Several Data Points Factor Into Our Cautious Stance Following the Market’s Continued Melt Higher

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

Once again the stock market continued to move higher last week following President Trump’s speech Tuesday night to a joint session of Congress and words from Fed Chairwoman Janet Yellen on Friday that opened the door to a potential rate hike this month.

Even though there were no major policy shifts and as we expected few details in President Trump’s speech last week, he called for both political parties to work together to get the country back on track after the last 8 years. That call for unity was far from surprising given that in order to move tax reform ahead and replace the Affordable Care Act, Trumps needs a united GOP and support from at least some Senate Democrats. Given the quick exit of Democrats following Trump’s concluding remarks, odds are the president will have much work to do to get his agenda flowing.

How did the stock market react to Trump’s speech?

Rather well, given the gap up in the Dow Jones Industrial Average past the 21,000 mark, one it held as we closed out the week. All in all, it was a good speech and one that in our view signals a more presidential Trump, but for those looking for harder details there was little to be had and it looks like the policy timetable has probably been extended. Our concern remains the increasingly out over its ski tips stock market will at some point have to catch up to the current low gear economic reality — more on that below.

On last week’s Cocktail Investing podcast Tematica’s resident mixologist, Tematica’s Chris Versace and Lenore Hawkins were joined by Boxed CEO Chieh Huang to discuss opportunities that have the company’s club warehouse business expanding at a furious clip. We see it Boxed sitting at the intersection of our Cash-strapped Consumer and Connected Society investing themes, with a dash of Disruptive Technology thrown in. Perhaps the most startling thing is what Cheih sees further upending the retail industry and hitting companies like Macy’s (M), Kohl’s (KSS), Nordstrom (JWN) and others — it’s not something most are thinking about and it’s not Amazon (AMZN). To find out what that disruptor is as well as hear Chris and Lenore’s musings on the economy and hash through several Thematic Signals, click here.

It’s conversations like these that we have on the podcast allow us to have thematic foresight rather than follow the Wall Street herd that relies on rear-view confirmation or what we’ve come to all “postsight.”

The Market Continues to Lean Out Over its Ski Tips

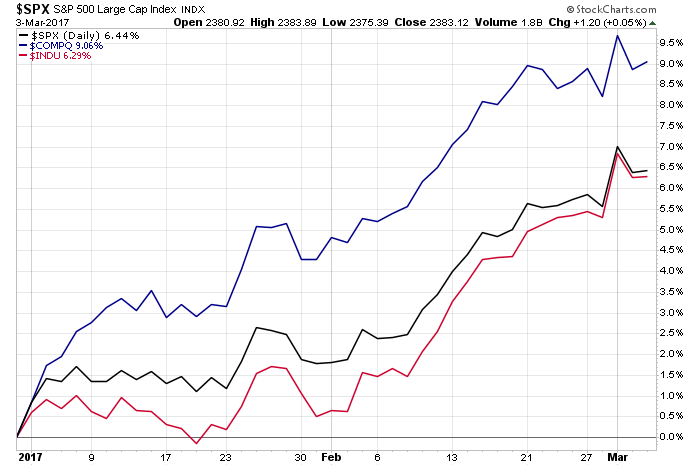

As we entered March, the overall stock market has been robust year to date. Perhaps the best indication of that is the 1,000 point move in the Dow Jones Industrial Average since January 25. That’s right, in just over a month that index of 30 stocks moved from 20,000 to over 21,000 and closed last night at 21,115.55 — up a hair more than 6.8 percent.

We’ve said before that we tend to favor the S&P 500 for a number of reasons, one of them being its a far more representative view of the stock market. Five hundred stocks vs. 30, and what that means is the Dow can be influenced by just a handful of stocks. That’s exactly what’s happened with this latest 1,000 point move — it was primarily due to Apple (AAPL), Goldman Sachs (GS) and Boeing (BA).

Why do we point this out?

Lest one think the market is moving higher across the board, it’s really less than a handful of stocks that are driving the Dow higher. We saw this toward the end of 2016, when if you didn’t own Goldman Sachs shares, odds are you were left trailing the market. We’re seeing this reflected in more than 115 hedge funds have imploded since late 2016 according to ImplodeNet that tracks implosions in the hedge fund, mortgage lending and homebuilding markets.

Given the moves we’ve seen in several positions on the Tematica Select List that have galloped ahead of the market, led by our Disruptive Technology, Connected Society and Aging of the Population investment themes, we’re hardly ones to complain.

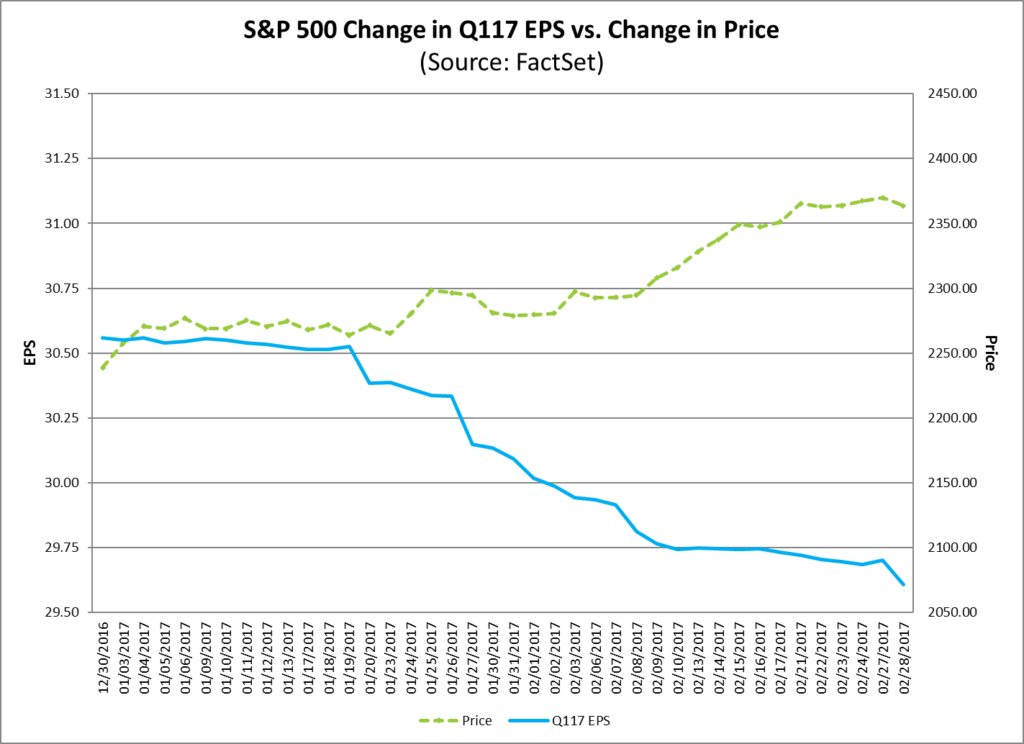

Rather than fall victim we fall victim to the easy trap that is patting ourselves too hard on the back, we prefer to understand the realities of the market’s movements to both appreciate its move higher as well as comprehend the risks that could move it lower. At more than 18x forward earnings for the S&P 500 that have already started to tick lower, and on signs the near-term economy is likely stuck in low gear near-term we’ll continue to tread cautiously.

Other data points that factor into our cautious stance following the market’s continued melt higher include:

- The 12-month trailing P/E ratio for the S&P 500 has crossed above 22 today. That’s 5.5 points above the index’s average P/E of 16.56 going back to 1954.

- Taking a forward view, the S&P 500 closed Friday at 18.2x expected 2017 earnings vs. the 5-year average of 15.3, and the 10-year average of 14.4.

- During the first two months of the first quarter, analysts lowered 1Q 2017 aggregate earnings estimates for the S&P 500 group companies by 3.1 percent. Not quite the direction we would expect if the economy were picking up steam.

- CNNMoney’s Fear & Greed Index has flipped from a Neutral reading just a month ago to Extreme Greed this week. One of the historical mistakes we’ve seen individual investors make is to chase the market after having sat on the sidelines during a strong move in the market only to get in at or near the top.

- The Volatility Index remains trapped between 11-13 year to date, among its lowest level over the last 5+ years.

As we look at those items, as much as we would are hopeful for the domestic economy and the market over the next year, we continue to question what the potential catalyst could be that would take some wind out of the market’s sail near-term? While we ponder that question, we’ll continue to look for companies with strong multi-year tailwinds like those that have powered our Disruptive Technology, Connected Society, Content is King and Aging of the Population positions on the Tematica Select List higher.

The Week Ahead – March 6, 2017

Looking at the economic calendar for next week, it’s a robust one that starts off with January Factory Orders and concludes with the February Employment Report. In between, we’ll get several other indicators like the 4Q 2016 reading on Unit Labor Costs and the usual smattering of private sector jobs data for February from ADP and Challenger Gray & Christmas.

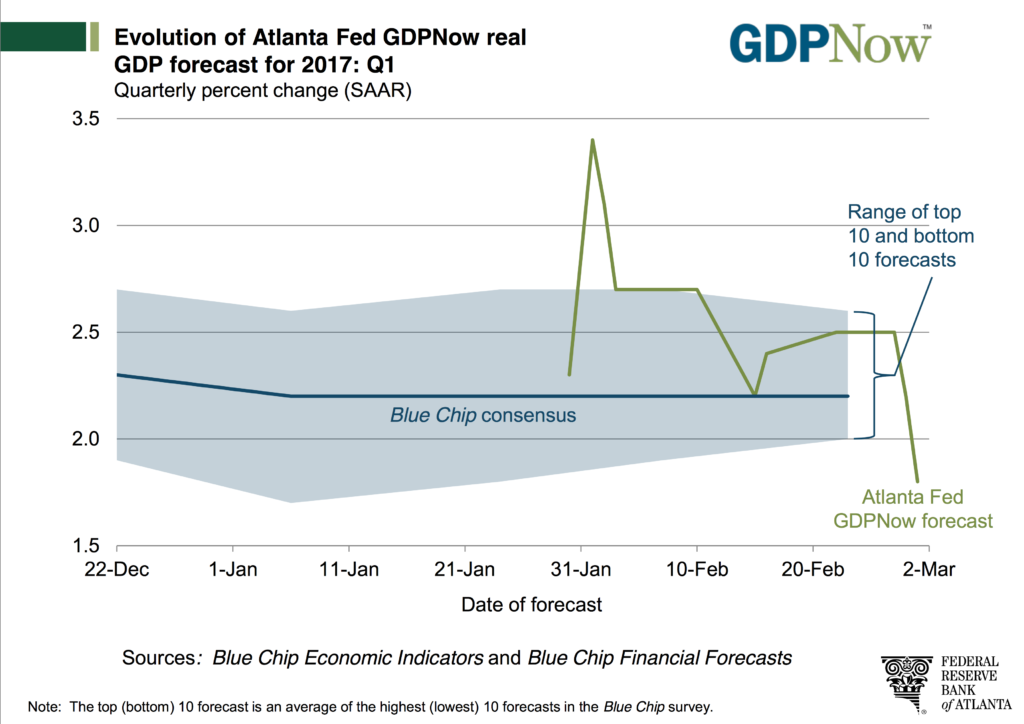

We’d note the February Employment Report comes just a few days ahead of the Fed’s next FOMC meeting on March 15-16. We suspect it will be ample fodder for the market, which following last week’s ISM indices and Final February PMI reports from Markit Economics sees a greater chance of a March rate hike than it did just a few weeks ago. Friday’s speech by Fed Chairwoman Yellen opened the door for such a rate hike, but even as the odds of that happening have jumped significantly over the last week the Fed isn’t exactly known for its rational thinking at times. Consider that as Yellen opened the March rate hike door, the Atlanta Fed GDPNow assessment of 1Q 2017 GDP dropped to 1.8 percent from the prior forecast of 2.5 percent.

While the folks at the Atlanta Fed revised their forecast due to weaker than expected real personal income expenditures as well as contracting core capital goods orders and shipments in January, the NY Fed’s FRBNY Staff Nowcast stood 3.1% for 1Q 2017. Makes one wonder if they talk with each other at these 12 regional Federal Reserve banks.

While recent data has shown a more sure-footed global economy and signs inflation is picking up, we still question whether we will see a rate hike in the very near-term. Remember, Fed Chairwoman Janet Yellen’s comments during her recent Congressional testimony regarding having time to digest and assess the economic impact of President Trump’s fiscal policies.

With next to no details on those policies having emerged, and 8 days until the Fed breaks from its next FOMC meeting, we continue to think May is a more likely time frame for the next rate hike; even so, we’ll continue to watch the data over the coming days so as to no be asleep at the switch. That data includes watching both the Financial Select Sector SPDR Fund (XLF) and the PowerShares DB US Dollar Index Bullish (UUP). The fact that UUP shares tumbled on Friday following Yellen’s speech would suggest the stock market has yet to be convinced a March rate hike is a lock.

With exactly four weeks to go until the close of the current quarter, we’ve got another week that is simply jam packed with investor conferences. Here’s a short list for the week ahead as well as some stocks and ETFs that are likely to see some action from these events:

- 2017 Citi Global Property CEO Conference, which includes a variety of companies ranging for Connected Society contenders like Equinix (EQIX) and Dupont Fabros (DFT) to Kimco Realty Corp. (KIM).

- Cowen and Company 37th Annual Health Care Conference — with a host of companies across our Aging of the Population investment theme, the ETF to watch will be iShares Dow Jones US Healthcare (ETF)

- Deutsche Bank 25th Annual Media, Internet, and Telecom Conference 2017 – this will see the who’s who in our Content is King and Connected Society investing themes, and means the barometer to watch will be the Technology Select Sector SPDR Fund (XLK). Others that could be a tad piggy this week include iShares U.S. Technology ETF (IYW) and First Trust Dow Jones Internet Index Fund (FDN)

- RBC Capital Markets Financial Institutions Conference, which means keeping tabs on the Financial Select Sector SPDR Fund (XLF)

- UBS Global Consumer and Retail Conference — With companies ranging from Macy’s (M) to Starbucks (SBUX) and Buffalo Wild Wings (BWLD) presenting, odds are the Consumer Discretionary Select Sector SPDR Fund (XLY) will see some action.

And while you may be thinking that with four weeks to go until we close the current quarter, surely there can’t be anymore companies left to report quarterly earnings. We hate to break it to you, but yes, there are more to be had and we’ve spelled them out for you below. The two greatest buckets of earnings reports to be had this week fall into our Fattening of the Population, Food with Integrity and Rise & Fall of the Middle Class investing themes.

- Will Weight Watchers (WTW) feel the Oprah halo effect?

- Will the ramping competition for Whole Foods Market (WFM) benefit United Natural Foods (UNFI) and Cavalo Growers (CVGW)?

- What does Armstrong World (AFI) have to say about the expected home remodeling boom?

- Is Ulta Beauty (ULTA) seeing any online share loss to Amazon (AMZN)?

- Will Natural Beverage (FIZZ) look to change its drink formulations like Coca-Cola (KO) and PepsiCo (PEP) to minimize sugar? But what about taste?

The answers to those question in more in the week ahead.

Earnings on Tap This Week

The following are just some of the earnings announcements we’ll have our eye on for thematic confirmation data points:

Affordable Luxury

- Peak Resorts (SKIS)

- Vail Resorts (MTN)

Aging of the Population

- Almost Family (AFAM)

- Care.com

- Surgery Partners (SRGY)

Cashless Consumption

- Verifone (PAY)

Cash-strapped Consumer

- Buckle (BKE)

- Stein Mart (SMRT)

- Tailored Brands (TLRD)

Connected Society

- Ciena (CIEN)

Economic Acceleration/Deceleration

- Air Transport Services (ATSG)

- Navistar (NAV)

- Ply Gem Holdings (PGEM)

Fattening of the Population

- AdvancePierre Foods (APFH)

- Bob Evans (BOBE)

- Bojangles (BOJA)

- El Pollo Loco (LOCO)

- Famous Dave’s (DAVE)

- Ignite Restaurant (IRG)

- Medifast (MED)

- National Beverage (FIZZ)

- Vivus (VVUS)

Foods with Integrity

- Amplify Snack Brands (BETR)

- Cavalo Growers (CVGW)

- United Natural Foods (UNFI)

Fountain of Youth

- ELF Beauty (ELF)

- Ulta Beauty (ULTA)

Guilty Pleasure

- Brown Forman (BF.B)

- Red Rock Resorts (RRR)

Rise & Fall of the Middle Class

- Armstrong Flooring (AFI)

- Citi Trends (CTRN)

- Dick’s Sporting Goods (DKS)

- Hibbett Sports (HIBB)

- Valspar (VAL)

- Vera Bradley (VRA)

- Signet Jewelers (SIG)

Safety & Security

- KEYW Holding (KEYW)