While financial, industrial and small cap stocks in the US have been partying like it’s 1979, investors would be wise to take more than a passing look across the Atlantic at Europe’s next biggest threat.

You’ve probably seen commentary about Italians voting on a constitutional referendum; not exactly riveting material.

Italy, Europe’s fourth-largest economy, is a nation in desperate need of reforms, having underperformed its major trading partners for decades, with the latest per capita GDP below 1997 levels and metropolitan area employment levels well below those in most of Europe.

Obviously, change is needed, but what is this referendum, why do you care and what is the herd getting wrong?

If you google the topic, you can get endless details on the vote, but here are the salient points. The Italian nation in its current form was born right after WWII and as such, has a deep-seated fear of concentrated power; pretty understandable after the fun times under Mussolini and his buddy Hitler.

That fear created a government with essentially two congressional bodies, both like America’s House of Representatives, except with more than double the members and even more layers of government from the top federal level on down to localities. There are a lot of people whose entire raison d’etre is to express their opinions and these are Italians, so the whole thing takes longer and is more emphatic.

The intention of the measures in the referendum, according to Prime Minister Mario Renzi, is to make government less complex and more functional, with fewer people involved and fewer layers. For example, today the Chamber of Deputies (Congress) has 630 members, (elected by voters age 18 and older) and the Senate has 350 members, (elected by voters 25 and older). The Senate would be cut to 100 members appointed by the regional elected governors, rather than by voters, and would only be involved in major decisions such as war or international treaties versus today where both houses basically participate in everything equally. The province layer of government would be officially removed.

Britain’s Prime Minister David Cameron wipes his eye as he addresses a news conference during a European Union leaders summit in Brussels March 20, 2015. REUTERS/Francois Lenoir

There’s more to it, but that gives a general sense. This bill is vast and complex, making a vote on it challenging as voters are unable to decide between the changes they support and those they don’t; it is all or nothing.

The bill was originally introduced by Renzi and his center-left party, then voted on by the Chamber and Senate twice. Yes, twice. It is now being put to a general vote by the electorate, illustrating the challenges of getting anything done in Italy’s government.

When it was first introduced and discussed, Renzi was enjoying more support than he is today, which led him to make the same mistake made by former UK Prime Minister David Cameron with Brexit, by making passage of the bill an endorsement of him. Back then Renzi vowed he’d not only resign, but would give up his political career; talk about laying it on thick. Recently Renzi has tried to soften his rhetoric, but most think that in the public’s that mind ship has long since sailed, so it would be tough for him to renege on those vows.

A man walks on a logo of the Monte Dei Paschi Di Siena bank in Rome, Italy September 24, 2013. REUTERS/Alessandro Bianchi/File Photo

Opponents claim that a “yes” vote would give Renzi excessive power, which when you think back to the 1930s and 1940s, gives anyone in that part of the world understandable heartburn. While many are likening this vote to Brexit and Trump, the dynamics here are materially different. Brexit was primarily a, “Screw you!” to the status quo and bureaucrats in Brussels. Trump stormed into D.C. amongst cries of “Drain the Swamp!” Many are looking at the polls in Italy today, which indicate a “no” vote majority, and likening them to the inaccuracies of the Brexit and Trump predictions – that is a mistake.

The truth is at this point, most Italians don’t really even understand what the referendum is all about and Beppe Grillo, the leader of the Five Star movement, is helping to give voters the impression that a “yes” vote would give Renzi near-dictatorship powers.

Those Italians who understand that red tape is the biggest enemy of the country would vote “yes” over and over again. The problem is that those that would vote “yes”, tend to be better educated and higher income earners, which has given this vote a vibe of class warfare. With many of Italy’s business elite thinking that Renzi may be Italy’s last hope, that schism is visible to most everyone.

The Importance of this Referendum on Worldwide Markets

Investors need to care about this because the market has decided that this vote is an indicator of Italy’s ability to make much-needed reforms and that matters because of the impact of Italy’s banks and sovereign debt. The actual quality or validity of the reforms proposed in the referendum have become almost meaningless. For those within Italy the vote has become a referendum on Renzi and as Italians grow increasingly frustrated that their lives haven’t materially improved, even some members of Congress from within Renzi’s own party who originally voted for the referendum are now scrambling to develop compelling arguments for why they now oppose it.

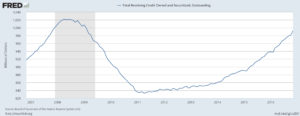

Italian banks are in a world of hurt, which is almost intuitive if you look at the nation’s credit markets and weak economy. Italy has negligible public credit markets, so borrowing means a trip to the bank, which makes credit risk more highly concentrated than in countries like the US, which have robust bond markets. During the financial crisis and in the years following, banks engaged in a lot of extend-and-pretend, some of that of their own volition, some after cozy chats with government officials, hoping that at some point in the not-too-distant future, the economy would get back on its feet and those struggling loans could be made good.

Despite a rapid procession of new leaders, the economy has yet to recover. Granted, it is better today than in 2012, with a few new stores popping up here and there rather than seeing yet another one shut down week after week. The unemployment rates for younger Italians, however, remain tragic and intense frugality is more the fashion than Milan’s latest catwalk. Businesses remain weak, so borrowers and banks that made those loans are still struggling. Adding to the pain are the piles of sovereign bonds warehoused at banks and the even more painful dirty little secret that the Italian government is notorious for not paying its own bills. This creates a twisted triangle between the bank pressuring companies to pay their debts, those companies, in turn, trying to collect from the government and bureaucrats dialing up the banks for leniency towards those the government owes.

The Shake Out From this Vote Will be Felt Worldwide

Leader of the Five Star Movement and comedian Beppe Grillo.REUTERS/Remo Casilli

If contrary to the polls the “yes” vote wins, Italian bonds and banks will rally and the MIB (Italian stock index) will have a huge relief rally, particularly given its over-exposure to banks, and the euro will likely strengthen relative to other currencies.

If the polls are right and we see a “no” vote by a large margin, Italian yield spreads over German bunds will widen a lot. Italian bank stocks will accelerate downward and Banca Monte dei Paschi di Siena (MPS) will likely need external aid, which will put the European Central Bank in the hot seat, and all eyes will be on German Chancellor Angela Merkel who is also watching Germany’s Deutsche Bank spiraling downward.

Renzi will be pressured to resign, (unless the win is by the smallest of margins) and the Italians will find themselves back at the polls, with the outside chance that Beppe Grillo’s Five Star could gain additional traction, which would be terrifying for anyone doing business in the region. The euro will weaken materially. European banks as a whole will likely take a hit and the dollar will get pushed further and further up as money races out of increasingly dicey Eurozone into the relative safety of the US dollar and US assets – a tailwind to US stocks and bonds. The Italy economy would slow further thanks to the increased uncertainty, which would bleed over into other European nations and global trade. The acceleration to the rising dollar headwind facing US multinationals could render the Fed’s rate hike decision irrelevant in comparison and harm growth back in the States at a point when the economy looks just finally be gaining a bit of traction.

While it may seem like a minor event on the global stage now, history is full of moments that initially seemed of little importance, but like the final grain of sand that ignites a landslide, in retrospect, those moments changed the global landscape in ways that were previously unimaginable.