Wall Street & Yellen Finally Coming Around to Our Way of Thinking

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

Well, among a host of data reports and political developments that came at us last week, among the most important was the fact that Fed Chairwoman Janet Yellen finally copped to the fact that the domestic economy is indeed moderating. It’s a drum we’ve been banging for some time here at Tematica Research, and like the heard that it is, many on Wall St. quickly followed with a similar assessment. Better late than never we guess.

The scary thing is it comes at a time when the S&P 500 closed last Friday at 18.7x times 2017 earnings per share. At some point, the discrepancy between the economy, expectations and market valuations will have to be reconciled. That’s of course, why we’re here — to break it all down and determine what it means for investors as we head into what will no doubt be some serious readjustments of expectations.

In this Week’s Monday Morning Kickoff:

- Drilling into Friday’s June Retail Sales Report

- Yellen & CBO Pouring Some Cold Water on Trump’s Economic Plans

- Trump Bump has Become the Trump Slump

- GDP Expectations: Already on the Wrong Trajectory

- Second Half Earnings Expectations are Lofty

- Earnings We’ll Be Paying Attention to This Week

Last week was another solid week for stocks — a week that saw all the major market indices climb higher week- over-week. The bulk of that move came after dovish testimony by Fed Chairwoman Janet Yellen mid-week, who copped to the fact that the domestic economy is indeed moderating.

For regular readers, that should come as no surprise, as we here at Tematica have been writing about the weakening of the economy for some time here in the Monday Morning Kickoff, on TematicaResearch.com and it’s been the focus of many the conversation on our podcast, Cocktail Investing. We and Janet Yellen are not alone — although if we did get that chance there is much we’d share with her — as the same moderating view of the economy’s speed was also echoed by the latest Fed Beige Book that hit soon after Yellen’s comments.

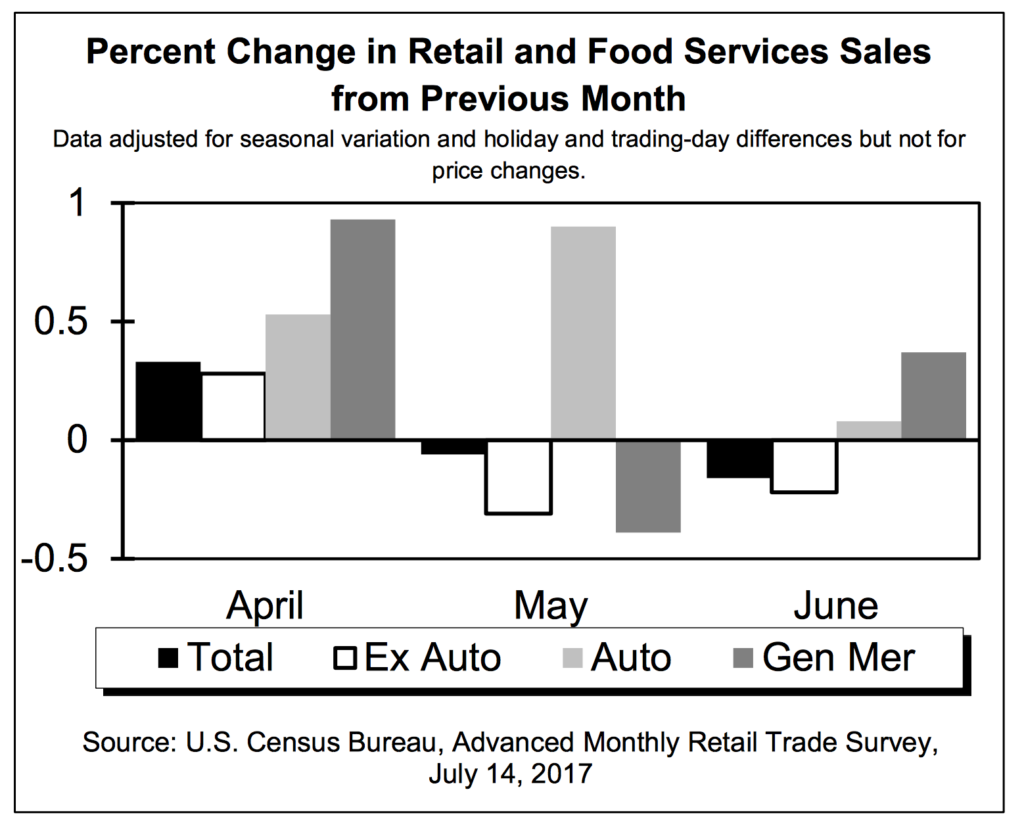

Data later in the week, including the lack of inflation shown in the June CPI report (another sign we are seeing more deflation than inflation as energy prices fall), the slight improvement in manufacturing industrial production in June and the weaker than expected June Retail Sales report point to another step down in GDP expectations for 2Q 2017.

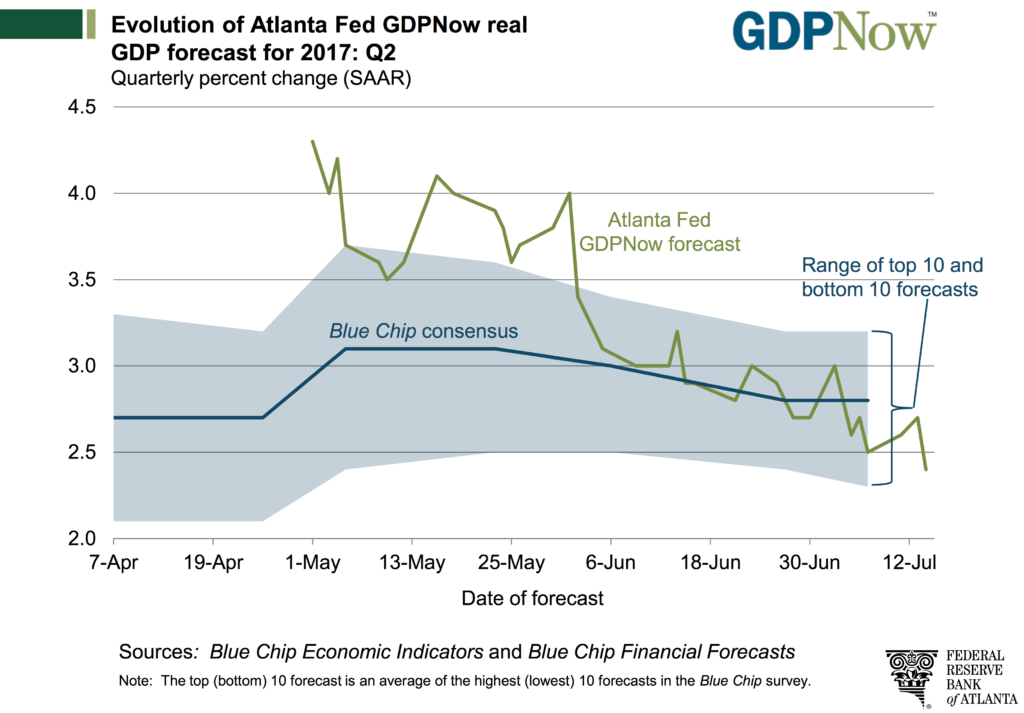

That’s exactly what we saw with the Atlanta Fed, once again cutting its 2Q 2017 GDP forecast to 2.4 percent. For those keeping score at home, that forecast represents yet another reduction, coming down from the recent 2.7 percent forecast and 4.0 percent in June.

In sum, the week’s data likely means we’ll have even longer to wait for the Fed’s next interest rate hike, especially if the Fed begins to unwind it balance sheet beginning this September.

Drilling into Friday’s June Retail Sales Report

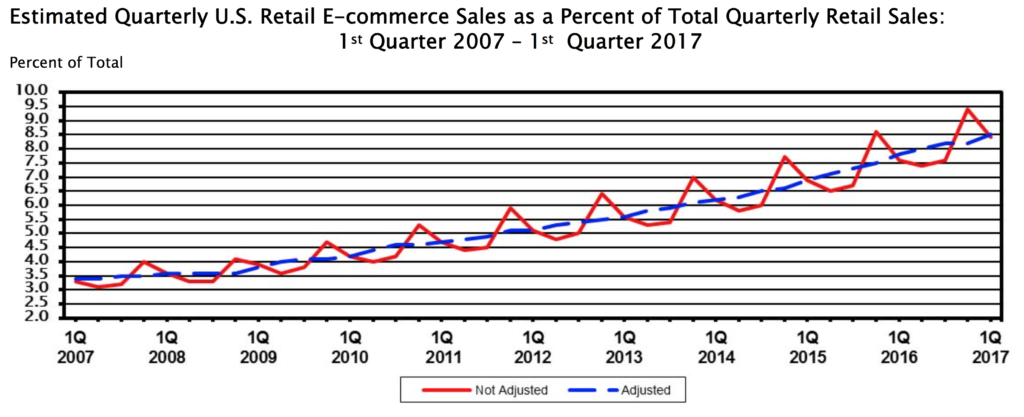

The Retail Sales for June produced month-over-month declines almost across the board as well as confirming signs for our Cash-Strapped Consumer investing theme. The key standouts in the monthly data were Non-store retailers, confirming the shift to digital commerce continues, and building materials. Given the drop in oil prices that is flowing through to gas prices, the fall in the gas station line item came as little surprise. The same can be said about the drop in department store sales, down 0.7 percent month over month, given reports of mall traffic declines.

Before moving on, we’d note the June Retail Sales report caps the data for 2Q 2017 and in tallying the three months, Non-store retail sales rose 10 percent year-over-year, while department stores fell more than 3 percent — not to overstate the obvious, but this is clear cut confirmation of our Connected Society investing theme as well as our Cashless Consumption, and the old mall-based department store is looking more and more like the dinosaur of the retail space. We have yet to see an online or mobile shopping portal that accepts cash or check – if you see one, please let us know.

Yellen & CBO Pouring Some Cold Water on Trump’s Economic Plans

Also last week, citing productivity growth challenges, both Yellen and the Congressional Budget Office (CBO) poured some cold water on President Trump’s goal of getting the economy back to 3 percent growth. That’s the latest blow to the administration that is seeing its agenda once again slip as healthcare reform is now more likely an August event with tax reform sliding to after September from its August. As these delays are baked into forecast cakes, we expect companies to offer more tempered outlooks for the second half of 2017, which means a reset to earnings expectations is likely in the offing.

It’s important to remember, we have yet to see S&P 500 EPS expectations reset to account for earnings prospects in the oil patch due to falling oil prices. With signs OPEC members are veering away from oil production cuts, we could see further price cuts. While good for gas prices and modest incremental consumer spending at the margin, it likely means outlooks for oil company earnings will be another weight on S&P 500 earnings expectations.

Friday did see positive results for the banks, such as JP Morgan (JPM) that shared it saw credit card volumes rise 15 percent and merchant processing volumes up 12 percent year over year – good news for our Cashless Consumption investing theme. JP Morgan’s results were also buoyed by loan growth and the benefit of higher interest rates year over year during the quarter. Among an upbeat report, however, we did notice the company boosted its net charge off, which is something we’ll be focusing on as it relates to our Cash-Strapped Consumer investing theme, given the levels of outstanding credit card, student and automotive debt. We’ll be looking for confirmation this earnings season and as part of Back to School spending.

As we exit the second week of 3Q 2107, we are bracing for more than 2,000 earnings reports coming at us at a time when economic data signals yet another slowdown in the domestic economy while inflation data continues to rollover as well. As we mentioned earlier, stocks rallied last week largely on Fed Chairwoman Janet Yellen adopting a more dovish tone than she has in the recent past. One of the issues at hand is that upward movement has only made the stock market as measured by the S&P 500 even more expensive. This coming at a time when odds are we are going to see expectations for the second half of 2017 get a haircut.

Today’s outlook is much different than it was back in late 4Q 2017 to early 1Q 2017. Just so we are on the same page, the S&P 500 closed Friday at 18.7x times 2017 earnings per share, which are still based on the expectations that were set early on in 2017. For context, the 5-year average multiple is 15.4 and the 10-year average is 14.0.

Trump Bump has Become the Trump Slump

Whenever we’ve had a new president take office, expectations for getting things done tend to run rather high, and with Trump that was no exception. On the notion that the Trump administration would get things done post haste as they say across the pond to repeal the Affordable Care Act, pare back regulations, overhaul the tax code while reducing rates, and begin to rebuild the crumbling domestic infrastructure, expectations for GDP and S&P 500 earnings called for dramatic year over year improvement at the start of 2017.

Flash forward to today, and we are still hip deep in healthcare reform that could get pushed out until later in the quarter. Even Senator Mitch McConnell is calling for a delay to Congress’s summer recess until the third week of August so it can make progress on healthcare reform. As our own Lenore Hawkins called it on this week’s episode of Cocktail Investing, this process has been like “a cat wearing silk slippers on an ice rink!”

At the same time, Treasury Secretary Steve Mnuchin shared, “the Trump administration hopes to roll out its “full-blown” tax reform plan in early September and sign it into law by the end of the year.” While we are all for tax reform, the issue is the timetable for this has now slipped from the original August target. We’ve also heard nary a word on domestic infrastructure, which given the American Society of Civil Engineers grade of D+, is in serious need of being rebuilt. It’s an issue that parties from both sides of the aisle all seem to agree on, but can’t seem to turn the page and get to.

GDP Expectations: Already on the Wrong Trajectory

Throughout the second quarter and into July, we’ve seen GDP expectations continue to tick lower. In particular, the Atlanta Fed’s GDPNow started off at 4.3 percent for 2Q 2017 and while it bobbed and weaved around during May, since June it’s been on a declining slope. As of July 14, the Atlanta Fed’s 2Q GDPNow forecast stood a 2.4 percent, which is several basis points above the New York Fed’s 2Q2017 GDP Nowcast reading of 1.9 percent.

Given the data we’ve been eyeing, it comes as no surprise the New York Fed sees the current quarter a tad softer than 2Q 2018 with its current view settling in around 1.8 percent. By comparison, The Wall Street Journal’s Economic Forecasting Survey for GDP in the second quarter sits at 2.7 percent, down from 3.0 percent over the last several weeks. We know the herd takes some time to catch up to what is really going on, and we see this as no exception.

Second Half Expectations are Lofty

We’re at the mouth of 2Q 2017 earnings season, and given the shift from Trump Bump to Trump Slump and slowing economic data, odds are management teams will be adopting a more conservative view on the back half of 2017. Here’s the thing, current expectations call for the S&P 500 group of companies to deliver EPS growth of 11 percent in the second half of the year compared to the first. Over the last several years, those companies have delivered EPS growth of 5.6 percent in the back half of the year vs. the first half.

As those expectations get revised lower, we will see 2017’s full year EPS growth get revised lower; depending on how much lower, historical market multiples would suggest we could see downside of 3 to 9 percent in the S&P 500 index from current levels. We’d note that if second half of the year earnings matched the historical average relative to the first half of the year, it would mean EPS growth of 7 to 8 percent year over year for all of 2017, which is still solid, but likely means there is still downside to be had relative to current view calling for more than 10 percent EPS growth for the S&P 500 in all of 2017.

What this means is there is a far greater probability of volatility returning to the market as we move deeper into 2Q 2017 and the market looks to re-read the changing tea leaves. If we’re right and EPS expectations for the S&P 500 are cut, we’ll be faced with one of two things:

- Either the market becomes that much more expensive than the 18.7x multiple on expected (but still yet to be revised lower) 2017 EPS it is currently trading at;

- Or investors will reassess the market multiple, likely pushing it lower, as those EPS cuts are made.

We find the second scenario far more likely and if we’re right it means is we will see the domestic stock market give back some gains. While some are not fans of such times, we get really excited because it means we can revisit quality companies at better prices with favorable risk-to-reward trade-offs in their stock prices. And by quality companies, we mean well-run ones that have pronounced multi-year thematic tailwinds powering their businesses.

Turning to the Week Ahead

As we indicated a few times above, this week begins the 2Q 2017 earnings gauntlet with more than 280 companies will reporting. More than 600 companies will be reporting next week and more than 1,200 during the first week of August. Make no mistake, this week will set the tone for what’s to come over the following few weeks.

As you can see below in our Tematica Earnings Calendar, which sorts reporting companies by our investing themes, 13 of our 17 themes will have data and commentary coming over the next five days. Given active positions on the Tematica Select List, which are the stocks we see the strongest current thematic tailwinds behind them, we’ll be paying extra attention to reports from Skyworks (SWKS), Ericsson (ERIC), T-Mobile USA (TMUS) and Qualcomm (QCOM) as well as Visa (V) and Blackhawk Networks (HAWK). None of those stocks are currently on the Tematica Select List, but the data and insights we can ferret out from their earnings reports should provide some proof-points for the underlying thesis behind our investment themes as well as the stocks actually on the Select List.

Following last week’s economic data filled days, next week’s helpings serve up the latest housing data as gives us a first look at regional Fed bank findings on the domestic economy in July. As important as this data is, we expect earnings to be the primary driver of the week ahead.

Earnings We’ll Be Paying Attention to This Week

Affordable Luxury

- Del Frisco’s Restaurant (DFRG)

- Pool (POOL)

Aging of the Population

- Charles Schwab (SCHW)

- Johnson & Johnson (JNJ)

Asset-lite Business Models

- Athenahealth (ATHN)

- Medidata Solutions (MDSO)

- Qualcomm (QCOM)

Cash-Strapped Consumer

- Skechers USA (SKX)

Cashless Consumption

- Blackhawk Networks (HAWK)

- Visa (V)

Connected Society

- Ericsson (ERIC)

- Skyworks (SWKS)

- T-Mobile USA (TMUS)

Content is King

- Netflix (NFLX)

Economic Acceleration/Deceleration

- CSX (CSX)

- JB Hunt Transportation (JBHT)

- General Electric (GE)

- Honeywell (HON)

- Union Pacific (UNP)

- United Rentals (URI)

Guilty Pleasure

- Dunkin’ Brands (DNKN)

- Harley-Davidson (HOG)

- Philip Morris (PMI)

- Polaris Industries (PII)

Fattening of the Population

- Del Taco (TACO)

- Rise & Fall of the Middle Class

- Danaher (DHR)

- PPG Industries (PPG)

- Sherwin Williams (SHW)

- United Continental (UAL)

- Whirlpool (WHL)

Safety & Security

- Checkpoint Software (CHKP)

- Lockheed Martin (LMT)

Tooling & Re-Tooling

- Robert Half (RHI)

- Scholastic Corp. (SCHL)