Key Points from this Alert:

- After March quarter earnings that shut down the doomsayers, an upsized capital return program and ahead of the upcoming WWDC 2018 event in June, our price target on Apple (AAPL) shares remains $200.

- What’s the Fed likely to say later today?

- We are scaling into AXT (AXTI) shares on the Tematica Investing Select List at current levels and keeping our long-term $11 price target intact.

- We are also adding to our position in LSI Industries (LYTS) shares at current levels, and our price target remains $11.

Apple delivers for the March quarter and upsizes its capital return program

Last night in aftermarket trading, Apple (AAPL) shares popped more than 3% after closing the day more than 2% higher as Apple delivered a March quarter that was a sigh of relief to many investors. More specifically Apple served up results on the top and bottom line that were ahead of expectations, guided current quarter revenue ahead of expectations and upsized not only its share repurchase program, but its dividend as well. Heading into the earnings report, investors had become increasingly concerned over iPhone shipments for the quarter, particularly for the iPhone X, following recent comments on high-end smartphone demand from Taiwan Semiconductor (TSM), Samsung and others. That set a low sentiment bar, which the company once again walked over.

What Apple delivered included iPhone shipments modestly ahead of expectations – 52.2 million vs. 52.0 million – and an average selling price that fell $70 to $729. Down but certainly not the disaster that many had fretted for the iPhone X. iPad shipments were also stronger than expected and Apple continued to grow its Services business with Mac sales in line with analyst forecasts. Looking at the Services business, Apple is well on track to deliver on its $50 billion revenue target by 2021 and that’s before we factor in what’s to come from its recent acquisitions of Shazam and Texture as well as its burgeoning original content moves. In my view, that original content move, which replicates a strategy employed by Netflix (NFLX) and Amazon (AMZN), will make Apple’s already incredibly sticky devices even more so.

Think of it as Tematica’s Content is King investing theme meets Connected Society and Cashless Consumption… and yes, I need a better name for that three-pronged tailwind combination.

On the guidance, Apple put revenue ahead of consensus expectations and signaled a modest dip in gross margins due to the memory pricing environment. Even so, the sequential comparison for revenue equates to a quarter over quarter drop of 12.5%-15.5%, which likely reflects a mix shift in iPhones toward non-iPhone models. Pretty much as expected and far better than the doomsayers were predicting.

The bottom line on the March quarter results and June quarter outlook was investors fretted about the iPhone X to an extreme degree… an overreactive degree… forgetting the company has a portfolio of iPhone products as well as other products and services. Some may see the report as giving investors a sigh of relief, but I see it more as a reminder that investors should not count Apple out as we move into an increasingly digital lifestyle.

Is the company still primarily tied to the iPhone? Yes, but it is more than just the iPhone and that is something that will become more apparent in the coming year. We’re apt to see more of that in a month’s time at the company’s annual World-Wide Developer Conference, which several months later will be followed by what continues to sound like an iPhone product line up with refresh with several models at favorable price points.

The added cherry on top of the company’s meet to beat quarter and outlook was the incremental $100 billion share repurchase program and the 16% increase in the dividend. That dividend boost brings the company’s annual dividend to $2.92 per share, which equates to a dividend yield of 1.7%. Looking at dividend yields over the last few years applied to the new dividend supports our $200 price target for Apple shares.

- After March quarter earnings and ahead of the upcoming WWDC 2018 event in June, our price target on Apple (AAPL) shares remains $200.

What’s the Fed likely to say later today?

While many were focused on Apple’s earnings, others, like myself, were also getting ready for the Fed’s latest monetary- policy meeting, which concludes today. Market watchers expect the FOMC to leave interest rates unchanged, but recent data (as well as some comments that company executives have made this earnings season) suggest that we’re seeing a pickup in U.S. inflation.

For example, Caterpillar (CAT) last week shared that its margins likely peaked during the first quarter due to rising commodity prices, most notably steel. Meanwhile, the April IHS Markit Flash U.S. Composite Purchasing Managers Index report last week showed that average prices for goods and services “increased solidly. The rate of input price inflation was the quickest since July 2013.”

And on the manufacturing side, the report noted that “price pressures within the factory sector intensified, with the rate of input-cost inflation picking up to the fastest since June 2011.” Markit also wrote that the services sector “witnessed its average cost burdens climbing month over month as well.”

We also learned just this week that the U.S. Personal Consumption Expenditures Price Index (which happens to be the Fed’s preferred inflation metric) rose 2.4% year over year. While that’s down a few ticks from February’s 2.7%, the PCE came in well above the Fed’s 2% inflation target for the second month in a row.

And lastly, the April ISM Manufacturing Index’s price component edged up to 79.3 from 78.1 in March, easily marking 2018’s highest level so far.

All of these figures have likely caught the Fed’s eyes and ears. Make no mistake about it — the central bank will review them with a fine-toothed comb. The FOMC came out of its last policy meeting rather divided as to the number of rate hikes it expects for 2018. Some FOMC members preferring the three hikes that markets widely expect, but others on the committee increasingly leaned toward four.

In the grand scheme of things, four vs. three rate hikes isn’t a “yuge deal” (as President Donald Trump would say). In fact, more investors are likely expecting the higher numbers of hikes given the recent inflationary economic data. But that’s just the investor base. Odds are that any language in the FOMC’s post-meeting communique that points to an upsized pace of rate hikes is bound to catch the mainstream media and others off-guard.

And one way or another, the Fed’s comments are bound to make the wage data that we’ll be getting in this Friday’s U.S. April jobs report a key focus. A hotter-than- expected headline number will boost the odds that we’ll see a fourth rate hike this year.

But between now and then, expect to see lower-than-usual trading volumes as investors wait to see the latest economic figures while also digesting this week’s litany of earnings reports. Things could get a little wonky, as investors reset expectations for corporate earnings and FOMC hikes, but I’ll continue to let our thematic tailwinds be our guide.

Scaling into AXTI (AXTI) shares …

Last week was a challenging one for shares of AXT Inc. (AXTI) and LSI Industries (LYTS), and while that is painful and frustrating in the near-term, I view this as an opportunity to scale deeper into both positions at better prices. The silver lining is this will improve our cost basis for the longer term.

With regard to AXT, the smartphone industry has been currently transfixed on comments from Taiwan Semiconductor (TSM), Samsung and SK Hynix that all warned on demand for high-end smartphones. As we saw last night, those comments were not necessarily indicative of Apple’s iPhone shipments for the March quarter and as I pointed out above Apple has a portfolio of smartphones and a growing services business. Also, given comments from mobile infrastructure company Ericsson (ERIC) and chip-supplier Qualcomm (QCOM), 5G smartphones should be hitting in 2019, which we see fostering the beginning of a major upgrade cycle for the iPhone and other vendors.

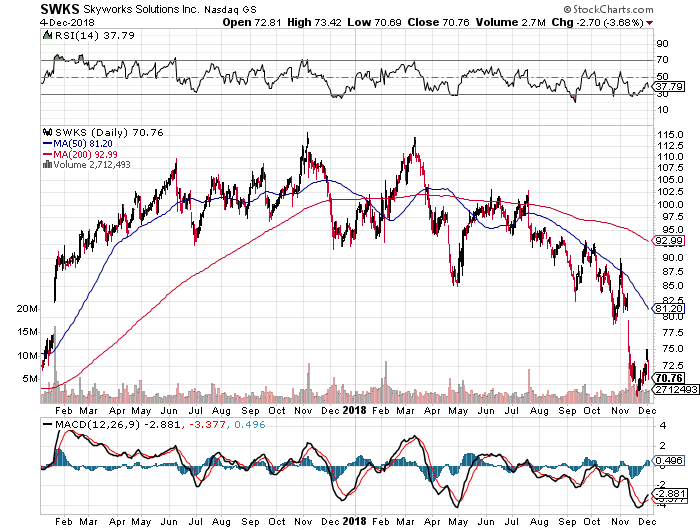

This is a great example of focusing on the long-term drivers rather than short-term share-price movement. Later this week two of AXT’s customers — Skyworks Solutions (SWKS) and Qorvo (QRVO) — will report their quarterly results. I expect those reports to reflect the short-term concerns as well as the longer-term opportunity as wireless connectivity continues to move past smartphones. With AXT’s substrates an essential building block for the RF semiconductors, let’s remain patient as I keep our long-term price target at $11, following the company’s first-quarter 2018 results that beat expectations but also call for sequential improvement in both revenue and earnings per share.

- We are scaling into AXT (AXTI) shares on the Tematica Investing Select List at current levels and keeping our long-term $11 price target intact.

… and buying more shares of LSI Industries (LYTS) as well

Now let’s turn to LSI Industries. Concerns about a sudden management change last week, just days ahead of the company’s quarterly earnings report, led LYTS shares to plummet 20% but rebound a bit later in the week even as LSI reported March-quarter results that missed both top-line and bottom-line expectations. While the search for a new CEO is underway, what was said during the earnings conference call was favorable, in my opinion, and supports my thesis on the shares.

First, let’s tackle the elephant in the room that is the sudden CEO departure. As one might expect, such a late in the quarterly reporting game resignation is bound to jar investors, but the near 29% move lower over the ensuing few days was more than extreme. That said, a sudden CEO departure raises many questions, and when it’s in a market that has been registering Fear on the CNNMoney Fear & Greed Index, investors tend to a shoot first and ask questions later mentality.

What I saw on the earnings conference call was a calm management team that is looking for a next-generation CEO. What I mean by that is one that understands the changes that are happening in the lighting market with increasing connectivity in lighting systems and signage. This to me says the desired CEO will be one with a technology background vs. one with a legacy lighting background. Much the way the lighting technology being used is being disrupted with LEDs and soon OLEDs, LSI needs a forward-thinking CEO, not one that only thinks of traditional light bulbs.

Second, the company’s lighting business is nearing the end of its transition to light- emitting diodes (LEDs) from traditional lighting solutions. During the March quarter, LSI’s LED business grew 14% year over year to account for 92% of the segment vs. roughly 80% in the year-ago quarter. Despite that success, the legacy lighting business continues to decline, with sales of those products falling by more than 55% year over year in the March quarter.

With one more quarter left in its transition to LEDs, the weight of the legacy lighting business likely won’t be a factor much longer, and that should allow the power of the LED business to benefit the bottom line. The LED business is riding the combined tailwinds of both environmentally friendly green technology as well as the improving nonresidential landscape.

Alongside its earnings report, LSI’s Board of Directors declared a regular quarterly cash dividend of $0.05 per share that is payable May 15 to shareholders of record as of May 7. The annualized dividend equates to LYTS shares offering a dividend yield of 3.4% at recent levels, well above its historical range of 1.5%-2.5% over the 2015-2017 period. Applying those historical dividend yields to the current annualized dividend yields a share price between $8-$13. The stock market liked this as LYTS shares rallied some 10% over the last several days, but we still have ample upside to my long-term $11 price target.

This tells me that there is much further to go fro LYTS shares in the coming months as LSI finds a CEO and gets its story back on track. Let’s remain patient with this one.Helping with that patient attitude was yesterday’s March Construction Spending Report, which revealed private nonresidential construction rose 3.8% year over year for the month on a non-seasonally adjusted basis.

- We are adding to our position in LSI Industries (LYTS) shares at current levels, and our price target remains $11.