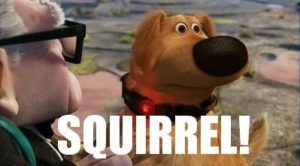

Market rebounds like a dog chasing a squirrel

If you’re not of an age where the Pixar “Up” movie was in constant rotation in your household, then this reference might not be totally up your alley, but for us at least, last week’s market reaction to the unexpected unemployment report was very much like the dog in that movie. No matter what he would be doing . . . the next second, even mid sentence, he’d be distracted and totally focused on a potential squirrel.

If you’re not of an age where the Pixar “Up” movie was in constant rotation in your household, then this reference might not be totally up your alley, but for us at least, last week’s market reaction to the unexpected unemployment report was very much like the dog in that movie. No matter what he would be doing . . . the next second, even mid sentence, he’d be distracted and totally focused on a potential squirrel.

Sure, the employment report for June showed the U.S. economy added 287,000 jobs in June — the largest increase since last fall, and as a result, the S&P 500 index soared in response, surging 1.5 percent to 2,129.83, just a point below its previous all-time high level of 2,130.82 reached May 21, 2015.

But while the market clearly liked what it saw in that report, there are other underlying concerns that we continue to chew on like a good bone . . . even ignoring the squirrel in the yard, which have us concerned.

In this week’s Monday Morning Kickoff:

- Even if the June Employment Report wasn’t the one time snapback we think it was, when we put that report aside, we continue to see many uncertainties (Brexit fallout, stronger dollar, Italian bank risk, 2016 presidential election, etc.) that are likely to restrain overall business spending and economic growth in the back half of 2016.

- Given the number of uncertainties, we continue to question the ability of the S&P 500 companies to deliver the near 13 percent growth rate expected for the second half of the year.

- The velocity of earnings reports will pick up considerably this week, with more than 50 such reports coming our way, giving us our first look into what promises to be a rocky Q2 earnings season.

- The June Retail reports for PPI, CPI, Retail Sales and Industrial Production all hit at the end of this week, and should lend some perspective around the better than expected June Employment Report.

Click below to download the full report: