Latest Data Suggests Even More Downward Revisions to Earnings and GDP

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

It’s been two weeks since the last edition of our Monday Morning Kickoff, and while the first of those two weeks was rather quiet, by comparison, this past week has been filled with noise. The issue at hand is that noise level is going to swell this week into a near deafening roar as earnings season kicks into high gear.

Late last week we discussed many of the issues plaguing the market, the majority of which we identified to regular readers of the Monday Morning Kickoff and Tematica Investing subscribers, on the latest Cocktail Investing Podcast episode and in our view, it’s a great recap of the last several weeks and primer for what’s ahead.

During the last two weeks, we’ve seen the stock market bounce up and down with both oil and gold prices doing the same. Not oh so surprising given it was the calm before the 1Q 2017 earnings storm that kicks off this week and continues into early May.

As we alluded to above, with more than 2,000 corporate earnings reports on deck over the next two weeks, 1Q 2017 earnings will be in higher gear at a time when a growing amount of hard data points to a sharp slowdown in 1Q 2017 and a weak start to 2Q 2017. In addition to the regular economic data, there are other indicators, such as oil and gold prices, that are also signaling concern.

With those details in mind, let’s jump right into the data that has led us to conclude that we’ve only just begun to see the revision of earnings and GDP expectations — both headed in the wrong direction . . .

Pressure on Oil Prices

Over the last six months oil prices have vacillated between a low near $43 per barrel and $54, but more recently oil prices have been more volatile in the last 45 days. The latest blow in oil prices came following a report on Tuesday that, “US crude stockpiles fell less than expected in the latest week while gasoline stockpiles grew unseasonably” — not exactly something we want to hear as economists and others trim back their GDP forecasts.

Oil prices ended sharply lower on Friday, settling below $50 a barrel for the first time this month as signs of greater US output raised questions as to the potential impact of extended production cuts on the part of OPEC. Per Baker Hughes (BHI), the number of US oil rigs rose by another 5 to reach 688 and marked the 14th consecutive weekly increase.

Turning to Gold

Prices for gold traded off compared to last week, but with political tensions running high following the US bombing Syria and missile launches from North Korea, prices for the precious metal remain well above March levels. Year-to-date, gold prices have experienced a more pronounced move as the stock market soared in January and February, stretching valuations despite the weakening economic outlook. As we discussed on the latest edition of the Cocktail Investing podcast, we are seeing inflation metrics begin to roll over as the year over year comparisons ease and that could restrain gold prices in the near-term.

Back to that GDP Trimming

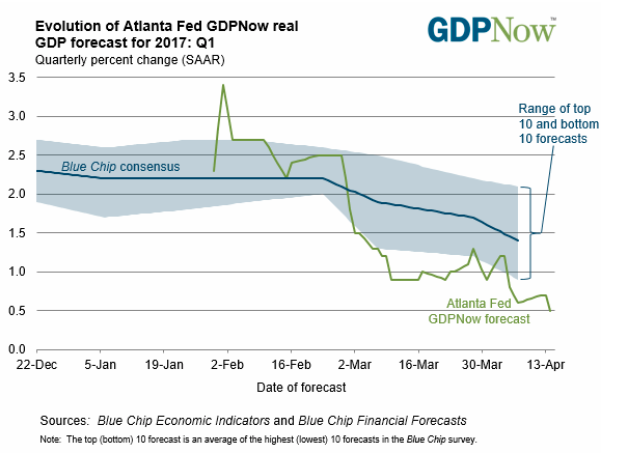

Perhaps the best representation of that GDP trimming can be found on page 3 of the Atlanta Fed’s GDP Now 1Q 2017 GDP forecast, which showed a forecast as high as

3.4 percent in early February, only to fall over the ensuing weeks to 0.5 percent once we had the March housing starts and industrial production figures. Speaking of that March Industrial Production report, the headline figure of 0.5 percent for the month was better than expected.

Digging into the report, however, revealed the bulk of the month over month improvement was due to utility production, which more than offset the fall in manufacturing activity. We’d note that was the first reported contraction in that measure of manufacturing activity in several months. Even if we exclude the step-down in the production of motor vehicles and parts, March manufacturing output still declined. Furthermore, revisions to January and February meant manufacturing activity was weaker than previously thought.

We’d also call out the April misses in the Empire Manufacturing Index and the Philly Fed Index this week as well as a lot of hemming and hawing language in the latest Fed Beige Book this week. The fact that Markit’s April Flash U.S. Composite Output Index at 52.7 (53.0 in March), a 7-month low, is also going to weigh on growth expectations given the April data hit 7-month lows for both services and manufacturing.

Yes, we realize that we have been talking about this for several weeks as we tried to “be where the puck was going” to use the hockey analogy, and while we take solace in knowing that once again the herd is catching up to us, we’re not exactly thrilled the latest data suggests there is more downward revising to be done.

Is the Fed Still Up for Two More Interest Rate Hikes?

With all the data we’ve just covered as the backdrop, we are also seeing a drop in Fed interest rate hike expectations. Just a few weeks ago, 57 percent of traders expected the Fed to boost interest rates two more times this year, but as of last night, that expectation fell to 36 percent according to CME Group’s FedWatch program. Given the vector and velocity of the economy per the April data thus far, we’re not surprised, and with inflation data likely to face stiff comparisons in the coming months, odds are we could see that 36 percent expectation fall even further in the coming weeks. Certainly not good for banks.

Tracing back to the market’s recent up and downs, this tells us investors continue to look for direction, and in our view the coming days are likely to offer the road map. The issue is, it may not be the route that most are hoping to get and its guide will be the plethora of earnings reports we get not just this week, but increasing in pace over the next two weeks as we mentioned at the open.

A Market Searching for Identity

Right now, we’re seeing even more political drama unfold in Washington, and when we put it all together with the hard data we’re looking through, it tells us there is more risk to be had in the near-term than reward. While we recognize we are likely preaching to the choir at this point, the simple truth is corporate expectations need to be reset given the economic climate and as that happens we are likely to see more wind taken out of the stock market’s sales.

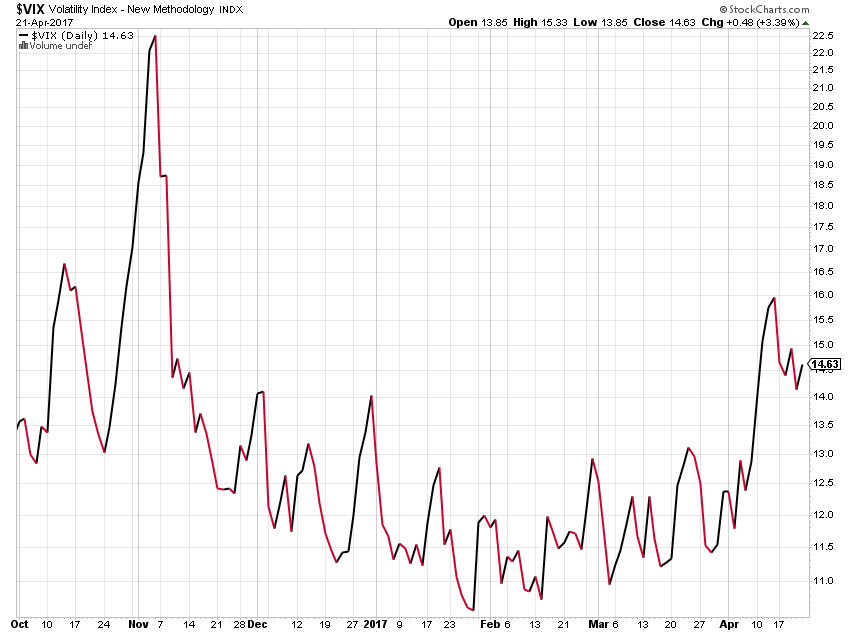

In looking at the recent move in the Volatility Index (VIX), which recently hit its highest level since before the November election, the market is on edge as earnings ramp up. Adding to this is some new findings from the Bank of America Merrill Lynch monthly fund manager survey that shows some 83 percent of fund managers believe U.S. stocks are overvalued. As always we try to put data like this into perspective, and in doing so we find that 83 percent is a record number for data that reaches back to 1999.

Yikes!

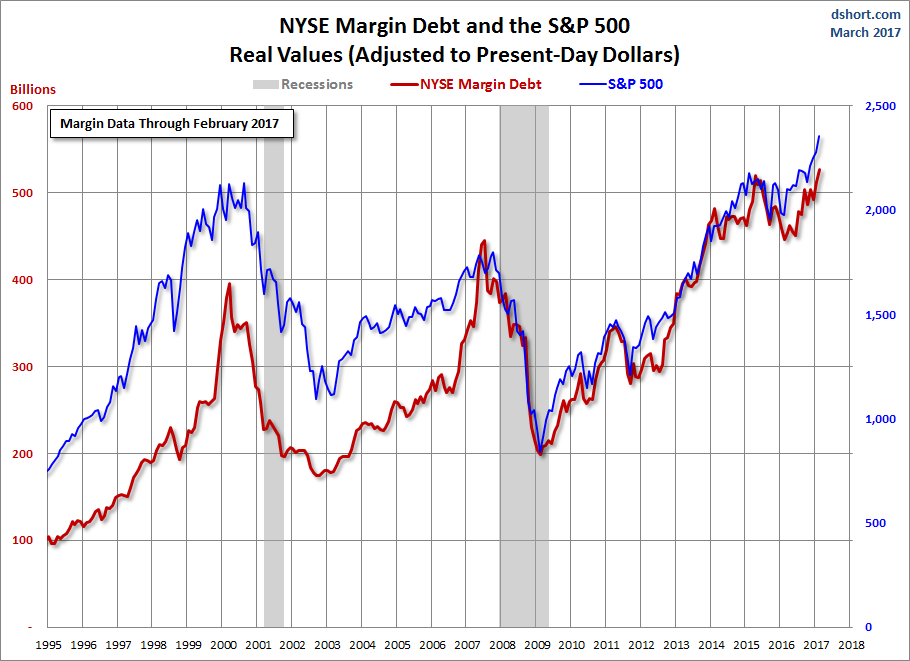

But another yikes data point can be found in the end of month data for margin debt published by the New York Stock Exchange. According to the latest report, margin debt climbed to a new record high in February at $528.2 billion. Here’s the context — that’s up 2.9 percent from $513.3 billion in January, which had been the first margin debt record in nearly two years. And this is where we remind that margin leverage cuts both ways — it can be a powerful lever in a rising market, but it can quickly compound the pain in a falling one.

Now that certainly tells several things, but the one we are zeroing in on is the simple fact that in a nervous market like the one we are currently in, investors are likely to shoot first and ask questions later when faced with a barrage of earnings reports, especially if they or the guidance they offer come up short. Recognizing this likelihood, we here at Tematica have adopted a more defensive position over the last several weeks, and we’ll be looking for opportunities to buy thematically well-positioned companies at better prices in the weeks ahead.

Turning to the Week Ahead

As we get ready for the rush of quarterly earnings reports this week, three comments from last week are likely to set the stage:

“The first quarter was an interesting one, as we entered it with a lot of optimism about what the new administration might do to further improve the economy. As the quarter continued, some of this optimism has slowed and now companies are more cautious or skeptical about what shape some of the programs, including tax reform, infrastructure projects and ACA reform will take and when they might actually take effect, if at all.”

— Brown & Brown (BRO) CEO Powell Brown (Insurance Broker)

“During the first quarter of 2017, commercial loan growth was sluggish across the industry. Our large corporate customers tell us that they are optimistic about the future, but are awaiting more clarity regarding potential changes in tax and regulatory reform, infrastructure spend and trade policies.”

— US Bancorp (USB) CEO Andy Cecere

“On the US, I think there’s a general observation here and that is pretty weak consumer demand and that’s not a particular issue here for Nestle. I think that’s all throughout…category by category, whether it’s us or anyone else, what you’re seeing is fairly soft demand, even in the face of pretty good fundamental economic data.”

— Nestle (NSRGY) CEO Mark Schneider

Not exactly commentary that points to a teeming economic environment or an expected rebound in 2Q 2017. That said, we’ve been fairly steadfast in our view that we would not see any real impact from President Trump’s fiscal policies until late 2017 and more in 2018.

As we look at the almost 1,000 companies reporting earnings this week, we’ll dispense with the usual thematic earnings calendar in favor of sharing with you which company reports we’ll be listening to you. And of course, we’ll be doing this by theme. Here it is:

On the economic data front, this week we have several lingering pieces of March data, including Durable Orders and New Home Sales, as well as the first look at both GDP and the Employment Cost Index for 1Q 2017. As we pointed out above, we’ve seen expectations for 1Q 2017 GDP slide as the quarter progressed, but odds are there are those that will still be surprised when the data is reported.

If we’re right it will mean another round of GDP revisions, which will come at a time when Wall Street is recalibrating its earnings expectations for 2Q-3Q 2017. While we don’t see a correction in the stock market, we could see an earnings season related pullback as once again the herd wakes up to what we’ve been saying over the last few months.

Thematic Earnings Calendar

With almost 1,000 companies reporting earnings next week, we’ll dispense with the usual thematic earnings calendar in favor of sharing with you which company reports we’ll be listening to you. And of course, we’ll be doing this by theme. Here it is:

- Affordable Luxury — Del Frisco’s (DFRG), Royal Caribbean (RCL)

- Aging of the Population — Ameriprise Financial (AMP), Carriage Services (CSV), LPL Financial (LPLA)

- Asset-lite Business Models — Alphabet (GOOGL), Ultimate Software (ULTI), Medidata Solutions (MDSO)

- Cashless Consumption — Heartland Financial (HTLF), Vanitv (VNTV), Blackhawk Network (HAWK), PayPal (PYPL)

- Cash-strapped Consumer — JetBlue (JBLU), Supervalu (SVU)

- Connected Society — Amazon (AMZN), AT&T (T), Cavium Networks (CAVM), Skyworks (SWKS), UPS (UPS), Comcast (CMCSA)

- Content is King — Nielsen (NLSN), Regal Entertainment (RGC)

- Disruptive Technology — iRobot (IRBT), Synaptics (SYNA), Corning (GLW)

- Economic Acceleration/Deceleration — 3M (MMM), Trinity Industries (TRN), Ingersoll Rand (IR), Norfolk Southern (NOC)

- Fattening of the Population — Brinker (EAT), Dr. Pepper Snapple (DPS), PepsiCo (PEP), Restaurant Brands (QSR), Nutrisystem (NTRI), Domino’s Pizza (DPZ)

- Foods with Integrity — Chipotle Mexican Grill (CMG), Panera Bread (PNRA)

- Fountain of Youth — Helen of Troy (HELE)

- Guilty Pleasures — Hershey Foods (HSY), Boston Beer Co. (SAM), Churchill Downs (CHDN), Starbucks (SBUX), MGM Resorts (MGM)

- Rise & Fall of the Middle Class — Whirlpool (WHR), Tupperware (TUP), Colgate Palmolive (CL),Host Hotels (HST), VF Corp. (VFC), Under Armour (UA)

- Safety & Security — Lockheed Martin (LMT), Zixi Corp. (ZIXI), Flir Systems (FLIR), Fortinet (FTNT)

- Scarce Resources — Haliburton (HAL), Barrick Gold (ABX), Waters (WAT), Exxon Mobil (XOM)

- Tooling & Re-Tooling — New Oriental Education & Technology (EDU), Heidrick & Struggles (HSII), Capella Education (EPLA)