Booking a win on Mattel puts, adding a truck call option play

Key Points from this Alert:

- We are closing out the Mattel (MAT) April 2018 13.00 put (MAT180420P00013000) position, and booking a 54.5% win in the process.

- We are keeping our short position in Funko (FNKO) share intact as well as our short position in Target (TGT).

- Given the successful offerings in both Dropbox (DBX) and Spotify (SPOT), we will continue to hold the GSV Capital (GSVC) Jun 2018 10.000 calls (GSVC180615C00010000).

- We are issuing a Buy rating and adding the Paccar (PCAR) May 2018 70.00 calls (PCAR180518C00070000)that closed last night at 1.36.

- We are setting an initial stop loss at 0.60 and will look to raise it in the coming weeks as the calls move higher.

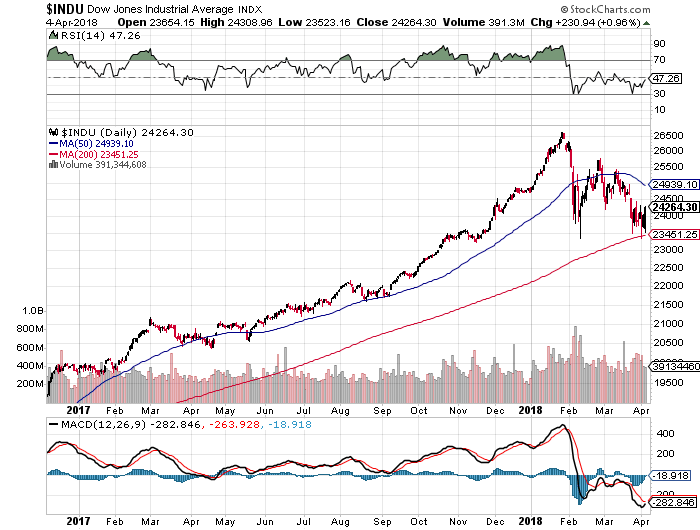

If there was any question over the volatility that has returned in the stock market, all we have to do is look at yesterday’s trading. The market opened with Dow falling several hundred points on the news of China second set of tariffs, but closed the day up essentially 1% as it became clear that it will be some time before the announced tariffs by China and the U.S. are enacted. Odds are this means we are entering a period of negotiation between these two countries that will result in further sparks before coming to a final resolution.

As we can observe from the above chart, over the last few months, we’ve seen far greater swings in the market than all of 2017. As I’ve shared in recent weeks, this can make for a challenging environment for options trading, and we’ve had our share of hits and misses so far this year. In yesterday’s Tematica Investing, I shared that we will remain loyal with our thematic investing strategy because over time the tailwinds will resurface and that means utilizing a longer time frame with our options as well as employing short positions for companies hitting pronounced tailwinds and other pain points.

Even as we contemplate those time horizons, we have just a few weeks until our Mattel (MAT) April 2018 13.00 put (MAT180420P00013000) expire. As of last night, the puts closed up 54.5% from our initial buy in just a few short weeks ago, and while it is tempting to stay the course, given the market swings, I’m making the call to book these gains now. Therefore, we will sell these MAT puts and close the position.

- We are closing out the Mattel (MAT) April 2018 13.00 put (MAT180420P00013000)position, and booking a 54.5% win in the process.

Even as we book that win, we have yet to see the full impact of the Toys R Us fallout. According to data published by the NPD Group, Toy R Us accounted for 12% of that industry and that liquidation is poised to weigh on toy suppliers. At the same time, per the January and February data for Personal Consumption consumers have been dialing their spending back compared to 4Q 217 levels, preferring instead to save. These data points have us keeping our short positions intact for both Funko (FNKO) as well as Target (TGT).

Sticking with our GSV Calls

In yesterday’s Tematica Investing weekly issue, I added GSV Capital (GSVC) shares to the Tematica Investing Select List with an $11 price target. The catalyst for that Asset Lite addition was the successful offerings in the last few weeks by Dropbox (DBX) and now Spotify (SPOT) that should drive GSV’s net asset value (NAV) per share higher. Those comments also hold for our GSV Capital (GSVC) Jun 2018 10.000 calls (GSVC180615C00010000).

- Given the successful offerings in both Dropbox (DBX) and Spotify (SPOT), we will continue to hold the GSV Capital (GSVC) Jun 2018 10.000 calls (GSVC180615C00010000).

Adding Paccar calls on record first quarter truck orders

Also on the Tematica Investing Select List, we have shares of heavy and medium duty truck company Paccar (PCAR). Despite the slump in the shares over the last few weeks, we’ve continued to hear of the truck shortages that led us to add the shares to the Select List. We’ve also seen strong year over year improvement in heavy truck orders. Late yesterday, it was reported by FTR Transportation Intelligence that 1Q 2018 orders for heavy-duty trucks came in at 133,900 – a 98% gain year over year and the highest level since 2006.

This data sets the stage for a very strong 1Q 2018 earnings report from Paccar, and with that in mind, we are adding the Paccar (PCAR) May 2018 70.00 calls (PCAR180518C00070000) that closed last night at 1.36. Given the current market volatility, which could persist into the upcoming earnings season we’ll set an initial stop loss at 0.60 and look to raise it in the coming weeks as the calls move higher. We should be buyers of these calls up to the 2.00 level.

- We are issuing a Buy rating and adding the Paccar (PCAR) May 2018 70.00 calls (PCAR180518C00070000)that closed last night at 1.36.

- We are setting an initial stop loss at 0.60 and will look to raise it in the coming weeks as the calls move higher.