A View on Food, Energy and China

We’ve seen energy prices spike recently, leaving many, including yours truly, grumbling disdainfully while trying to avoid inhaling that ever-lovely, wafting eau-de-pump, watching the dollars rack up to a mind-boggling level as my voracious SUV sucks down another pocket-full with a grating “ping” as its thirst is finally satiated. (Throwing a little literary flair in this morning!) We are seeing some downward pressures on oil prices and many argue that we are in for a significant down-turn. At Meritas, we don’t attempt to time short-term market fluctuations believing that is more appropriate for those who head to Vegas for the weekend. We do however, look at longer-term trends and build investment strategies around those. When it comes to energy, the trends are pretty clear. While the demand from the developed world is not expected to go through the roof in the future, as emerging markets significantly increase their level of affluence, their demand will rise dramatically and given the size of the populations we are dealing with, this will be impactful. (See Chart below, source: FactSet, BP Statistical Review of World Energy as of 12/31/2010)

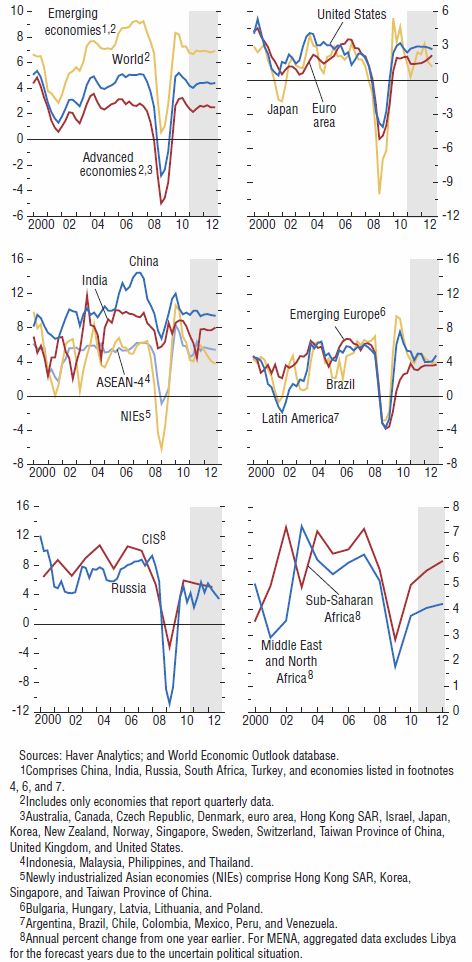

This should come as no surprise given the shift in growth from the advanced economies to the emerging markets, with emerging and developing economies posting strong growth while advanced economies languish.

REAL GDP (Quarterly % Change from Year Earlier)

Since 2001, the average real GDP growth rate in the emerging markets was 6.3% year-over-year while in the developed world only 1.9% year-over-year. In the 10 years prior to this, emerging markets averaged 3.7% vs. 2.0% for developed markets.

We are carefully watching for a potentially “hard landing” in China, which we believe to be more likely than not, but in the longer-term the global engine of growth lies more in the emerging markets than in the developed. Additionally, the U.S. Energy Information Administration is expecting significant increases in coal demand from China, which could be quite beneficial for the U.S. as we produce about 35% of the world’s coal supply.

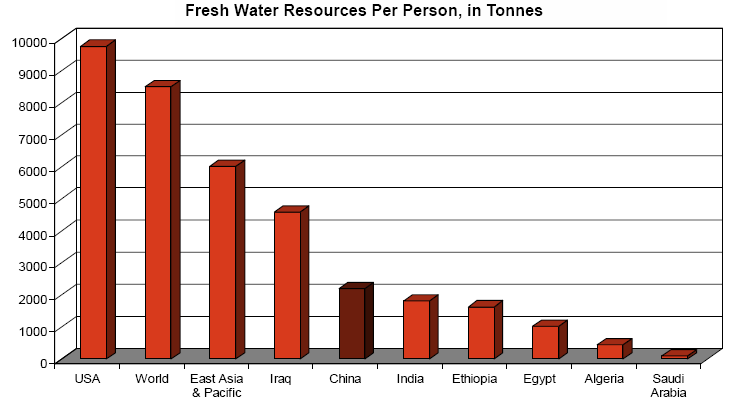

Additionally China’s policy of being agriculturally self-sufficient is not sustainable given it has 22% of the world’s population, only 6% of the world’s arable land and water resources per person on par with India’s (and that water is high polluted) with a population increasing its demand for more inefficient proteins such as beef. (Chart below from GaveKal)

However, this isn’t a simple story as China has benefited from a policy similar to the “Bernanke put” in the form of a “Wen Jiabao put” whereby when growth dropped below 8%, the government stepped in to get the economy moving again by either squeezing more productivity out of its worker and/or increasing debt. Today those aren’t viable options as a debt cannot be increased much with an already existing inflation problem and workers cannot be squeezed further. If China wants to continue its 7-8% growth, it will need to reduce local governments’ use of debt to cover fiscal deficits, improve the efficiency of its capital markets through significant financial reports and allow the economy to shift towards the service sector to unlock new sources of productive growth.

However, this isn’t a simple story as China has benefited from a policy similar to the “Bernanke put” in the form of a “Wen Jiabao put” whereby when growth dropped below 8%, the government stepped in to get the economy moving again by either squeezing more productivity out of its worker and/or increasing debt. Today those aren’t viable options as a debt cannot be increased much with an already existing inflation problem and workers cannot be squeezed further. If China wants to continue its 7-8% growth, it will need to reduce local governments’ use of debt to cover fiscal deficits, improve the efficiency of its capital markets through significant financial reports and allow the economy to shift towards the service sector to unlock new sources of productive growth.