Bulls Buck Bob Farrell Rule #5

An article in the WSJ today reminded me of Bob Farrell’s rule #5:

The public buys the most at the top and the least at the bottom.

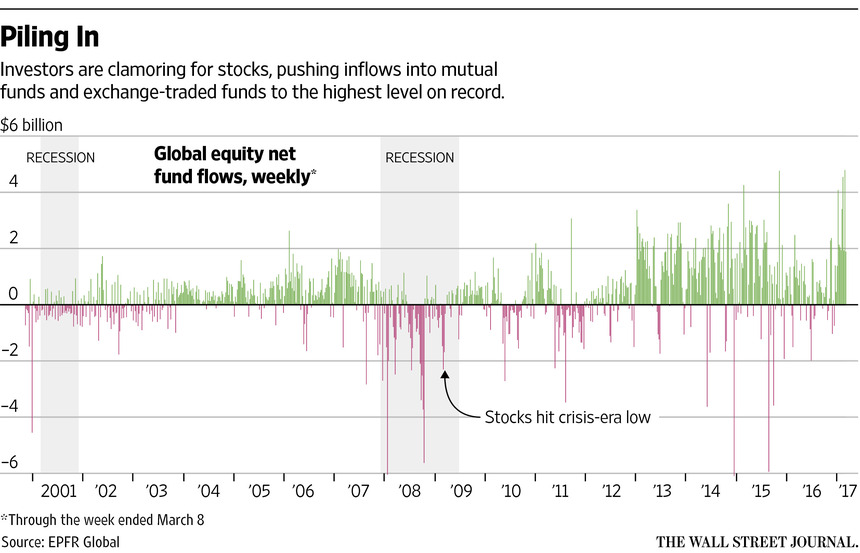

Eight years into the bull market with more than a tripling of the major indices and the retail investor has decided to jump in with both feet, plowing nearly $80 billion into U.S.-based equity funds since the election with $6.7 billion of that coming in last week alone. Sentiment is so high that the Investor Intelligence survey shows the bulls at 63.1 percent, the highest reading since January 1987! The bears at a hibernating 16.5 percent, l four leaving us with four bulls for every bear. Can you heard the herd of hooves?

In the WSJ article we learn of just how bullish retirees have become.

One of Ms. Gugle’s clients has increased his stock allocation to around 80% from 70% in recent months after cutting back on bonds amid concerns about low returns.The client, George Bohmfalk, a 69-year-old retired neurosurgeon in Charlotte, says he has faith that remaining loyal to a low-cost passively managed portfolio is more productive than trying to pick winners and losers. But he’s concerned about what the Trump administration may do, and he worries about U.S. stocks’ lofty valuations.

So what kind of returns can these folks expect? When forward-looking P/E ratios are in today’s range, between 18x and 20x, the coming year on average generates around 1.1 percent with a whopping 4.5 percent over the next five years, ouch. While P/E ratios don’t serve as an accurate signal for a market top, they do suggest a cap to returns.

I know, I know, I keep blowing the bubble bugle but bulls hear me out.

- Margin debt is now at $513 billion, which is the highest level ever recorded. That’s a sure toppy sign and when we get some pullbacks, all that leverage makes wee little moves a lot more painful.

- We are seeing declining breadth, with more new 52-week lows than highs in the past four sessions, the longest streak since November 4th – another toppy indicator.

- The small-cap Russell 2000, which is often a leading indicator, is now flat for the year and 4 percent below its highs.

- The S&P 500 has gone 57 days without a 1 percent intra-day swing, something we have not seen in at least 35 years and recalls to mind the mantra of Raoul Pal of Global Macro Investor and Real Vision, “Suppressed volatility leads to heightened volatility.”

- Survey data is veritably giddy with excitement over an expected economic acceleration while actual economic growth is barely treading water at just over 1 percent annual rate, a classic end-of-cycle divergence.

- We’ve only seen households’ exposure to the stock market at or above the current 21.1 percent level fives times in the past 16 years. Bob Farrell’s number five is screaming out on this one.

- U.S. high-yield corporate bond (aka junk) yields approached cycle lows recently but are now starting to widen in a more risk-off trend and as the saying goes, bonds lead stocks. Pay attention!

Source: Individuals Tiptoe Further Into Long-Running Stock Rally – WSJ