Summer Heat Makes for a Good Time to Employ and Energy Call

NEW NAME, SAMES GREAT SERVICE

You may have noticed at the top of this post that we’ve made a modest name change in this service:

TEMATICA PRO is now TEMATICA OPTIONS+

Why did we make this change? Quite simply, to more accurately reflect the strategy of the service, which is to utilize a combination of options and other strategies, like shorting, to target superior gains over the short-term.

Will Options+ still be tied to the Tematica Investing newsletter? Yes

Will we be employing the same strategies and thematics we always have? Yes

So what’s changed? Nothing other than the name. You’ll see the changes rolling out across the website today and over the next few days. But rest assured, while the name has changed, nothing else has.

Are we good? Good. Now let’s get to it as we say because we’ve got some things to cover, including a new call option trade for the summer doldrums. Here we go…

Summer Heat Brings XLY Calls Into Play

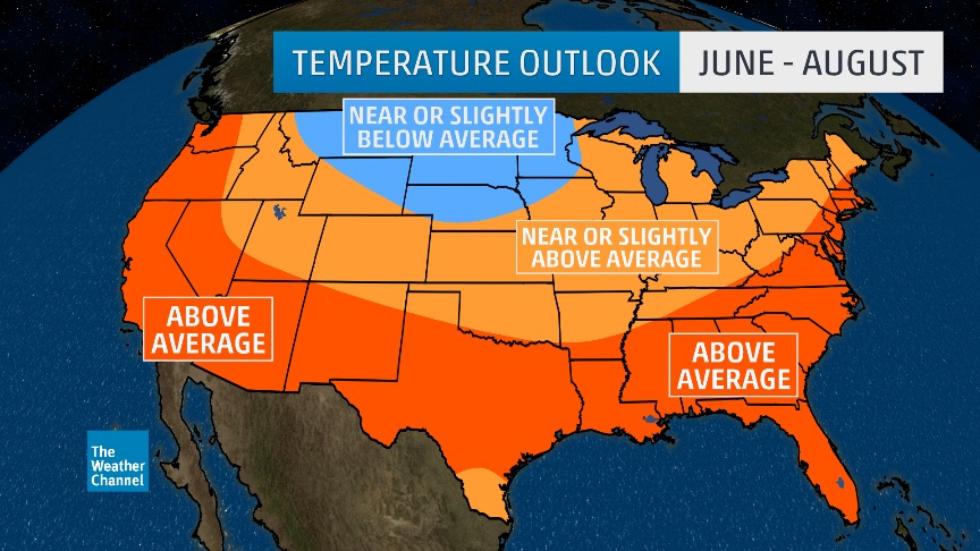

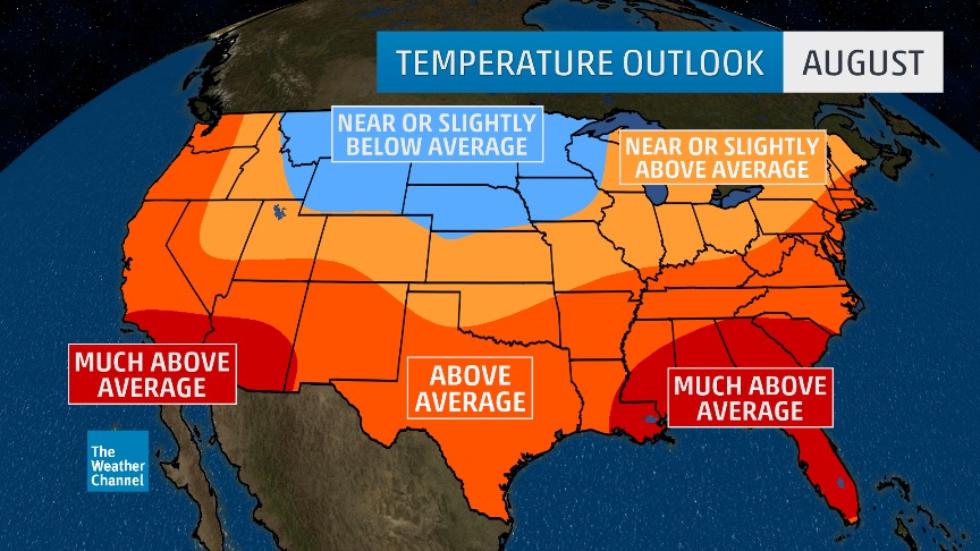

In yesterday’s Tematica Investing we added a new Scarce Resource investment theme play to the Tematica Select List with Teucrium Corn Fund (CORN) shares. As part of our investment thesis for that move, we shared the outlook for “normal or warmer than normal temperatures during the summer” months. Normally the hazy, hot and humid weather builds throughout the summer, and as we can see in the graphics below we are once again slated to get a greater portion of the country blanketed in above average temperatures come August.

What this means is more people turning to their air conditioning and making adjustments. This, in turn, will spur demand for electricity and that means a seasonal surge in utility production. We’ve seen this before, and in the short-term it means utility stock get goosed higher.

At the same time, we’re heading into an earnings season that will in all likelihood lead to a revision in expectations for the back half of the year. If we’re right, this means investors will be looking for safer havens as we finish out the summer. Given what we’ve now heard out of Washington, it looks increasingly like we won’t have any significant movement on tax reform or healthcare reform until September. We expect that as well as the latest round of data showing the domestic economy is slowing to be factors in soon to be updated corporate guidance.

To help position Tematica Options+ accordingly for these two likelihoods, we’re adding the Utilities SPDR ETF (XLU) September 15, 2017 $52 calls (XLU170915C00052000) that closed last night at 0.95. We’ve selected that strike date to capture the full impact of the summer heat as well as the full span of 2Q 2017 earnings reports. Because this is a new position, we are holding off with a protective stop loss at this time; we will look to review that decision as the calls trade higher over the coming weeks.

- We are adding the Utilities SPDR ETF (XLU) September 15, 2017 $52 calls (XLU170915C00052000) that closed last night at 0.95.

- Because this is a new position, we are holding off with a protective stop loss at this time; we will look to review that decision as the calls trade higher over the coming weeks.

Watching the Calendar for Our Other Positions

We’ve seen our inverse ETF, short and call option positions move back and forth over the last two weeks. Over the next few days, we’ll be entering the 2Q 2017 earnings gauntlet and we’ll be getting a slew of data that should confirm the rationale behind the trading positions we’ve put in place over the last several weeks.

It will start tomorrow with June Retail Sales, and that report should put some favorable context and perspective around Costco Wholesale’s June performance. While Costco shares and the call positions we have in place have been weighed down by Amazon (AMZN) concerns, the data should show that much like Amazon, Costco continues to gain consumer wallet share. Remember too, the other key aspect of the Costco investment thesis – rising membership fee income – stands to benefit in the coming months from new warehouse openings as well as the recent membership fee price increase.

- We continue to rate Costco Wholesale (COST) October 2017 173 calls (COST171020C00173000) calls a buy at current levels.

Turning to both our Dycom Industries (DY) September 2017 $90 calls (DY170915C00090000) and the AXT Inc. (AXTI) November 17, 2017 calls (AXTI171117C00007500), both are up nicely from our initial buy-ins. The next catalyst for both will be had between July 25-27, when both AT&T (T) and Verizon Communications (VZ) report their 2Q 2017 results. Alongside the quarter’s revenue and earnings, we expect both to update their capital spending plans and discuss their 5G deployment timeline. With more devices being connected, clogging up existing networks these two companies, as well as their competitors, are likely to keep the pedal to the metal with new capacity additions as well as new technologies that improve network capacities.

We remain bullish on Dycom Industries (DY) September 2017 $90 calls (DY170915C00090000):

- With last night’s close, we’re up 47 percent from our initial buy-in

- This has us keeping our current stop loss at 6.50 in place.

We’ve seen a nice rise in our AXT Inc. (AXTI) November 17, 2017 calls (AXTI171117C00007500), which closed last night up just over 27 percent from where we added them last month. As such:

- We’re boosting our stop loss to this call position to 0.50 from 0.35, which if tripped during what could be a turbulent earnings season, will limit the positions downside to just 10 percent.

- As the position moves higher, we’ll look to boost that stop loss level further.

Also on July 25, General Motors (GM) will report its 2Q 2017 results. We’ve already witnessed several months of declining monthly auto sales, with GM losing more share than its competitors as its inventories have climbed. The rollover in industry auto sales has led to several step-ups in promotional activities that are poised to weigh in on margins. Despite these data points, Wall Street has only shed $0.01 per share from its 2Q 2017 EPS expectations for GM over the last 60 days, which is when the auto data rolled over and GM slashed its 2Q 2017 industry forecast. We continue to have a bearish outlook for GM shares and expect it to revise its second half outlook to match its recent industry forecast – in other words, lower.

- Our continued bearish view on GM shares has us keeping our short position intact.

- Our stop price, for now, remains at $40.