Weekly Wrap: Retail Spending Figures Have the Financial Media Giddy, But Just How Strong is the Consumer?

The biggest driver for the markets in the past week has been the increased likelihood of getting some sort of tax reform bill passed before Christmas. As of Thursday’s close, the technology sector had gained more than 1.2% over the prior five trading days, reversing its slide earlier in the month. Telecom gained nearly 2.0% and Consumer Discretionary over 1.1% while Materials, Utilities and Financials lost ground. That being said, the S&P 500 ended Thursday on a less upbeat note, declining the most in one day since mid-November. Factoring in the move, the S&P 500 was on track to finish the week up roughly 6% quarter to date, which equates to it trading at more than 20x consensus 2017 EPS expectations.

While the market has been near-euphoric over the potential for tax reform, Tuesday’s elections made passage more challenging as Democrat Doug Jones won the historically red state of Alabama. Republicans now hold a mere 51-49 advantage in the Senate. Following a tight election, the Alabama votes now need to be certified, which will not occur until after Christmas, but no later than January 3rd. If the Republicans can push this bill through, as promised, before Christmas, the Republican incumbent Luther Strange will be voting instead of Doug Jones. If the vote gets delayed until 2018, we may see a split 50-50 vote since Republican Bob Corker is likely to oppose the bill. This would require Vice President Mike Pence to break the tie, that is unless one more Republican decides to defect. Talk about getting some political leverage!

Aside from the excitement over tax reform, the mindboggling price explosion that is Bitcoin got even more interesting this week as Bitcoin futures began trading on the CBOE on Sunday night. Unsurprisingly, it was an eventful debut with two temporary trading halts and crashes on the CBOE’s website due to the heavy traffic. Expect to hear a lot more from us in the coming months concerning the evolving cryptocurrency landscape as part of our Cashless Consumption investing theme. Despite the downplay they received by Fed Chair Janet Yellen during this week’s FOMC press conference, these technologies have the potential to utterly disrupt the way the global economy works, creating just the kind of tailwind we like to see for those companies properly positioned.

On the economic front, it has been a busy week, as central bankers once again took center stage. The Federal Reserve announced, as expected, another rate hike on Wednesday. Thursday the European Central Bank left rates unchanged but raised the region’s GDP forecasts by 0.5% to 2.3% in 2018 and by 0.2% to 1.9% in 2019. The Bank of England also left rates unchanged as it faces continued political uncertainty amongst the BREXIT negotiations and mixed economic data.

Thursday morning, we learned that U.S. retail sales were stronger than expected, with 12 of the 13 categories reported by the Commerce Department seeing gains. Total Retails Sales were up 0.8% month over month in November versus estimates for 0.3%, ex autos up 1.0% versus expectations for 0.6% and ex autos and gas up 0.8% versus expectations for 0.4%. October’s numbers were also revised higher across the board, painting a rosier overall picture. Over the past three months, total sales have increased by 3.4%, the fastest 3-month pace since April 2014. The two categories with the biggest gains were gas stations and, in keeping with our Connected Society investing theme, digital sales. Those online retailers enjoyed their biggest monthly increase in sales since October 2016.

The data, along with the package volume surge reported by research firm ShipMatrix that shared that “consumers are buying even more online than even the carriers expected”, confirms the accelerating shift to digital shopping aspect of this investing theme. Needless to say, we continue to feel rather good about the shares of Amazon (AMZN) and United Parcel Service (UPS) on the Tematica Investing Select List. Circling back to the November Retail Sales report, the only category to lose ground was Autos and Parts Dealers, and this should make next week’s earnings report from Carmax (KMX) far more interesting.

All that retail spending has the mainstream financial media giddy, but one has to wonder just how strong the consumer can be with the current situation index for Restaurant Performance is at a six-month low of 99.5, where anything under 100 is contractionary. The customer traffic sub-index sits at 97.0, compared to December 2007 when it was 97.2. In Thursday’s Retail Sales report, the reported year over year growth in retail and food services was 5.7%, but stripping out food services, standalone retail sales rose 6.3% year over year – more confirmation that all is not well in restaurant land. In keeping with our Cash-Strapped Consumer investing theme, we suspect debt rattled consumers are focusing more on saving and selectively spending on presents than indulging as they shop this holiday season.

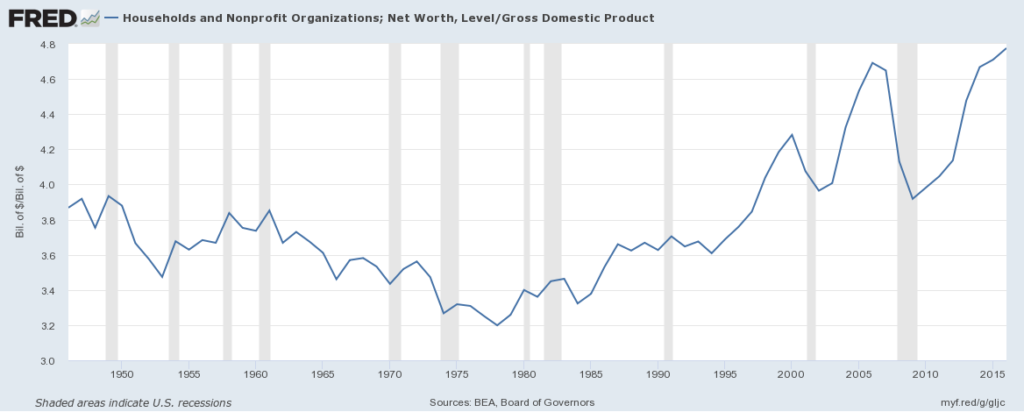

The challenge with any data, including the monthly Retail Sales report is it measures aggregate spending, meaning for the nation as a whole, which can give an inaccurate picture of what different types of households may be experiencing. For example, while Household net worth has been improving, as the following chart illustrates, and has surpassed the prior 2006 peak, the improvements are not enjoyed evenly.

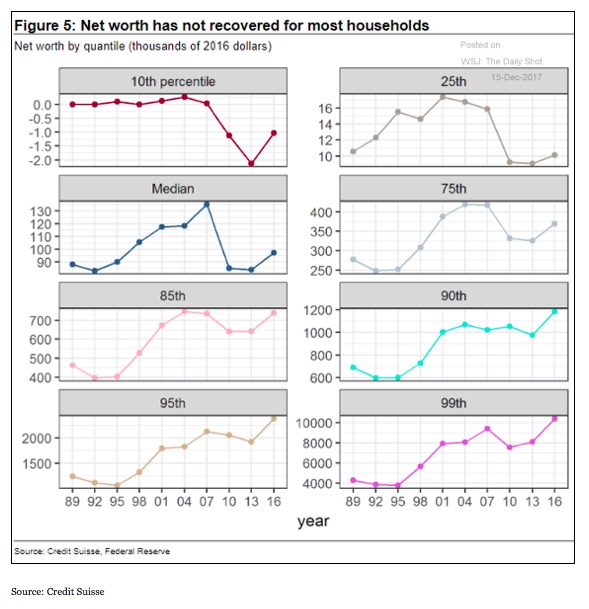

Only those in the 90th percentile and above of net worth have seen their net worth reach new highs. The 10th, 25th, median and 75th are still well below their peaks, proving that this really has been a time in which the rich get richer and the poor get poorer. (Hat tip to the WSJ Daily Shot for this chart)

This is fairly intuitive when we look at what has been happening with asset prices in recent years versus wage gains. Asset prices have been rising significantly, benefiting those who already owned assets. Wage gains have been weak at best, so those who improve their financial position by earning more continue to struggle, part of our Cash Strapped Consumer investing theme.

Earlier in the week, the Job Openings and Labor Turnover Survey (JOLTS) revealed an unexpected decline in the level of job openings in October, reaching a five-month low of 5,999k versus expectations for 6,135k. On a more positive note, hires rose to a new high for this cycle at 5,552k, up from 5,320 in September. Initial jobless claims fell by 11,000 this week, dropping below expectations for 236,000 to 225,000, just 2,000 higher than the cycle low of 223,000 reached in mid-October.

We also received the November release of the NFIB Small Business Optimism index on Tuesday which revealed that small business owners are the most optimistic going all the way back to 1983, making October the second highest level on record. With an already tight labor market, net plans to increase employment rose to the highest level on record at 24%, up from 18% in the prior month. Interestingly, plans to increase compensation dropped to a net 17% from 21% in the prior month – we read this as their going to hire more but fewer are planning to pay more in an economy in which the lack of available talent is often cited as one of companies’ biggest challenges. Also, rather odd is that while eager to hire more, only 23% of those polled intend to raise prices versus 24% last December.

Wednesday’s Consumer Price Index data supported the NFIBs finding that few intend to raise prices as it showed very little inflationary pressures with the Core CPI up just 1.8% year-over-year. However, the year-over-year changes in the Producer Price Index has accelerated across a range of categories with Goods and Total Price Inflation for businesses at the highest level since January 2012. Construction and Services Inflation is also near the strongest levels in recent years. Core PPI (ex food, energy and trade) rose 2.4% year-over-year

Thursday’s Markit’s Flash PMIs for much of the major developed economy manufacturing sectors came in well above expectations. The Euro area manufacturing and production PMI hit record high as did Germany, these along with France and Japan all continue to accelerate to the upside.

The bottom line for this week is that we continue to see signs of improvement, but when it comes to households in the U.S., improvements are not broadly shared. We are seeing signs of inflationary pressures in producer prices, but little in terms of wage price pressures. On the consumer side, the great deflationary force that is online and mobile consumer shopping continues to overpower any potential inflationary pressures. The push-pull of these dynamics bodes well for companies that are riding the tailwind of our Connected Society investing theme, while addressing pain points being felt by Cash-Strapped Consumers.