Trump’s Tit for Tat With China Adding to Market Uncertainty

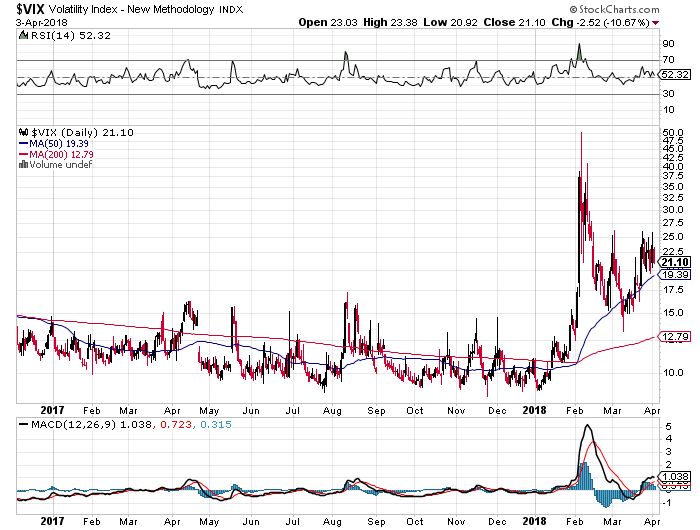

On Monday, I shared my view about the changing narrative that has hit the stock market over the last few months and how like any good drama, there have been several twists and turns. The stock market, however, is not a fan of drama as it tends to lead to uncertainty, which in the lingo of the market equates to volatility. We’ve certainly seen that come thundering back into the market over the last two months.

Here’s a quick recap just so we are on the same page:

- Back in January the market mood was one of optimism, fueled by high expectations over the positive benefits to be had from tax reform.

- The change began in early February with questions being asked about the speed of interest rate hikes to be had by the Fed and then sped up as tweets and subsequent tariff conversation emanated from the White House.

- Soon the economic data was coming in slower than expected, leading to negative revisions for 1Q 2018 expectations.

- The White House’s tariffs have now been met by a reprisal of tariffs from China that are far greater in size and scope than their initial opening salvo.

Earlier today, China expanded its tariffs to more than 100 product categories that sum up to some $50 billion. For anyone surprised by that action I have a bridge in Manhattan I would like to sell you. While I’ll wait to see how all of this plays out, it increasingly looks like where there is trade war smoke there could be a fire. It’s also possible China has wizened up to Trump’s negotiating tactics and is calling him on it.

As we digest this tit for tat tariff action, my growing concern is what this means for the guidance to be had at the upcoming 1Q 2018 earnings season.

On the back of tax reform, consensus expectations for S&P 500 EPS growth this year were at 18.5% compared to 2017 – well above the 7.6% that was averaged over the 2002-2017 time frame. In January I shared my view those expectations were “priced to perfection” and everything would have to go right. As we’ve seen over the last several weeks, things haven’t been quite so perfect, and amid the current uncertainty, I expect companies to adopt a cautious tone as the update their 2018 outlook. The silver lining is companies have used the last few months to assess the impact of tax reform, and we should see more outlooks reflect that. This could lead to dividend boosts, upsized share repurchase programs and lower tax rates that will goose EPS forecasts. Once again, the devil will be in the earnings details.

Along the way, privacy and user data concerns were once again kicked up following the ongoings at Facebook (FB) and more recently President Trump has turned his tweet focus to Amazon (AMZN), the U.S. Postal Service (USPS) and how Amazon is being “subsidized.”

That noise you just heard was me shaking my head in response. I see it more as a struggling USPS cutting a deal to help it defray costs as it contends with the headwinds associated with our Connected Society investing theme. I’m only surprised that Trump hasn’t lashed out over how incompetent the USPS has been and how poor of a deal it inked, rather that attack Amazon. Let’s also not forget that Trump is less than pleased with his coverage in The Washington Post, which is owned by Amazon’s Jeff Bezos.

The sum of all this has weighed heavy on the market, wiping out all gains to be had in 2018. Again, a very different market than we saw at the end of 2016 and all of 2017.

When we look at the market, perspective and context are key as they help us make sense of things when the market is topsy-turvy or to use the industry jargon – volatile. We find that asking some key questions help center us amid the stock price waves that are moving up and down. As Warren Buffett reminded us in his recent shareholder letter, we are buying businesses not pieces of paper. With that in mind,

- Are we likely to see any slowdown in the shift to online shopping or cloud adoption?

- Will people suddenly shun streaming content?

- Are we likely to forsake searching the internet for information in one form or another?

And so on.

The answers to those questions keep our positions in Amazon, Alphabet (GOOGL), and others on the Tematica Investing Select List intact.

From time to time, the stock market will get a bit wobbly and that will jar some investors creating some havoc along the way. We’ve seen that before, and as much as we’d like to think we won’t see it again, that’s not rather likely. One of the downsides of investing is dealing with human nature, and when things get a little hairy so to speak human nature tend to take over. We’ve all been there, and I suspect you know what I’m talking about.

At times like these as investors, we want to refocus on the fundamentals, our thesis, the data and the thematic signals we are receiving day in, day out. If they remain intact, then we may use any dramatic price swings to help improve our position. If not, then we have to make some changes, no matter how unpleasant they may seem at the moment.

Not to downplay it, but this is part of investing – twists and turns that can give as much indigestion as excitement. The clues we follow, our thematic signals, help us keep on the path and rise the thematic tailwinds.

From time to time, do market forces blow and get us a little of course? Yes, but as we’ve come to see, thematic tailwinds persist and despite the short-term disruption, their impact continues.