Jumping Back into The Display Trade

In yesterday’s Tematica Investing we shared that Disruptive Technologies investment theme holding Applied Materials (AMAT) will report its latest quarterly results, shedding light on demand for both semiconductor and display capital equipment. The company has been quite vocal about demand for organic light emitting diode displays over the last few quarters, in part because the currently capacity constrained industry has been a driver of rising display equipment demand. This has made AMAT’s display comments a thing to watch when it comes to Universal Display (OLED).

Over the last few weeks, investors have started to reassess the domestic stock market. Who can blame them, given the stretched valuation and rising uncertainty that we talked about in this week Monday Morning Kickoff and alluded to in yesterday’s Tematica Investing?

What investor nervousness has done, however, is result in a pullback in Universal Display shares just as Apple (AAPL) is on the cusp of debuting its next iPhone model in the coming weeks. Once again there has been much chatter and speculation over this newest addition, but one item steadily reported is that the new iPhone will include organic light emitting diode displays. Apple even went as far as to invest in LG Display to ensure it has adequate supply over the coming quarters. And that doesn’t factor in other smartphone manufacturers that are switching to the display technology or applications such TVs and wearables that are utilizing it as well.

In our view, we are poised to see another step up in demand for organic light emitting diode displays, which should be confirmed later today by Applied Materials. While OLED shares are on the Tematica Select List, we’re going to add the Universal Display (OLED) September 2017 135 calls that closed last night at 0.45 to the Options+ list this morning. We’re also going to set a protective stop loss at 0.25, given our market-related concerns as we head into September where things could get a little bumpy. As we write this, this morning’s futures suggest a soft market open, but we’d be inclined to add these OLED calls up to 0.65.

- Adding the Universal Display (OLED) September 2017 135 calls that closed last night at 0.45 to the select list, and setting our stop loss at 0.25.

- We’d be inclined to add these OLED calls up to 0.65.

Looking Ahead to Our Next Potential Trade

The Universal Display calls we added above have a very clear set of catalysts that we can point to over the coming weeks – earnings from Applied Materials and Apple’s pending debut of the latest iPhone. Near-term that’s likely to be the exception given that we’re in the dog days of summer ahead of the Labor Day weekend, which is the line in the sand for businesses getting back to work. From a Tematica Options+ perspective, it means we’re going to chew over a number of potential positions including ones in AXT Inc. (AXTI), United Parcel Service (UPS), Skyworks Solutions (SWKS) and others as we prepare for what’s ahead once the push to the year-end commences.

As a reminder, the last two weeks of August tend to be ones in which people try to squeeze in the last bit of summer vacation, and that means both news flow and trading volumes will be lighter than usual. This year we’ve got the added issue of those manning the desks trying to determine if the Fed will embark on its balance sheet unwinding in a few weeks’ time. Yesterday’s July Fed monetary policy meeting minutes were once again murky on this dolling out the “soon” description. On the back of the better than expected July Retail Sales Report and a mixed report on July single-family housing activity, we’ll be watching today’s Industrial Production and next week’s July Durable Goods report to see what they say about the vector and velocity of the economy.

Given our comments over the last few days, all of this means we’ll continue to keep our inverse ETF positions in play, especially since we are hearing that we could see tensions with North Korea bubble back up as the US embarks on widely expected military exercises in the region in the coming weeks.

Checking in on General Motors…

As you know, we’ve had a bearish bent on shares of General Motors (GM)over the last few months and thus far the position has been profitable. We’ve received a number of confirming data points for the industry slowdown and the bloated inventories that GM is dealing with. That’s led to a widespread use of incentives that are poised to put a crimp in profits and EPS generation.

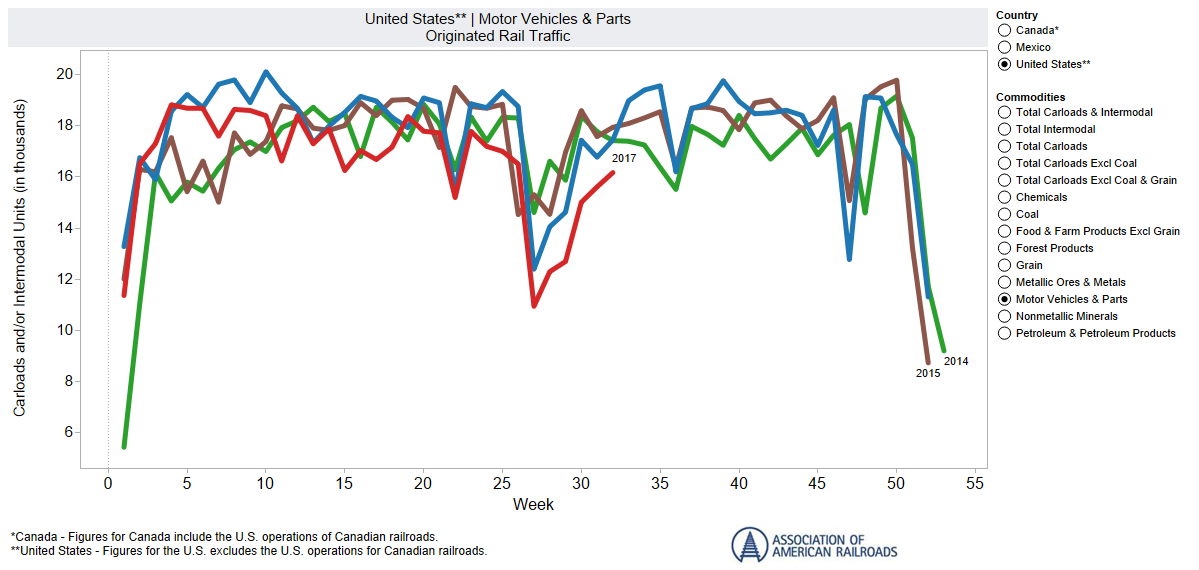

Checking in on weekly rail traffic for autos and auto parts, even though we’ve seen a rebound in recent weeks the traffic remains well below levels registered in 2014, and 2015 and 2016. Not a good combination, but then again for us it solidifies that bearish view on GM shares.

If that wasn’t bad enough, now we’re hearing that GM may be on the hook for an additional $1 billion to address claims stemming from faulty ignition switches several years back. While this could be a non-event, if it turns out to be the case it’s another thorn in the side of the company. As these plays out, we’ll continue to look at other data when it comes to auto demand, and soon the August auto sales data. For now, we’ll continue to keep our short position on GM shares in place.

- We are holding steady with our short position in General Motors (GM) shares and our price target remains $30. Our buy-stop level remains at $40.