There Are Things Underfoot In the Market That Could Cause Some Scares

As we like to say at Tematica, the stock market is much more like a good movie than a photo in that there are several story beats with a developing plot that can have a few twists and turns.

In keeping with our Connected Society and Content is King investing themes, we would say the market is resembling Netflix’s Stranger Things and its sequel – even though the market has been moving higher, there are things underfoot that could cause some scares and shouts like we saw last week when the market had its worst performance since August. With tax reform stalling and likely pushed out well into 2018, we’re scratching our heads to find the catalyst that will drive the market even higher from current levels.

As Tematica’s Chief Macro Strategist, Lenore Hawkins, talked about on last week’s podcast and described in Friday’s Weekly Wrap, with corporate debt levels at record highs and margin debt growing at a 12% annual rate while equity fund cash balances are at near record lows – who’s left to keep buying?

That’s the question we ponder as we look to match up earnings expectations vs. the market’s valuation, which even after last week’s modest move lower, still sits at a lofty 19.7X for the S&P 500. With the bloom off tax reform, the market will take its cue from the next rash of economic data and corporate earnings as well as company commentary to be had at investment conferences

On the Economic Front

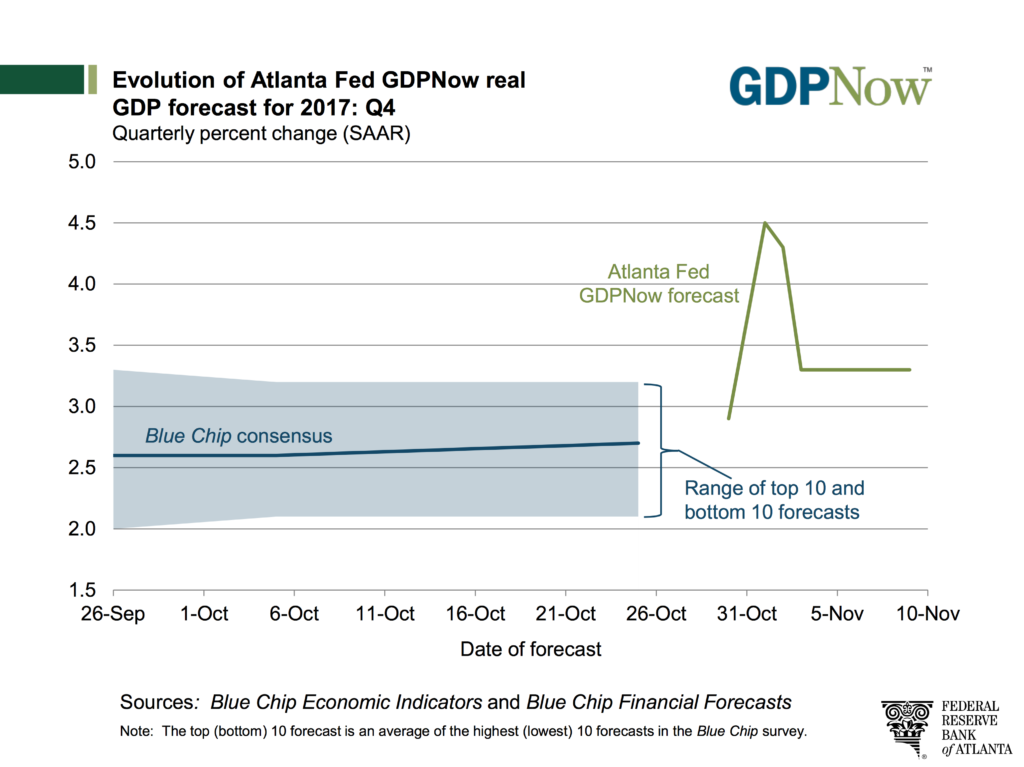

Exiting this week, we will be halfway through the current quarter (crazy we know), and that means it’s time to check in and see how GDP expectations are faring. Per the Atlanta Fed, it’s GDP Now forecast has already fallen to 3.3% from the 4.5% forecast it issued on November 1st. By comparison, the NY Fed’ Nowcast reading for the quarter is 3.16%.

Here’s the thing, we’re just starting to get the data that will shape the GDP reading for the current quarter and that means the forecasts will continue to bob and weave based on the October data. Following a relatively quiet week of economic data, the coming week will be chock full of data ranging from inflation with both the October PPI and CPI readings as well as October Industrial Production and October Retail Sales. In the Industrial Production report, we expect a positive sequential comparison as the September hurricane impact fades.

With the Retail Sales report, we’ll once again be looking for confirmation on the aspect of our Connected Society investing theme that centers of the accelerating shift to digital commerce at the expense of brick & mortar retailers, especially department stores like Macy’s (M) and JC Penney’s (JCP). In our view, this report, coupled with rising consumer debt levels and tepid wage gains, is likely to set the tone for the holiday shopping season. That said, given the continued rise in Halloween spending, which topped $15 billion per Harris/CIT (and yes we here at Team Tematica ate our weight in Kit Kats and Reese’s Peanut Butter Cups this year), we’re likely to see a sequential bump in certain retail categories.

Exiting the week, the October Housing Starts report will be published and the question on investor minds will be if month over month declines over the last several months continued or will we see a pick-up in activity as post-hurricane rebuilding continues?

On the Earnings Front

As we mentioned above, the overall velocity of corporate earnings will tick down sharply this week, but that doesn’t mean there aren’t a number of key reports that will help shape the market this week. Here are some of the ones that we’ll be focusing on and some of the questions we’ll be seeking answers to:

- With Macy’s (M) and Kohl’s (KSS) reporting negative same-store-sales data yet again last week, we’ll see if Target’s (TGT) store remodeling is helping it manage the “Amazon effect” and whether Gap (GPS) is seeing a rebound outside of its Cash-Strapped Consumer friendly Old Navy business.

- Keeping with our Cash-Strapped Consumer investment theme, results from TJX Companies (TJX) and Ross Stores (ROST) are poised to show that yes, there are retailers that are performing well despite all the headline focus on Amazon.

- We’ll also get quarterly results from Wal-Mart (WMT), and we’ll be focusing on its digital commerce results as well as its outlook for the 2017 holiday shopping season. The same goes for Best Buy (BBY).

- With Amazon having now unveiled its private label athletic wear products, comments from Dick’s Sporting Goods (DKS) and Hibbett Sports (HIBB) should prove illuminating, while Foot Locker’s (FL) results should tell us what’s going on with demand for basketball and running shoes from Nike (NKE), Adidas (ADDYY) and Under Armour (UAA).

- Given restaurant traffic and ticket data, we were not surprised by the disastrous results from Red Robin (RRGB) and Dine Equity (DIN) last week set. Rather we see them setting the tone for restaurant company earnings including that from Famous Dave’s (DAVE) this week.

- On the technology side of the market, and in keeping with our Connected Society, Disruptive Technologies and Safety & Security investing themes, we’ll be assessing Cisco’s (CSCO) take on network spending and look for confirmation the ramp for organic light emitting diode displays from Applied Materials (AMAT).

With earnings season waning, it should come as no surprise that we are once again seeing a lift in investment conference activity. Given that we’re only now just exiting the earnings onslaught for 3Q 2017, odds are companies presenting at these conferences will not deviate from their formal guidance. During these presentations, however, we may glean comments and data points that provide some industry insight. Here are a some of the conferences that we’ll be monitoring:

- UBS Global Technology Conference 2017

- Stifel Healthcare Conference 2017

- Morgan Stanley Global Consumer & Retail Conference 2017

- Goldman Sachs Industrials Conference 2017

- Needham Networking & Security Conference 2017

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week. Here are some of the highlights we saw this week:

Cashless Consumption

Apple doubles down on Cashless Consumption with Apple Pay Cash

Leveraging its smartphone install base and the popularity of messaging Apple is bringing its Apple Pay Cash feature to market with its iOS 11.2. Currently available to those in the iOS beta program, Apple Pay Cash will offer stiff competition to Venmo, owned by PayPal (PYPL) as well as other “send cash” apps like Zelle used by JPMorgan Chase (JPM), PopMoney at Citi (C) and others that allow you to send-and-receive money virtually between you and friends. While fees associated with this will be akin to collecting cookie crumbs, given Apple’s install base this has the potential to be a positive contributor to Apple’s burgeoning Service business. Read More >>

Disruptive Technologies

A Disruptive Technology for Visually Impaired

In a recent Cocktail Investing podcast with Audi regarding the company’s autonomous car initiative, Audi Government Affairs executive Brad Stertz mentioned that one of the demand-drivers for the technology will be the handicapped. In particular, Brad mentioned the visually impaired and how their economic productivity is significantly hampered because of their difficulty in getting to work. Read More >>

Cash-Strapped Consumer/Food with Integrity

Restaurant traffic continued to fall in October

Recent earnings reports from Red Robin Gourmet Burgers (RRGB) and DineEquity (DIN), parent of IHOP and Applebee’s, showed continued same-store sales declines, which in our view reflects our Cash-Strapped Consumer investing theme. As these rear-view mirror results continue to come in, we’re focusing on more recent data that point to some improvement, but while some may put a rosy spin on the data, we’re still seeing negative traffic and a high use of promotional activity.

While we continue to see Cash-Strapped Consumer favoring eating at home, and likely embracing Costco’s (COST) grocery offerings to stretch spending dollars, we’ll continue to look for publicly traded restaurants that are looking to leverage consumers’ preference for organic and natural diets that are a part of our Food with Integrity investing theme. Read More >>

Guilty Pleasure

After 20 years, Hershey introduces its first new candy bar

In 2005, The Hershey Food Company renamed itself “The Hershey Company” and many saw this as indicating product changes to come following Apple Computer renaming itself simply Apple. Since then we’ve seen Hershey expand its offering into gum, mints and other candy categories, but also into jerky to catch a ride in our Food with Integrity investing theme. But there is no denying our Guilty Pleasure investing theme, and after 20 years of not introducing a new candy, Hershey is launching one in tandem with the Winter Olympics.

While we’re game to give it a whirl, we’re wondering if the company lost its Hershey Bar mold and scrambled to design this new one? Despite the funky design, the non-chocolate offering suggests Hershey is thinking more globally with this new product. We’ll see how it catches on and if it tastes as good as one of our favorites, The Hershey Almond Bar. Read More >>