WEEKLY WRAP: Don’t Let the Debt Ceiling Deal Fool You

This week our Safety and Security investing theme, unfortunately, reigned supreme. Just days after the worst storm in modern U.S. history took nearly one quarter of U.S. refining capacity offline and dropped a biblical amount of rain on Texas, here comes Hurricane Irma, the most powerful Atlantic Ocean hurricane in recorded history after having done major damage in the Caribbean. Right behind her is Hurricane Jose, currently a Category 3.

Apparently not to be outdone, Mexico was struck by its strongest earthquake in a century, measuring 8.2 magnitude, just before midnight on Thursday local time, which resulted in a Pacific tsunami warning issued immediately after. Then there is Hurricane Katia, which could hit the eastern coast of Mexico in a few days.

Whoever has been ticking off mother nature, please knock it off. Of course, all kidding aside, our hearts and prayers go out to all those affected.

There is something distinctly unnerving seeing equity markets relatively calm when mother nature is tossing a whopping 4 apocalyptic-like disasters our way. But then if the South Korean Kospi doesn’t care about North Korea rattling its nuclear sword, then we suppose the S&P 500 might not be terribly fussed about nature tossing a little Armageddon our way.

These horrific natural disasters are also reflected in our Scarce Resources investing theme as the price of frozen concentrated orange juice, lumber, Brent crude, heating oil, nickel and aluminum rise. We’ve also seen shares of Home Depot (HD) and Lowe’s (LOW) both gain over 5% since the start of the month. Given the magnitude of these storms and subsequent destruction, we expect the fallout to dominate headlines over the coming days. We also recognize companies ranging from Disney (DIS) to Kroger (KR) will see disruptions that will weigh on expectations for the current quarter as well as the speed of the economy.

As investors, however, we continue to see signs of a stock market that is poised for greater volatility than we’ve seen over the last few months. Yes, we recognize that September tends to be that way, but it’s looking like this September will be more volatile than some. We say this given:

- Federal Reserve Vice Chair Stanley Fischer announced he was stepping down for “personal reasons.” His term was to end June 2018. Between his departure and likely end of Fed Chair Yellen’s term, Trump needs to fill six out of seven positions, which just adds more uncertainty into monetary policy. Keep in mind that it will be a major challenge to find anyone that will be both dovish and pro-deregulation. We’ve heard that after his comments regarding Trump’s handling of Charlottesville, Gary Cohn is no longer being considered for Fed Chair when Yellen’s term ends in early 2018.

- Treasury Secretary Mnuchin warned that the U.S. could seek to sanction any country trading with North Korea in an effort to put the kybosh on this missile and nuclear testing insanity. China and Russia quickly signaled their opposition, reducing the chances that this area of geopolitical uncertainty will be resolved diplomatically in the near-term.

- Back in D.C., within hours of Paul Ryan announcing that the Democrats’ proposal on the debt-ceiling was “ridiculous and unworkable,” Trump overruled both his Treasury Secretary and GOP leadership by siding with the Dems over the three-month debt ceiling extension, which has some GOP conservatives already labeling it the “Pelosi-Schumer-Trump Deal.” So that relationship is going well.

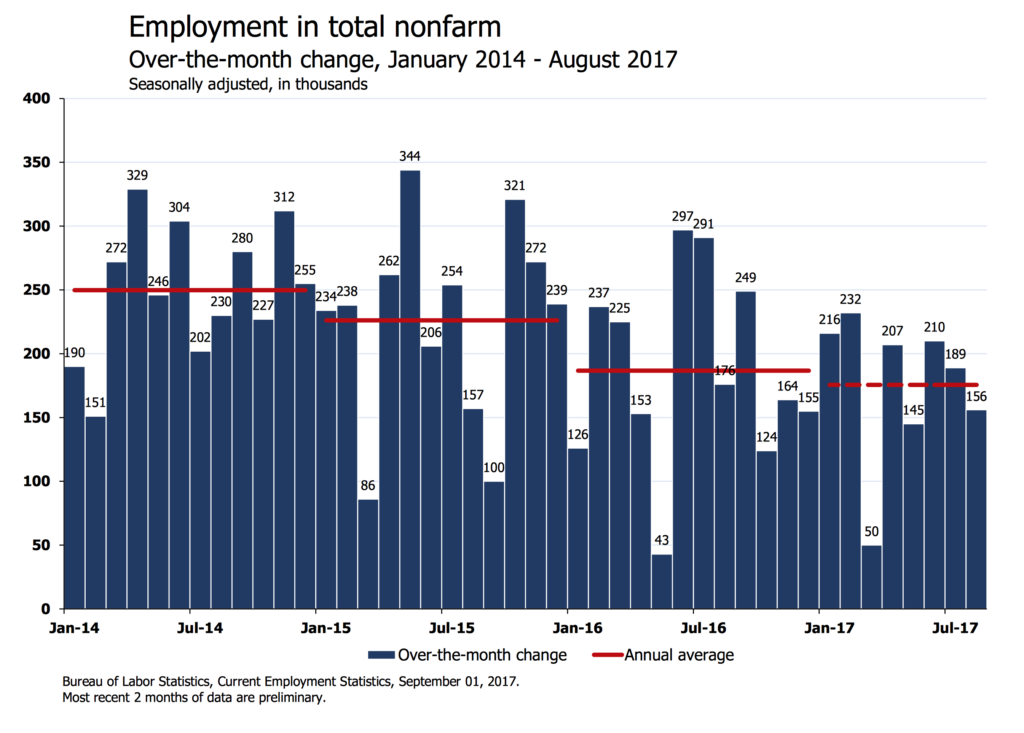

Meanwhile, the U.S. economy continues to show signs of being long in the tooth, as even the Bureau of Labor Statistics has acknowledged that employment growth has been slowing.

The Fed’s Beige Book revealed that “contacts in many Districts expressed concerns about a prolonged slowdown in the auto industry,” and “low inventories of homes for sale continued to weigh on residential real estate activity across the country.” These are typical late stage indicators with slowing employment growth and peaking home and auto, (although the damage from the recent storms is likely to help with some of that excess auto inventory as folks will need to replace their submarined vehicles.)

The Fed’s Beige Book revealed that “contacts in many Districts expressed concerns about a prolonged slowdown in the auto industry,” and “low inventories of homes for sale continued to weigh on residential real estate activity across the country.” These are typical late stage indicators with slowing employment growth and peaking home and auto, (although the damage from the recent storms is likely to help with some of that excess auto inventory as folks will need to replace their submarined vehicles.)

While the ISM non-manufacturing business activity index did improve to 57.5 in August, up from 55.9 in July, this is the second weakest reading over the past twelve months and still well below the 60+ levels we saw at the beginning of the year. As for future growth prospects, the share of businesses expanding dropped to the lowest level of the year at 67% from 78% in June and July.

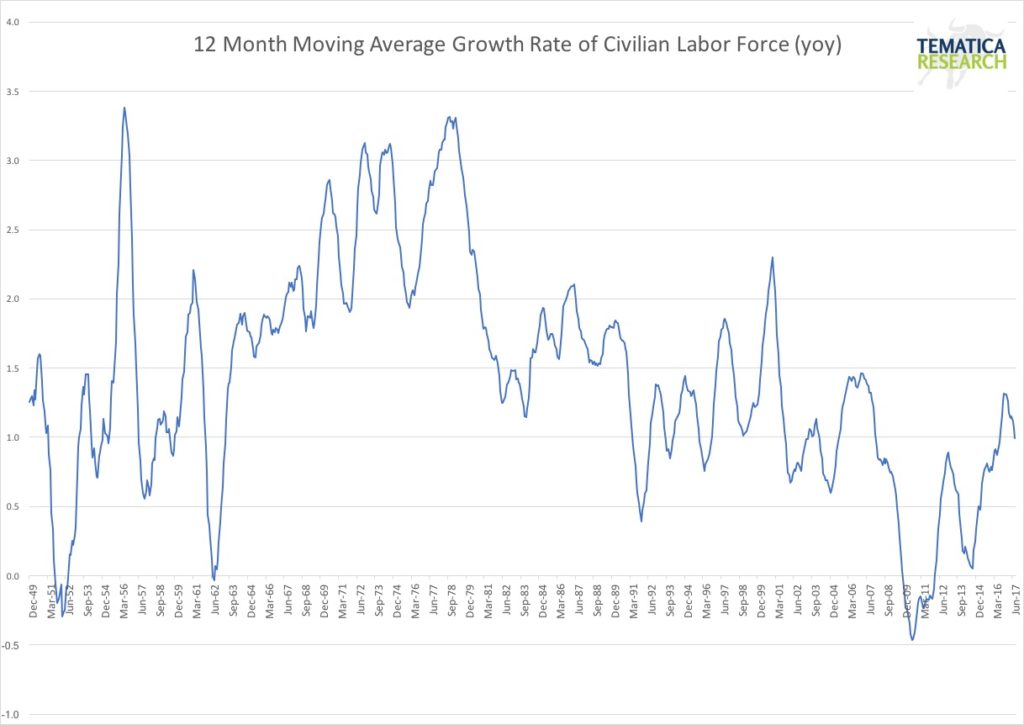

We are seeing some improvement in productivity, with nonfarm productivity rising 1.5% on an annualized basis in Q2 versus expectations for 1.3% after having growth of a mere 0.1% in the first quarter. Obviously, we like to see productivity improving, but the longer-term trend is still nothing to get excited about. Remember that the potential growth of an economy is a function of just two things: improvements in productivity and growth in the labor pool. The civilian labor has been growing at less than 1% for much of the time since the post-financial crisis.

In other cheery news, the U.S. Dollar is on course for its biggest weekly slide in almost fourth months, dropping to its lowest level in 33 months. Mario Draghi’s recent comment that the European Central Bank could start QE tapering as early as October pushed the euro up over $1.20 and further weakened the dollar. Weakness has also been driven by the decreasing likelihood of further rate hikes in 2017, made more unlikely by the ongoing natural disasters coupled with the North Korea-related tensions. The dollar has declined for six consecutive months, the longest slide in 14 years, and is down over 12% from post-election highs. The Amex Dollar Index (DXY) has broken down through major support levels and sits at levels last seen at the start of 2015.

The Treasury market is also reflecting the less-rosy outlook with the 10-year Treasury yield hitting its lowest level since the election, on its way towards 2%. While the major U.S. indices are mostly unchanged since the start of the month, the SPDR Gold Shares ETF (GLD) has gained over 3% and the iShares Silver Trust ETF (SLV) is up nearly 4% and the long-dated iShares 20+ Year Treasury Bond ETF (TLT) has gained over 1.3%. Risk-off is the new black so far in September.

The bond market is also indicating we are in the later stages of this business cycle with the rather pronounced decline in yields. The pullbacks we’ve seen in shares of the more cyclical segments of the stock market also indicate that the coming months are more likely to see further slowing in the economy.

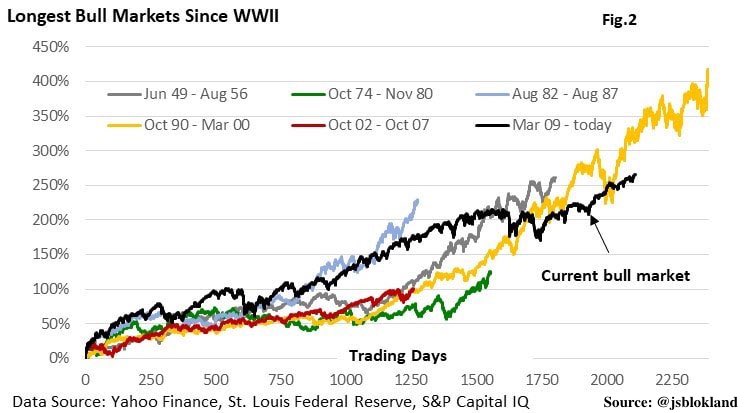

The current bull market is the second longest since WWII, outpaced only by the one ending in March 2000. That one also saw record high valuations and much talk of “this time it’s different.”

Stepping back, we have valuations that remain heady, with the decidedly meh reactions to earnings and revenue beats, (most shares actually fell on reaction day) in the last reporting round reflecting the priced-to-perfection. We have an economy and a bull market that are both long in the tooth heading into what is typically the most volatile time of the year on top of unusually high domestic and geopolitical tensions.

The U.S. economy is no longer the “cleanest shirt” in the laundry in terms of economic growth as Europe and emerging markets look increasingly more robust and have more attractive valuations. Don’t forget that going back to even before 1900, the U.S. has experienced a recession within 12-months of the end of every two-term presidency. We have experienced the second longest run in history of trading days without a 5% or more pullback in the S&P 500. Reversion to the mean demands that prolonged periods of hyper-low volatility must result in heightened volatility.

While we may see some market relief as the debt-ceiling battle has been pushed back 3-months — removing the possibility of a technical default in October — the upside potential from here, versus the downside risk, indicate caution. Investors would be wise to put on some protection and have a plan for getting out if things get wiggly. Yes, that is one of the technical terms we use here at Tematica.