Weekly Issue: Closing Out 2 Positions While Focusing On Yet Another Pain Point

- We are closing out our position in the Wayfair (W) June 80 calls (W180615C00080000), which closed last night at 6.30, delivering a return of more than 150% over the last week.

- We are also closing out our position in GSV Capital (GSVC) Jun 2018 10.000 calls (GSVC180615C00010000), which have been hard hit despite the monetization of key holdings Spotify (SPOT) and Dropbox (DBX).

- We are issuing a Buy on the Cummins Inc. June 2018 150.00 calls (CMI180615C00150000)that closed last night at 2.64 and setting a stop loss at 1.70.

- As a reminder, Funko (FNKO), a short position on the Tematica Options+ Select List will report its quarterly results after tonight’s market close. We continue to have our buy stop order set at 10.00

- The next date to watch for our short position in Target shares will be May 15, when the Commerce Department publishes the April Retail Sales report. We expect to see signs of the retail apocalypse continue as consumers continue to shift toward digital shopping

Closing out our trades in Wayfair and GSV Capital call for a net positive

Last week we added the June 2018 80.00 call position in Wayfair (W), a digital commerce company focused on home décor, furniture and housewares. Over the last few days, following the upbeat earnings report that was had last week, which led to several price target increases, our call position gapped up more than 150% as of last night’s close. Not bad for one week of trading, but rather than get all heady over that success let’s remember that paper profits aren’t tangible ones until the exit trade is made.

As Tematica’s Chief Macro Strategist, Lenore Hawkins, and I talked about on this week’s Cocktail Investing Podcast, near-term the investing teeter-totter appears to be slanted toward the risk side. Therefore, my recommendation is to turn that hefty paper profit in the Wayfair calls and turn it into realized gains. As we exit that position, we’re going to exit the GSV Capital June 2018 10.00 calls as well. It’s no secret these have been hard hit, and even after the company’s March quarter results that I touched on yesterday I don’t see the shares cracking the 8.00 level let alone the 10.00 in the short-term. Longer-term as GSV monetizes more of its investment portfolio, I strongly suspect its net asset value per share will continue to rise – this keeps the GSVC shares on the Tematica Investing Select List.

- We are closing out our position in the Wayfair (W) June 80 calls (W180615C00080000), which closed last night at 6.30, delivering a return of more than 150% over the last week.

- We are also closing out our position in GSV Capital (GSVC) Jun 2018 10.000 calls (GSVC180615C00010000), which have been hard hit despite the monetization of key holdings Spotify (SPOT) and Dropbox (DBX).

With trucking order numbers strong, we are adding a derivative engine call option play

In mid-February, we added shares of heavy and medium duty truck company, Paccar (PCAR) to the Tematica Investing Select List given rising order levels for its products due to both an improving economy and the current truck shortage. Since then, we’ve seen robust year over year order growth for heavy and medium duty trucks in both March and April.

Last week, heavy truck component supplier Eaton (ETN) upsized its NAFTA heavy duty truck production forecast to 295,000 this year, up from the 275,000 it had at the start of 2018. Engine company Cummins (CMI) also boosted its expectation for North American heavy truck industry production this year to 286,000 units, up 29% vs. 2017 and above its prior guidance of 266,000 units.

This week several companies talked about the current truck shortage, including Knight Swift (KNX), RPM International (RPM), and several other. Comments like the following from PotlatchDeltic Corp. (PCH) – “It appears that the transportation shortage largely linked to truck and rail issues is not going to be short-lived” suggest the current truck shortage has legs.

Moreover, data from Statista points to the average age of heavy trucks is around 14 years old, which means truck owners and lessors have aged equipment on their hands. This is another factor that could spur continued growth in truck orders over the coming months especially given the changes put in place with tax reform pertaining to depreciation.

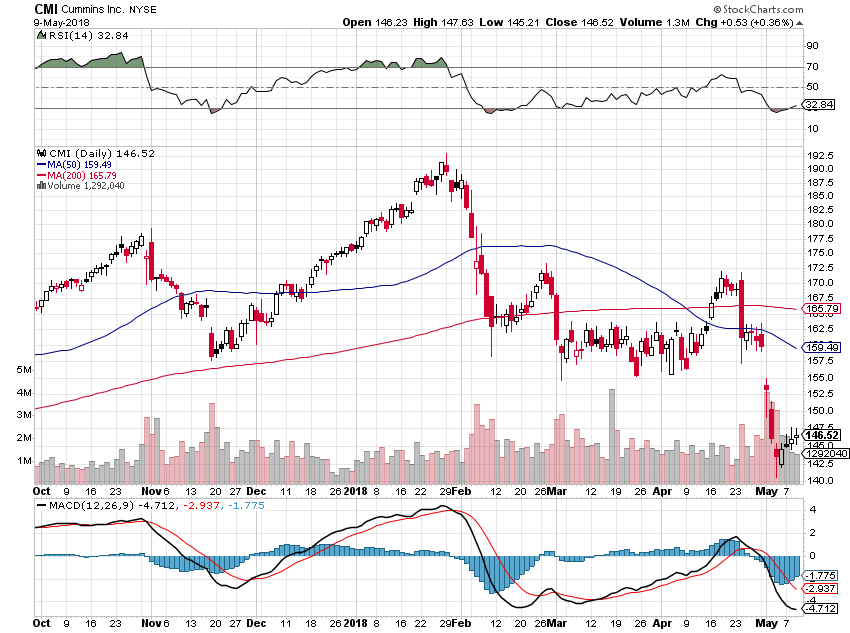

As tempted as I am to add a call option position in Paccar, the reality is though call options are thinly traded and half modest open contract sizes. This has us looking into the food chain for a supplier that derives a hefty piece of its sales and profits from the heavy and medium duty truck industry. That brings us to Cummins, which is not only seeing robust engine demand from the trucking industry but also from the construction equipment one as well. What makes Cummins even more attractive is that despite the positive engine fundamentals, its shares are down nearly 18% in 2018 even though the company is posed to grow its earnings by almost 25% year over year this year. And when we look at the technical chart below, we see CMI shares are oversold.

One of the strategies that we love to capitalize on is pain points, and the current truck shortage is one that will hit profits. Moreover, newer trucks have far better fuel economies that ones that were built more than 10 years ago. To capitalize on this, as well as the oversold nature of CMI shares, I’m the Cummins Inc. June 2018 150.00 calls (CMI180615C00150000) that closed last night at 2.64 to the Tematica Options+ Select List. As we do this, I’ll factor in my comments above about the skewing of potential risk in the market over the coming weeks, and that has me setting a protective stop loss for this position at 1.70.

- We are issuing a Buy on the Cummins Inc. June 2018 150.00 calls (CMI180615C00150000)that closed last night at 2.64 and setting a stop loss at 1.70.