More Earnings, April Data and The Fed: Another Busy Week For Sure

DOWNLOAD THIS WEEK’S ISSUE

The full content of The Monday Morning Kickoff is below; however downloading the full issue provides detailed performance tables and charts. Click here to download.

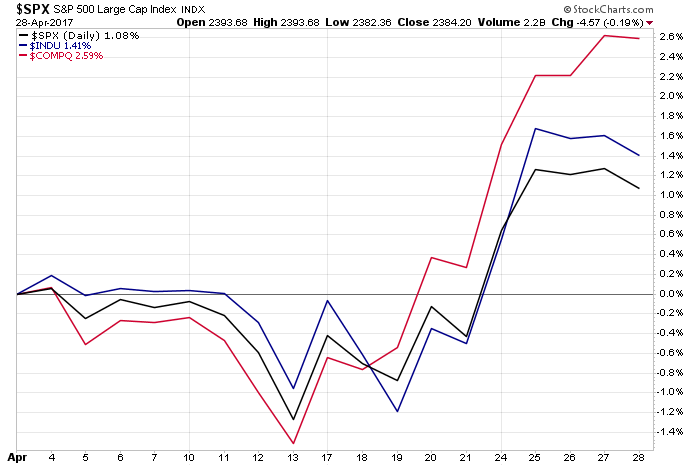

Last week was a busy one for investors, as we faced a plethora of earnings, economic data and the latest happenings in Washington that arguably brought some uncertainty back into the stock market. All that as we closed the books on the month of April, which saw stocks return 1.0 to 2.5 percent depending on which of indices you examined.

For much of the month, it was looking like the stock market would end April flat or a bit down, but then came these last five days, which saw a strong move higher early in the week following the initial round of the French elections. That outcome calmed concerns over a potential Frexit that would have likely led to more talk of unwinding of the eurozone. We viewed the market’s reaction last Monday and Tuesday as more of a sigh of relief that one tied to an accelerating economy.

As the week wore on we received a mixed back on the earnings front — some better-than-expected and also some that were not — par for the course over the last few years. Contained in those reports, however, we are seeing a growing trend of companies trimming their expectations for the current quarter, 2Q 2017. This is hardly a surprise, given the slowing pace of the domestic economy and dollar-related headwinds that we are hearing companies like Amazon (AMZN) once again call out.

Thus far roughly 60 percent of the S&P 500 companies have reported their 1Q 2017 quarterly results and that means we still have just over 200 to go. Over the next five days, we’ll get results from another 118 of those companies, which means by the end of the week we’ll have heard from just over 80 percent of the S&P and that should give us a very solid look at where expectations for 2Q and 3Q 2017 are headed.

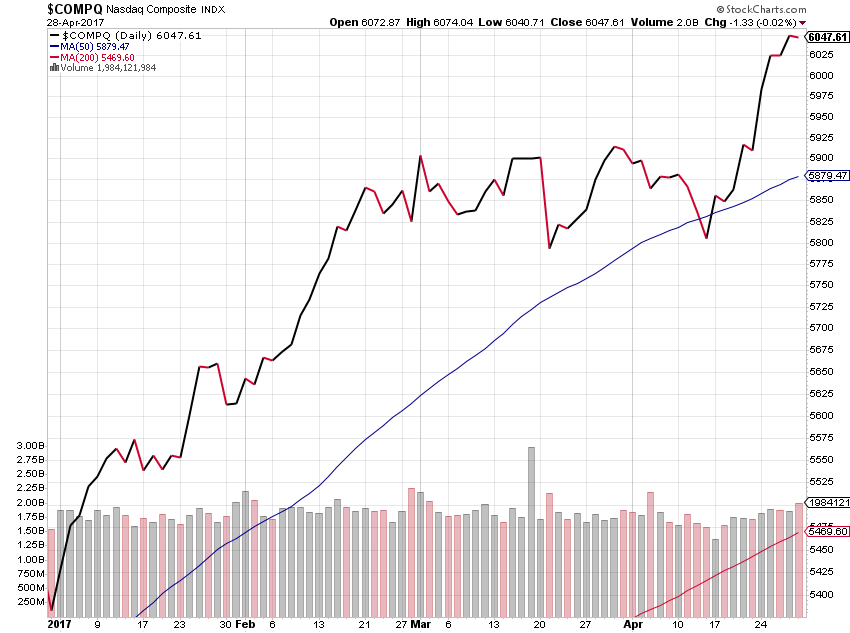

Even as we make those adjustments, the S&P 500 is closing April at more than 18x 2017 earnings expectations. As we discussed on last week’s Cocktail Investing podcast, we find the market’s year to date move has really been led by just five stocks — Amazon, Alphabet (GOOGL), Facebook (FB), Apple (AAPL) and Microsoft (MSFT). Those moves help explain the out-performance of the Nasdaq Composite Index both in April, where it was up 2.5 percent vs. 1.0 percent for the S&P 500, and year to date, where it is up 12 percent compared to 6.5 percent for the S&P 500.

While we continue to see additional upside in our Tematica Investing positions in AMZN, GOOGL and FB shares, given strong moves in these five stocks over the last several quarters, we have to recognize that some investors may opt to take some profits when eyeing not only the market’s valuation but also a slowing economy and renewed uncertainty in Washington. That possibility is heightened by the recent pops in these stocks that have once again pushed the Nasdaq Composite Index into overbought territory. With Apple and Facebook reporting this week, we could see that index climb even further. Of course, keep in mind, that continued climb would serve to push it even further into overbought territory.

The Reality of a Slowing Domestic Economy Is Crystal Clear Now

We’ve been talking about the slowing domestic economy here at Tematica for what seems like some time now, and if there was any doubt in our sentiment, Friday’s underwhelming initial 0.7 percent GDP reading for 1Q 2017 should have erased it. Not only did that initial GDP reading miss expectations of 1.3 percent, simply put it was a downward vector and velocity compared to 4Q 2016’s 2.1 percent and 3.5 percent in the back half of 2016.

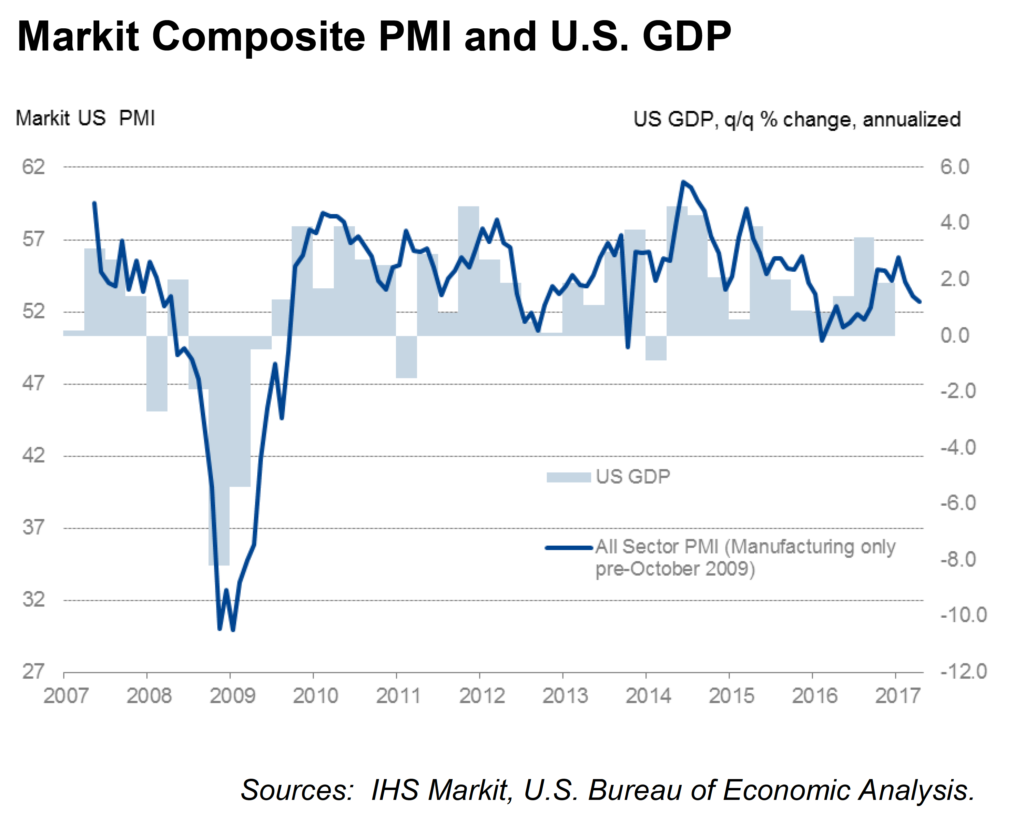

Taking a somewhat longer view, 1Q 2017 turned in one of the weakest performances in the last three years. Moreover, the first looks at how the domestic economy performed suggest it’s off to a rather slow start in the second quarter, with not only the Markit Flash US PMI for April hitting a seven month low, but also month over month declines at several regional Fed economic activity indices for the month.

Taking a somewhat longer view, 1Q 2017 turned in one of the weakest performances in the last three years. Moreover, the first looks at how the domestic economy performed suggest it’s off to a rather slow start in the second quarter, with not only the Markit Flash US PMI for April hitting a seven month low, but also month over month declines at several regional Fed economic activity indices for the month.

Here’s the thing, as of Friday, economists surveyed by MarketWatch saw growth rebounding to a 2.8 percent rate in the second quarter. While we’ll start to get a slew of April data over this upcoming week, even if we adjust for the winter storms in March, it’s looking like that 2.8 percent forecast is going to be a stretch, given slower rates of output and new order growth reported thus far in the April data and the continued drop in backlogs of work found in Markit’s Flash US PMI report.

Does Yellen know when to “Fold ‘Em” on the remaining rate hikes?

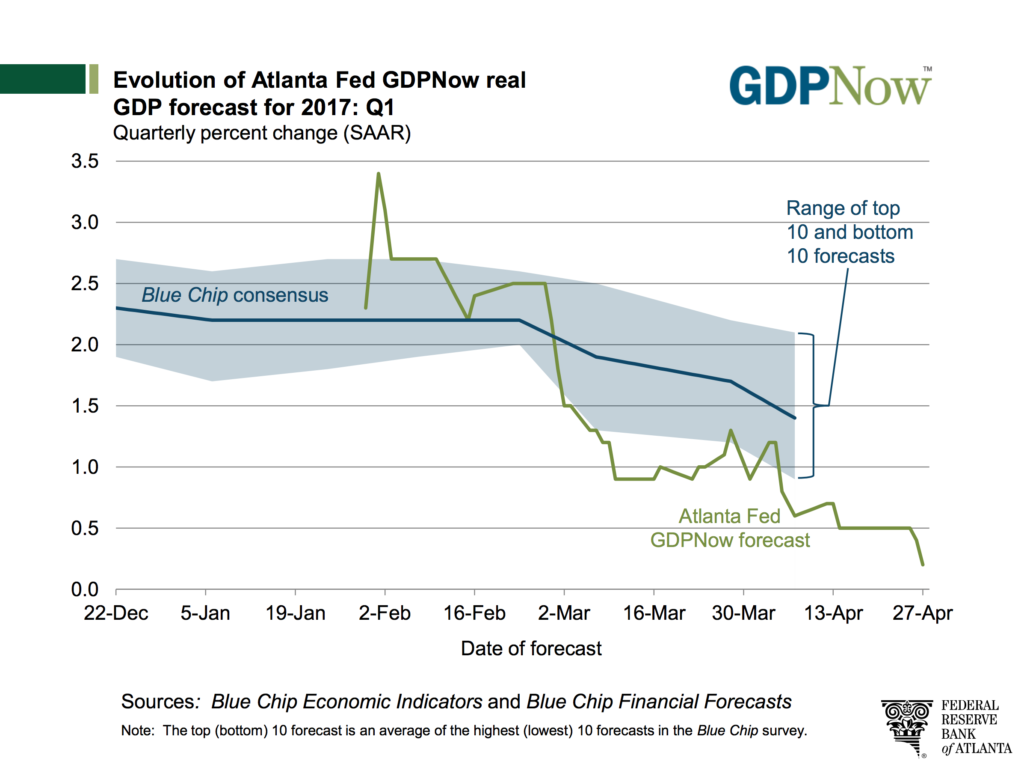

As signs that the US economy was once again slowing emerged over the last several weeks — was reflected in the Atlanta Fed’s GDPNow forecast for 1Q 2017 GDP falling from 3.4 percent in early February to all of 0.5 percent early last week — expectations for the two remaining Fed rate hikes in 2017 per the CBOE’s FedWatch also fell. Odds are Friday’s 1Q 2017 GDP report, along with signs in the Commodity Research Bureau Spot Commodity Price Index that inflation is starting to roll over compared to last year will push out Fed rate hike timing expectations even further.

The Fed’s next policy meeting will be held this week, May 2 and 3, and while the growing consensus is that the Fed is likely to push potential rate hikes to June or later in 2017, historically speaking, the Fed has done a great job of hiking interest rates at exactly the wrong time — heading right into a slowing economy and more often than not a recession. While we don’t see signs of a recession, we continue to see the Fed in a hard place given the length of the current recovery and the need to put some arrows in its monetary policy quiver for the next eventual recession and the once again slowing economy that is seeing delinquencies climb and loan growth fall.

If you’re thinking we’re glad we don’t have Janet Yellen’s job, you would be rather correct. This does mean that ahead of the Fed’s next few monetary policy meetings in May and June, every key economic data point will be closely scrutinized. In other words, it will be economic Groundhog Day on cable television once again. Rather than succumb to the talking heads, we’ll continue to let the data be our guide, which has served us and our subscribers quite well thus far.

Trump’s Tax “Plan” isn’t really a plan, is it?

As far as that renewed sense of uncertainty coming out of Washington, the latest GOP effort to repeal and replace the Affordable Care Act is scrounging for votes. And while a federal government shutdown was averted this week, it was done only with a one-week extension, so that will certainly add to this week’s April data and Fed policy meeting fireworks. As if that wasn’t enough, the Washington drama has begun on tax reform following President Trump’s “plan”, which amounted to a one-page outline on corporate and individual tax rates as well as cash repatriation.

Retail and apparel stocks cheered the lack of a border adjustment tax in the outline, but Treasury Secretary Steven Mnuchin has said the border adjustment tax doesn’t work. As Washington gets ready to haggle over the president’s plan it could mean this tax gets rethought as well. Given Trump’s pledge to rebuild U.S. infrastructure, the border adjustment tax might be one way to fund that spending, so we suspect we haven’t heard the last on this just yet. We discuss all of that and what it likely means for investors on last week’s Cocktail Investing podcast — click here to listen.

Turning to the Week Ahead

Over the coming days, we get the usual start-of- the-month data combined with another 1,000 corporate earnings reports and, as we mentioned earlier, the next Fed policy meeting. For those of you who thought last week was busy, this first week of May is going to be a doozy — March personal income & spending, the April data for auto and truck sales, ISM manufacturing and services, and the usual montage of employment data.

During the week, be sure to visit TematicaResearch.com for all our latest thoughts and thematic insights, as well as past episodes of the Cocktail Investing podcast. Finally, we end this week with Cinco de Mayo, so whether it’s a regular or virgin margarita, be sure to have some fun as we put this busy week behind us on Friday

In examining the 1,000 companies reporting this week, including 118 S&P 500 companies, here’s what we’ll be watching from a thematic perspective:

Affordable Luxury: Malibu Boats (MBUU), Hilton Grand Vacations (HGB), Ruth’s Hospitality Group (RUTH), Callaway Golf (ELY)

Aging of the Population: Cardinal Health (CAH), CVS Health (CVS), Merck (MRK), Pfizer (PFE), Waddell & Reed (WDR), Almost Family (AFAM), Care.com (CRCM), Physicians Realty Trust (DOC), Senior Housing (SNH), AMN Healthcare (AMN)

Asset Lite Business Models: Shopify (SHOP), GoDaddy (GDDY), Quad/Graphics (QUAD), Criteo SA (CRTO), Avis Budget (CAR), Cardtronics (CATM), LogMeIn (LOGM)

Cashless Consumption: Mastercard (MA), Western Union (WU), Square (SQ), Moneygram (MGI), Global Payments (GPN)

Cash-strapped Consumer: Rent-A-Center (FCII), Tanger Factory (SKT), RetailMeNot (SALE), Hanesbrands (HBI), Groupon (GRPN)

Connected Society: Apple (AAPL), Facebook (FB), Charter Communications (CHTR), Akamai Tech (AKAM), Match Group (MTCH), Telenav (TNAV), Twilio (TWLO), Century Link (CTL)

Content is King: Dish Network (DISH), Cinemark (CNK), Glu Mobile (GLUU), Activision Blizzard (ATVI), Madison Square Garden (MSG)

Disruptive Business Models and Technology: IIVI (IIVI), Tesla (TSLA), Immersion (IMMR), Universal Display (OLED)

Economic Acceleration/Deceleration: Flowserve (FLS), Cummins (CMI), Eaton (ETN), Granite Construction (GVA), STAG Industrial (STAG), Freightcar America (RAIL), General Cable (BGC), US Concrete (USCR)

Fattening of the Population: DineEquity (DIN), Bravio Brio (BBRG), Denny’s (DENN), Mondelez International (MDLZ), Papa John’s (PAPA), Potbelly (PBPB), Weight Watchers (WTW), Yum! Brands (YUM), Cheesecake Factory (CAKE), Habit Restaurants (HABT), Del Taco (TACO), Medifast (MED), Shake Shack (SHAK)

Foods with Integrity: Freshpet (FRPT), Sprouts Farmers Market (SFM)

Fountain of Youth: Nautilus (NLS), Planet Fitness (PLNT), Estee Lauder (EL), Fitbit (FIT), Nu Skin (NUS), Sally Beauty (SBH)

Guilty Pleasure: Altria (MO), Boyd Gaming (BYD), Reynolds American (RAI), Craft Brew Alliance (BREW), Red Rock Resorts (RRR), Dunkin Brands (DNKN)

Rise & Fall of the Middle Class: Armstrong World Industries (AWI), Haverty Furniture (HVT), Hilton (HLT), Dentsply Sirona (XRAY)

Safety & Security: FireEye (FEYE), Olin Corp. (OLN), Carbonite (CARB)

Scarce Resources: Agrium (AGU), Archer-Daniels (ADM), Mosaic (MOS), American States Water (AWR), American Water Works (AWK), Aqua America (WTR)

Tooling & Retooling: Chegg (CHGG), Strayer Education (STRA), Grand Canyon Education (LOPE)