In the last 24 hours we’ve had four Tematica Investing Select List positions – United Parcel Service (UPS) Amazon (AMZN), Alphabet (GOOGL) and Apple (AAPL) – report their quarterly earnings. Across the four companies, it was a mixed bag — on one hand, we have solid performance and profits at Amazon and Apple, while on the other hand, both United Parcel Service and Alphabet lagged in converting their respective topline strength into profits. We’re going to dig into company specifics below, but in summary:

- We are increasing our long-term price target on Amazon shares to $1,750 from $1,400, which keeps our Buy rating on the shares in place. As a quick reminder, we continue to see Amazon as a company to own not trade

- We are maintaining our $200 price target on Apple, which also keeps our Buy rating intact.

- With Alphabet shares, we are now boosting our price target to $1,300 from $1,150, which offers upside of 15% from current levels. Subscribers that are underweight GOOGL shares are advised to let the full impact of last night’s earnings announcement be had and wade into the shares in the coming days.

- We are trimming our United Parcel Service price target to $130 from $132.

United Parcel Service

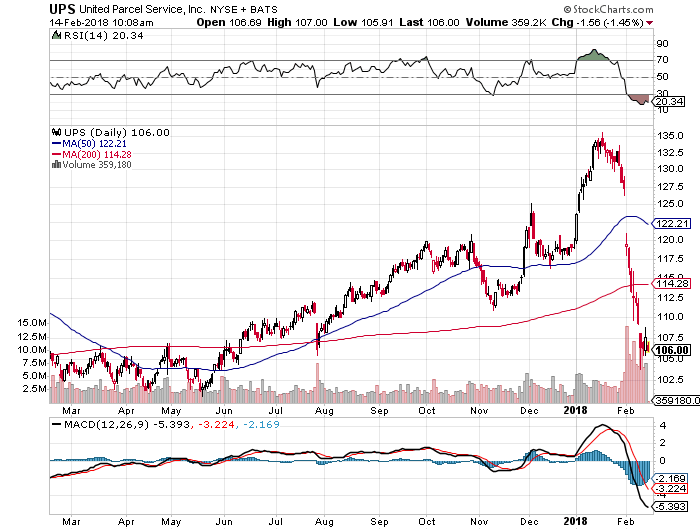

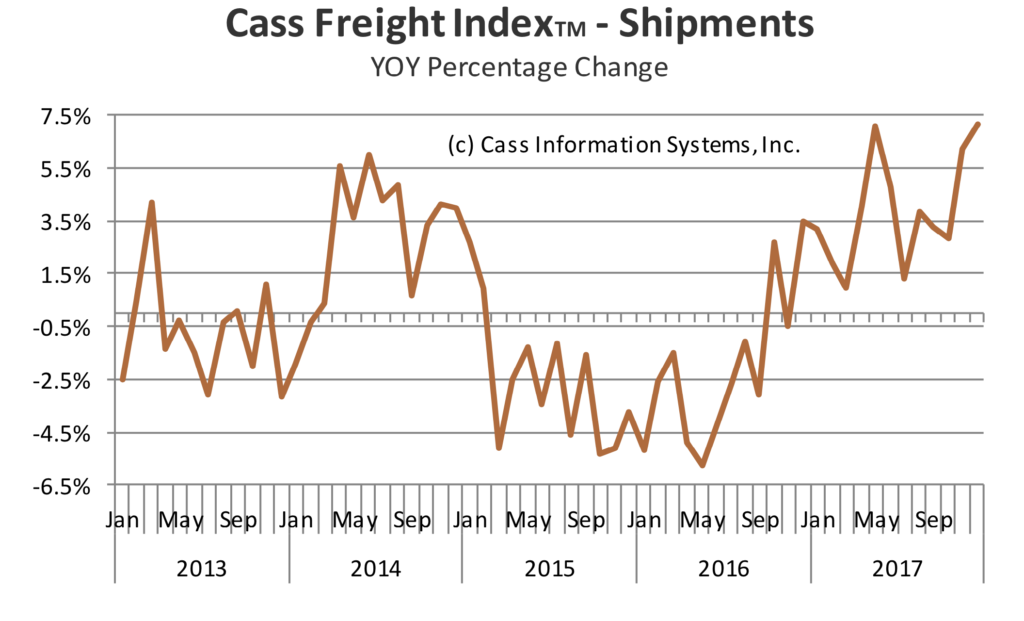

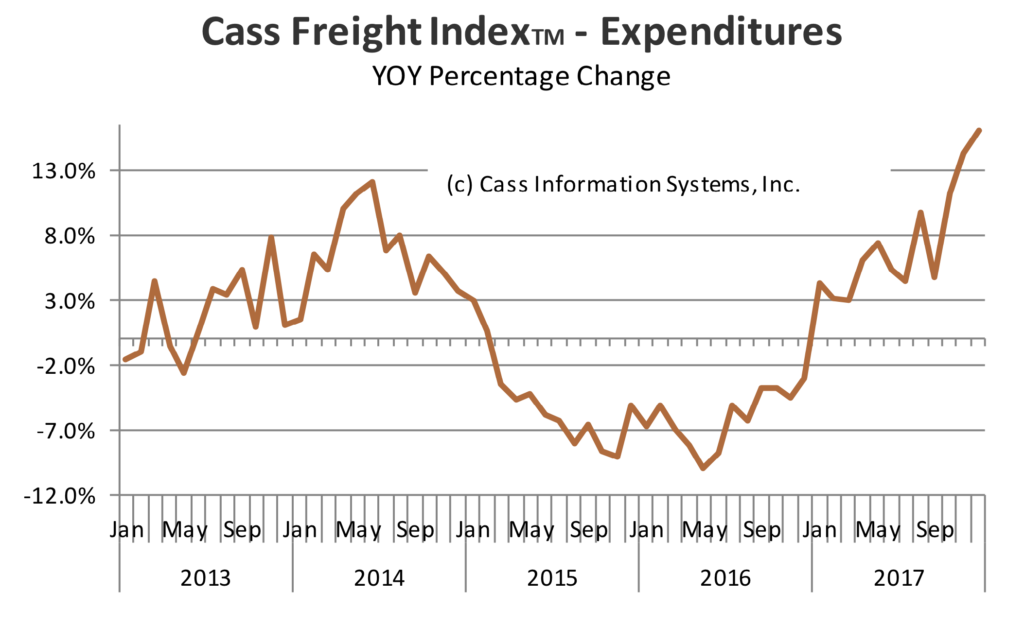

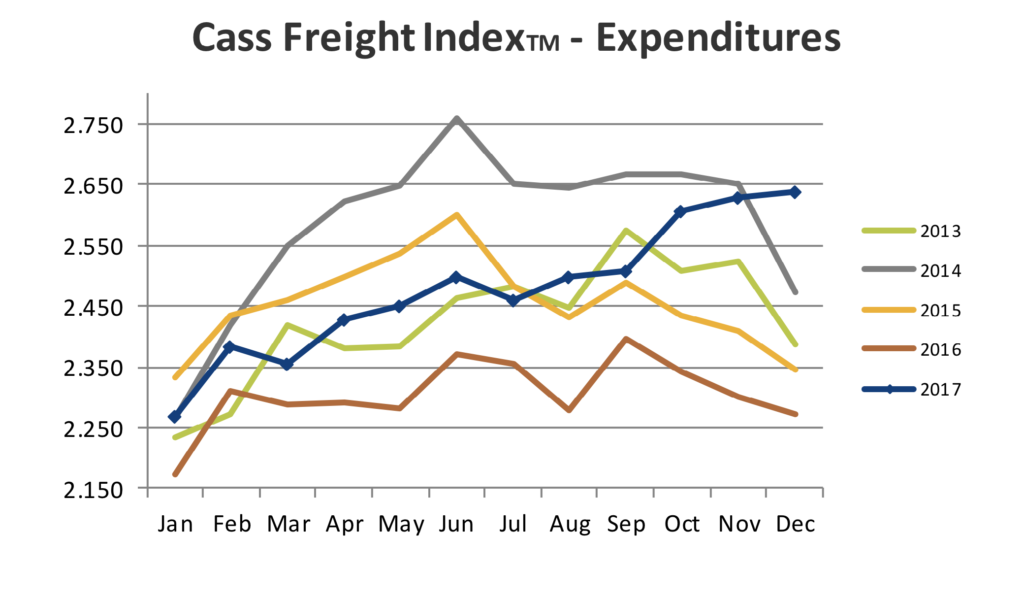

Shares of United Parcel Service slumped throughout the early part of the day yesterday, and while they did recover off their lows, the day ended with the shares down just over 6% following the company’s December quarter earnings report. Inside that report, the company reported slightly better than expected top-line results of $18.83 billion, up 11.2% year over year, vs. the expected $18.2 billion. The issue that pressured UPS shares was revealed in the 2.5% year over year increase in EPS to $1.67 even though that figure was slightly ahead of expectations. Comparing those two growth rates as well as looking at the year over year drop in operating margin for the quarter to 12.2% from 13.1%, we find UPS’s network capacity was once again overwhelmed by the shift to digital shopping in the US. Outside of that business, its profits climbed at its International business as well as Supply Chain and Freight Segment.

Near-term following the year-end holiday shopping season we are entering the seasonally slower part of the year for UPS’s business. If historical patterns repeat, we’re likely to see the shares range-bound over the coming months with them trending higher as more data shows the continued shift toward digital shopping that is powering its UPS Ground business. With more pronounced share gains likely to reveal themselves in the shopping-heavy back half of the year, we’re inclined to be patient investors with UPS, reaping the rewards as more companies continue to embrace the direct-to-consumer business model either on their own or through partnerships with other companies, like Amazon. We will continue to monitor oil and at the pump gas prices, which could be a headwind to UPS’s efforts to improve margins at its US Domestic business in the coming months. In terms of the company’s 2018 outlook, it guided EPS between $7.03-$7.37 billion, a 20% increase year over year at the midpoint, which is in line with expectations.

Apple

After the market close yesterday, Apple reported December quarter results that bested Wall Street expectations on the top and bottom line even though iPhone shipments fell short of expectations and dipped year over year. More specifically, the company served up EPS of $3.89 per share, $0.04 ahead of consensus expectation on revenue of $88.29 billion, which edged out expectations of $87.6 billion. While Apple once again bested expectations, the truly revealing revenue and EPS comparisons are had versus the December 2016 quarter as revenue rose 12.6% year over and EPS 16%.

Year over year revenue improvement was had in the iPad and Services business — the latter benefitting from Apple’s continued growth in active devices, which hit 1.3 billion in January, up from 1.0 billion just two years ago. Mac sales, in terms of revenue and units, edged lower year over year and Apple Watch volumes rose 50% year over year on the strength of Apple Watch 3. Despite the 1.2% year over year drop in iPhone shipments, the higher priced newer models drove the average selling price in the December 2017 quarter to hit roughly $795 up from $695 in the year ago quarter. That pricing surge led iPhone revenue to climb 12.5% to $61.6 billion. Digging into the results, we find the year over year improvements even more impressive when we consider iPhone X didn’t go on sale until early November and the December 2017 quarter had one less week compared to the December 2016 one.

All in all, it was a solid December quarter for Apple, and as we all know, there has been much speculation over iPhone production levels in the first half of the year, particularly for iPhone X. While Apple did issue its take on the March quarter – revenue between $60-$62 billion (vs. $52.9 billion in the March 2017 quarter), gross margin between 38%-38.5% and operating expenses $7.6-$7.7 billion – it was its usual tight-lipped self when it came to device shipments.

Let’s remember chatter over the last few weeks was calling for steep cuts to iPhone X shipments, but Apple ended the December quarter with channel inventories near the lower end of its 5-7-week target range. On the earnings call, Apple shared that iPhone should be up double digits year over year in the March 2018 quarter with the non-iPhone businesses up double digits as well. If we assume iPhone average selling prices remain relatively flat quarter over quarter, back of the envelope math suggests Apple is likely to ship 48-49 million iPhone units – roughly a 3%-5% drop in shipments year over year. That is far less than the talking heads were talking about over the last few weeks and explains why Apple shares rallied in aftermarket trading.

We see this as a positive for our Universal Display (OLED) shares as well – our price target on those remains $225.

From our perspective, the Apple story remains very much intact and with several positives to be had in the coming quarters. When Apple reports its March quarter results, we expect a clearer picture of how Apple plans to leverage the benefits of tax reform on its capital structure and share potential dividend and buyback plans. Next week, Apple’s HomePod will be released and before too long we expect to hear more about iPad and other product refreshes before the talk turns to WWDC 2018. Along the way, we hope to hear more concrete plans over Apple’s push into original content, a move we continue to think will make its ecosystem even stickier and likely result in even more people switching to Apple devices.

- Our price target on Apple (AAPL) shares remains $200.

Amazon

Turning to Amazon, we were expecting a strong quarter given all the data points we received over the accelerated shift to digital shopping during the 2017 holiday season and we were not disappointed. For the December quarter, Amazon’s net sales increased 38% to $60.5 billion. Excluding the $1.1 billion favorable impact from year-over-year changes in foreign exchange rates, the quarter’s net sales still increased a robust increased 36% year over year. By reporting segments, North America revenues rose an impressive 42% year over year, International by 29% and Amazon Web Services (AWS) just under 45%.

More impressive than the segment revenue results was the year over year move in operating income in North America, which rose 107% for the quarter, and the increase in sales in AWS (Amazon’s cloud computing division), with sales increasing 46% for the quarter. That led the company’s overall operating income to climb to $2.1 billion in the quarter, up significantly from $1.3 billion in December 2016 quarter. In our view, after delivering 11 quarters of profitability, Amazon has shown the naysayers that it can prudently invest to drive profitable growth and innovation. Period.

The seasonally strong shopping quarter resulted in Amazon’s North America division being the largest generator of profit for the quarter, a role that is usually had by AWS. Looking at the profit picture for the full year 2017, we find AWS generated nearly all of the company’s operating profit. We continue to be impressed by Amazon’s ability to win not just profitable cloud market share but fend off margin erosion as players like Alphabet and Microsoft (MSFT) look to win share in this market.

If we had to find one issue to pick with Amazon’s December quarter report it would be the continued losses at its International business. Those losses tallied $0.9 billion in the December 2017 quarter and $3.06 billion for all of 2017. We understand Amazon continues to expand its footprint in Europe and Asia, replicating the Prime and content investments it has made in the US, to drive long-term growth. As we have said before, Amazon is leveraging its secret weapon, AWS (10% of 2017 sales but more than 100% of 2017 operating profits), and its cash flow to fund these long-term investments and as patient investors, we accept that. We would, however, like to have a better understanding what the timetable is for bringing the International business up to at least to break even so it’s no longer a drag on the company’s bottom line.

In typical Amazon fashion, Amazon’s earnings press release contained a plethora of highlights across its various businesses, but the few that jumped out at us were:

- In 2017, more than five billion items shipped with Prime worldwide.

- More new paid members joined Prime in 2017 than any previous year — both worldwide and in the U.S.

- Amazon Web Services (AWS) announced several enterprise customers during the quarter: Expedia, Ellucian, and DigitalGlobe are going all-in on AWS; The Walt Disney Company and Turner named AWS their preferred public cloud provider; Symantec will leverage AWS as its strategic infrastructure provider for the vast majority of its cloud workloads; Expedia, Intuit, the National Football League (NFL), Capital One, DigitalGlobe, and Cerner announced they’ve chosen AWS for machine learning and artificial intelligence; and Bristol-Myers Squibb, Honeywell, Experian, FICO, Insitu, LexisNexis, Sysco, Discovery Communications, Dow Jones, and Ubisoft kicked off major new moves to AWS

- AWS continues to accelerate its pace of innovation with the release of 497 significant new services and features in the fourth quarter, bringing the total number of launches in 2017 to 1,430.

Those are but a few of the three-plus pages of highlights contained in the December quarter’s earnings press release. These and others show Amazon continues to expand its reach, laying the groundwork for further profitable growth in the coming quarters.

In characteristic fashion, Amazon issued revenue guidance for the current quarter that was in line with expectations – $47.75 – $48.7 billion – that equates to year over year growth between 34%-42%. Per usual, the company also issued it “you could drive a truck through it” operating income forecast calling for $0.3-$1.0 billion for the quarter.

- We are boosting our price target on Amazon (AMZN) shares to $1,750 from $1,400 and we continue to view them as ones to own for the long-term as the company continues to disrupt the retail industry and is poised to make inroads into others.

Alphabet/Google

Rounding out yesterday’s earnings blitzkrieg, was Alphabet, which delivered yet another 20% plus increase in revenue for the December quarter. The performance bested Wall Street expectations, but the company’s bottom line disappointed and missed the consensus by $0.37 per share.

For the record, Alphabet reported December quarter EPS of $9.70 vs. the expected $10.07 on revenue of $32.32 billion. At 85% of overall revenue for the quarter, advertising remains the core focus of revenue. Year over year in the quarter, the company’s advertising revenue rose 22% with growth compared to the year ago quarter also had at its Network Members’ properties and other revenue segments.

The difference between the company’s top line beat and bottom line miss can be traced primarily to its Traffic Acquisition Costs (TAC) — the fees it pays to partner websites that run Google ads or services. Those fees climbed 33% year over year to resemble 24% of advertising revenue vs. 22% in the December 2016 quarter. The continued rise in TAC reflects the ongoing shift in the company’s mix toward mobile, which makes the increase not a surprising one as mobile search and content consumption continues to grow faster than desktop.

On a positive note, the company prudently managed operating expenses, which accounted for 26.6% of revenue in the quarter down from 27% a year ago. The net effect led Alphabet’s overall operating margin for the quarter to slip to 24% from 25% in the December 2016 quarter.

Outside of the core advertising business, the company continues to make progress on its other initiatives better known as Google Other, which includes cloud, its Pixel phones and Google Play. On the earnings call, the management team called out that Google Cloud has surpassed $1 billion, a notable achievement but to be fair the company lags considerably behind Amazon in the space. That said, ongoing cloud adoption leaves ample room for future growth in the coming quarters.

Turning to the company’s Other Bets segment, which houses its autonomous vehicle business Waymo, Google Fiber, home security and automation business Nest and its Verily life sciences business units, it continues to be a drag on overall profits given the operating loss of $916 million on revenue of $409 million. The positive to be had is the unit’s revenue climbed 56% year over year and size of the operating drag compressed 16% vs. the year-ago quarter and was less than $940 million it was Wall Street expected it to be. We see that as progress given the less than mature nature of the businesses housed in Other Bets. As they mature further, we expect them to be less of a drag on overall profits with several of them potentially adding to the valuation argument to be had for the shares as they become a more meaningful piece of the overall revenue mix.

On the housekeeping front, the company’s Board authorized the repurchase up to an additional $8.6 billion of its Class C capital stock. With more than $101 billion on the balance sheet in cash and equivalents exiting 2017 the company has ample funds to opportunistically repurchase shares.

- The net impact of Alphabet’s bottom line miss looks to have the shares open lower this morning, which when paired with our new $1,300 price target (up from $1,150) offers some 15% upside to be had. That along with our view the company’s search and advertising businesses make it a core holding even as it grapples with the transition to mobile from desktop.