MONDAY MORNING KICKOFF: Have analysts underestimated the hurricane-related disruption?

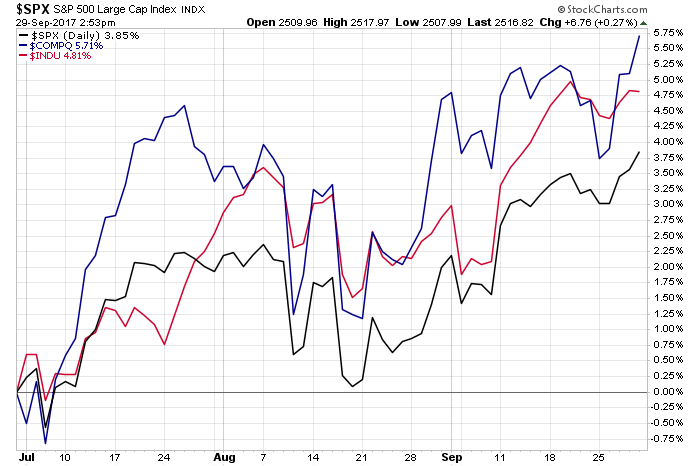

With Friday’s market close, we shut the books not only on September but also 3Q 2017. For the three-month period, the S&P 500 returned X%, while the Dow Jones Industrial Average delivered X% and the Nasdaq X%. Like most end of the quarter weeks, we got a few earnings reports last week and pairing those with the ones we’ll get this week should offer a framework for what we are likely to hear in the weeks ahead.

With Friday’s market close, we shut the books not only on September but also 3Q 2017. For the three-month period, the S&P 500 returned X%, while the Dow Jones Industrial Average delivered X% and the Nasdaq X%. Like most end of the quarter weeks, we got a few earnings reports last week and pairing those with the ones we’ll get this week should offer a framework for what we are likely to hear in the weeks ahead.

Also last week, we finally saw the highly anticipated, but short on details, unveiling of the tax reform from Team Trump and the GOP.

While the proposal looked like an image with a coloring book – the “colors” or in this case the details that still need to be filled in – a bare-bones analysis by the Committee for a Responsible Federal Budget finds that while the plan “calls for roughly $5.8 trillion of tax cuts and $3.6 trillion of base broadening, resulting in about $2.2 trillion of net tax cuts through 2027.” We always roll our eyes a little when we see 10-year forecast such as these as they tend not to factor in the statistically probable recession that is likely to happen during the forecast period.

We see this opening tax reform salvo as more a conversation starter that will, we hope, lead to more productive conversations in the coming weeks. Our perspective is reduced tax rates could put more disposable income in consumer pockets – not a bad thing for an economy that is largely influenced directly and indirectly by consumer spending. As more details emerge and negotiations are had, Team Tematica will revisit this topic accordingly.

In a few weeks, we’ll start the time-honored tradition of corporate earnings season, but as we begin October it means we will first face the usual data deluge for the prior month. In this case, that data will shed a fuller picture of the economic impact from the recent trifecta of hurricanes during the month. If last week’s quarterly earnings from restaurant chain company Darden Restaurants (DRI) is any indication, analysts underestimated the hurricane-related disruption that was had. We see that report as simply setting the stage for what is to come in the coming weeks at retailers, restaurants and other companies that were impacted by the both Harvey and Irma. Odds are as those results are digested, investors will be recalculating the potential upside to be had with a stock market that is trading at more than 19x expected 2017 earnings as they adjust those very same earnings expectations for the market.

As we get ready for the economic data and earnings deluge that awaits us, we’d invite you to listen to our latest Cocktail Investing Podcast. In this episode, we discuss the evolution of the autonomous car and the far-ranging disruption that is likely to ensue across a number of industries and companies with Brad Stertz of Audi’s Government Affairs team. Trust us when we say, it will blow your mind and change the way you think about why you have a car and how you use it.

On the Economic Front

As you know, September had three major hurricanes that impacted various parts of the U.S. Economists estimate the ensuing disruption could cut as much as six-tenths of a percentage point from GDP growth in 3Q 2017. The coming weeks will give us a better sense of how deep that hurricane-related cut to GDP really is as we get a fuller picture of how the economy fared in September. It starts this week when we get the usual start of the month data for September – ISM Manufacturing, Auto & Truck sales, ISM Services, and several looks at job creation during the month including the all-important one form the Bureau of Labor Statistics.

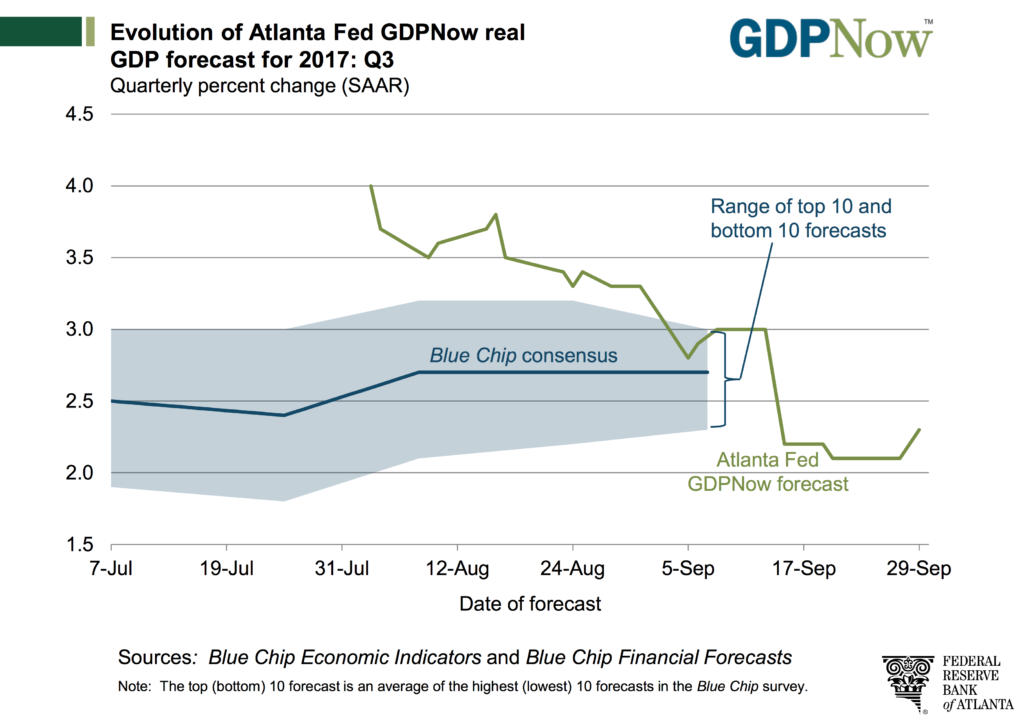

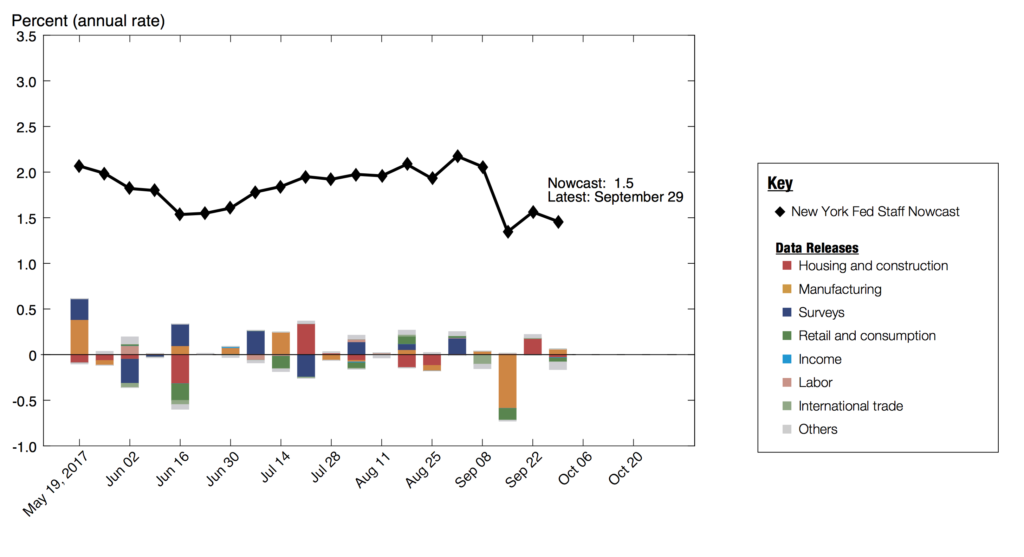

As we digest these reports, we’ll be tabulating the impact to 3Q 2017 GDP expectations at the Atlanta Federal Reserve and the New York Federal Reserve. Even before next week’s data is published, we’d point out the Atlanta Fed has already taken a hatchet to its 3Q 2017 GDP forecast, dropping it to 2.1% last week from 4.0% on August 3rd.

Not quite the vector or velocity one would associate with the continued climb higher in the domestic stock market, but the Atlanta Fed is not alone in its revisions as the New York Fed now sees the economy cruising along at a breezy 1.6%, down from 2.2% as we entered September. Again, these Fed forecasts are updated as the economic data is reported and this likely means we will be seeing even more downward revisions in the coming weeks.

More recently we’ve witnessed both oil prices and the dollar rebound owing to the impact of continued supply cuts and hopium surrounding the Federal Reserve’s interest rate hike forecast. The decline in both of these items during 3Q 2017 were part of the fuel for the stock market’s continued move higher over the last few months.

As we continue to watch both oil prices and the dollar to assess the likelihood of them moving from 3Q 2017 tailwinds to 4Q 2017 headwinds, we’ll pay close attention to company comments on these two items. Last week, when Nike (NKE) reported its quarterly results it shared that one of the key margin headwinds it will be facing will be FX. We heard this again from spice and marinade company McCormick & Company (MKC) during its quarterly earnings call as well in its expectations for an unfavorable currency impact of 1% this year.

On the Corporate Earnings Front

While we are still a few weeks out from the true earnings bonanza for 3Q 2107, we still have a number of companies reporting this week. This includes earnings from beverage and snack company PepsiCo (PEP), French fry company Lamb Weston (LW), seed and intellectual property company Monsanto (MON), Guilty and Pleasure investment theme contender Constellation Brands (STZ) as well as Cash-Strapped Consumer play Costco Wholesale (COST) and Rise & Fall of the Middle Class and Fattening of the Population rolled into one, Yum China (YUMC).

Some of the questions we’ll be contemplating as those quarterly results are issued are how are they fairing vs. declining restaurant industry traffic? Are consumer still opting for premium beer, wine and spirits or are they conserving cash and opting for mid-tier options? Is Costco continuing to garner consumer wallet share despite the hype that says Amazon (AMZN) is the sole retail winner? For what it’s worth, the last time we were in a Costco, it was packed!

As we look to assess the dollar’s next move, it means paying attention to any and all Federal Reserve tea leaves. That has us keeping tabs on what Fed Chairwoman Janet Yellen says on Wednesday (Oct. 4th) as well as what several other Fed heads, including James Bullard, Robert Kaplan and John Williams, have to share about the economy and monetary policy during planned speeches this week. Quickly, our view on this is over the last few years the Fed has targeted a number of interest rate increases only to be stymied by the lackluster economy. Realizing the business cycle is increasingly long in the tooth, we suspect the Fed is looking to get more policy arrows back in its quiver for the next eventual recession, when it hits. It’s not lost on us that the Fed has a superb track record of boosting rates as the economy slips into a recession, and that’s without the added unknowns to be had as it unwinds its $4.5 trillion balance sheet. Yeah, we’ll see about those four planned rate hikes between now and the end of 2018…

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week. Here are some of the highlights we saw this week:

Aging of the Population/Cash-Strapped Consumer:

For more Americans, going back to work beats being retired

A new study that examines the re-entry to the workforce by retirees shows that it’s more than Cash-Strapped Consumers that fall within the confines of our Aging of the Population investing theme. In addition to those that haven’t saved enough to retire, others that miss the social, as well as intellectual challenges of working, have also returned to the workforce. Perhaps this need to solve their boredom is tied to the fact that we are living increasingly longer lives?

Cashless Consumption/Disruptive Technologies:

Virtual-reality shopping expands with payment capability from Mastercard and Swarovski

We’ve seen several gaming, augmented reality and virtual reality applications come to market recently, including some furniture-based applications. Now we are seeing a new partnership jump into the AR/VR waters. This pairing of MasterCard and Swarovski brings our Disruptive Technologies and Cashless Consumption investment themes together as shoppers can purchase within the immersive shopping experience. How long until homebuilders enable AR walkthroughs of model homes? Will we be able to use in-app purchases to change paint colors or visualize brand specific furniture and electronics?

Cash-Strapped Consumer:

Student Loan Defaults Increase For First Time In Five Years

Here at Tematica, we’ve been closely monitoring consumer debt levels and default rates to assess the impact on disposable income and consumer spending levels. Some of the data is published on a lag basis, and that’s the case with education loan default data published by the Department of Education. The latest report showed a pickup in the default rate in 2014, but we suspect that figure has continued to move higher since then due to weak wage growth, the pickup in part-time jobs vs. full-time ones and rising consumer debt levels. Those who are in default will likely embrace our Cash-Strapped Consumer theme as they look to stretch their disposable income while trying to maintain student debt repayments.

Safety & Security:

More cyber pain as Whole Foods and Sonic are hit by hackers

Another day, another cybersecurity breach. Or so it seems as this week two high-profile cyber attacks were revealed – Whole Foods and Sonic Corp. Retail and restaurant pain from these attacks is just the latest in a growing number of reminders that cybersecurity spending will continue to be on the upswing as hackers get more creative and we continue to move deeper into not only our Connected Society but also Cashless Consumption themes.