Fundamentals Go Out the Window

Macro Economic and Geopolitical Forces Continue to Dominate the Market

Markets

As of Thursday’s close, the markets were little changed over the week even as the trade wars intensified with Trump threatening to raise the stakes to over $500 billion of Chinese imports. While small-cap stocks were the big performers for most of the second quarter — with the Russell 2000 up as much as 11.6% for the quarter through June 20th, (well ahead of the S&P 500’s 4.8% move and even the 10.2% one for the Nasdaq) —we’ve a change in the market leadership since that date as the S&P 500 has outperformed as of Thursday’s close, gaining 1.3% versus the Russell 2000 losing -0.3%.

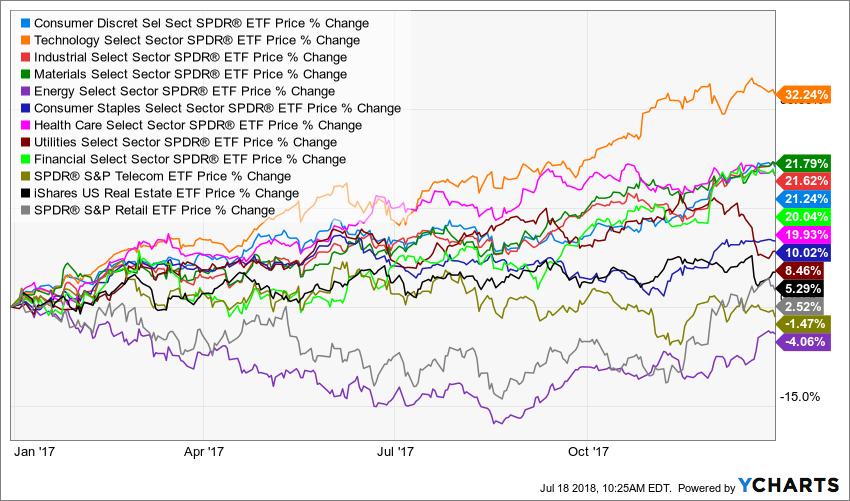

Last year the retail sector was one of the weakest performers, as the SPDR S&P Retail ETF gained just 2.5% on the year.

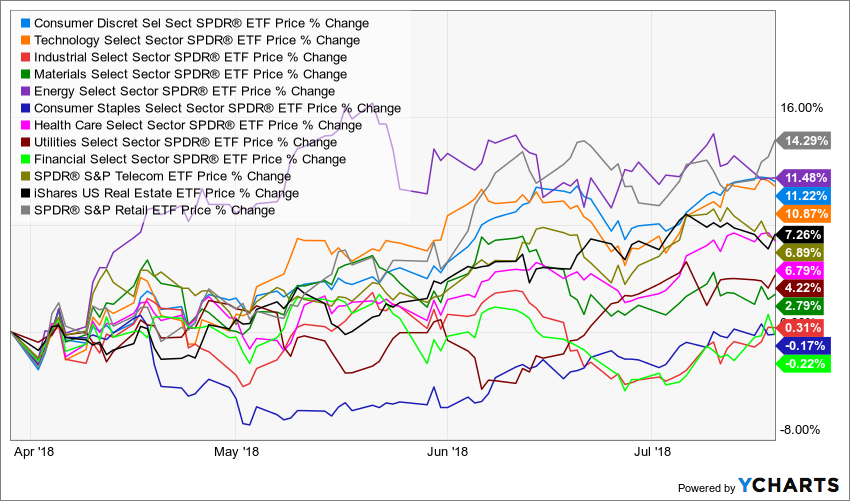

Since the start of the second quarter, as international trade tensions have risen, creating a headwind to global sales, and yet retail has been the strongest performer, gaining 14.3%, outpacing even technology, which is up just +10.9% in comparison.

So far, of the 69 companies in the S&P 500 that have reported earnings for the June quarter, 30 mentioned tariffs as a concern in their earnings call and 41 mentioned foreign exchange rates. With the US Dollar Index (DXY) up 6% in the past three months, that is a material headwind to international sales. One factor driving the dollar higher has been the Fed’s rate hikes, which makes shorter-term US bonds more attractive to international investors because they pay a higher rate than non-US bonds and can provide an extra return if the dollar continues to appreciate relative to their domestic currency.

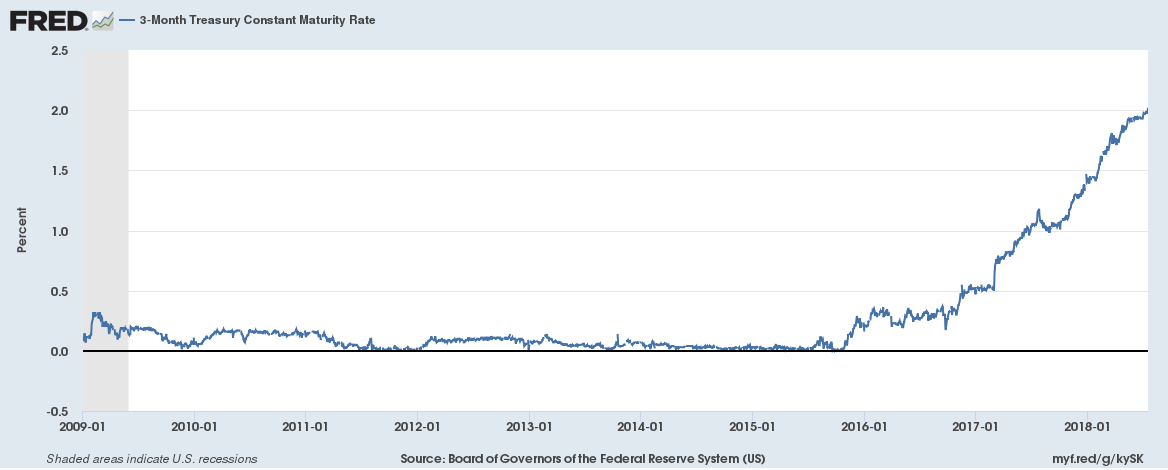

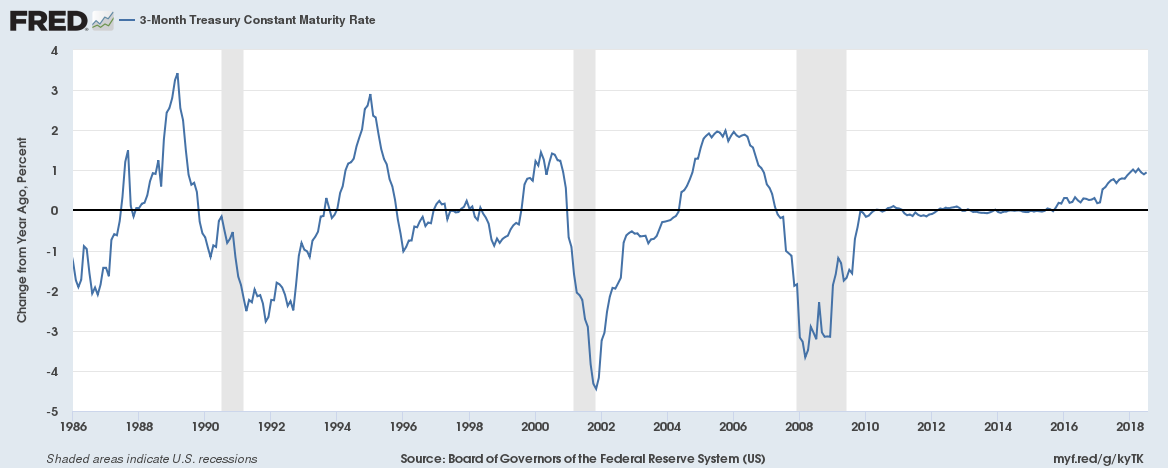

The yield curve . . . ah yes, the yield curve . . . continues to shrink with the 10-year 2-year spread down to 0.24 basis points versus 125 at the end of 2016 and the 30-year 5-year spread down to 22 from a post-financial crisis peak of 302 in November 2010 as short-term rates rise significantly and longer-term rates remain subdued. The yield on the 3-month Treasury Bill over time illustrates just how much things have changed.

Three out of the last four times we’ve seen such rapid changes have preceded recessions, typically by a couple of quarters.

Keep in mind, however, that these indicators are not great for timing and even if we follow historical norms in terms of timing, we are a few quarters away from any recessionary dips. So let’s look at the economic data. Also too, despite assurances from Larry Kudlow that he doesn’t see any recession at the forefront until AT LEAST 2024, I’ll continue to watch the data, which is a nice segue to talk about…

The Economy

We continue to see inflationary pressures as the Producer Price Index (PPI) from the Bureau of Labor Statistics this week showed core PPI (including trade services) reaching its highest level since 2011. The primary drivers were transportation and energy – not a surprise there, given what we are seeing in oil markets, the desperate search for truck drivers and a shortage of trucks as evidenced by robust monthly new truck order data. The one rather surprising area of deceleration on a year-over-year basis was health care.

Manufacturing still looks solid today, but we are seeing reasons for concern in the coming months. The Empire Manufacturing Composite declined in June, but less than expected. New Orders and Shipments declined, with Shipments particularly weak but more concerning is the cliff dive of Capex plans for 6 months ahead. This is in contrast to data out of the Richmond, Kansas City and Dallas Federal reserves, so we aren’t getting overly concerned, but this fits along with the rising uncertainty generated by the trade wars. We’ll be watching for more confirming data points.

While Empire Manufacturing was rather dour, the June Industrial Production data beat expectations, rising +0.6% month-over-month versus expectations for a +0.5% increase. That said, May was revised down significantly from -0.1% to -0.5%, leaving us with an overall picture that is weaker than expected. The major gains for the IP data came from an increase of +7.8% in the motor vehicle and parts category that was the aftermath of a temporary disruption in parts supplies – not a trend.

Wednesday, we had a big miss on housing data, with US housing starts falling 12.3% in June to a nine-month low, making for the biggest percentage decline since November 2016 and the biggest relative to expectations since January 2007. Every region experienced a decline, so this isn’t about a regional weather condition. The year-over-year trend is back down to -4.2% with single-family construction falling -9.1% in June – its worst in 2018 and multifamily starts fell -20%.

Things aren’t looking like they will get better in housing in the near-term either as building permits fell -2.2% in June, having declined for three consecutive months and for four of the past five. Mortgage applications also declined last week, down 2.5%. The NAHB housing market index was unchanged in July, matching expectations and while it remains at an elevated level of 68 by historical standards, it has been slowly eroding from the cycle high of 74 in December 2017 and is today slightly weaker than back in December 2016. The present sales index component from NAHB echoed this trend, below the expansion peak of 80 from December 2017 to sit unchanged from June at 74. The forward-looking six months out sales index hit a 10-month low of 73 in July, after having declined in 4 of the past 5 months – again indicated that Q3 is unlikely to be an improvement over Q2. The Conference Board’s measure of homebuying intentions in May and June were the weakest in over two years and the University of Michigan’s home purchase plans index fell to the lowest level since December 2008.

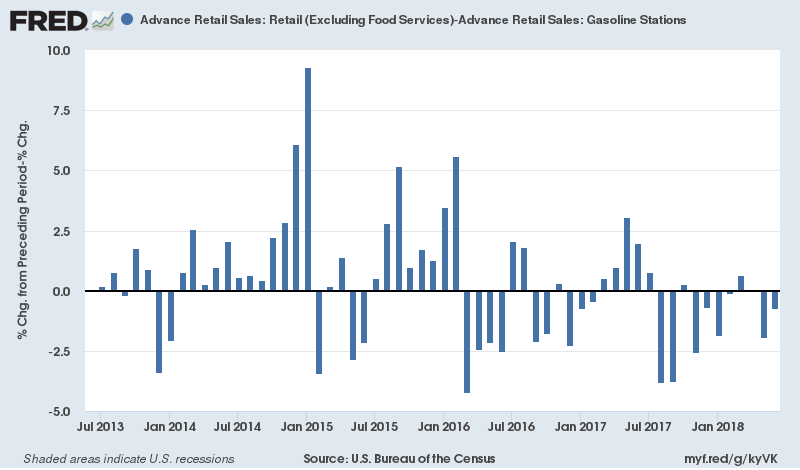

For all the headlines about retail sales — which rose +0.5% in June after a +1.3% gain the prior month — core retail sales, which exclude the more volatile sales at gas stations, restaurants and bars, has been declining.

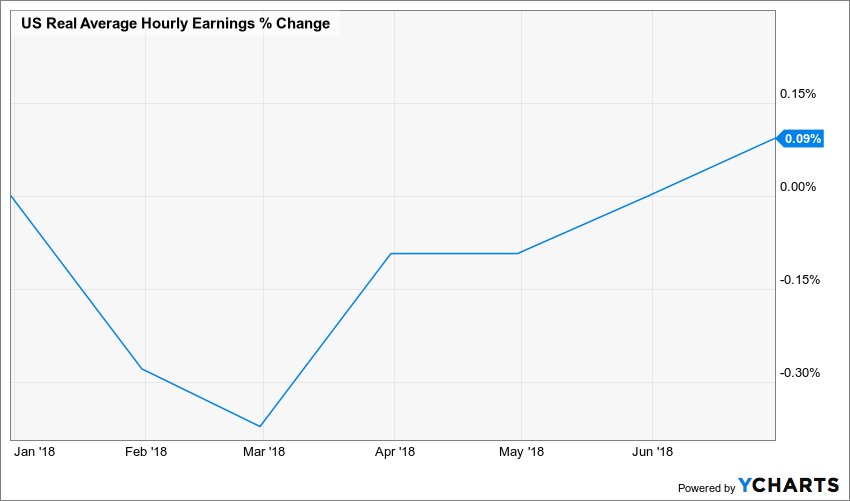

Which fits with the reality that despite the talk we are hearing about wage pressures, real average hourly earnings, which take inflation into account, have yet to take off. And yes dear reader, despite all the chin wagging over the June retails sales report the underlying data confirms our Middle-class Squeeze investment theme here at Tematica.

The Fed’s balance sheet normalization process, which started in November has reached the planned plateau of rolling off $50 billion per month. Tuesday Chair Powell spoke to the Senate Banking Committee and in his prepared testimony stated that the FOMC, “believes that for now, the best way forward is to keep gradually raising.” Gave himself quite a bit of wiggle room there with the “for now,” didn’t he?

Powell also commented that, “We’ve heard a rising chorus of concern, which now begins to speak of actual capex plans being put on ice for the time being,” in response to trade war concerns.

President Trump weighed in on the Federal Reserve’s actions this week on a CNBC interview stating that, “Because we go up and every time you go up, they want to raise rates again. I don’t really—I am not happy about it. But at the same time I’m letting them do what they feel is best….I don’t like all of this work that we’re putting into the economy and then I see rates going up.”

The Bottom Line for the Week

We are firmly in a macro and geopolitical dominated market. For now, businesses and the market are becoming increasingly nervous about the President’s ongoing trade battles and conflicting comments out of the summit with Putin. This is a headwind to capex investment and puts investors in a cautionary mode. If he manages to actually succeed here with improving the terms of trade for the US and if his talks with China end up giving them more control over North Korea, effectively greatly reducing the nuclear threat there, the major market risk would be to the upside.

Next week we will get more on the housing sector with June’s New Home and Existing Home Sales reports, along with the second quarterFHFA Housing Price Index, and the MBA Mortgage Applications Index. We’ll also get more on the state of the manufacturing sector with the Durable Goods report and most importantly, the first read on second-quarter GDP will be released next Friday. We’ll also see just how all this trade war talk is affecting consumers with the Michigan Sentiment Index.