Assessing the Market as We Get Ready for 1Q17 Earnings Deluge

Despite yesterday’s move higher in the stock market, March to date has seen the Dow Jones Industrial Average move modestly lower with a larger decline in the Russell 2000. Only the Nasdaq Composite Index has climbed higher in March, bringing its year to date return to more than 9 percent, making it the best performing index thus far in 2017. By comparison, the Dow is up 4.75 percent, the S&P 500 up 5.35 percent and the small-cap heavy Russell 2000 up just 0.75 percent year to date.

So what’s caused the move lower in the stock market during March, bucking the upward trend the market enjoyed since Election Day 2016?

Despite the favorable soft data like consumer confidence and sentiment readings, investors are waking to the growing disconnect between post-election expectations and the likely reality between domestic economic growth and earnings prospects. Fueling the realization is the move lower in 1Q 2017 earnings expectations for the S&P 500, per data from FactSet, as well as several snafus in Washington, including the pulling of the vote for the GOP healthcare plan. These have raised questions about the timing and impact of President Trump’s stimulative policies that include infrastructure spending and tax reform.

We’ve been steadfast in our view that the earliest Trump’s policies could possibly impact the US economy was late 2017, with a more dramatic impact in 2018. On a side note, we agree with others that would have preferred to have team Trump focus on infrastructure spending and tax reform ahead of the Affordable Care Act. As we see it, focusing on infrastructure spending combined with corporate tax reform first would have boosted confidence and sentiment while potentially waking the economy from its 1.6 to 2.6 percent annual real GDP range over the last five years sooner. We’d argue too that that would have likely added to Trump’s political war chest for when it came time to tackle the Affordable Care Act. Oh well.

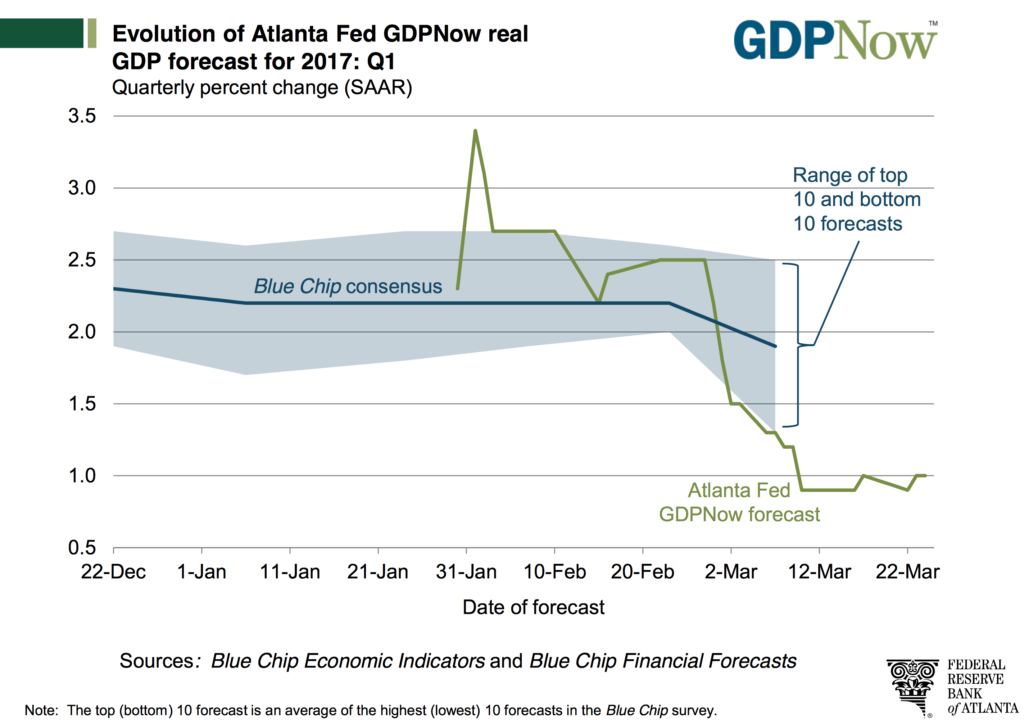

So here we are and the enthusiasm for the Trump Trade is being unraveled as growth slows once again. As depicted above, the most recent forecast for 1Q 2017 GDP from the AtlantaFed’s GDPNow sits at 1.0 percent compared to 1.9 percent for 4Q 2016 and 3.5 percent in 3Q 2016. Even a grade school student understands the slowing nature of that GDP trajectory. Despite all the upbeat confidence and sentiment indicators, the vector and velocity of GDP forecast revisions and push outs in the team Trump timing has led to to the downward move in S&P 500 EPS expectations for the current quarter and 2017 in full.

With Americans missing bank cards payments at the highest levels since July 2013, the delinquency rate for subprime auto loans hitting the highest level in at least seven years and real wage growth continuing to be elusive, the outlook for consumer spending looks questionable. Factor in the aging of the population, which will have additional implications, and it looks like the consumer-led US economy is facing more than a few headwinds to growth in the coming quarters. These same factors don’t bode very well for the already struggling brick & mortar retailers like Macy’s, Sears, JC Penney, Payless and others.

Now here’s the thing, currently, the S&P 500 is trading at 18x 2017 expectations —expectations that are more than likely to be revised down than up as the outlook for U.S. economic growth in the coming quarters is revisited. In three days, we close the books on 1Q 2017 and before too long it means we’ll be hip deep in corporate earnings reports. If what we’ve seen recently from Nike, FedEx, General Mills, Kroger and Target is the norm in the coming weeks, it means we’re more likely to see earnings expectations revised even lower for the coming year.

While it’s too early to say 2017 expectations will be revised as steeply as they were in 2016, (which started the year off with the expectation of a 7.6 percent increase year over year but ended with only a 0.5 percent increase following 4Q 2016 reporting), but any additional downward revisions will either serve to make the market even more expensive than it currently is or lead to a resumption of the recent downward move in the market. Either way, odds are there is a greater risk to the downside than the upside for the market in the coming weeks.

Buckle up; it’s bound to get a little bouncy.