Weekly Wrap for June 8 2018

The Market

Most of the major US indices gained over the past week as did almost all sectors as of mid-day trading on Friday, with the exception of the Utilities sector, which lost around 3%. The economic data for the week came in mostly positive, but further reinforced the view that we are late in the business cycle. Things are heating up once again on the geopolitical front, which by the end of the week had investors back on the defensive.

Consumer stocks led the market on Monday, with the Consumer Discretionary ETF (XLY) and the Consumer Staples ETF (XLP) gaining 1.12% and 0.83% respectively. The Nasdaq closed above 7,600 for the first time in its history, having previously peaked at the opening on March 13th at 7627.52 – notch one up for the bulls.

Internet stocks have been particularly strong with the Dow Jones US Internet Index rising more than 100 points since testing its 20-day exponential moving average just one week ago. The index moved into overbought territory Monday with its RSI (Relative Strength Indicator) going above 70. Monday also saw strength in Retailers as the Down Jones US Apparel Retailers Index gained 2.74% and is also overbought with its RSI above 75 as of Monday’s close.

Tuesday the Nasdaq set another record high record close as tech stocks continued on their tear, likely fueled by the, I would argue questionable, belief that they are relatively insulated from trade wars compared to say industrials which are clearly facing strengthening headwinds as tariff talk tempers flare.

Wednesday the Nasdaq once again closed with a new all-time high and the Dow Jones Industrial Average gained 1.4% to move above 25,000, closing at its highest level since mid-March. Materials and Financials were the strongest performing sectors with the 10-year Treasury yield rising to 2.98%.

Thursday, the Dow Jones Industrial Average gained 0.6% thanks primarily to McDonald’s (MCD), which gained 4.4% on news that of more layoffs intended to reduce its corporate structure and make the company more nimble and competitive. Only on Wall Street are layoffs considered good news. The Nasdaq, after four consecutive days of gains and three of record closes, fell 0.7% thanks to widespread loses in tech after U.S. Senator Mark Warner, vice chairman of the Intelligence Committee, said he’s looking for answers from Alphabet (GOOGL) and Twitter (TWTR) on whether the companies have any data sharing agreements with Chinese vendors. That of course came after Facebook (FB) disclosed it had done just that. The pain continued for Facebook as it also disclosed that as many as 14 million of its users may have had their private posts shared publicly thanks to a software glitch. Wait, you mean things posted on the internet don’t necessarily remain private? Shocking.

By Friday the risk-on momentum faded as renewed problems in Italy, Brazil and South Africa as well as rising international trade war verbal battles dampened investor confidence. We’ve seen this waning confidence also manifest itself in the reduction of the enormous net speculative long position of 42,192 S&P 500 option contracts as of April 24thto just 27,606 – the lowest level since mid-March.

The strengthening dollar trend, which has been a solid tailwind for small cap stocks, has taken a breather of late. The Amex Dollar Index (DXY) declined from its May 29thpeak of 94.83 to close Thursday at 93.45. As a point of reference, the index started the year at 92.30 and bottomed at 88.62 on February 15th. We’ll be watching this to see if it is a short-term consolidating pull-back or if the strengthening greenback trend is reversing.

The Economy

As we learned this week, global Manufacturing PMI has hit a 10-month low, primarily from a loss of momentum across Developed Markets. The Orders-to-Inventories ratio indicates that this is likely to continue as it has dropped to its lowest level in 11 months. The globally synchronized growth story is taking a further beating. While the US manufacturing PMI is near its highest level in over 40 months, the Eurozone is at a 15-month low. That being said, most countries are still seeing expansion – above the all-important 50 line in these reports – just not as many as the roughly 90% of them that we saw around the start of the year. It is important to not only look at levels, but also the changing vector and velocity and how it syncs with the prevailing narrative.

As more countries are slowing, we are also seeing rising cost pressures. Globally output prices have hit a 7-year high as have supplier delivery times. This is a headwind to margins, which we have discussed here frequently, that is likely to be made worse with the growing trade wars. Another area of rising costs is in the US labor market, which is seriously tight. For those with a college degree, the unemployment rate is down to just 2.0%. Joblessness in the leisure and hospitality sector has hit a record low of less than 5% while the financial sector unemployment rate has dropped from 8% earlier in the recovery to a near all-time low of 1.7%.

For those who get a bit irritated at my rather dour sounding assessment of the job market – I know you are out there — a tight labor market is fantastic for job seekers, but not so great for the overall equity market as below average unemployment historically has meant rising labor costs which hurt margins. We have equities priced richly in an environment in which multiple cost categories are on the way up. The S&P 500 is on track to close this week at roughly 17.3x expected 2018 earnings vs. the 2002-2017 average of 16.8 – we should expect to see more people come out of the woodwork and sharing their view the domestic stock market is or is quickly approaching fair value.

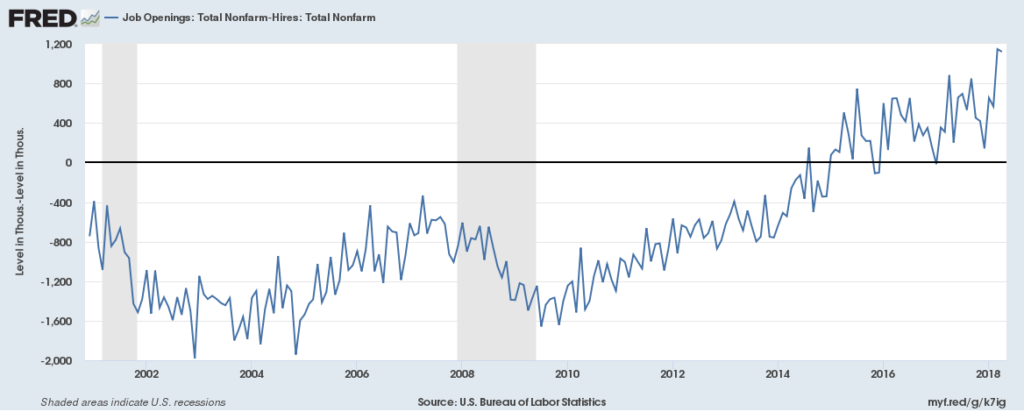

This week the JOLTS report (Job Openings and Labor Turnover Survey), a personal favorite, was released by the Bureau of Labor Statistics and it reinforced the view of a problematically tight labor market. The level of job openings reached a new record high of 6.7 million in April versus the number of unemployed, which stands at just 6.1 million. So not only do we have a tight labor market, which is getting tighter, but we have a material disconnect between the jobs employers need to fill and the skillset of those still on the sidelines of this economy. The labor tightness is evident in the cycle-high quit rate of 2.3%. Keep in mind that as the voluntary quit rate rises, wage growth follows with about a 90% correlation at a 6-month lag. If that doesn’t convince you that businesses will be paying more in the future, there are over 1.1 million more job openings than there were hires, something wholly unprecedented in recorded history.

The labor tightness is evident in the cycle-high quit rate of 2.3%. Keep in mind that as the voluntary quit rate rises, wage growth follows with about a 90% correlation at a 6-month lag. If that doesn’t convince you that businesses will be paying more in the future, there are over 1.1 million more job openings than there were hires, something wholly unprecedented in recorded history.

We have a near record high 23% of those polled by the National Federation of Independent Businesses reporting that labor quality is their top concern. It is no wonder they feel this way given that according to the Bureau of Labor Statistics, total compensation for all civilian workers in all industries and occupations saw the biggest 12-month percent change in the first quarter of 2018 since the third quarter of 2008.

May ISM Non-manufacturing Index rose to 58.6 in May from 56.8 in April, beating expectations for 57.6. Digging into the details we saw some positives as well as some reasons for concern. On the positive side, Business Activity rose to a 3-month high alongside strengthening in New Orders and Employment. We are concerned however to see that over 50% of the gain in the overall index came from a surge in Supplier Delivery Delays, this sub-index now at the highest level since November 2005, and Order Backlogs rose to an all-time high. When delivery times get stretched and backlogs rise, we typically see higher prices. We can add another one to the inflation side of the ledger and in this report as the Prices Index is now at its highest level since September 2012.

Putting it all together, those who regularly read my musing know how frequently I repeat what ought to be, (in my somewhat humble and occasionally annoyed opinion when reading the news) a daily mantra for all who work in or with government –

The growth of an economy is the sum of the growth in the labor pool and the growth in productivity.

- We have productivity levels that are quite low by historical norms.

- We have an aging population with the largest demographic heading into if not already in retirement.

- We have demand for labor that exceeds the supply by a record margin.

- We have rising labor costs thanks to a tight labor market amidst an environment in which we see rising costs across a wide range of areas from transportation to material input costs with tariffs set to exacerbate that problem in an equity market that is richly priced.

I love to see solid employment and rising demand as a member of society but am less excited as a long-term investor when that unemployment hits record lows.

Turning to the Week Ahead

The upcoming big events will likely be the G7 Summit in Canada June 8-9, the meeting between North Korea and the President, and the Federal Reserve’s FOMC meeting, which begins on Tuesday. We’ll get the National Association of Independent Business Optimism Index report on Tuesday as well, (we’ll be looking for more data on the labor market) along with the Consumer Price Index. Wednesday brings the FOMC Meeting Announcement and Chair Powell’s press conference. We’ll be looking to see the committee’s stance, if they offer any, on the risks presented by all this tariff talk and their assessment of rising costs. Thursday brings the Retail Sales report which we will assess in light of a near record low household savings rate, rising credit card balances and rising subprime auto default rates. Thursday also brings Business Inventories and Import/Export Prices, which we will evaluate with respect to, among other factors, the strengthening dollar. Friday we’ll receive Industrial Production, Consumer Sentiment and the market will experience the Quadruple Witching of options expirations which includes stock market index futures, stock market index options, stock options and single stock futures – likely making for a more volatile day and higher trading volumes than we’d otherwise experience.