WEEKLY ISSUE: Earnings start off just as we expected, which isn’t a good thing

In this Week’s Issue:

-

A Picture is Worth a Thousand Words, So Here are Four Thousand Words

-

Investor Uncertainty Pushes AT&T Below Our Stop Price

-

USA Technologies – A Tug of War in the Short-term, but Long-Term Opportunities Remain

-

McCormick Scoops Up Reckitt Benckiser Group Plc

-

Watch-Out for More to Come this Week on Disney and Amazon

Second quarter earnings season really began late last week, and as we’ve been expecting it’s been anything but smooth sailing. While we’ve only received a handful of reports over the last few days, looking at ones from JPMorgan Chase (JPM), Bank of America (BAC), Goldman Sachs (GS), rail company CSX (CSX) and Harley Davidson (HOG), they’ve been less than well received despite reporting beats relative to expectations for 2Q 2017. As we are fond of saying, the devil is in the details, and in each report, there has been something that has raised investor’s eyebrows.

The clearest case was with Harley Davidson, which slashed its 2017 outlook and now expects motorcycle shipments to be down 6 to 8 percent compared to 2016 vs. its prior call for a flat market year-over-year. We’ve haven’t dug deep into its earnings report, but Harley’s outlook cut could very well be a result of the Baby Boomers slowing down their purchase rate these “hogs” — a headwind to the Aging of the Population theme if there ever was one.

As you well know, a rollback to corporate earnings is exactly what we’ve been expecting. Our position here has been that this rollback was inevitable for the second half of 2017 given the confluence of data showing a clearly slowing economy and the stalled Trump agenda in Washington — both of which have likely revived at least some degree of uncertainty in the c-suite.

Earlier this week, there was another blow as the GOP shifted from repealing and replacing the Affordable Care Act to just simply repealing it. That news pressured the dollar and was another sign of the hamster wheel the Trump administration is caught on when it comes to its agenda. This is but another notch in the uncertainty belt and the question to be pondered now is will team Trump move past healthcare reform to focus on tax reform and other items, like rebuilding domestic infrastructure? Time will tell, but odds are it’s going to be at least several weeks until we have an answer.

A Picture is Worth a Thousand Words, So Here are Four Thousand Word

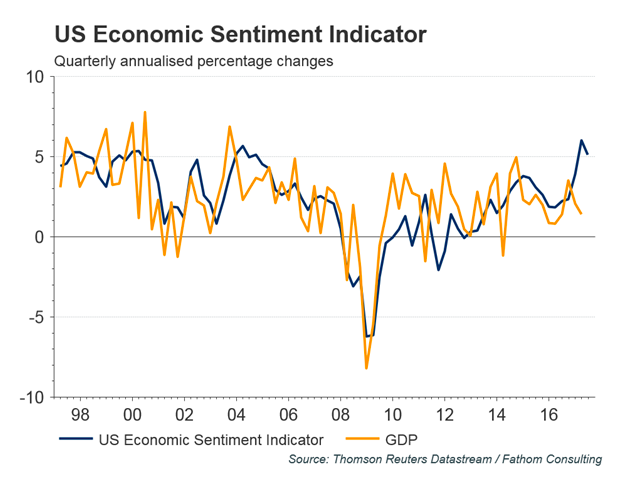

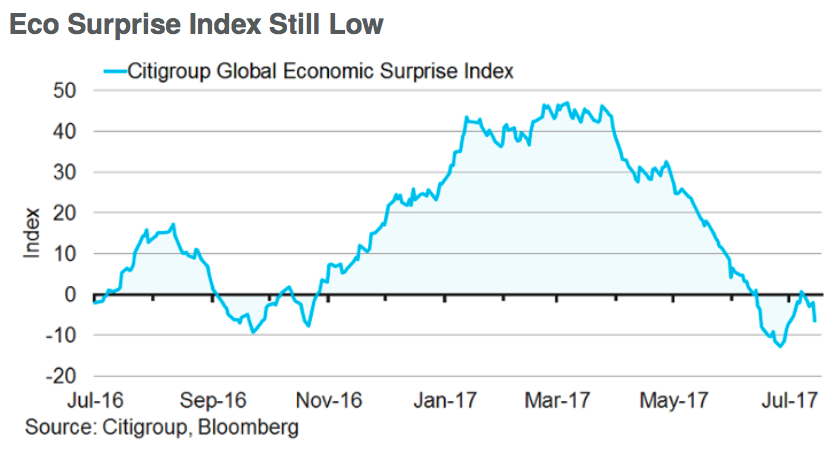

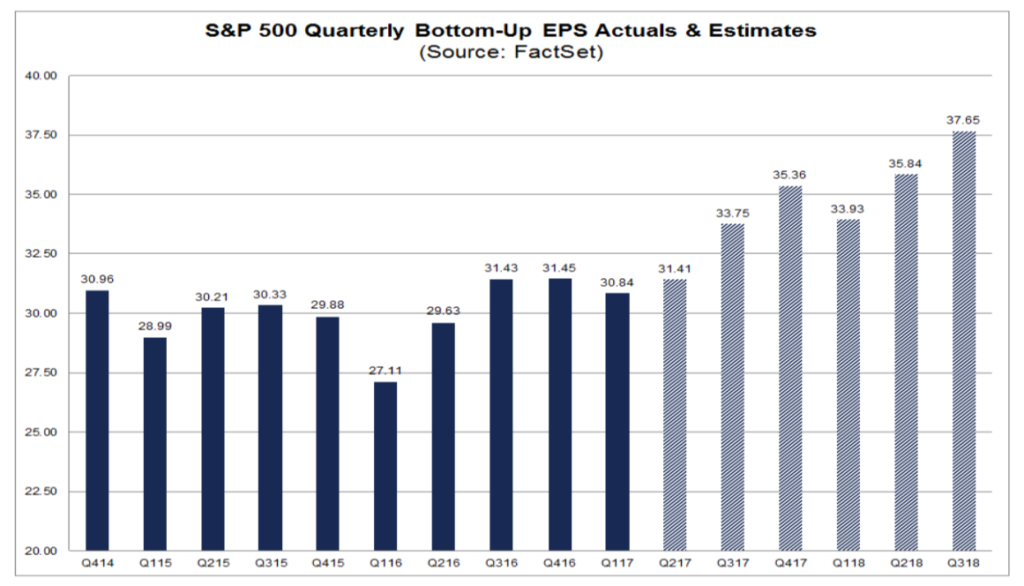

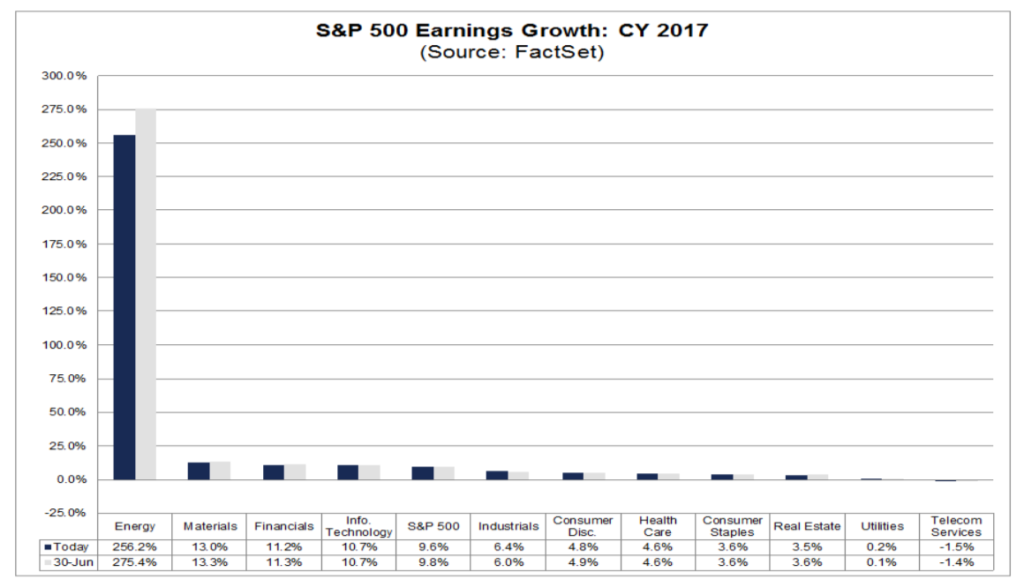

In this week’s Monday Morning Kickoff, we ticked off the reasons why the resetting of expectations I alluded to above was, well, expected. If a picture is worth one thousand words, then here are four thousand that provide a great visual summary of what is about to occur.

Tying these four together, we see the disconnect between the speed of the economy and expected earnings for the back half of 2017.

Current expectations call for earnings-per-share growth of just over 11 percent in the second half of 2017 vs. the first half — nearly double the 5.6 percent average of the last several years. As we can see in the above graphs, given the speed of the economy mixed with the push-outs in the Trump agenda, it’s looking very likely there needs to be a walk-back in guidance. Keep in mind, too, that we are only starting to see EPS expectations for oil and energy companies revised lower following the move in oil prices. I make note of this because the energy sector was slated to be the big driver of EPS improvement in the second quarter and back half of 2017.

The bottom line is we are just at the start of second-quarter earnings and we’ve got more than 220 reports to go this week, followed by more than 600 next week, and more than 1,200 to close out the first week of August. It’s going to require a lot of digging, thinking and re-calculating over the next few weeks, but team Tematica will be here to get you through it.

The good news is a pullback in the market will allow us to pick up thematically well-positioned companies at better prices or scale into well-positioned ones that are already on the Tematica Select List at better prices than we have today.

Investor Uncertainty Pushes AT&T Below Our Stop Price

This week we were stopped out of AT&T (T) shares as our $36 stop loss was triggered. The net result after accounting for dividends received was a modest loss given the $37.63 buy-in price last November. We continue to favor the pending transformation in the company’s business that adds a Content is Kingmoat around its connective business that will occur when it completes its pending acquisition of Time Warner (TWX) later this year. As we head into further into 2Q 2017 earnings and the dog days of summer, we’ll let the shares cool off and revisit them over the coming week.

USA Technologies – A Tug of War in the Short-term, but Long-Term Opportunities Remain

Last week we shared USA Technologies (USAT) was looking to raise additional funds through a stock offering that would likely be dilutive to its bottom line. Our position as shareholders was that while we were less than thrilled with the strategy, we also understood the need for additional capital so it could continue to capitalize on our Cashless Consumption investing theme. This week, we received some rather positive news from the company as it boosted its June quarter outlook.

More specifically, during the quarter USA Technologies received a “substantial” repeat order from an existing customer that dramatically increased its service revenue during the quarter. The company now sees June quarter revenue of $32 million to $34 million compared to the consensus expectation of $27.4 million. Moreover, based on the updated forecast USAT now sees its 2017 annual revenue coming in between $102-$104 million (remember the company is a June fiscal year end). That number is an increase of roughly 33 percent and ahead of the $97 million expected by investors.

Mixing and matching those two items, we would not be surprised to see USAT shares toggle back and forth as the good news (upside relative to expectations) is counterbalanced by the stock offering. We continue to like USA Technology’s positioning in our Cashless Consumption investing theme, which could put it on the acquisition radar screen of larger companies, and we will continue to be patient investors.

- Our price target on USAT shares remains $6, but should the shares pullback below $4.75 in the near-term we’d be willing to scale deeper into the position.

McCormick Scoops Up Reckitt Benckiser Group Plc

Early this morning it was reported that McCormick & Co (MKC), which sits between our Foods with Integrity and Rise & Fall of the Middle Class investing themes, will buy the food business of British consumer goods conglomerate Reckitt Benckiser Group Plc for $4.2 billion. Acquired products include French’s Mustard, the world’s leading mustard brand, as well as Frank’s RedHot Sauce (a team Tematica staple) and Cattleman’s line of sauces, which will push McCormick to the forefront of the condiment category in the U.S. as well as bolster its growing international footprint.

Per the company’s press release, McCormick will integrate the acquired business into its consumer and industrial segments, and targets $50 million in cost synergies by 2020. Given its conservative nature, we suspect there could be more synergies to be had, especially once we factor in cross promotion and product extension possibilities.

- For now, our price target on MKC shares remains $110. As more details, including the financing of this transaction, are revealed we’ll look to revisit that price target, most likely with an upward bias.

- If shares come under pressure following today’s news, we’d be inclined to scale deeper into the position closer to the $91.80 cost basis we have on the Tematica Select List.

Watch-Out for More to Come this Week on Disney and Amazon

Last weekend, The Walt Disney Co. (DIS) held its latest D-event, which is the company’s showcase of new movie trailers and announcements. Also, Amazon (AMZN) continued its seemingly daily new feature announcement, this time revealing through recent trademark filings that it is looking to attack the growing meal kit business — not a surprise given the recent agreement to acquire Whole Foods Market (WFM).

Both of those events require a fair level of unpacking and entirely separate reports from this weekly summary issue. Once our analysis is complete, we will post updates here for subscribers. You should also be sure to check the site regularly as well, because not only are all issues posted to the website first, there is also a whole host of other content featured on a daily basis — Macro economic insights from our Chief Macro Strategist Lenore Hawkins in “Elle’s Economy”, Thematic Signals where we trace key thematic happenings that are ripped from the headlines, and Cocktail Investing, our weekly podcast with myself and Lenore.

And then, of course, there is also the Tematica Select List performance charts, which I am happy to say are now being updated at the end of each trading day and are presented in a new, expanded format. There is lots to read and consume here, with more enhancements planned, so be sure to check it out today.