It’s Still Rock & Roll: As the Dollar Gets Rocked, Equities Continue to Roll

One of the most important realities my colleague and Tematica Chief Investment Officer Chris Versace and I point out in our book, Cocktail Investing, is that the economy and the markets aren’t the same thing and can diverge. Put another way, the economy is like the annual seasons, while the market is more like the weather. You can have unseasonably warm winters and exceptionally cool summers.

Much of the current bull market has occurred during the weakest economic recovery in history — exceptionally warm days despite early Spring shall we say? Now the markets are exultant to see an improving economic picture in much of the world, forgetting that we are already in a market that is hot, hot, hot!

Out of the 17 trading days so far in 2018, as of Thursday’s close, the S&P 500 has closed at new record highs twelve times, gaining 6.2% since the start of the year, the best start to a year since 1987 when the market rose 11.3% in the first 17 trading days. The slope of the accelerating upward moves is steepening, which is a textbook move for the late stage blow-off top of a bull market.

Equities have reached impressively extreme measure by quite a few metrics. The charts shown here from Chris Metli of Morgan Stanley illustrate just how wild it has become with the net holdings of S&P 500 call options at the 100th percentile while the net holdings of S&P 500 puts are at the 0th percentile. Talk about lopsided sentiment!

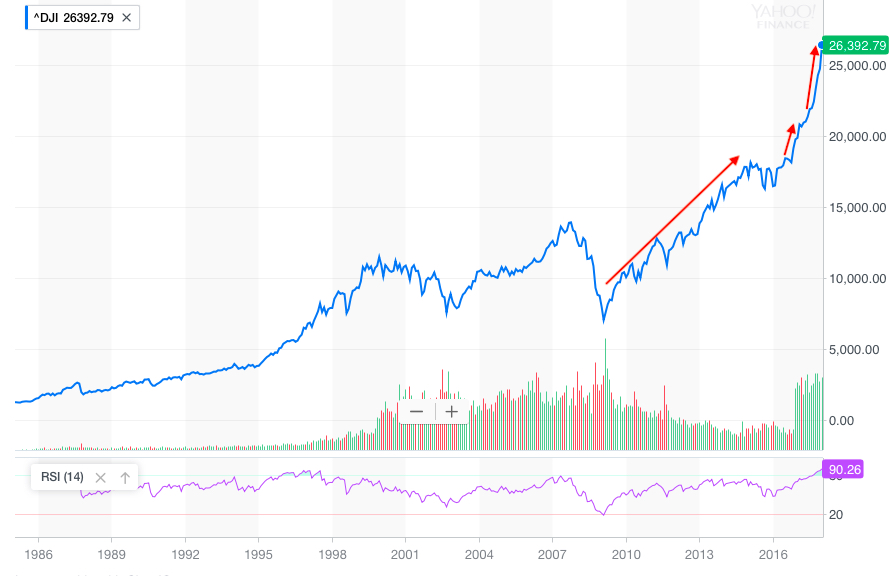

The chart below shows the near vertical moves in the Dow recently and even more incredible has been the degree to which the index is in overbought territory with the 14-day RSI (Relative Strength Index) at a level never before seen.

The total market capitalization as a percent of GDP has also reached a new all-time high, surpassing even the dotcom boom. Think about that.

This metric isn’t very useful for timing market directional changes, but it illustrates just how richly priced equities have become relative to history which from our perspective implies that robust future returns are going to be tough.

Mark McKinney of Kopernik Global Investors, LLC pointed out in his recent letter, “It’s Like Déjà vu All Over Again”:

The increase in the value of world stock markets in the past 18 months ($25 trillion) equals the total value of the world’s stock markets at the bottom in March 2009.

Did we mention lofty?

U.S. equities are also richly priced relative to other countries according to the CAPE® Ratio (the metric takes the inflation-adjusted price index of an equity benchmark and divides it by the moving average of the preceding ten years of equity benchmark earnings) as calculated by Barclays Bank of London, which you can explore here. This becomes important when we look at what is happening with the dollar. For perspective, the current CAPE ratio for the S&P 500 has been higher than today’s 33.6 reading, just once, during the dotcom boom. For some perspective, it took the dotcom boom to take out the prior peak of 32.6 that was put in place in 1929. The takeaway is it is extremely rare that we see the CAPE ratio at such lofty levels. For some additional context, today that ratio is two times its long-term average of 16.8 and in the past 137 years, we’ve seen valuations this high only 2% of the time.

We aren’t the only ones concerned with valuations at this point as the weekly sentiment survey from AAII saw bullish sentiment drop to a six-week low, but at 45.5%, is still well above the bull market average of just under 37%. Are we surprised by that drop? Given the data presented above and in the last few Weekly Wraps, we would say “no.”

A few sharp fellows have also commented recently on the state of equity markets:

- “My biggest concern is how little concern there is.” – Billionaire co-found of private equity company TPG, Jim Coulter

- “Underlying economic growth has been much better than people predicted, so that’s the good news despite all the political turmoil, but markets are very, very dangerous.” Allianz CEO Oliver Bate

- “This feels a little bit like 2006…. If interest rates were to move quickly, volatility was to move quickly it could be an interesting financial market in the next couple of years.” Barclays CEO Jes Staley

While Equities Soared, the Dollar Continued its Decline

The plummeting of the dollar was aided in part by Treasury Secretary Steven Mnuchin, who made headlines Wednesday from Davos when he stated that, “A weaker dollar is good for us as it relates to trade and opportunities.” We’ve touched on this in recent Cocktail Investing podcasts, and the January HIS Markit Flash U.S. PMI report showed “export sales expanded to the largest degree since August 2016.”

After Mnuchin’s statement, the dollar experienced its biggest one-day decline in 10 months. The AMEX Dollar Index (DXY) has fallen below 90 for the first time since late 2014 and has lost nearly 14% since late December 2016. Mnuchin walked his comment back on Thursday during a panel, “In the longer term, we fundamentally believe in the strength of the dollar.” The DXY appeared unimpressed, gaining just 0.11% after his comments Thursday.

This week we also learned that unlike the Federal Reserve, the European Central Bank currently has no plans to change its policy. President Mario Draghi commented that, “Based on today’s data, very few chances of a rate hike this year.” In a move that can be considered the central banker’s version of Reality TV smack down, Draghi commented not-so-subtly on Treasury Secretary Mnuchin’s remarks concerning dollar weakness:

The exchange rate has moved in part because of endogenous reasons, namely the improvement in the economy, in part to due exogenous reasons that have to do with communication. But not by the ECB, but by someone else. This someone else’s communication doesn’t comply with the agreed terms of reference.

Ouch! Quite a spanking from across the pond.

That dollar weakness is great news for those companies that generate a material level of revenue internationally, but don’t forget that it can have an impact on investors who see their gains negatively impacted by a falling dollar. International and domestic investors alike may look at valuations in the U.S. and decide there are better opportunities elsewhere, particularly given the moves in the greenback. For now, the market looks to be continuing this incredible melt up, but with this acceleration, the downside risks are rising.

Yes, there are signs that the economy is strengthening, but asset prices have risen dramatically and already reflect this. We don’t think anyone sane can say with a reasonable level of confidence when to go all in or get all out, but just as it is best to always fasten one’s seatbelt, regardless of one’s driving prowess, a little portfolio protection at such lofty levels could prove to be invaluable. Finally, when we hear comments about needing some sort of catalyst for a reversal, we’ll point out that no clear catalyst existed for the 2000 reversal. Lofty just can’t keep getting loftier.

We’ll conclude with Rules #4 and #5 from legendary Merrill Lynch market strategist Bob Farrell:

- #4: Exponential rising and falling markets usually go further than you think.

- #5: The public buys the most at the top and the least at the bottom.

One Final Thought

Earlier this week, myself and the rest of the Tematica Team headed south for the annual Inside ETFs conference in Florida where, given the vast flows into exchange traded funds in recent years, the mood was decidedly positive, even if the weather wasn’t as warm as we’d hoped.

While there my partner Chris Versace was able to speak with Douglas Yones, Head of Exchange Traded Products at the New York Stock Exchange concerning what is driving the ETF market and later with Jaime Wise of Periscope Capital who is responsible for the BUZZ index and the BUZZ US Sentiment Leaders ETF (BUZ). Check out our weekly Cocktail Investing podcast for the inside scoop from these two thought leaders.