Taking Some Profits on A Hyuuuuuuge Move in our Back to School Delivery Calls

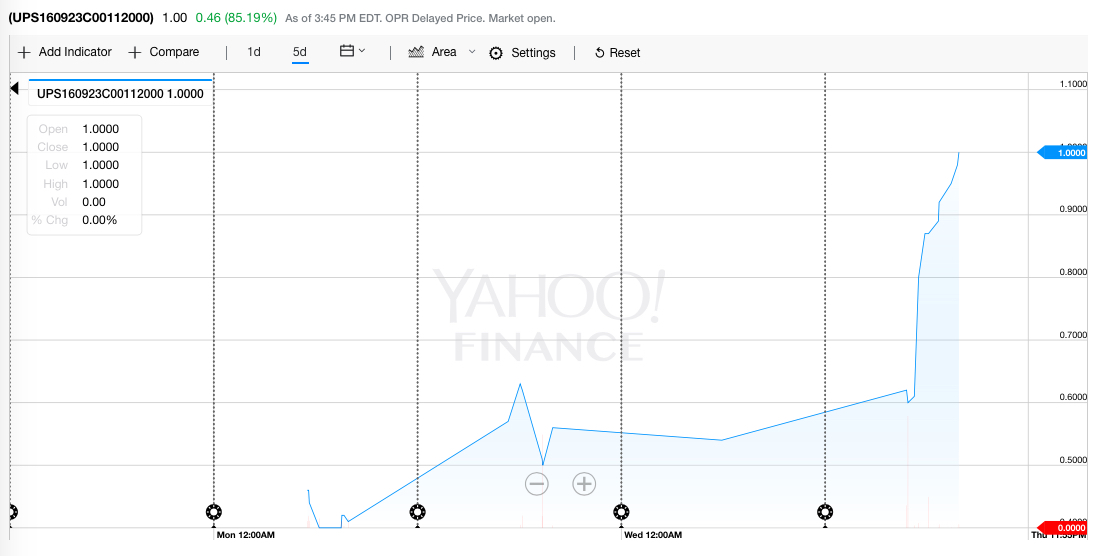

Yesterday we issued a Buy rating on United Parcel Service (UPS) UPS September 2016 $112 calls (UPS160923C00112000). We added the calls to the Tematica Pro Select List soon after the market open, but an hour after the market opened, the calls started to climb higher. At the close of trading yesterday, the calls reached 1.00, up more than 65 percent.

When we see such moves, we are inclined to hang on for more, but we are also reminded of the ol’ Wall Street adage — “Bulls make money, bears make money, but pigs get slaughtered.”

When we see such moves, we are inclined to hang on for more, but we are also reminded of the ol’ Wall Street adage — “Bulls make money, bears make money, but pigs get slaughtered.”

As such, we are selling half the call position, and keeping the other half in tact as we move deeper into Back to School spending. While it may be rather obvious, we would not commit new capital at current levels, and given the sharp pop, we are boosting our protective stop to 0.80 from 0.35. At the new level, should the stop loss be triggered, the remaining calls will lock in a profit of roughly 33%.