Category Archives: Uncategorized

Netflix’s ‘Stranger Things’ kicking up NetFlix ( $NFLX) as a Content is King player

The thesis this article raises about the connection between the appeal in Donald Trump with some Americans, our desire to return to a time when things were simpler and happier (the Reagan Years) and the success of the new series “Stranger Things” from Netflix is certainly an interesting, if not entertaining read. But what caught out attention were the stats on viewership of the series in just a little over two weeks time (see below), it’s why players such as Netflix (NFLX) and Amazon (AMZN) are winning across multiple themes we track.

“Stranger Things,” its latest original series, has far outpaced other Netflix originals in viewership. In the first 16 days, 8.2 million people watched the science fiction drama, putting it far ahead of hits like “House of Cards,” “Daredevil,” and “Jessica Jones.”

Source: Magic of Netflix’s ‘Stranger Things’ can explain rise of Donald Trump – Business Insider

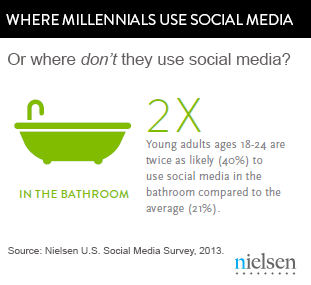

Millennials: Technology = Social Connection

Behind all those selfies, social media posts, likes, snaps, and shares, the Millennials are starting to impact real business models like banking, insurance and investing . . .

Millennials like to handle their finance themselves, and they primarily do so online. And their savvy extends beyond balancing their check books. Older Millennials are 28 percent more likely than average to buy mutual funds online. And, both younger and older Millennials are more likely than their older counterparts to engage in online trading. They’re also the heaviest Internet bankers and most likely to purchase insurance online.

The Connected Society and growing Cashless Consumption comfort are enabling BofA to shrink their footprint

Banks are increasingly adapting their business to the growing Connected Society. As comfort levels among consumers rise with Cashless Consumption, banks are able drive productivity higher and costs lower. Fewer people mean fewer salaries and lower benefit costs at a time when healthcare costs continue to climb no thanks to the Affordable Care Act. Without question one downside to this is jobs and eventually entire branches offices, which translates into a continuation of our Cash-strapped Consumer investing theme. While we note BofA is doing this to drive returns and profits, we can probably take it to the bank that it is not the only financial company doing this or at least planning to do so.

Bank of America had 4,689 branches as of the end of the first quarter, down from an average of 6,100 in 2009.

Bank of America’s shrinking headcount and branch footprint is a reflection of the powerful shift in habits by users. Instead of walking into traditional bank branches, Americans are growing increasing comfortable with banking on PCs and using their smartphones for everything from money transfers to depositing checks.

Digital transactions are way less expensive and keep customers happy. In fact, BofA said it costs less than a tenth of the expenses of traditional banks.

“Our strategy is putting everything on the mobile phone. If you have a thumb, you can bank,” Thong Nguyen, Bank of America’s co-head of consumer banking, said at an industry conference on Tuesday. “That’s where a lot of our strategy is going to move going forward.”

Source: Bank of America has 23% fewer branches than 2009 – Jun. 15, 2016