JOLTS Jars with Mainstream View of Jobs

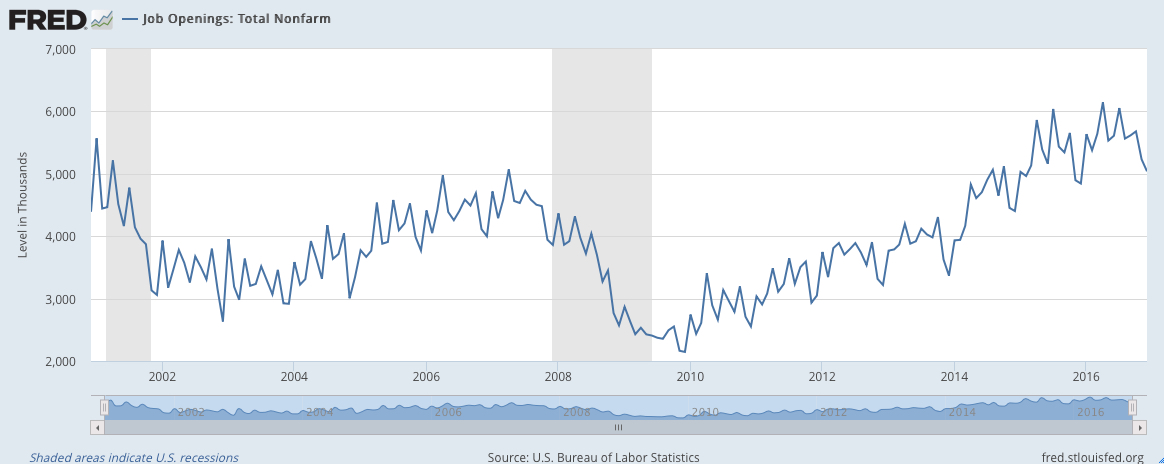

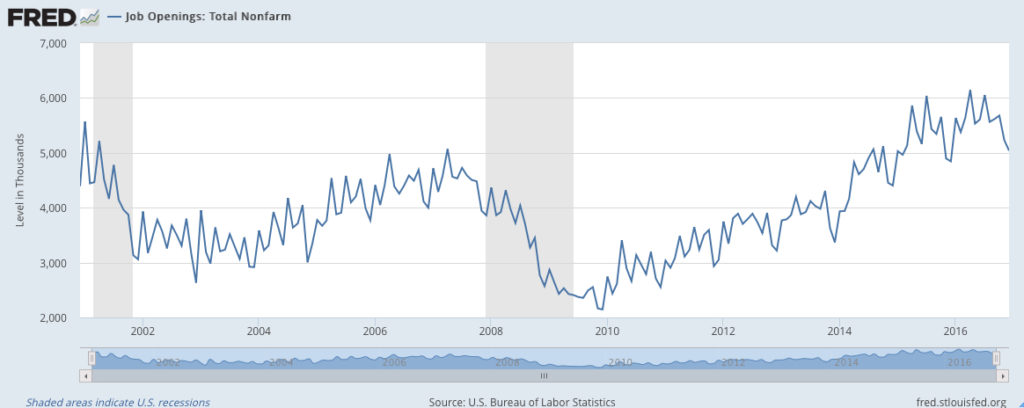

Yesterday the Bureau of Labor Statistics released its monthly JOLTS report (Job Openings and Labor Turnover Summary), revealing further details on labor market conditions in December. Despite all the post-election euphoria, the number of job openings actually declined by 4k and has dropped 130k since September.

While the number of new hires rose 40k, the level of hiring is 16k below the level in August and firings increased 16k in December, the third consecutive monthly increase for a cumulative 122k. That’s the highest level we’ve seen over a three-month period in more than three years. On the other hand, voluntary quits, which are viewed as an indication of confidence in the job market, fell by almost 100k in December.

While the number of new hires rose 40k, the level of hiring is 16k below the level in August and firings increased 16k in December, the third consecutive monthly increase for a cumulative 122k. That’s the highest level we’ve seen over a three-month period in more than three years. On the other hand, voluntary quits, which are viewed as an indication of confidence in the job market, fell by almost 100k in December.

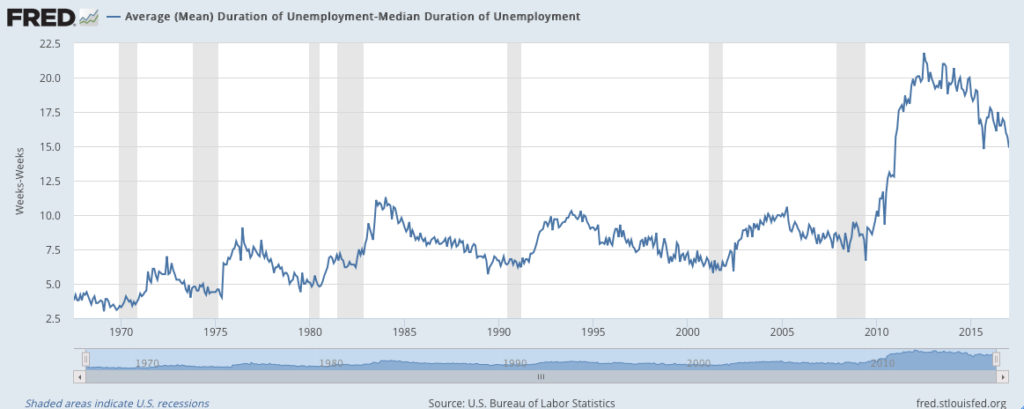

We continue to see a historically very high skew between the average duration of employment versus the median duration of employment. (The average takes all the numbers together and divides them by number data points so a few large outliers can affect it, while the median is just the middle data point when all the numbers are sorted in ascending value, this not affected in the same way by those outliers.) This means that there is a large group that continues to not find employment up until, (and likely beyond) the period for which they are eligible for unemployment.

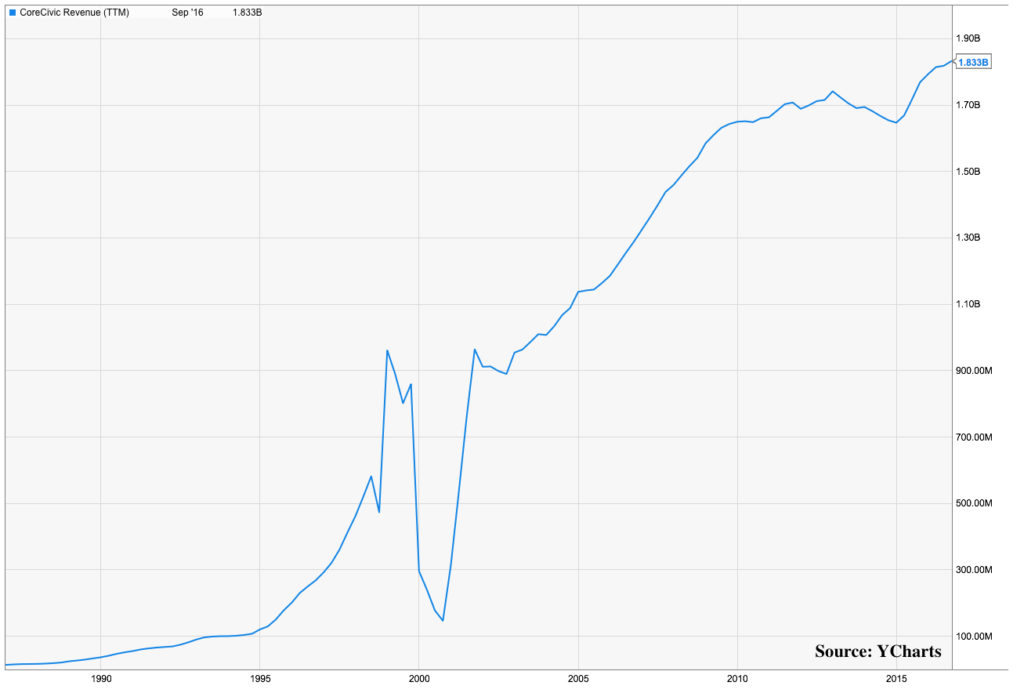

This is yet another manifestation of how the labor pool in the United States is structurally not functioning the way it has for decades. Having an unusually high percent of the population that would under more normal conditions be gainfully employed, contributing to the nation’s economic health, means that our potential growth is materially hampered. Just what is causing this structural alteration is the subject of much debate. Some argue it is caused by more generous policies around disability pay or other public assistance programs. Others have argued it is related to the percent of the population that has been incarcerated as the U.S. has the highest incarceration rate in the world: America is responsible for approximately twenty-two percent of the world’s prison population with only 4.4 percent of total population. Just look at the revenue trend for CoreCivic (CXW) which manages correctional and residential reentry faciliites.

We suspect that it is likely a combination of many of these factors and is also a result of the hangover from the last boom-bust cycle, in which many people became highly skilled in areas that are unlikely to regain their pre-bust employment levels. Someone who was a well-paid mortgage loan officer in 2007, is going to find a lot fewer openings in that field today, which means developing new skills and even more painful, likely taking a pay cut. Some may have found they cannot stomach the cut and so are staying on the sideline, nursing their understandably bruised ego. That means opportunity for those firms that can develop ways to take advantage of these unemployed and help them because productive again.

With a lower percent of the overall population employed it means that those with a job are shouldering a bigger portion of their family’s expenses. Adding to that, recall that Friday’s employment report showed that nominal annual wage growth was rather weak for 2016 at just 2.5 percent. Compare that rate to the 4 percent increase in rents and the over 5 percent increase in home prices and you get an image of households getting squeezed – something very much in tune with Tematica’s Cash-strapped Consumer investing theme.

Inflationistas ought to consider that and after having had near zero policy rates since 2008, with considerable rounds of quantitative easing on top of a record-breaking stock market and a recovery that is historically exceptionally long in the tooth, this is the best we can muster?

- CPI Inflation 2.1 percent

- PCE Inflation 1.6 percent

- Core PCE Inflation 1.7 percent

- Nonfarm Business Price Deflator 1.5 percent

- Unit Labor Cost 1.9 percent

- Employment Cost Index 2.2 percent

Add into that a strong dollar that is likely to continue to strengthen with oil looking to have topped out, (more on that later) and the inflation trade is not an obvious bet.