Weekly Issue: More Data Points To An Economic Slowdown Ahead

Key points in this issue:

- The Fed, recent economic data and downside guidance are setting up a rocky March quarter earnings season.

- We will continue to hold shares of Guilt Pleasure thematic leader Del Frisco’s Restaurant Group (DFRG) as we patiently wait for the next step of its strategic review process. Our price target of $14 remains in place.

- Be sure to check back on TematicaResearch.com later this week when I follow up on the announcements that Select List resident Apple (AAPL) made yesterday. There we are a number of things to cover, several of which position Apple’s business inside the Digital Lifestyle tailwind.

Data points to a slower economy ahead

Stocks finished last week on different footing compared to the start of the week. I type this, however, there is an attempt at a market rebound. While the major market indices trended higher ahead of Federal Reserve Chair Jerome Powell’s post-monetary policy press conference last Wednesday, the revelation the Fed would adopt a far more dovish stance, with no expected rate hikes in 2019, took the market by surprise. I talked about this on last week’s Cocktail Investing podcast, which if you missed it you can find it here.

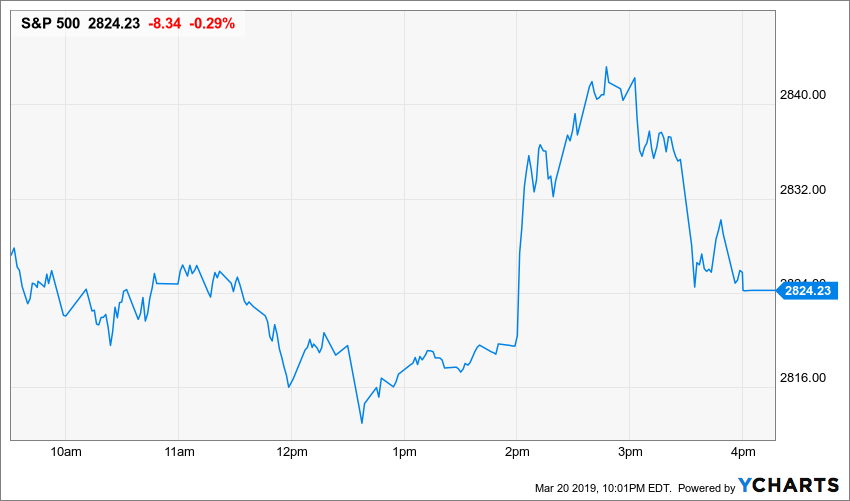

As you can see in the chart below, the market initially liked what it read in the FOMC statement – dovish as expected – but as it digested the Fed’s latest economic projections and Powell’s comments it traded off its 2 PM surge. There’s dovish and then there is, “Uh oh, they are worried!” To better understand what put a bitter aftertaste in the market’s mouth let’s have a blow by blow account of what it heard.

First, let’s turn to the Fed’s monetary policy press release. Right off the bat, it agreed with the data we’ve been getting of late that “growth of economic activity has slowed from its solid rate in the fourth quarter” due to in part to slower household spending and business fixed investment. We touched on this in our note yesterday, which means those comments were of little surprise as was the lack of rate hike as the Fed maintained its target range for the federal funds rate.

Now here comes the dovish statement that popped the market – “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.” In other words, the Fed’s patience means a more dovish stance in the near term and basically took any more hikes in 2019 off the table with just one possible in 2020.

Now let’s turn to the Fed’s latest iteration of economic projections, which show the Fed has reduced its 2019 GDP forecast to 2.1% from 2.3% in December and 2.5% in September. Interesting, given the CNBC March Fed Survey findings we shared yesterday that put 2019 GDP at 2.3%. We say interesting because the Fed tends to be the cheerleader for the economy, yet its forecast is below the CNBC consensus, but in line with the Economic Forecast Survey published by The Wall Street Journal. The Fed also trimmed its forecast for GDP in 2020 to 1.9% from 2.0% and left its 2020 view unchanged at 1.8%. No matter how you slice it, it’s slower growth ahead compared to what we saw in the second half of 2018.

Inside this forecast, the Fed also took a knife to its federal funds forecast for 2019 through 2021. For this year it now sees the federal funds rate at 2.4%, pretty much in between the 2.25% to 2.50% range it said it would maintain. For 2020-2021, the Fed now forecasts the federal funds rate will remain at 2.6%, down from its prior forecast of 3.1%. In other words, the prior view to boost rates to cool the economy and keep inflation tame is no longer. This goes hand in hand with the revised GDP forecast and comments issued in the formal press release.

What’s different this time around is the why as the Fed is reacting to the slowing economy and is aware that a more aggressive interest rate policy could erode the expected speed of GDP in the coming quarters. What we have here is a Fed that is looking to avoid, as best it can, one of the classic mistakes of the past, which is boosting interest rates into a slowing economy or recession.

Now let’s turn to the press conference to determine what was said that put that after taste in the market’s mouth. During Powell’s prepared remarks, his message was summed up in the following words – “We continue to expect that the American economy will grow at a solid pace in 2019, although likely slower than the very strong pace of 2018. We believe that our current policy stance is appropriate.” A pretty succinct was of summarizing the press release and economic projections.

Powell also addressed the Fed’s Balance Sheet Normalization Principles and Plans, noting the news the Fed intends “to slow the runoff of our assets starting in May, and to cease runoff entirely in September of this year.” In other words, a more dovish stance at the Fed and significantly so compared to that coming out of its last few FOMC meetings.

To recap and put this all of this into context, the “normal” federal funds rate for this business cycle sits between 2.25% and 2.5% versus 2.75% at the end of the Fed’s last tightening cycle in 2006 and 4% at the end of 2000 cycle – that’s not a whole lot of monetary ammunition for the next downturn.

By September the Fed will still hold over $3.5 trillion in bonds which equates to about 17% of GDP versus just 6% back in 2006.

Materially lower “normal” rates and a balance sheet that is nearly 3x heavier after over 10 years since the last recession, unprecedented monetary stimulus, solid tax cuts and a level of government spending the likes of which have not been seen outside of a recession or a war. Yeah, the markets got spooked.

This brings us to the likely question that spooked the markets – what is the Fed seeing that it has taken on a more pronounced dovish tone?

More than likely it viewed the slowing global economy, the pushouts in the US-China trade conversation and the potential for a Brexit delay as fanning the flames of uncertainty. Generally speaking, during periods of uncertainty both consumers and businesses tend to tighten their belts, could be another reason why March quarter guidance could be weaker than expected.

Those slower growing economy concerns were back in action Friday morning following the publication of March Flash PMI data for Japan, the EU and the U.S.

For Japan, the Flash Manufacturing PMI remained in contraction territory, with new order activity falling at a faster rate pointing to a “sustained downturn.”

Later this week we will close the books on the March quarter and prepare for the upcoming earnings season that is only a few weeks away. We’ll continue to listen to the Thematic Signals and other thematic signposts as we navigate what is likely to be another challenging period for the overall stock market.

Tematica Investing

Holding steady with Del Frisco’s shares

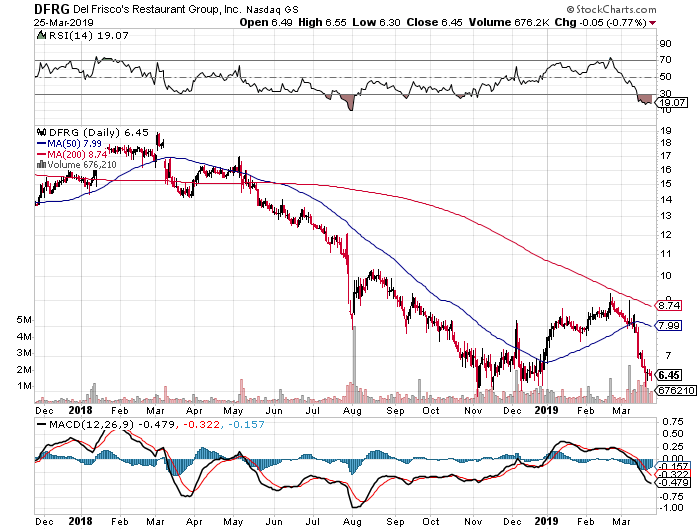

In aggregate our Thematic Leaders continue to perform well so far this year despite the recent fall off in Guilty Pleasure leader Del Frisco’s Restaurant Group (DFRG). Following its recent earnings report that shed no light on where the company is in its strategic review process, the shares continued to move lower over the last several days bringing the decline over the last month to more than 25%. Candidly, I am growing frustrated with this leader, but I know it’s simply the lack of news that is weighing on the shares. There have been a few reports suggesting the company could be cleaved into two parts to different buyers, which if true would explain the pronounced timetable.

Despite this frustration, and especially because the shares are deep into in oversold territory, our plan is to hold DFRG as the takeout story evolves further.

- We will continue to hold shares of Guilty Pleasure thematic leader Del Frisco’s Restaurant Group (DFRG) as we patiently wait for the next step of its strategic review process. Our price target of $14 remains in place.

Be sure to check back on TematicaResearch.com later this week when I follow up on the announcements that Select List resident Apple (AAPL) made yesterday. There we are a