What We’ll Be Watching for in the Stock Market in 2018

Welcome back. We here at Tematica hope you’ve had a wonderful holiday season, and aren’t suffering too much from the cold snap that is sweeping the nation.

The books have officially been closed on 2017 — both the year and the stock market — and it was a robust year for stocks and a solid one, too, for the Tematica Investing Select List. We’ve had a number of market-beating positions, ranging from Disruptive Technologies investment theme company Universal Display (OLED) that soared more than 205% in 2017, and Cashless Consumption investment theme play USA Technologies (USAT) that rocketed 116% higher since we added it to the Select List in April 2017. We also saw stellar market-trouncing returns in a number of other Select List positions, including Amazon (AMZN), which, as we have said, is the poster-child when it comes to thematic investing given the sheer number of thematic tailwinds at its back.

In 2018, we’ll continue to utilize our thematic lens looking to identify those companies whose business are riding thematic tailwinds and bobbing and weaving potential thematic headwinds. Of course, we’ll need to see sufficient net upside potential vs. downside risk to warrant getting involved. In other words, it will be business as usual.

In order to look forward, we must first see where we’re coming from.

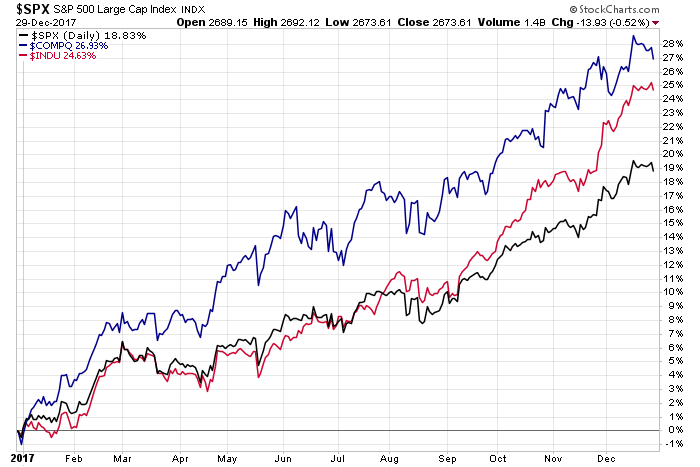

Trading for the last week of 2017 ended on a mixed and somewhat subdued note with no sign of a Santa Claus rally, despite solid consumer spending this holiday shopping season. The Dow Jones Industrial Average, S&P 500, small-cap heavy Russell 2000 and tech-laden Nasdaq Composite Index all finished lower in the last week of 2017. The picture for fourth-quarter 2017 was far more favorable, however, with all the indices well in positive territory. When added to earlier quarterly gains recorded in 2017, the market enjoyed one of its best years ever, with the Dow up 25%, the S&P 500 rising just shy of 20% and the Nasdaq soaring 28%.

In many ways, this leaves the overall market priced to perfection trading at more than 20x expected 2017 earnings for the S&P 500 group of companies. In a few weeks, we’ll start to get a taste of earnings reports for the fourth quarter, but as forward-looking investors, we are already eyeing how stocks and the market are poised to trade on 2018 earnings.

With that in mind, forecasts for the coming 12 months of the S&P 500 tend to be all over the map at this time of year, and we are now starting to see firms boost expectations based on tax reform, which was recently signed by President Trump. Recently, Credit Suisse and Canaccord Genuity hiked their price targets on the S&P 500 to 3,000 and 3,100, respectively, and both upped their EPS forecasts for the S&P 500 next year to $155. We’d note those two targets, which offer 12%-16% upside, suggest the current P/E of roughly 20x holds in 2018. That means their index price targets are reliant upon EPS growth in 2018 over 2017. There are other forecasts out there as well, such as one from Citigroup that was increased to 2,800 this week and offers roughly 4.7% upside from current S&P 500 levels.

One of the key factors driving those forecasts higher is the potential for a tax reform led EPS bump. One of the clearest examples of this came from FedEx (FDX), which recently stated:

“If the Tax Cuts and Jobs Act is enacted as set forth in the Joint Conference Report, we estimate our earnings per share could increase by $4.40 to $5.50 per diluted share for FY ’18 before mark-to-market year end pension accounting adjustments, primarily due to the revaluation of our net deferred tax liabilities.”

That, of course, is the perspective of just one company. However, when we look at the other 499 that comprise the S&P 500, there is ample reason to think S&P 500 earnings expectations will be adjusted higher for 2018. But, once again, we find ourselves saying context is key and coming into December the consensus EPS view for those 500 companies in 2018 sat at $146 per FactSet, up from $131.70 this year.

Candidly, we do expect to see further upward movements in S&P 500 earnings as economists and strategists tabulate the impact of tax reform across those companies, but the real question we will be asking is whether the implied 17%-18% move off of 2017 earnings is the right figure?

Spinning out of tax reform, we have heard from a growing number of companies that are redeploying the tax gains into increased spending as well as paying special bonuses to employees. Among those are AT&T (T), Comcast (CMCSA) and Wells Fargo (WFC). At the same time, we are seeing only modest bumps to GDP expectations in 2018.

One potential wrinkle to some of the more upbeat post tax-reform GDP forecasts is the question of consumer spending. It goes like this: Will consumers spend their incremental after-tax gains or use them to reduce ballooning levels of outstanding debt spread across credit-card, auto and student loans?

We have similar concerns when it comes to business spending. Expectations are that tax reform will boost corporate spending, and while we are hopeful, we will continue to listen to the data, especially given the chance that companies could once again hike dividends and buyback programs while consumers look to reduce their ballooning debt load. It’s not that we want to be Debbie Downers, but the monthly JOLTS report and NFIB Small Business Optimism Index indicate that finding qualified workers was a problem even before tax reform was passed.

According to the November NFIB report, “Finding qualified workers has been a persistent problem all year for small business owners, a reliable sign of growing economy. Last month, it was the second most important problem facing small business owners.”

To be blunt, it’s hard to see how that skill-set shortage is overcome with the passage of tax reform. In our view, this issue, along with prospects for softer than expected post-tax reform consumer spend, explains the more tepid GDP revisions we’ve seen thus far.

From a stock market perspective, our concern is that with the market trading at rich valuations and expectations running high, there could be some disappointment that weighs on the market in the coming months if the impact of tax reform is less than expected. We’ll continue to monitor developments and data to position the Tematica Investing Select List accordingly.

As we head into 2018, we’re acutely aware of upcoming potential catalysts for each position on the Select List, such as the Consumer Technology Show (formerly the Consumer Electronics Show) in January, post-holiday sales data and other monthly data. We’ll continue to eye all of this and more using our thematic lens as we continue to look for well-positioned investments.

The Week Ahead – Economic Data Returns and a handful of earnings reports

As we put the holidays once again behind us, it will be another four-day trading week. Odds are however, the pace will be somewhat brisker than last week.

This first week of 2018 will bring a plethora of economic news. It’s the usual beginning- of-the-month data that includes the December IHS Markit US Manufacturing and Services, ISM Manufacturing and Services, auto & truck and employment reports. These numbers should help us get a much firmer look at 4Q 2017 GDP, which per the Atlanta Fed and NY Fed (and before the December data), is expected to come in between 2.8%-3.9%. That compares to the 3.0% reading for 3Q and the current Wall Street Journal Economic Forecasting Survey consensus of 2.7% for 4Q. As we shared above, we’ll be watching the upcoming data to see which set of expectations is more probable and determine what it means for the overall market as well as the Tematica Investing Select List.

Also this week, we’ll get a valuable rearview mirror look at November construction spending. However, with President Trump set to unveil in a few weeks his framework to rebuild U.S. infrastructure, we suspect that we are not the only ones more focused on what’s to come. If you’re thinking that means we are turning over infrastructure-related rocks to find well-positioned companies whose shares meet our investment criteria, you would be correct.

From an earnings perspective, we are still in the corporate quiet period and while we’ll see some reports dribble out over the next two weeks, it’s not until January 16 that earnings season will kick into gear. Even so, there are still investing nuggets and data points to be had and that means we’ll be dissecting the results and outlooks from Rite Aid (RAD), Walgreens Boots Alliance (WBA), Sonic (SONC), Constellation Brands (STZ) and Greenbrier Companies (GBX). Central to all of these will be how each company views the impact of tax reform on 2018 EPS expectations as well as what each is seeing in their respective businesses and what that means for the economy, stock market, competitors and suppliers.