Will Tax Cuts Translate into Consumer Spending & Business Investment?

Following the first full week of trading in 2018, the S&P 500 is up over 3% for the first nine days of trading in the new year. That index is edged out by the Nasdaq Composite Index, which saw a boost following the tech-heavy news flow last week spinning out of CES 2018. That annual event is a bevy of confirming data points for our Connected Society and Disruptive Technologies investing themes, and subscribers to the Tematica Investing newsletter saw several positions on the Select List move higher in response.

Even though we have this week yet another shortened trading week, we will still see a be pronounced pick up in 4Q 2017 earnings reports and more economic data that will factor into 4Q 2017 calculations. Also on hand will be a first glance at how the economy is performing in 2018. Now let’s get down to business…

On the Economic Front

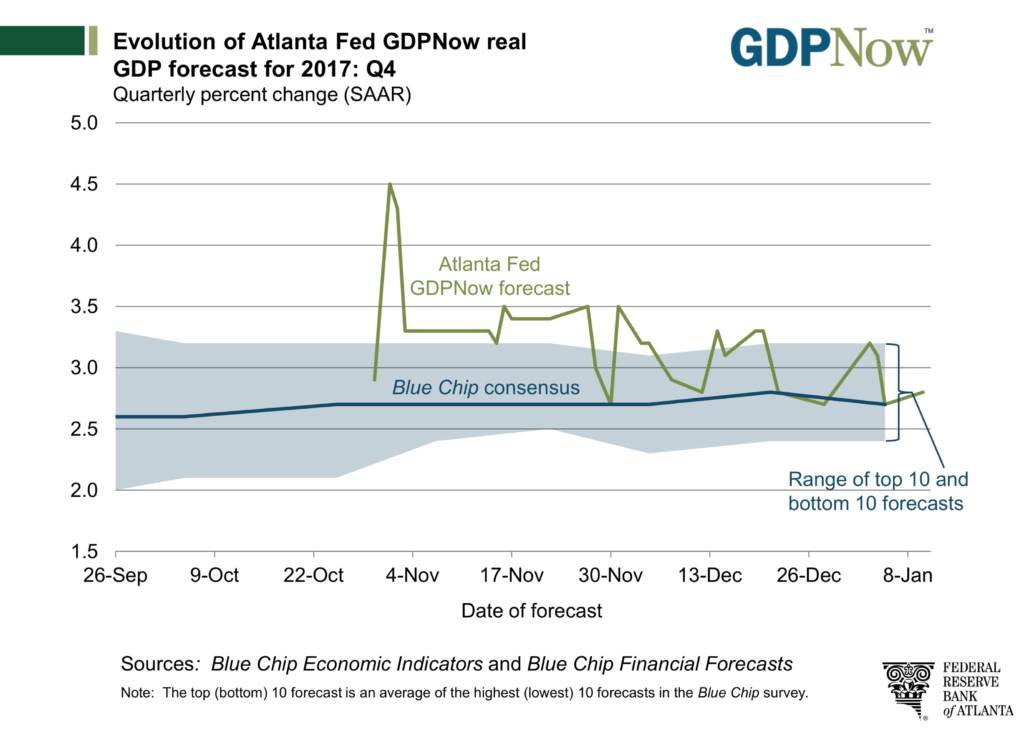

Since entering 2018, we’ve witnessed a modest drop in the Atlanta Fed’s GDP Now forecast for 4Q 2017 to 2.8% from 3.2%, primarily due to weaker than expected December auto sales and employment reports.

These reports have led to a tapering off in the Citibank Economic Surprise Index (CESI), which had been on the rise and well into positive territory exiting 2017. For those unfamiliar with the CESI, it shows how economic data are progressing relative to the consensus forecasts of market economists. A positive reading of the Economic Surprise Index suggests that economic releases have on balance been beating consensus expectations.

On the economic data schedule this week are several additional key pieces of data that will factor into 4Q 2017 GDP, namely the December figures for Industrial Production and Housing Starts. Over the last few months, we’ve seen a pick up in both single family housing permits as well as single family housing starts. Given the geographic breakdown, some of this upswing in activity can be attributed to post-hurricane rebuilding, but another likely factor could be homebuilders looking to cash in on the continued rise in new home prices given the limited supply of homes for sale over the last several quarters.

Turning to the December Industrial Production report, excluding the impact of the post-hurricane rebound in oil and gas extraction in the Texas region, industrial production was flat in November. With November’s Capacity Utilization reading of 77.1%, we continue to question the willingness of businesses to invest in property, plant and equipment given the degree of excess manufacturing capacity. In assessing the December data, we’ll be looking to see if there is a meaningful increase in capacity utilization. If not, we’ll see it as building our case that 2018 GDP is not likely to receive as big a tax reform boost as some are calling for.

The week ahead also brings us the latest Fed Beige Book iteration, the summary of anecdotal reports and economic findings from the various regional Fed Banks. With the Fed’s next FOMC meeting set for March 20-21, investors and economists will be mining this report for indications as to when the Fed could next boost interest rates. Finally, we’ll get first indications on how the domestic economy is fairing during the first month of 2018 with the January Empire Manufacturing and Philly Fed indices.

On the Earnings Front

Because of the Martin Luther King holiday, domestic stock markets are closed on Jan. 15 leaving us with another compressed trading week. The difference this time around is that by the end of this week reporting season will have moved into the fast lane. More than 80 companies are reporting their quarterly results and will update their respective outlooks. Hopefully, they will also touch on the impact to be had on their bottom line from tax reform. By comparison, only 48 companies have gone through that exercise over the prior two weeks.

What we learn this week will set the stage for next week when more than 350 companies will go through their quarterly earnings routine. By the time we close the week of Jan. 26, we should have pretty firm indications of the impact of tax reform on 2018 earnings expectations and soon after a clearer picture of where strategists see the S&P 500 going in 2018. We’ve seen several analysts boost their respective earnings forecasts ahead of these reports as they have lifted their S&P 500 price targets in the range of 3,000 to 3,100. The more earnings reports we have under our collective belts, the better we can see the intended image or in this case potential upside to be had for the S&P 500, much like coloring in the lines in a coloring book.

We still have our reservations over the extent that tax cuts will translate into consumer spending and business investment, but odds are the coming adjustments will lead the market to melt up further in the coming weeks. Nothing else has slowed it down in recent times, so why should that change, right? #sarcasm

In terms of what we’ll be looking for in these reports in addition to tax reform puzzle pieces:

- From rail companies CSX (CSX) and KC Southern (KSU), how was rail traffic in 4Q 2017 and what are its prospects for the current quarter? Are we poised to see a seasonal downtick after the holiday shopping season or will other parts of the economy buoy rail traffic?

- Similarly, what is JB Hunt Transportation (JBHT) seeing in the way of truck tonnage?

- From Fastenal (FAST) and Alcoa (AA), what is it seeing for the economy in terms of bright spots and weaks spots as we put 2017 further in the rear view mirror?

- Coming out of the Connected Society mecca that was CES 2018, does Taiwan Semiconductor (TSM) all of the announcements and product introduction translating into greater than expected chip demand for this year? Also, what are it’s capital spending plans for new semi-cap equipment and what does that mean for shares of Applied Materials (AMAT) and other semi-cap equipment companies?

- Are we seeing a tipping point for our Cashless Consumption investment theme here in the U.S.? Commentary from American Express (AXP) and Synchrony Financial should shed some light on that answer.

- With Bank of America (BAC), Citigroup (C), and US Bancorp (USB), what’s the outlook for loan demand vs. charge-offs? Are they seeing greater demand for capital compared to three or six months ago?

Thematic Signals

Each week we look for data points pertaining to our 17 investment themes, or as we call them Thematic Signals. These signals can be confirming or they can serve to raise questions as to whether a theme’s tailwinds are strengthening or ebbing. Be sure to check out the Thematic Signals section of our website to read more about these stories and others we publish throughout the week. Here are some of the highlights we saw this week:

Rising consumer credit card debt to be a headwind to GDP in 2018

Cash-Strapped Consumer

We are starting to get not only holiday sales results from the likes of Kohl’s (KSS) and others, but also December same-store-sales results from Tematica Investing Select List resident Costco Wholesale (COST) and its retail brethren. Thus far the results are positive and in some cases much better than expected, but when we see we think about the other shoe to drop. In this case, that is “How are consumers paying for all of this given that wages barely budged in 2017?” The answer is they have been turning to their credit cards… Read more here

Having Siri and Alexa join you in the shower

Affordable Luxury, Connected Society

It used to be there were a handful of places on could retreat to find some downtime, but it looks like we are on the verge of losing one as Moen is bringing the connected home and virtual assistant connectivity into the shower. Based on the price points, this functionality will mesh with our Affordable Luxury investing theme, but much like we’ve seen with cars the technology will trickle down to lower-tier offerings over time. How long until we can voice dictate messages? Better yet, how long until we can change the music?

Once again Amazon expands its Dash program, removing shopping friction along the way

Connected Society

It used to be that if you ran out of laundry detergent, the dirty clothes would pile up. Those days may soon be over as Amazon (AMZN) is rolling out virtual Dash buttons to third-party screens, like those now found on washing machines, dryers, dishwashers and other appliances. This further extends Amazon’s reach into the home as it removes the pain point that is running out of detergent, laundry soap, dryer sheets and others consumables used in and around the home. Pretty sneaky…sneaky like a fox because Dash buttons are only available to Prime members.

Is Diet Coke diluting and deluding itself with its latest move?

Food with Integrity, Guilty Pleasure, Fattening of the Population

Given falling sales of soda, both the regular “sugary” kind as well as diet, Coca-Cola is once again trying to entice consumers with a new round of Diet Coke-branded beverages that will be available in the coming weeks. We’ve not tried them, and while we’re somewhat skeptical our preference for first-hand research means giving them a go.

Our concern is the potential risk to the Diet Coke-brand, which to date has focused on cola beverages. And while we understand the argument to be had with brand extension and consumer choice, we’ve also seen too much choice dilute a brand resulting in a company that needs to bring a brand “back to its core.”

At the same time, creating a new brand is no easy task. To us, it says Coca-Cola could have a tough time ahead as it tries to keep consumers coming back for its products as they look for healthier alternatives.