Inflation Rising While Wages Are Falling

Holy hump day – markets look to be rockin’ and rollin’ again today after this morning’s data releases from the Bureau of Labor Statistics.

First on the dance floor is the U.S. Consumer Price Index (CPI), which rose more than expected. Headline figure increased 0.5% seasonally adjusted, over the prior month versus expectations for 0.3% increase and 2.1% over the last 12 months, not seasonally adjusted, versus expectations for an increase of 1.9%. Excluding food and energy, rose 1.8% nsa, versus expectations for 1.7%. The recent market fears that the Federal Reserve is going to get more aggressive in how quickly it takes away its loose policy punchbowl are only going to get worse after this report. Hello volatility, we didn’t think you were done with us!

Most areas saw price increases over the past year, with the exception of commodities less food and energy, declining -0.7%, new vehicles -1.2%, used cars and trucks, -0.6%, and apparel -0.7%. These declines reveal the lack of retail pricing power, even on the auto lot, reinforcing our Cash-Strapped Consumer investing theme as well as the deflationary power of our Connected Society theme whereby consumers are able to quickly compare prices without incurring any meaningful costs.

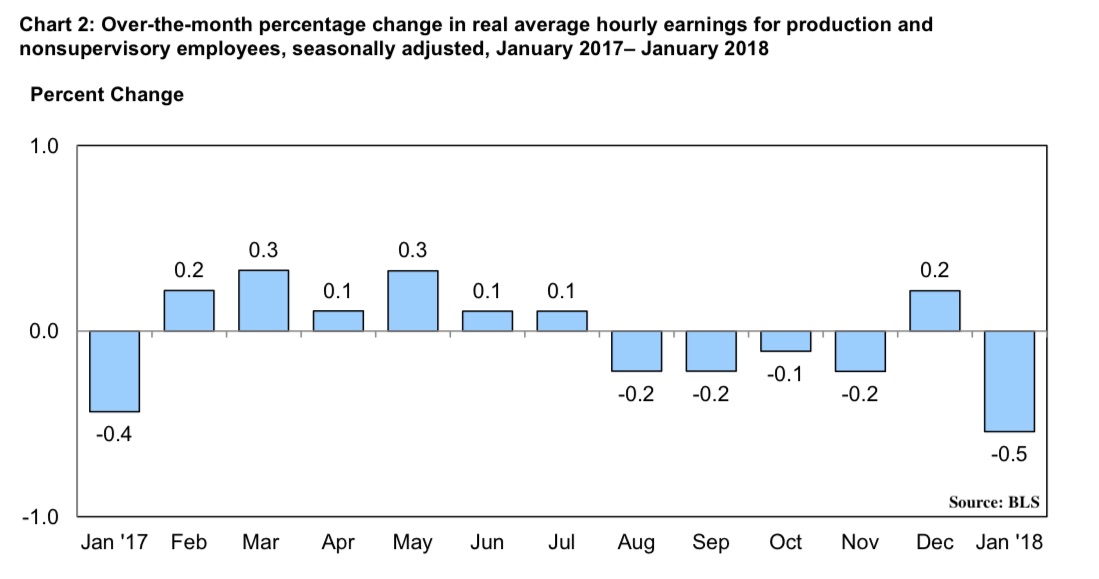

Next up is the Real Earnings Summary, also from the Bureau of Labor Statistics, which found that real average hourly earnings for all employees actually declined -0.2% from December to January, seasonally adjusted. Nominal earnings rose 0.3%, but the 0.5% increase in CPI wiped out that gain. What is even more disconcerting is that the over 80% of the population in the Production and Nonsupervisory Employees category saw their real average weekly earnings declined by 0.8% over the month thanks to both a decrease in real average hourly earnings and a 0.3% decline in average weekly hours. Year-over-year this group saw real average weekly earnings rise a meager 0.2% – again reinforcing our Cash-Strapped Consumer investing theme. Who can possibly feel better off when their weekly take home is basically the same as it was last year?

For all the talk of an accelerating economy, the over 80% of workers in the production and nonsupervisory category have now seen their real average hourly earnings decline in 5 of the past 6 months! Remember this when you read about how high Consumer Confidence has reached.

Roughly 70% of the economy is dependent on Consumer Spending. Over 80% have seen their earnings decline in 5 of the past 6 months while Consumer Credit has been rising. How much more can they spend?