What’s Next for the Markets After Last Week’s Turmoil?

There is no other way to say it — last week was a mother of a week for US stocks. We saw that reflected in the domestic market indices, which hit correction territory, and in our Tematica Investing Select List. Team Tematica has been on a number of programs, both TV and radio, as well as our own Cocktail Investing Podcast, sharing our views on the whys behind the market’s tumble into correction territory. We also published a rather lengthy note detailing what’s behind the market’s indigestion.

Exacerbating the resetting of expectations between economic growth, interest rates and inflation, stocks are also being hit by the lack of cash on the sidelines and margin debt that has been at record high levels. This lack of cash helps explain the magnitude of the dip, which is only amplified by institutional selling to raise cash in order to buy stocks at better prices. At the same time, margin calls are also prompting selling. Talk about a riptide curl of negativity being added to things.

Here’s the thing, with the economy on firm footing, odds are we are seeing just a correction. In our view the correction, while not pleasant in the moment, is a healthy thing for stocks given the meteoric rise and stretched valuations they had coming into 2018 due to a firming economy and “hopium” associated with tax reform. That said, we’ll continue to mine the data, especially next week, which adds another view on inflation.

What are we looking for to determine what’s next for the market? Great question, let’s talk about that and more…

On the Economic Front

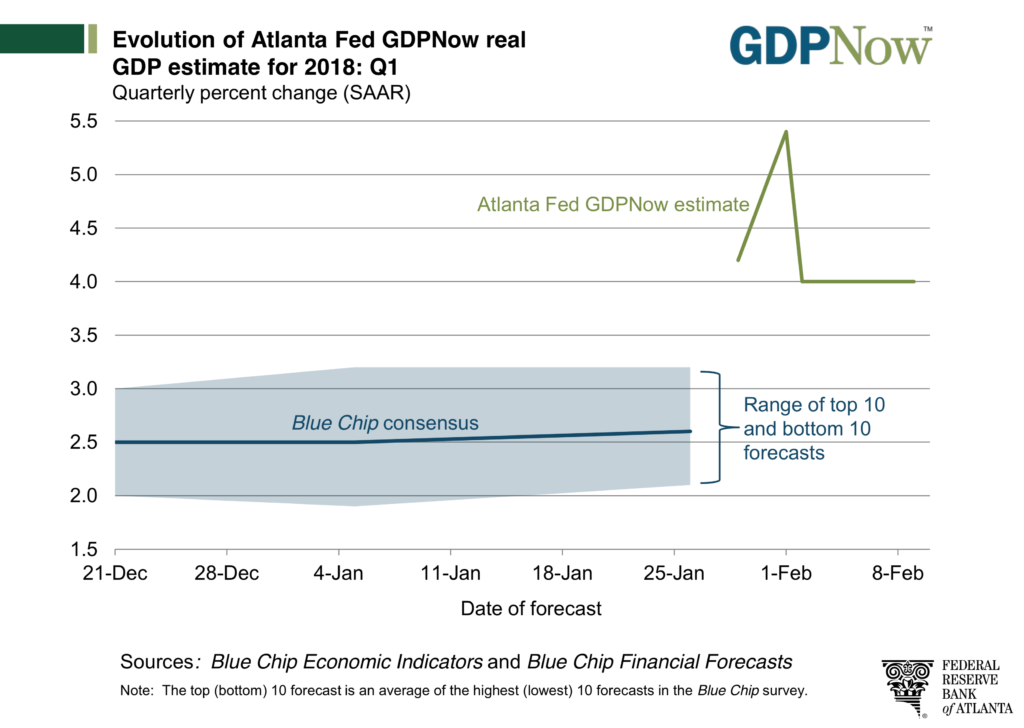

After a week that had less than a handful of key economic reports, we saw the Atlanta Fed’s GDP Now forecast come back down to reality as its current quarter GDP forecast was revised down to 4.0% from 5.4% on Feb. 1.

By comparison, on Friday the NY Fed adjusted its NowCast forecast for the current quarter to 3.35% from 3.22% on Feb. 2. We see that 3.3%-4.0% range as favorable compared to the 4Q 2107 GDP print of 2.6%, but we also know we are only now starting to get data that will shape current quarter expectations. For our greater thoughts on last week’s economic data, we suggest you devour last Friday’s Weekly Wrap by Tematica Chief Macro Strategist Lenore Hawkins.

As we mentioned earlier, the domestic stock market dropped into correction territory as investors reset expectations to account for a combination that includes a firming economy, the specter of rising inflation, and rising bond yield. On the heels of that correction, the economic data to be had this week will either stoke the flames of concern or pour some cold water on them. I say this because the slate of data this week includes the January figures for both CPI and PPI, which will be given a thorough going over to determine if we are indeed seeing inflation catch fire.

We’ll also get the January Retail Sales report, and we once again expect to see confirmation of our Connected Society investing theme as digital shopping takes share from department stores and other brick & mortar retailers. Do we think all retailers are headed for trouble? Nope, and one that has been on the Tematica Investing Select List is Costco Wholesale (COST), which once again delivered impressive same-store sales figures for January.

As we put Valentine’s Day 2018 behind us mid-week, we’ll get the January Industrial Production and Capacity Utilization report. We expect to see a pickup in utility activity given the cold temperatures that plagued much of the country, but the real focus will be the level of manufacturing activity as we look for confirmation on the speed of the economy. The capacity utilization figure, which has been edging higher in recent months, is still below levels at which companies have historically opened the purse strings and added capacity. If we don’t see a meaningful move in that figure in the coming months, it could call into question the willingness of companies to invest in property, plant and equipment with expected tax reform benefits.

Rounding out the week, we’ll get the latest Housing Starts & Building Permits figures for January, and we’d be more than a little surprised if the results were not impacted by the record low temps across the country much like they did in December. As the week closes, we’ll also get the first indications of how the domestic economy is fairing in February with the Empire Manufacturing Index as well as the Philly Fed Index. Inside both of those data sets, we’ll be breaking down the month over month comparison for not only shipments to gauge the strength of the economy, but also prices paid to see if inflation is picking up as the herd suspects.

On the Earnings Front

Last week we saw the peak of earnings reports for the current earnings season, coming in at more than 530, but the coming one will bring only a modest decline as we have nearly 475 companies reporting. That makes this week the second busiest week for corporate reporting this earnings season, and there are a number of industry leaders that will be taking center stage in the coming days – PepsiCo (PEP), Kraft Heinz (KHZ), Applied Materials (AMAT), Coca-Cola (KO), and Deere (DE) to name a few.

From a thematic perspective, in addition to those reports that will offer data points for our Disruptive Technologies and Food with Integrity investing themes, we’ll be mining for data from the Chegg (CHGG), Equinix (EQIX), VF Corp. (VFC), and Shake Shack (SHAK) earnings report as they related to our Tooling & Re-Tooling, Connected Society, Affordable Luxury and Fattening of the Population themes, respectively.

As we exit the week and the pace of corporate earnings begins to abate in a more meaningful way, we’ll be revisiting the current consensus expectations that call for the S&P 500 group of companies to grow their collected EPS by more than 17% year over year in the current quarter and by 17.4% for all of 2018. Those findings will help determine if there is more downside to be had. Currently, the S&P 500 is trading at 16.6x expected 2018 EPS, that well below the 20.2 x the index finished out 2017 and compares to the 16.8x multiple the index has averaged over the 2002-2017 time frame.

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can either be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week.

With soda getting left in the cold, PepsiCo trots out Bubly sparkling water

Foods with Integrity

Over the last decade, sugary soft drink volumes have been under pressure, but until recently soda companies have seen their case volumes bolstered by diet beverage that incorporate alternative sweeteners to deliver zero calories. With consumers becoming more health conscious as well as preferring healthier and good for you ingredients as part of our Food with Integrity investing theme, diet soda case volumes have also come under pressure and this is pushing companies like Coca-Cola, Dr. Pepper Snapple, Cott Corp., and PepsiCo to deliver new formulations and offer healthier alternatives. One of the biggest pushes is in flavored sparkling water, and now PepsiCo is joining the fray with Bubly, going head to head with not only La Croix, but also Coke’s line of flavored sparkling water under its Dasani brand.

Our Scarce Resource theme once again drives food inflation

Scarce Resources, Cash-strapped Consumers

Aside from uncovering data points that support our thematic perspective, we also like to connect the dots between our themes as well, given the potential for one theme to be a catalyst for the other. We’ve seen that in the past with droughts — a recurring aspect of our Scarce Resource theme — and we are seeing it once again as a current drought as this article from The New York Times details…

Politics and Technology Impact Gun Sales

Disruptive Technologies, Safety & Security

The thematic investing approach we utilize at Tematica Research focuses on identifying sustainable market shifts that come about due to shifting economics, demographics, psychographics, technologies, mixed with regulatory mandates and other forces. This week, we see all of these factors wrapped up in our Safety & Security investment theme in a decline in gun sales, as reported by Bloomberg…