Falling Bond Yields

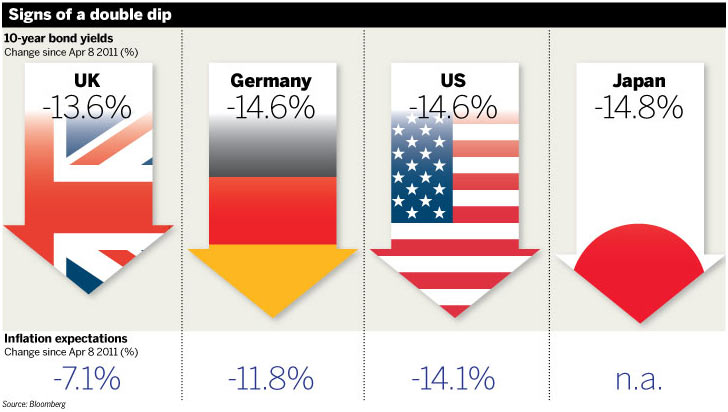

With all the talk about sovereign debt problems, from the PIIGS+ (Portugal, Ireland, Italy, Greece, Spain, and now Belgium) to the U.S. unsustainable debt trends, one would imagine that the cost of debt would show some of this concern. But we’ve recently seen yields drop significantly.

Why the decline? There has been a sharp drop in inflation expectations stemming from a clear decline in growth prospects in the developed countries for at least the remainder of the year. At the beginning of this year, the vast majority of investors thought government bond yields would rise consistently over the course of the year as economies recovered and growth rates normalized. But we’ve seen growth rates fall significantly below those initial forecasts, coupled with fears of how economies will fare as fiscal stimulus is withdrawn and quantitative easing in the States comes to an end.

Yours truly is ever watchful for rising inflation, but with a stalling economy, significant, sustained inflation is unlikely. What is more likely in the near to medium term are bouts of rising inflation expectations followed by deflationary expectations as the developed economies struggle to get back on their feet.

Bottom Line: This shows the importance of having a diverse portfolio because any “obvious” trend can reverse itself, particularly in these increasingly uncertain times, when governments are so heavily involved in the markets.