Alphabet/Google (GOOGL) Disruptive Innovators

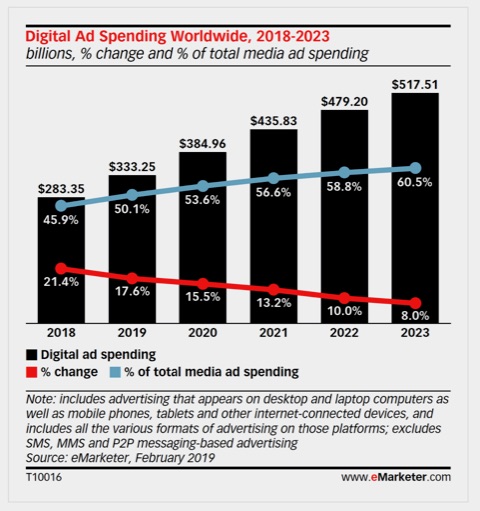

Earlier this week, Alphabet/Google reported mixed March quarter results with a beat on the bottom line, but quarterly revenue that fell shy of Wall Street consensus forecasts. Heading into the report, our GOOGL shares were up more than 22% year to date, even as recent reports from Facebook, Inc. (FB), Amazon and Twitter (TWTR) showed them gaining in digital advertising. Google bears have been pointing to growing traction from Amazon.com, Inc. (AMZN) in the digital advertising space, which continues to attract advertising spend from radio, TV and print. All of this set a very high bar for Google in terms of expectations, as it has been putting up 20% revenue growth in a string of recent quarters.

By the numbers, Google delivered EPS $11.90 per share vs. the expected consensus of $10.61 expected on revenue of $36.34 billion, vs. $37.33 billion expected. Digging into that 17% revenue increase year over year, Google’s core advertising revenue rose 15.3% year over year, down sharply from the 20%-24.4% range during 2018.

To some extent, this is the law of large numbers at play, and if we take a longer view, we see Google’s advertising revenue rose some 43% in the March 2019 quarter compared to the March 2017 quarter. Digging deeper into the figures, we find that YouTube, in particular, had difficult year-over-year comparisons following advertising changes implemented in early 2018.

So, what’s the issue?

According to forecasts from the likes of eMarketer, digital advertising spend is expected to grow 19%-20% this year compared to 2018.

It would appear that Google is off to a slow start in 2019, especially compared to the 26% year-over-year gain in advertising revenue put up by Facebook during its March quarter. Again, some perspective — Facebook’s March quarter advertising revenue was $14.9 billion, which is impressive, but is far behind the $30.7 billion captured by Google during the same quarter.

Despite its size, there are opportunities for Google to grab incremental digital advertising spend share in the coming quarters. Two such examples include new shoppable ad units in Google Images, which would allow brands companies to highlight multiple products available for sale in sponsored image results. The other ties to the company’s comping streaming gaming service introduced at its Game Developers Conference, allowing developers to reengage players with relevant ads across Google’s properties. And then there is Google’s position in mobile search and advertising as mobile utility continues to increase across the globe.

In short, Google’s core advertising business has several drivers of growth remaining. That said, I will monitor these and other efforts to grow the advertising business to ensure these plans are capturing revenue as expected. As one might expect, some across Wall Street trimmed their price targets, while the bears take the expected victory lap. I’ll continue to focus on the next 12-18 months, not the next few weeks. Our price target on GOOGL shares remains $1,300.

Nokia Corp. (NOK) Disruptive Innovators

Last Thursday morning, we received the March Durable Orders and Shipments report, which showed a 2.7% sequential increase in total orders and a 0.3% increase for shipments on the same basis. That’s a favorable order figure and suggests better-than-expected strength in the economy. However, with this report in particular, we need to ferret out the drivers between core capital goods, defense and aircraft. In doing so, we find core capital goods, the data series that ties best with the industrial and manufacturing economy, saw orders rise 6.6% month over month, while core capital goods shipments advanced 0.2%.

Digging a bit deeper into the March Durable Orders and Shipments report, we find considerable order strength in Communications Equipment (+9.0% month over month), Transportation (+7.0%) and Nondefense Aircraft & Parts (+31.2%), with more modest gains for Machinery, Motor Vehicles & Parts, and Electrical Equipment, Appliances and Components. Order declines were seen from Primary Metals, Fabricated Metal Products and Computers & Related Products.

Donning my investing hat, we see the surge in Communications Equipment adding confidence to the expected increase in 5G activity that should bolster its business in the coming quarters. Last week, Nokia delivered the telegraphed weak March quarter it signaled in January. If we were in the later stages of 5G network deployments, we would be far more concerned with these misses relative to Wall Street expectations. However, as both Verizon Communications Inc. (VZ) and AT&T Inc. (T) both shared this week, we are still in the very early earnings for 5G both here in the U.S. and abroad. Verizon even shared that it plans to announce more 5G-capable devices in the coming months. And this speaks to one of the key differentiators for Nokia — namely, Nokia Technologies, its IP licensing arm that delivers operating margins near 82%. That’s more than head and shoulders above historical margins for the Networks business during peak periods of demand. For the March quarter, nearly all of Nokia’s operating profit was generated by Nokia Technologies, which is on a run rate to deliver €1.4 billion (roughly $900 million).

The growing momentum in the 5G market is what allowed Nokia to keep its 2019 earnings forecast intact as the combination of revenue growth and improving margin profile falls to the bottom line. As Nokia noted in its earnings release, “5G revenues are expected to grow sharply, particularly in the second half of the year, driven by our 36 commercial wins to date.” As more device companies look to tap the 5G market opportunity, Nokia Technologies is positioned for further upside in the coming quarters. Should that come to pass, which in our view is more likely than not, it translates into either greater comfort with Nokia’s 2019 earnings-per-share targets or potential upside in the second half of 2019 and beyond.

Our position has been that 5G is a market opportunity that will gain momentum in the coming quarters and likely hit the U.S. commercial tipping point in 2020 with China/Japan to follow and then Europe. With hindsight being 20/20, we were likely early on adding Nokia to the Thematic Leaderboard, however, as the 5G inflection point approaches the shares will remain on the board. Subscribers who are underweight NOK shares should consider using post-March quarter earnings weakness in the shares to add to their holdings. Our long-term price target for NOK shares remains $8.50.