Friday’s Missed Shots: Retail, Inflation & Banks

Thank God it was Friday, as after the disappointing Retail Sales, weaker-than-expected CPI and bank earnings, most likely needed a drink. (Personal choice on a hot summer night is Tanqueray® Rangpur & tonic with cucumber, lime, and some shaved ginger, in case anyone was in dire need.)

Retail Sales

Retail Sales missed for the second month in a row and were down 0.2 percent month-over-month after a (revised) 0.1 percent decline in May. That’s the first time we’ve seen sales contract for two consecutive months since September and October 2015. Q2 real retail sales are growing at just 1.25 percent annual rate, which is less than half the average quarterly rate of 2.7 percent we’ve seen since the start of the recovery. Where is that accelerating growth? The post-election bump looks to have worn itself out.

Further emphasizing our Connected Society theme, retail sales for Brick and Mortar were up just 2.85 percent year-over-year with Online more than tripling that rate at 9.2 percent year over year. Last week Amazon took that trend to a whole other level, with its Prime Day sales up 60 percent from last year’s to sit somewhere in the $500 to $600 million range.

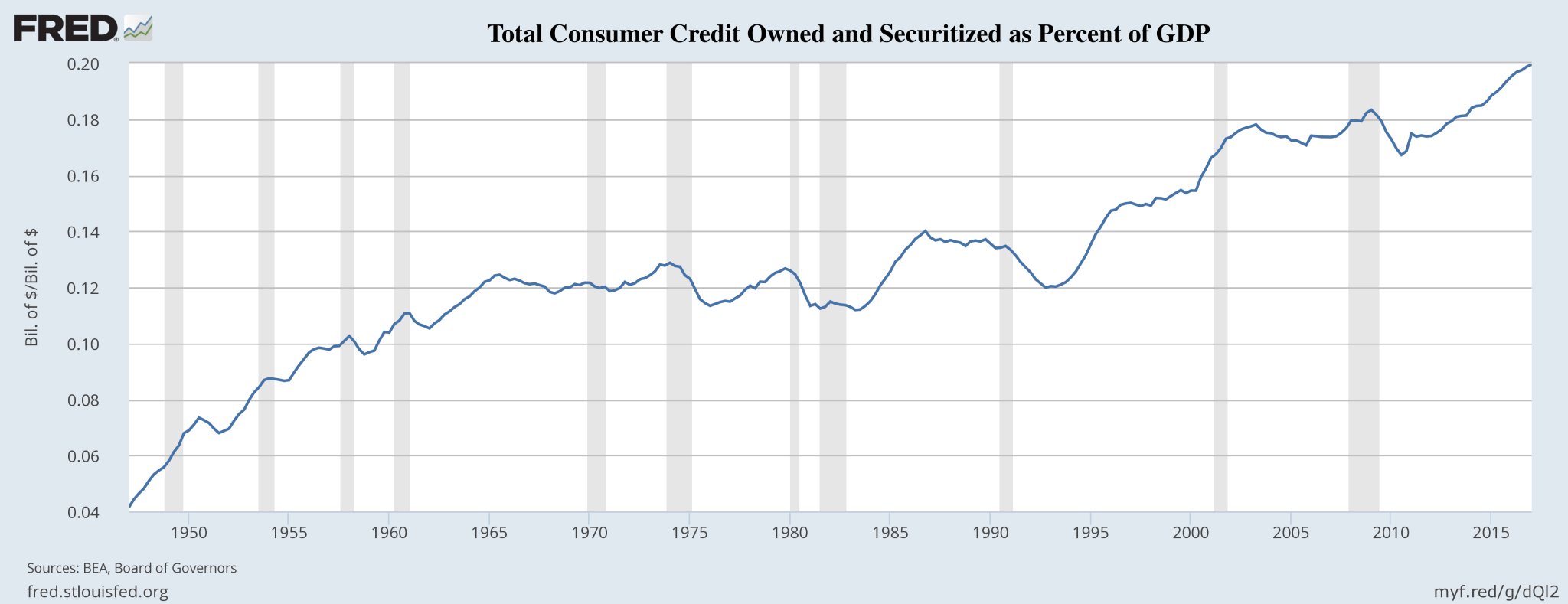

Restaurant sales have now been flat to negative in four of the past five months, which we see as a significant indicator of household spending intentions as going out to dinner is one of the first and easiest things to cut from the household budget. We are also concerned to see that Clothing Sales have now been down for two consecutive months as that jars with the Employment Growth data: typically these two are positively correlated as most want to look nice for their first day on the job. Perhaps some of the lack of spending has to do with just how earlier spending has been financed.

Spending can increase only through growing incomes or growing debt.

Well not that isn’t exactly a sustainable way to grow spending! Explains a bit about why we are seeing savings rates rise.

Inflation

Friday’s Consumer Price Index also came in as a surprise to the downside, (allow us to mention that as opposed to the consensus view, your Tematica team would have been surprised to see it come in much stronger.) Core CPI, the Fed’s preferred measure of inflation rose just 0.1 percent in June for an annual rate of just 1.7 percent, well below the Fed’s target rate of 2.0 percent.

To put the drop into even better perspective, at the start of the year, core CPI was trending at 2.3 percent annual rate, has dropped now to 1.7 percent, but if we look at the annualized rate since February, it is just 0.4 percent – talk about deceleration! We haven’t seen a number that low since the summer of 2010.

This data combined with Yellen’s more dovish than expected testimony last week has dropped the probability of another rate hike to just 50 percent. Chair Yellen expressed that the Fed is less confident in their assessment that we had been seeing only “transitory” softness in inflation. You don’t say! We will most likely see at most one more hike this year while the Fed begins the process of “normalizing” the balance sheet. We suspect the Fed is likely to shift its focus more onto reducing its balance sheet in an attempt to push up longer-term yields as no doubt the flattening we had been seeing earlier must have gotten their attention.

Banks

To round out what was a rather painful day for those looking for reasons to be optimistic about the economy, JP Morgan (JPM), Wells Fargo (WFC), and Citigroup (C) reported on Friday and while higher interest rates helped them meet their overall expected earnings, we saw signs of weakness in core businesses that are inconsisted with the narrative of an accelerating economy.

- JP Morgan reported that its fixed income earnings fell 19 percent during the quarter.

- Citigroup net income declined 3 percent from last year on revenues that were up a meager 2 percent. EPS was up 3 percent due to stock buybacks.

- Wells Fargo topline revenue was flat year-over-year from Q2 2016 with total loans declining from the first quarter by

Bottom Line: Friday’s data further reinforces that we are in the late stages of this business cycle with increasingly widespread indications of decelerating growth.