Can't Fight the Fed… or is it the Economy?

As the saying goes, “Don’t fight the Fed.” Or perhaps it is Mr. Bernanke that can’t fight the economy. While in the short-run I’ve seen the Fed show itself to be a potent force, I’m putting my bets in the long run on the economy in this seeming battle of wills.

Yesterday the Federal Reserve Chairman felt compelled to take the national stage and defend the actions of the Central Bank, a clear sign that things aren’t going well. So just how bad is it?

- GDP growth dropped from 3.1% in Q4 of 2010 to 1.8% in Q1 and 2/3 of Q1 went to inventories vs. final sales. The economy needs final sales to induce businesses to hire and invest.

- Obamacare makes it more expensive to employ. Note all the companies seeking exceptions from the law because they claim they cannot afford it. Another headwind to employment.

- The rules coming out of Dodd-Frank are still not complete, yet they go into effect in July. These rules affect not only the financial sector, but also businesses that look to hedge against business risks. Lack of clarity of the rules is a headwind to business expansion, thus job growth.

- The Administration continues to threaten tax hikes, which would increase costs for businesses and is a headwind to businesses investing and expanding.

- There is no credible plan for dealing with the national debt, which only adds to the uncertainty. The private sector is also forced to compete with the government for debt, another headwind.

- There is no clear, consistent dollar policy. The Treasury claims that a strong dollar is good for America, but the value of the dollar fell 7% in the past year alone.

- The necessary State and Municipal spending cuts are taking affect – another headwind to growth as government headcount and spending is reduced.

- The impact of the Japanese earthquake and questions over the country’s ability to recover and even more importantly get out of its economic malaise put more uncertainty into the global economy. I’ve heard some economists whose opinion I greatly respect refer to Japan as a bug in search of a windshield. More headwinds.

- Across the pond the EU continues its debt dance and game of kick the can. Just how long can a country spend more than it takes in and continue to receive in effect subsidies from its neighbors? Looks like we’ll all get to find out.

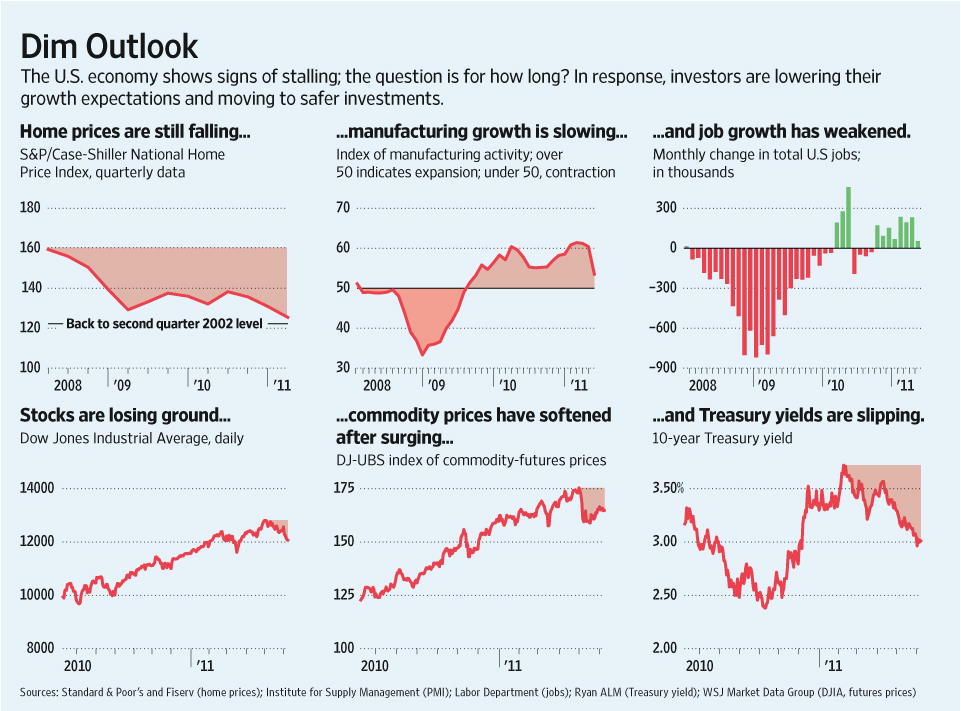

The chart below is from the Wall Street Journal and sums it up well in charts.

So what’s an investor to do? The market is now more in line with economic realities, so the importance of individual investment selection has returned. In 2009 and 2010 we had the “rising tide raises all boats” effect. Investors need to look for investments with healthy finances and good cash flow to the shareholders, rather than speculative hopes and dreams.