Once again, the herd catches up on Universal Display (OLED) shares

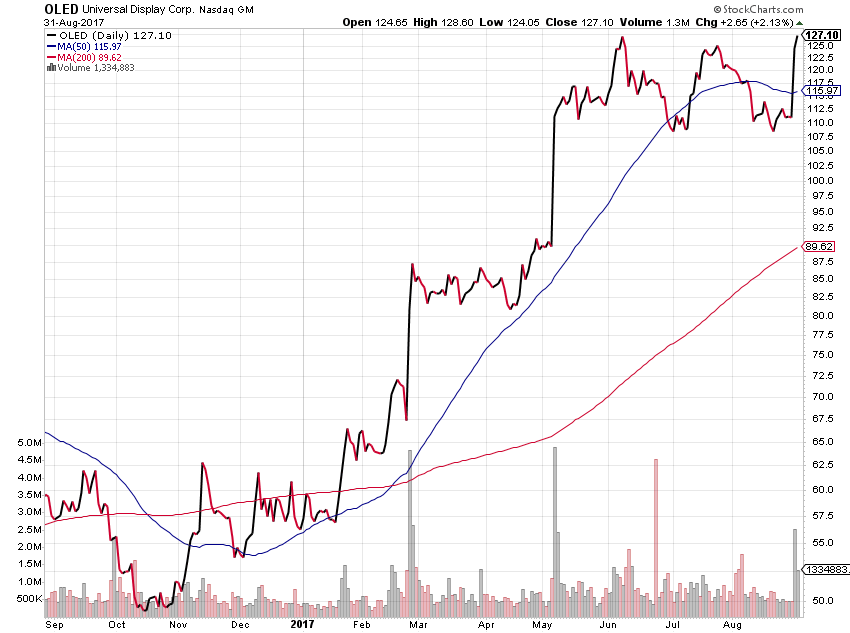

After languishing for several weeks, shares of Disruptive Technology company Universal Display (OLED) shares over the last two days popped $16, or more than 14%, to finish close last night at $127.10. The catalyst for the move was Deutsche Bank initiated coverage on the company with a Buy rating and a price target of $135, in line with our own.

While we like the herd catching up to our way of thinking, the surge in the shares comes with less than two weeks until Apple’s (AAPL) next iPhone event on September 12. We suspect over the next two weeks the iPhone rumor mill will be once again cranking up, with much chin wagging over the number of models, form factors and how many models will be employing an organic light emitting diode display. This likely means that at least in the short term, OLED shares are likely to melt higher, but as we’ve seen many, many times the devil is in the details when it comes to Apple’s new products. That means expectations in the near-term could get ahead of themselves, and we note this with 6% upside to our $135 target.

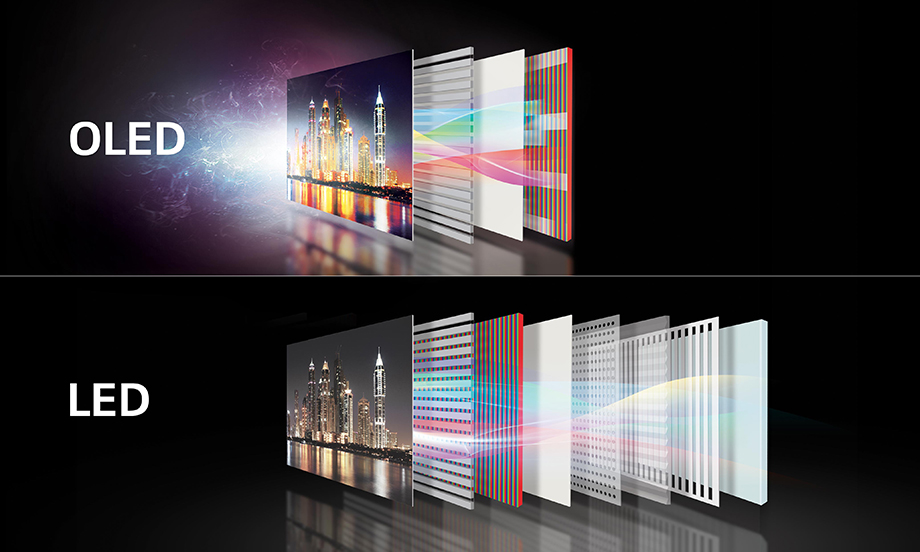

Make no mistake, we continue to see a bright future ahead for Universal Display and its organic light emitting diode chemicals and IP business over the coming quarters as the number of applications climbs alongside increasing screen sizes for smartphones and TVs. This has us long-term bullish on the shares, and while it’s likely that we might have to raise our price target on OLED shares again before the end of 2017, the risk we run in the very short-term is the shares are ahead of themselves at least temporarily.

Could this result in a “buy the rumor, sell the news” set up given Apple’s upcoming event? It’s possible, but given the medium- to longer-term growth prospects, we would see that as an opportunity for those that have missed out on scooping the shares thus far. As we’ve shared in the last few weeks, the $110-$115 share price band makes for a compelling proposition on risk-to-reward trade-off for patient investors. As new data becomes available, we’ll incorporate it into our thinking, including our price target.

- At current levels, subscribers should “Hold” Universal Display (OLED) shares rather than commit fresh capital.

- Our price target remains $135, but given expanding market applications for its products and licensing business, we’re inclined to be owners of the shares for the medium to longer term.