Weak Global Trade Yet One More Headwind for Banks

Yesterday the Danish shipping and oil giant A.P. Moller-Maersk (AMKBY:OTC) reported fourth-quarter net profit below consensus expectations with EBITDA of $1.5 billion versus expectations for $2.01 billion. The company also delivered top line revenue of $8.89 billion, below analysts forecasts for $9.54 billion. That swing and a wide miss pushed the shares down almost 6 percent at the open in the U.S. OTC markets.

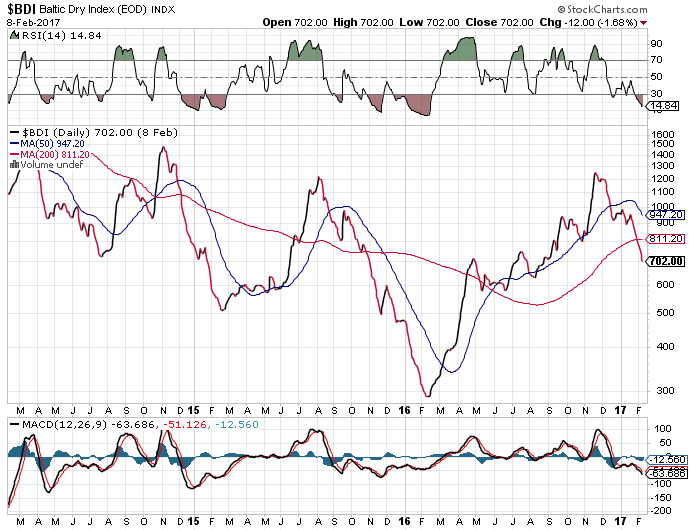

That miss shouldn’t be all that surprising when we look at how much global trade has been slowing in recent years. For example, the Baltic Dry Index, which essentially measures the demand for shipping capacity versus the supply of dry bulk carriers, had been on a steady downward trend for years but started improving in the early parts of 2016. That upturn has now been reversed with the index once again trending downward, falling below both its 50-day and 200-day moving averages, indicating further weakness in global trade.

In fact, according to the Director of the World Trade Organization, General Roberto Azevedo, world trade is likely to have grown just 1.7 percent in 2016, the weakest rate of growth since the financial crisis. It takes a bit to compile all the data so that’s the estimate for now.

This doesn’t affect just shipping as today Commerzbank reported earnings that fell 5 percent in the fourth quarter due in part to provisions against bad shipping loans.

German banks were among the biggest lenders to shipping in the boom years before the financial crisis, but have since suffered from the brutal downturn in the industry caused by a slowing global economy and chronic oversupply in the container market.

According to Stephan Engels, CFO, the bank isn’t expecting things to improve much in 2017.

“Our view for 2017 is just as critical as it was for 2016, as far as shipping overall is concerned,” he said. “We still have — particularly for container ships — more new vessels coming on to the market than are being scrapped. And that in a market which is already on the whole operating below full capacity.”

While the headlines continue to be dominated by the new administration, data points like this are not getting the attention they normally should as investors bid up prices based on hope, while the hard data gets ignored.

Weak levels of global trade mean translates into reduced economic potential for everyone, particularly the world’s major economies.

Source: Commerzbank earnings dip on increased maritime loan provisions