Apple and Snap Earnings from the Floor of the NYSE

Apple’s earnings show it’s much more than just an iPhone company, while SNAP continues to operate in a precarious place

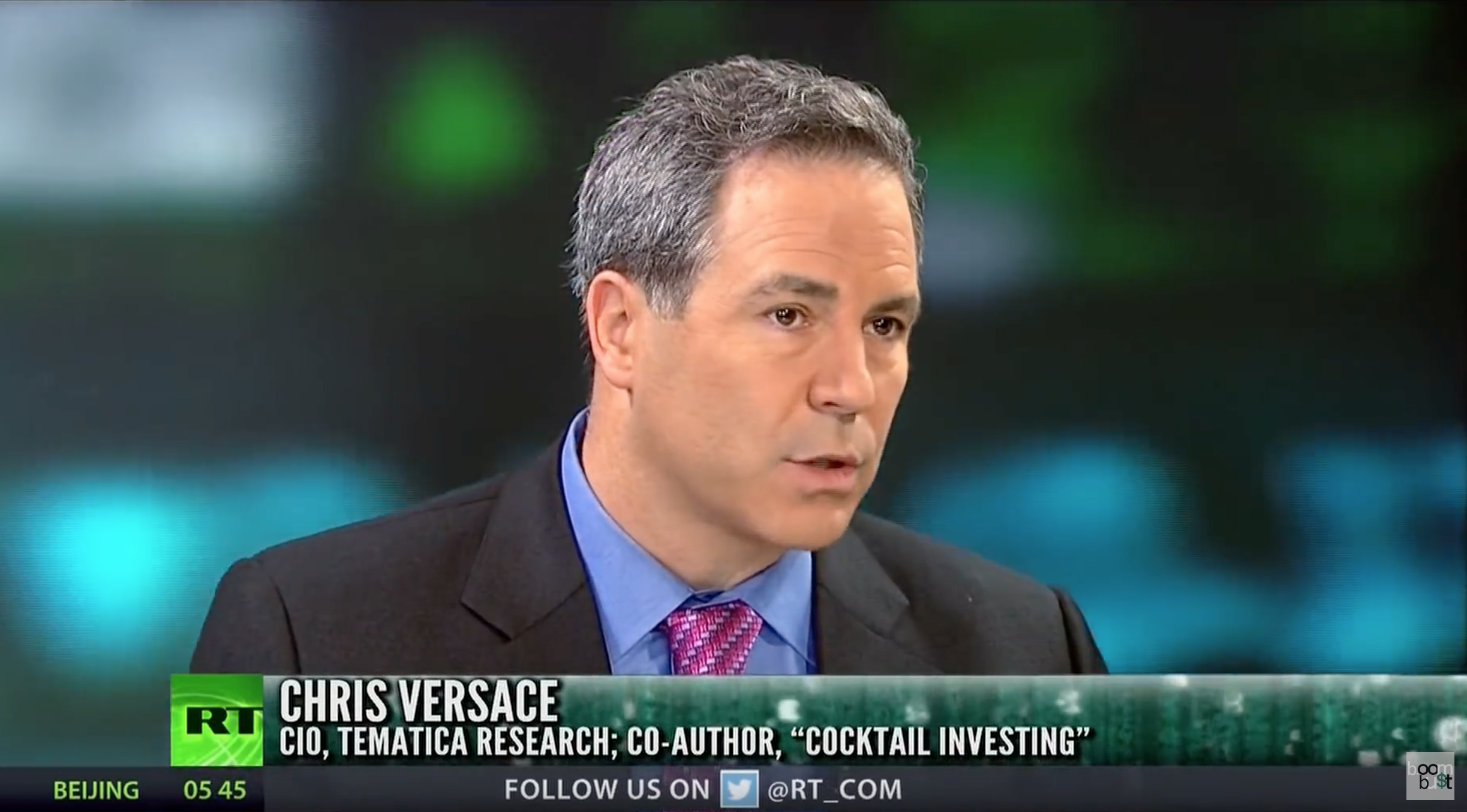

On Tuesday May 1, 2018 Tematica Chief Investment Officer Chris Versace joined Hope King and Brad Smith of Cheddar live from the floor of the New York Stock Exchange to break down the most recent earnings announcements from Apple (APPL) and SNAP (SNAP). Click here to view the full segment . . .