Facing Reduced Market Visibility

- While equity markets resumed their upward trend this week, with most of the major indices up over the past five days, trade and tariff tensions came to a boil exiting the week.

- Bond markets are less confident as the yield curve continues to flatten.

- The lack of available talent continues to be a headwind to the economy, yet wage growth is still less than would be expected given the unemployment rate.

- While the data coming in still shows a strong domestic economy, we are seeing signs and concerns the trade war could exacerbate an already slowing global economy.

The Markets

It was a short trading week with below average volume thanks to the mid-week Independence Day holiday and fairly light as well for economic data. Monday all the major indices closed in the green with technology and utilities the strongest sectors. What? Yep, the Technology Select Sector SPDR ETF (XLK) rose +0.89% and the Utilities Select Sector SPDR ETF (XLU) rose +0.71% — talk about an odd couple.

Tuesday the markets opened again in the green, but then fell throughout the day with the Russell 2000 closing in negative territory. After having been hit hard on Monday, the Energy ETF (XLE) led the sectors, gaining +0.63% after WTI crude briefly rose above $75 barrel. The Technology ETF (XLK) lost -1.2%, wiping out Monday’s gain, thanks in no small part to the ongoing drama with Facebook’s (FB) data sharing debacle.

Thursday equities were back in a bullish mood after Wednesday’s holiday, with small cap stocks continuing to outperform. The bond market was less optimistic as it reacted to the release of the Federal Reserve Open Market Committee minutes with a bearish further flattening of the yield curve. The spread between the 10-year Treasury yield and the 2-year is down to 0.30%, a level last seen in 2007. The FOMC minutes also reflected concern that trade policy could pose substation risks to growth, and this was before the President’s latest threat for new tariffs on an additional $500 billion of imports from China.

… many District contacts expressed concern about the possible adverse effects of tariffs and other proposed trade restrictions, both domestically and abroad, on future investment activity; contacts in some Districts indicated that plans for capital spending had been scaled back or postponedas a result of uncertainty over trade policy. Contacts in the steel and aluminum industries expected higher prices as a result of the tariffs on these products but had not planned any new investments to increase capacity.

Friday, tariffs on around $34 billion of Chinese imports kicked in and China began implementing its own retaliatory tariffs. The European Union is preparing a new list of tariffs on approximately $21.1 billion in imports from the US. This is no longer a game of chicken and no one looks like they could be willing to back down.

Also on Friday, we also got the June nonfarm payroll report, which beat expectations for 195,000 new jobs, coming in at 213,000. The unemployment rate rose to 4% from 3.8% as the labor force participation rate rose by 0.2% with more people entering the workforce. Average hourly earnings rose 2.7%, below expectations for 2.8% increase. Payrolls were also revised up an additional 37,000 for April and May. In summary, jobs are plentiful, wage increases are still below historical norms for this level of unemployment yet companies are struggling with the lack of available talent.

If you are a regular reader of our work, you’ve no doubt seen either me or my partner Chris Versace mention our concern that an awful lot of perfection is expected of corporate performance this year and heading into Q3. It was the focus of this week’s Cocktail Investing podcast. We are more cautious as the impact of the tax cuts and the increase in federal spending is likely to wane as we head into the back half of 2018 and we have not yet seen the impact of the escalating trade wars. As we head into the Q2 earnings season it is worth noting that, according to research from Bespoke Investment Management, going back to 2001, there have been more than 150,000 quarterly earnings reports with the average stock gaining +0.08% on its earnings reaction day. However, the Q2 earnings season is the only quarter where stocks typically average a decline of -0.09% on their earnings reaction day with stocks that beat EPS estimates gaining less than in the other three quarters and those that miss taking a bigger hit than in other quarters.

We chalk this up to the simple fact that June quarter reporting offers the first hard look at how companies see the back half of the year. As Chris and I talked on the podcast, the last several weeks have seen a growing number of risks and uncertainties that are likely to result in companies issuing more conservative guidance vs. expectations at the beginning of 2018. The issue is, despite these mounting risks, we have yet to see a meaningful nudge down in consensus EPS expectations for the S&P 500 in the back half of 2018.

The Economy

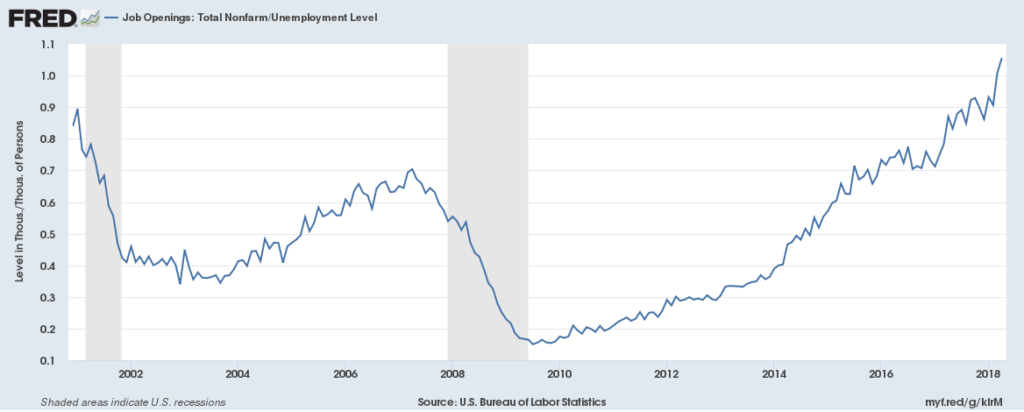

The big economic news of the week was all about employment. On Thursday, the ADP Employment report for June was a fairly material miss, with a gain of just 177,000 versus expectations for 190,000, driven primarily by companies being unable to find the right talent in the available labor pool. There are now more job openings that unemployed persons at a time when legal immigration is being reduced.

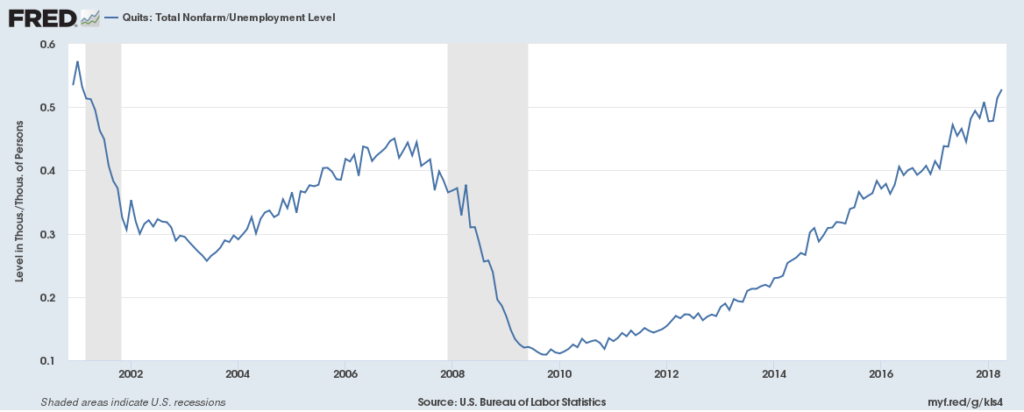

In fact, the level of voluntary quits as a percent of unemployed is at a level not seen since the dotcom boom.

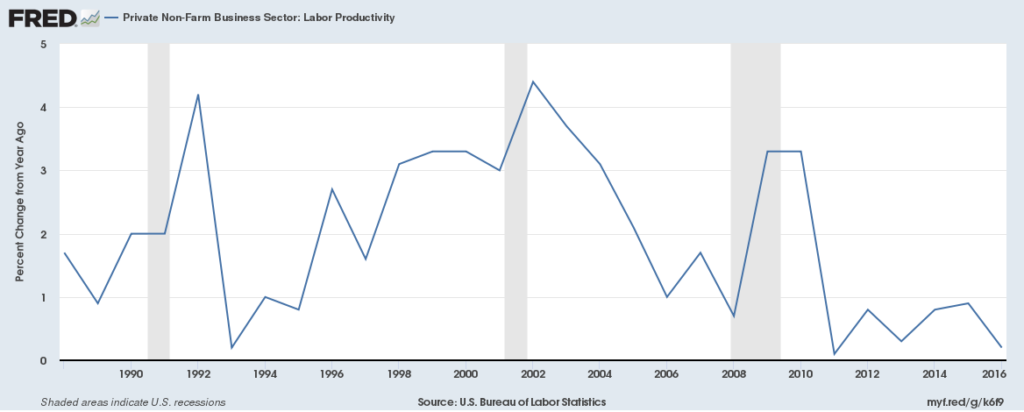

Recall that the growth of an economy is the sum of the growth in the labor pool and the growth in productivity.

With productivity fairly stagnant, the lack of available labor is a significant headwind to rising GDP.

With productivity fairly stagnant, the lack of available labor is a significant headwind to rising GDP.

According to the National Federation of Independent Businesses Small Business Jobs Report,

“While near record high levels of owners are hiring or trying to hire, 83 percent of respondents reported few or no qualified applicants for the positions they were trying to fill. Twenty-three percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up one point), the highest reading since 2000, and one point below the all-time survey high.”

This week, while the Markit June Manufacturing PMI declined modestly, the ISM Manufacturing Index for the US bounced in June, rising to 60.2 from last month’s 58.7, beating expectations and tying for the second highest reading of the current expansion. The Institute for Supply Management (ISM) noted in this month’s release that, “the PMI® for June (60.2%) corresponds to a 5.2% increase in real gross domestic product (GDP) on an annualized basis.” So there’s that!

I will point out though that the biggest increase in June relative to May came from Supplier Deliveries, which reached its highest level in over 14 years, and Imports with Backlog Orders seeing the biggest decline. Hmmmm – that big surge in delivery times is likely driven by the aforementioned tight labor market (drivers in short supply) and potentially some stockpiling efforts in response to all the trade war talk. In fact, if we removed the impact of the big jump in delivery times and the composite ends up nearly unchanged month-over-month.

I’m not liking that drop in backlogs as we look forward to Q3. On a positive note, the ISM Non-Manufacturing Index was stronger than expected at 59.1 versus expectations for 58.3. In contrast to the manufacturing index, new orders rose over the month, which is a positive sign for GDP.

Taking a wider economic view, the global Markit Manufacturing PMI fell to an 11-month low in June with forward-looking new orders index declining further from the drop in May. The number of countries in expansion during June fell to 76%, an 18-month low. That synchronized global expansion looks to be a thing of the past.

The bottom line is the US economy continues to be one of the strongest in the developed world, which alongside the interest rate differentials and a central bank in tightening mode, is driving the US dollar higher which is a headwind to exports. The labor market is flashing warning signs and the unpredictable nature of the escalating trade wars means reduced visibility into the back half of 2018. We’ll be closely watching for trends in corporate guidance as we head into this next earnings season.

Next week, we’ll be taking a much need break as we recharge and prep for the onslaught of earnings to come in the later part of July and into August, so we’ll be back with the next edition of the Weekly Wrap in two weeks time.