Q1 GDP Flops as Expected – now what?

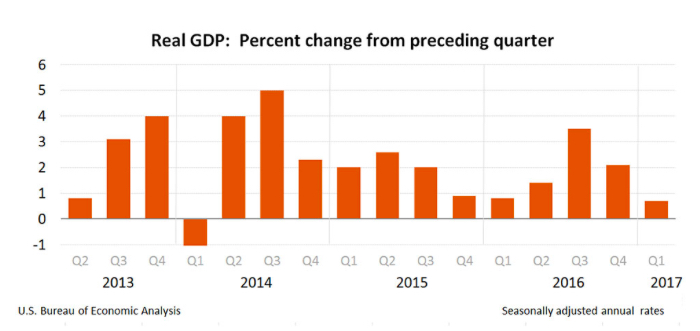

Friday the first estimate for Q1 GDP was released and as we’d expected, it was a serious flop at just 0.7 percent growth for the quarter versus expectations for 1.0 percent. The weakness was driven primarily by weak consumer spending which was the weakest since the fourth quarter of 2009. Meanwhile, consumer sentiment is still rockin’ and rollin’ along with optimism and the talking heads on mainstream financial news are quick to brush this quarter off to the usual weather and this year to the late tax refunds – it’s always sumthin’!

This morning we learned that Personal Income rose just 0.2 percent in March versus expectations for 0.3 percent and last month’s increase of 0.4 percent while Personal Spending was flat versus expectations for a 0.2 percent increase and a 0.1 percent increase the prior month. Personal Consumption Expenditures Index fell 0.2 percent in March, the first drop in this measure of inflation since February 2016 and the biggest one-month drop since January 2015.

We’re not terribly convinced of this whole “seasonal” thing when wage growth remains elusive despite supposed “full employment.” You know things are feeling toppy when the use of ” ” increases!

The ISM Manufacturing Index also came in below expectations, falling to 54.6 versus expectations for a decline to 56.5 from 57.2 in March. Looking at the individual components of the report, 10 of the 11 are improved on a year-over-year basis, but on a month-over-month basis, 7 of 11 declined. The employment component saw its largest monthly drop since November 2008, which doesn’t bode well for this Friday’s employment report. On a more positive note, the export orders component hit its highest level since April 2011, which indicates considerable strength from overseas markets. The other manufacturing measure, Markit Manufacturing PMI came in unchanged from flash estimates and met expectations, but was also sequentially weaker.

Construction spending dropped 0.2 percent in March and has been fairly weak on a year-over-year basis. Last week the Trump administration announced a 20 percent tariff on lumber imported from Canada. This type of lumber is typically used in residential single-family homes and according to the National Association of Homebuilders, tariffs between 15 percent and 25 percent are expected to increase the price of new homes by an average of $1,000. This presents another headwind to the already weak construction sector which, when it comes to at least home building, has claimed that one of the major headwinds impacting the historically very low inventories is the level of regulation/permitting involved.

On a more positive note with construction, on a three-month annualized pace, construction spending has been the strongest since March of 2016 with two consecutive months of double-digit 3-month annualized spending for the first time since 2015. Residential Housing Investment has improved by 26 percent over the past three months.

At the other end of the spectrum, Office Construction is down almost 15 percent at an annual pace in the last three months, the slowest pace since April 2013, confirming the data we’ve seen indicating rising vacancies and falling rental rates.

Bottom Line: While sentiment remains robust, the hard data paints a picture of a more mixed economy with some concentrated areas of strength, while the overall picture remains an economy that is growing at a very subdued pace. As usual, the mainstream financial media is claiming the first quarter results can essentially be dismissed as due to seasonal effects, but with the various confirming data points we’ve seen, we still believe that we are in the very late stages of the business cycle and are likely to see continued weakness in the months ahead.