The Market Climbs Higher, But Look at These Two Charts and It’s Ruh-Roh Time

As the stock market continued to get further and further out over its ski tips last week, as investors we have a split mind on the current state of things. On the one hand, we’re certainly enjoying the higher stock prices. On the other hand, we are mindful of the increasingly stretched market valuation. One of the common mistakes see with investors is they all too easily enjoy the gains, but tend not to be mindful of the risks that could wash those gains away.

Over the last few weeks, we here at Tematica have been pointing out the growing disconnect between the stock market’s valuation and the current economic environment. We have a snootful of data points that underscore our cautious stance in this week’s Monday Morning Kickoff, but we wanted to share two charts from our weekend reading that caught our cautious eye.

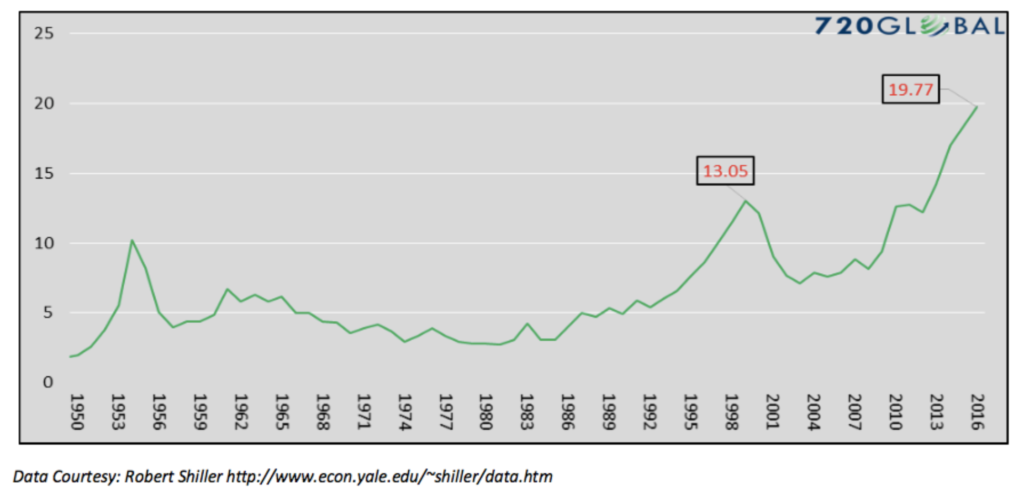

There have been some who call into question the use of Robert Schiller’s Cyclically Adjusted Price to Earnings (CAPE) ratio, but Tematica’s Chief Macro Strategist Lenore Hawkins does a pretty good job handling that criticism. Exiting last week the CAPE to GDP growth of 19.77 has far surpassed the 1999 peak and all points back to at least 1950. As we like to say when looking at data, context and perspective are key to truly understanding what it is we’re looking out. So here’s that context and perspective for the current CAPE to GDP reading — it is over three times the average for the last 66 years. Going back to 1900, the only time today’s ratio was eclipsed was in 1933 and that reflected the Great Depression when GDP has been running at close to zero for nearly a decade.

There have been some who call into question the use of Robert Schiller’s Cyclically Adjusted Price to Earnings (CAPE) ratio, but Tematica’s Chief Macro Strategist Lenore Hawkins does a pretty good job handling that criticism. Exiting last week the CAPE to GDP growth of 19.77 has far surpassed the 1999 peak and all points back to at least 1950. As we like to say when looking at data, context and perspective are key to truly understanding what it is we’re looking out. So here’s that context and perspective for the current CAPE to GDP reading — it is over three times the average for the last 66 years. Going back to 1900, the only time today’s ratio was eclipsed was in 1933 and that reflected the Great Depression when GDP has been running at close to zero for nearly a decade.

Students of CAPE will point out that in order for the CAPE to GDP to fall back to more normalized levels, we either need to see a dramatic increase in GDP (not likely in the near-term) or we need to see a pullback in the CAPE. Here’s the thing, as Michael Lebowitz of 720 Capital points out, “if we assume a generous 3% GDP growth rate, CAPE needs to fall to 18.71 or 35 percent from current levels to reach its long-term average versus GDP growth.” Based on the data we’re seeing, there is a rather high probability 2017 GDP is more likely to be closer to 2.5 percent than 3.0 percent per The Wall Street Journal’s Economic Forecasting Survey of more than 60 economists, which means to hit normalized levels, the CAPE would need to fall further than 35 percent.

As you ponder that and think on why it has us a tad cautious, here’s more food for thought:

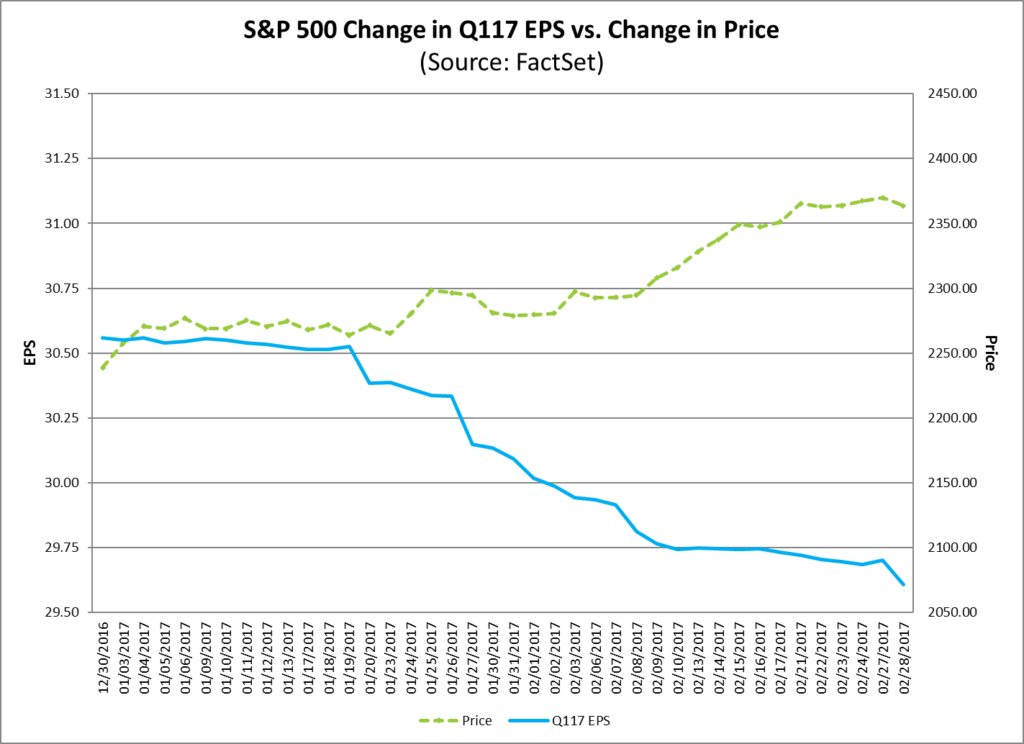

Coming into 2017, forecasts called for the S&P 500 group of companies to grow their collective earnings more than 12 percent year over year, marking one of the strongest years of expected growth in some time. Granted energy companies are likely to be more of a contributor than detractor to earnings growth this year, but we as can be seen by the graph above, earnings expectations for the S&P 500 are already coming down for the current quarter. Those revisions now have year over year EPS growth for the collective at up just over 10 percent.

Are we getting data that shows the current quarter isn’t likely to break out of the low-gear GDP we’ve been seeing for most of the last few years?

Yep.

Are earnings expectations for 2Q-4Q 2017 still calling for 8.5 to 12.5 percent earnings growth year over year?

Yep.

Is it increasingly likely that President Trump’s fiscal policies won’t have a dramatic impact until late 2017 and more likely 2018?

Yep and yep.

The bottom line is we have the stock market melting higher, pulling a Stretch Armstrong-like move in terms of valuation even though earnings expectations for 2017 are starting to get trimmed back.

Yep, you can color us cautious at least for the near-term. While we continue to use our thematic foresight to ferret our companies poised to ride several of our thematic tailwinds, the current market dynamic has us being far more selective.

l